- Home

- »

- Plastics, Polymers & Resins

- »

-

Plantable Packaging Market Size, Share, Trends Report 2030GVR Report cover

![Plantable Packaging Market Size, Share & Trends Report]()

Plantable Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Seaweed, Cellulose), By Application (Food & Beverages, Cosmetics), By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-468-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plantable Packaging Market Summary

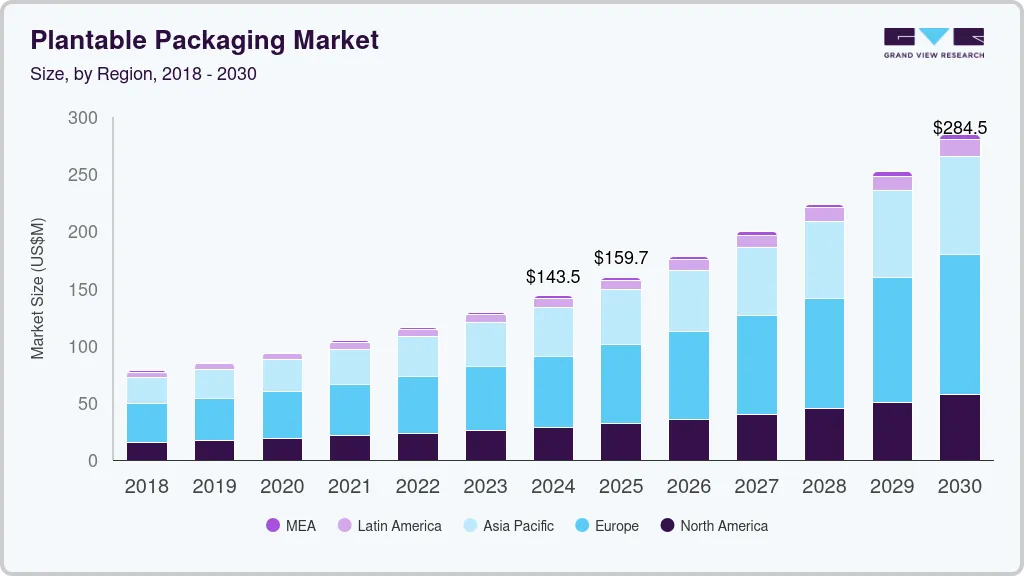

The global plantable packaging market size was estimated at USD 143.5 million in 2024 and is projected to reach USD 284.5 million by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The global market is gaining momentum due to increasing consumer demand for eco-friendly and sustainable packaging solutions.

Key Market Trends & Insights

- Europe plantable packaging market held over 43.0% in 2023.

- The U.S. plantable packaging market is experiencing rapid growth, driven by increasing consumer demand for sustainable and eco-friendly solutions.

- Based on material, seaweed-based packaging is emerging as the fastest-growing material segment.

- Based on type, flexible packaging holds the largest revenue share in the market.

- Based on application, the food and beverage sector dominates the market

Market Size & Forecast

- 2024 Market Size: USD 143.5 Million

- 2030 Projected Market Size: USD 284.5 Million

- CAGR (2025-2030): 12.1%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

The first to introduce plantable packaging was the company Pangea Organics under the slogan “Coming from the earth and going back to it.” They collaborated with Seeds of Change, the largest US producer of organic seeds, and UFP Technologies and launched a series of body- and skin-care products packaged in a 100% compostable molded fiber box. The box needs no glues and dies and consists of 100% post-consumer paper board.With rising environmental concerns and stringent regulations on plastic waste, plantable packaging provides an innovative solution that not only reduces waste but also contributes to environmental restoration. These packaging materials embedded with seeds decompose in the soil, allowing the seeds to germinate. This dual functionality appeals to environmentally conscious consumers and companies looking to enhance their green credentials.

Product launches are driving market demand as companies strive to capitalize on this emerging trend. For example, Plantable Paper, a Canada-based company, launched plantable seed packaging for various products, ranging from stationery to cosmetics. Similarly, in the UK, Little Green Paper Shop introduced plantable gift-wrapping paper, making strides in sustainable packaging. The food and beverage sector is another key adopter, with brands like Pangaia using plantable packaging for their clothing, which can grow flowers or herbs when planted.

There is a growing opportunity for plantable packaging across various sectors, such as cosmetics, pharmaceuticals, and even industrial goods. With a strong push toward circular economy practices, plantable packaging represents a promising opportunity for sustainable innovation. Increasing government support, consumer preference for biodegradable materials, and advancements in packaging technology further accelerate its adoption.

Material Insights

Based on material, the market has been segmented into bagasse, starch-based, bioplastics, cellulose, seaweed, and others. Bioplastics, derived from renewable biomass sources such as corn starch or sugarcane, dominate the material segment due to their versatility and performance. They provide a near-identical alternative to traditional plastics while being compostable. Bioplastics are heavily used in both rigid and flexible packaging for food, beverages, and cosmetics. Brands like Coca-Cola have already integrated bioplastics into their packaging solutions, propelling its market growth.

Seaweed-based packaging is emerging as the fastest-growing material segment due to its rapid biodegradability and abundant natural supply. Brands like Notpla are developing seaweed-based packaging for food and beverage applications. Seaweed is gaining attention due to its low environmental impact, requiring no fertilizer or freshwater to grow, and it holds immense potential for reducing marine plastic pollution.

Cellulose-based packaging, extracted from wood fibers, offers an environmentally friendly alternative, especially for food and beverage packaging. It is compostable and derived from abundant natural sources. Though still an emerging segment, it holds promise for expansion as brands seek sustainable options.

Type Insights

Based on the packaging type, the market is segmented into flexible and rigid packaging. Flexible packaging holds the largest revenue share in the market, driven by its versatility, lightweight nature, and ease of storage. Plantable flexible packaging includes wraps, pouches, and bags made from materials embedded with seeds. It is commonly used in the food and beverage industry for snacks, tea, and small consumable products. Its ability to mold into various shapes while maintaining its eco-friendly attributes makes it a preferred choice for brands. Moreover, it offers cost advantages over rigid packaging and aligns with consumer demand for convenience and sustainability.

Rigid packaging is also gaining popularity within the market, particularly in sectors like cosmetics and pharmaceuticals. Offering enhanced durability and protection for products, rigid plantable packaging includes items like seed-infused cartons and containers. These types of packaging are particularly effective in protecting fragile goods while still offering eco-friendly disposal methods, making them increasingly popular for premium products.

Application Insights

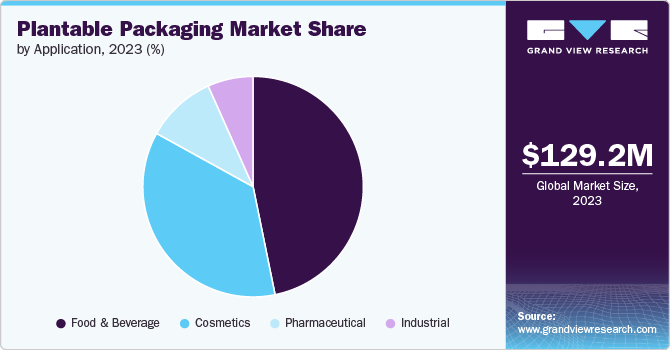

Based on application, the market is segmented into food & beverages, cosmetics, pharmaceuticals, and others. The food and beverage sector dominates the market due to the increasing demand for sustainable, biodegradable packaging options. Restaurants, cafes, and food manufacturers are rapidly adopting plantable packaging for wraps, containers, and pouches. Brands like Lush and Pangaia are using plantable materials for takeout packaging and product wraps, aligning with consumer preferences for eco-friendly alternatives.

The cosmetics sector is anticipated to witness the fastest CAGR over the forecast period, driven by demand for sustainable and eco-conscious products. Major brands are exploring plantable packaging options for containers and boxes. Cosmetics packaging, especially for high-end skincare and beauty products, is adopting innovative plantable designs as companies look to enhance their environmental responsibility.

Plantable packaging in the pharmaceutical sector is emerging, particularly in the form of seed-infused cartons for medical supplies. As regulations push for more sustainable packaging in healthcare, there is growing interest in plantable options to reduce environmental footprints.

Regional Insights

The plantable packaging market in North America, particularly the U.S. and Canada, is witnessing growing adoption of plantable packaging. This is driven by consumer preference for sustainable products and stricter environmental regulations. Key sectors include food and beverage, cosmetics, and personal care products. Companies like Plantables have introduced innovative packaging solutions that resonate with the region's eco-conscious consumers.

U.S. Plantable Packaging Market Trends

The U.S. plantable packaging market is experiencing rapid growth, driven by increasing consumer demand for sustainable and eco-friendly solutions. Plantable packaging, often made from biodegradable materials embedded with seeds, aligns with the shift towards reducing plastic waste. Major trends include the adoption of plantable packaging in industries such as cosmetics, food & beverages, and e-commerce, where companies are aiming to enhance their sustainability credentials.

The rise in eco-conscious consumers is pushing brands like Lush Cosmetics and Pangea Organics to use plantable packaging for their products, setting an example for others. Additionally, small businesses on platforms like Etsy have adopted seed-infused packaging to offer a unique unboxing experience. The growth of urban gardening and green initiatives further fuels this trend. However, challenges include scaling production and ensuring seed viability. Overall, plantable packaging offers both an eco-friendly solution and an interactive, consumer-engaging packaging experience.

Europe Plantable Packaging Market Trends

Europe plantable packaging market held over 43.0% revenue share in 2023 due to strict environmental regulations and consumer demand for green products. The European Union’s circular economy plan is driving companies to adopt biodegradable materials, with the food and beverage sector leading the way. Brands across France, Germany, and the UK are adopting plantable packaging, particularly in premium product segments like cosmetics and food.

Asia Pacific Plantable Packaging Market Trends

Asia Pacific plantable packaging market is anticipated to experience rapid growth over the forecast period due to increasing government regulations on plastic waste and a rising awareness of sustainability. Countries like China, Japan, and India are adopting plantable packaging in the food and beverage and cosmetic sectors. The region’s abundant agricultural resources, combined with a growing middle-class population, are driving demand for innovative and eco-friendly packaging solutions.

India plantable packaging market is driven by the government’s initiatives to reduce single-use plastics and promote biodegradable alternatives. With a large agricultural base and increasing urbanization, there is significant demand for eco-friendly packaging in both rural and urban sectors. Companies like EcoCric are leading the way by offering plantable seed paper products, bags, and containers.

Key Plantable Packaging Company Insights

The market is in a nascent stage of development, with the presence of a significant number of companies. The sustainable packaging industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to the circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

-

In January 2024, La Foundary, an Australian startup, developed an innovative, sustainable packaging solution that utilizes mushroom mycelium to transform agricultural waste into eco-friendly packaging. This technology is gaining traction as a viable alternative to traditional plastic packaging, which has significant environmental drawbacks.

-

In August 2023, Israeli start-up MadeRight secured funding to expand its development team and refine its fungi-based packaging production process with the aim of achieving a commercially viable prototype. MadeRight is developing a sustainable alternative to plastic packaging with fungi. Leveraging a fermentation process that sees mycelia cultivated from industrial organic waste, the start-up wants to produce high-performance materials.

Key Plantable Packaging Companies:

The following are the leading companies in the plantable packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Botanical PaperWorks

- The Mend

- Eco Marketing Solutions

- Greenfield

- Dong Guan on the Way Packaging Products Co., Ltd.

- Earthly Goods, inc.

- Searo

- FlexSea

- Evoware

- Sway Innovation Co.

Plantable Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 159.7 million

Revenue forecast in 2030

USD 284.53 million

Growth rate

CAGR of 12.1% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Botanical PaperWorks, The Mend, Eco Marketing Solutions, Greenfield, Dong Guan on the Way Packaging Products Co., Ltd., Earthly Goods, inc., Searo, FlexSea, Evoware, Sway Innovation Co.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plantable Packaging Market Report Segmentation

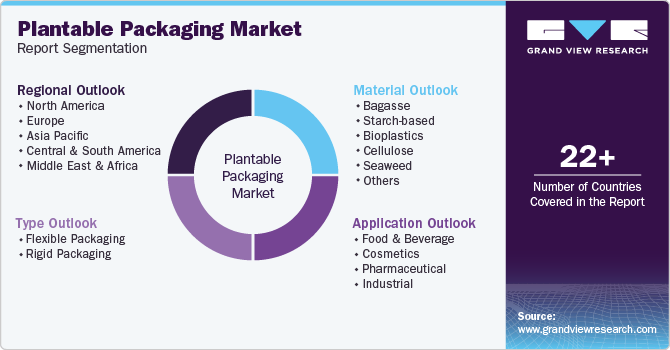

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plantable packaging market report based on material, type, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bagasse

-

Starch-based

-

Bioplastics

-

Cellulose

-

Seaweed

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flexible Packaging

-

Rigid Packaging

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food And Beverage

-

Cosmetics

-

Pharmaceutical

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plantable packaging market was estimated at USD 129.23 million in 2023 and is expected to reach USD 143.50 million in 2024.

b. The global plantable packaging market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030, reaching around USD 284.53 million by 2030.

b. The food and beverage sector dominates the plantable packaging market due to the increasing demand for sustainable, biodegradable packaging options. Restaurants, cafes, and food manufacturers are rapidly adopting plantable packaging for wraps, containers, and pouches.

b. Some of the key players in plantable packaging include Botanical PaperWorks, The Mend, Eco Marketing Solutions, Greenfield, Dong Guan on the Way Packaging Products Co., Ltd., Earthly Goods, inc., Searo, FlexSea, Evoware, and Sway Innovation Co.

b. The Global Plantable Packaging Market is gaining momentum due to increasing consumer demand for eco-friendly and sustainable packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.