- Home

- »

- Consumer F&B

- »

-

Plant-based Milk Market Size, Share & Growth Report, 2030GVR Report cover

![Plant-based Milk Market Size, Share & Trends Report]()

Plant-based Milk Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Almond Milk, Oat Milk, Soy Milk, Coconut Milk), By Nature (Organic, Conventional), By Flavor (Flavored, Non-Flavored), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-343-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant-based Milk Market Summary

The global plant-based milk market size was estimated at USD 20.84 billion in 2024 and is projected to reach USD 32.35 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. Consumers are increasingly seeking dairy alternatives due to lactose intolerance, allergies, and the desire for lower-calorie, nutrient-rich options.

Key Market Trends & Insights

- The Asia Pacific dominated the plant-based milk market and accounted for a revenue share of over 47.1% in 2023.

- The plant-based milk market in the U.S. is expected to grow at a CAGR of 5.7% over the forecast period.

- Based on product, the almond milk segment accounted for a revenue share of 56.0% in 2023.

- By nature, the conventional plant-based milk segment accounted for a revenue share of 85.5%.

- By flavor, the non-flavored plant-based milk segment held the largest share of 64.7% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 20.84 Billion

- 2030 Projected Market Size: USD 32.35 Billion

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2023

Furthermore, technological advancements and innovation in product development have improved the taste and texture of plant-based milks, making them more appealing. In addition, the rising popularity of veganism and flexitarianism, as more people around the world switch to plant-based diets, has expanded the consumer base. All these factors collectively are expected to drive the demand and growth of the plant-based milk market during the forecast period.Health and wellness trends have been a major driving force behind the popularity of plant-based milk products. Many consumers are becoming more health-conscious and are seeking alternatives to dairy milk that offer similar nutritional benefits without the potential drawbacks. For example, lactose intolerance and dairy allergies are common issues that plant-based milks can address effectively. According to the National Institute of Diabetes and Digestive and Kidney Diseases, approximately 68% of the global population has lactose malabsorption, making lactose-free alternatives highly appealing.

Plant-based milks such as almond, soy, oat, and rice milk often contain lower levels of saturated fats and cholesterol compared to cow's milk, which can contribute to better cardiovascular health. The American Heart Association has highlighted the importance of reducing saturated fat intake to lower the risk of heart disease, driving health-conscious consumers toward plant-based alternatives. Additionally, many plant-based milks are fortified with essential nutrients like calcium, vitamin D, and vitamin B12, thus driving the preference for and the demand of plant-based milk across the world during the forecast period.

Manufacturers are continually investing in research and development to improve the taste, texture, and nutritional profile of plant-based milks. Advances in food technology have enabled the creation of plant-based milks that closely mimic the creaminess and mouthfeel of cow's milk, further contributing to its increasing acceptance among the consumers.

Furthermore, the variety of plant-based milk options has expanded significantly in recent years, with choices ranging from almond milk to oat milk, rice milk, coconut milk, and even more niche varieties like hemp milk and pea milk. Each type offers unique benefits and caters to different dietary needs and taste preferences. For example, oat milk has gained popularity for its creamy texture and suitability for frothing in coffee, while almond milk is favored for its low-calorie content.

Government policies and regulatory support have also contributed to the growth of the plant-based milk market.In the U.S., the Dietary Guidelines for Americans have recognized the nutritional benefits of plant-based diets, encouraging consumers to consider plant-based alternatives as part of a healthy eating pattern. Furthermore, many governments around the world are offering subsidies and financial incentives to promote the cultivation of crops used in plant-based milks, such as almonds, soybeans, oats, and rice.

For instance, In the European Union, the Common Agricultural Policy (CAP) provides subsidies to farmers who adopt sustainable farming practices. The CAP has been reformed to include greening measures, which reward farmers for crop diversification, maintaining permanent grassland, and creating ecological focus areas. These measures indirectly support the production of crops used in plant-based milks by promoting environmentally friendly farming practices, thus contributing to the growth of the plant-based milk market during the forecast period.

Product Insights

Almond milk accounted for a revenue share of 56.0% in 2023. Almond milk is low in calories compared to other plant-based milks, making it an attractive option for weight-conscious consumers. Furthermore, almond milk is rich in vitamins and minerals, particularly vitamin E, known for its antioxidant properties, thus contributing to the increasing demand and preference for almond milk among consumers.

Additionally, leading brands like Almond Breeze and Silk have invested heavily in marketing, emphasizing the health benefits and versatility of almond milk. These brands have established a strong foothold in the market, making almond milk a familiar and trusted choice for consumers, further augmenting its growth and acceptance during the forecast period worldwide.

The oat milk market is expected to grow at a CAGR of 9.4% from 2024 to 2030. Oat milk is rich in dietary fiber, particularly beta-glucan, which has been shown to help lower cholesterol levels. Furthermore, oat milk often contains higher levels of protein compared to other plant-based milks, making it a nutritious option for consumers. Moreover, innovations in oat milk production have led to the creation of high-quality products that meet consumer demands. The introduction of flavored oat milk, fortified oat milk, and oat-based creamers has expanded the product range, attracting a broader consumer base. These factors are expected to drive market growth for oat milk during the forecast period.

Nature Insights

Conventional plant-based milk accounted for a revenue share of 85.5% in the plant-based milk market in 2023. Conventional plant-based milks have a broader distribution network and are more widely available in supermarkets, grocery stores, and convenience stores. The ease of access to conventional products makes them the go-to choice for many consumers. Furthermore, conventional plant-based milks are generally more affordable than their organic counterparts, further making them more accessible to the consumers. This easy accessibility to conventional plant-based milk is expected to keep the dominance of conventional plant-based milk during the forecast period.

On the other hand, the organic plant-based milk market is expected to grow with a CAGR of 11.5% from 2024 to 2030. There is a growing consumer preference for organic products due to perceived health benefits. Organic plant-based milks are free from synthetic pesticides, fertilizers, and genetically modified organisms (GMOs), which appeals to health-conscious consumers. The increasing awareness of potential health risks associated with synthetic additives drives the demand for organic alternatives.

Additionally, there is an increase in launches of organic plant-based milk by manufacturers, expected to further augment its growth during the forecast period. For instance, in June 2024, Milkadamia expanded its line of premium plant-based milks with the launch of Shelf-stable Macadamia Nut Milk in the U.S. It is the company’s first USDA organic offering.

Flavor Insights

Non-flavored plant-based milk accounted for a revenue share of 64.7% in 2023 in the plant-based milk market. Non-flavored plant-based milks are highly versatile and can be used in a variety of applications, from cooking and baking to blending with other ingredients. This versatility makes non-flavored milk a staple in many households, driving its market dominance. Furthermore, many consumers perceive non-flavored plant-based milks as healthier options compared to flavored varieties, which often contain added sugars and artificial flavorings. Health-conscious consumers prefer non-flavored milks to avoid added sugars and maintain a balanced diet, further driving its market demand during the forecast period.

The flavored plant-based milk market is expected to grow at a CAGR of 8.6% from 2024 to 2030. Flavored plant-based milks cater to consumers' taste preferences, offering a variety of flavors such as chocolate, vanilla, and strawberry. These flavors make plant-based milks more enjoyable for consumers, particularly children and those who find non-flavored options bland. In addition, manufacturers are continually innovating to introduce new and exciting flavors, which attract consumers looking for variety. Limited-edition flavors and seasonal offerings create excitement and drive sales in the flavored plant-based milk segment. All these factors are expected to drive market growth for the plant-based milk market during the forecast period.

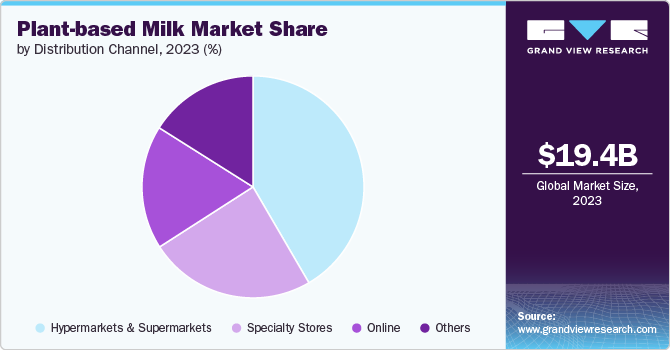

Distribution Channel Insights

Sales through hypermarkets & supermarkets accounted for a revenue share of 41.6% in 2023 in the plant-based milk market. Hypermarkets and supermarkets have extensive reach and cater to a large customer base. They are conveniently located and attract high footfall, making them the preferred shopping destination for many consumers. Furthermore, these retail outlets offer a wide variety of plant-based milk products, including different brands, types, and flavors. The extensive product range allows consumers to compare and choose according to their preferences, driving sales through this channel.

Sales of plant-based milk through online channels are expected to grow with a CAGR of 10.4% from 2024 to 2030. The convenience of online shopping is a significant driver for the growth of online sales. Consumers can easily browse, compare, and purchase plant-based milk products from the comfort of their homes. Furthermore, the availability of home delivery services adds to the convenience.

Moreover, online platforms often offer a wider range of products compared to physical stores. Consumers can find specialty plant-based milks and niche products that may not be available in local supermarkets. This wider selection attracts a diverse consumer base and will drive the preference for online channels is expected to drive high sales growth through this channel in the plant-based milk market during the forecast period.

Regional Insights

The North America plant-based milk market is expected to grow with a CAGR of 6.8% from 2024 to 2030. North American consumers are becoming increasingly health-conscious, driving them towards plant-based alternatives. Many are seeking to reduce their intake of saturated fats and cholesterol, which are prevalent in dairy milk. Plant-based milks like almond, soy, and oat milk offer lower calorie content and are often fortified with essential nutrients such as calcium, vitamin D, and B12. This aligns with the growing trend of clean eating and holistic wellness, thus driving up the product sales in the region during the forecast period.

U.S. Plant-based Milk Market Trends

The plant-based milk market in the U.S. is expected to grow at a CAGR of 5.7% from 2024 to 2030. The U.S. market benefits from extensive innovation and variety in plant-based milks. Companies are continuously developing new products and flavors, catering to diverse tastes and dietary needs. The availability of a wide range of options, from almond and soy milk to newer varieties like pea and hemp milk, ensures that there is a plant-based milk for every consumer preference, further driving the sales of plant-based milk in the country during the forecast period.

Europe Plant-based Milk Market Trends

The Europe plant-based milk market is expected to grow at a CAGR of 7.3% from 2024 to 2030. The European Union’s policies promoting sustainable agriculture and reducing environmental impact indirectly support the plant-based milk market. Subsidies and incentives for growing crops used in plant-based milks, along with labeling regulations that ensure transparency, contribute to the market’s growth. Furthermore, the rise of veganism and vegetarianism, along with flexitarian diets, further supports the growth of the plant-based milk market in the region.

Asia Pacific Plant-based Milk Market Trends

The Asia Pacific plant-based milk market accounted for a revenue share of over 47.1% in 2023. The rise of vegetarianism and veganism, driven by concerns about animal cruelty, supports the demand for plant-based milks. Additionally, traditional dietary practices in countries like India, where vegetarianism is prevalent, align well with the consumption of plant-based milks. Furthermore, the influence of Western dietary trends, including the popularity of plant-based diets, is increasing. Younger generations, in particular, are more open to adopting new dietary habits and are driving the demand for plant-based milks in the region during the forecast period.

Key Plant-based Milk Company Insights

The global plant-based milk market is characterized by the presence of numerous well-established and emerging players. Manufacturers are expanding their portfolios to include a wide variety of plant-based milks, such as almond, soy, oat, coconut, rice, hemp, and pea milk. By offering diverse options, they cater to different taste preferences, dietary needs, and allergy considerations. Furthermore, to compete with dairy milk, many plant-based milk manufacturers fortify their products with essential nutrients like calcium, vitamin D, vitamin B12, and protein. This ensures that their products meet consumers' nutritional needs and appeal to those looking for dairy milk alternatives.

Key Plant-based Milk Companies:

The following are the leading companies in the plant-based milk market. These companies collectively hold the largest market share and dictate industry trends.

- Danone S.A.

- Blue Diamond Growers

- The Hain Celestial Group, Inc.

- Califia Farms, LLC

- SunOpta Inc.

- Ripple Foods, PBC

- Elmhurst Milked Direct, LLC

- Pacific Foods of Oregon, LLC

- Oatly AB

- Daiya Foods Inc.

- Dohler GmbH

- Horizon Organic

Recent Developments

-

In June 2024, Califia Brand, known for its dairy-free products, introduced 'Complete Kids,' a nutritious alternative to dairy milk aimed at children. This product combines peas, chickpeas, and fava beans, providing 8g of protein, Omega-3, calcium, choline, and prebiotics. It contains 50% less sugar than traditional milk and offers a smooth, creamy flavor. Califia Brand has made the milk accessible through online platforms and U.S. grocery stores.

-

In May 2024, Lactalis Canada, a subsidiary of the French dairy company Lactalis, has launched a new plant-based milk brand called "Enjoy" in Canada, targeting health-conscious consumers. The brand product portfolio includes six varieties of plant-based milk: plain oat, almond, and hazelnut milks, as well as vanilla-flavored oat and almond options, and a hazelnut-oat blend. These milks are non-GMO, gluten-free, and free from artificial colors, preservatives, and flavors.

-

In April 2024, PLANTSTRONG Foods has introduced a line of fortified whole plant-based milks in the United States. The milk comes in four varieties: Unsweetened Almond, Unsweetened Oat, Oat & Almond, and Oat & Walnut, all packaged in 32-ounce containers that require no refrigeration until opened. These products are exclusively offered in over 500 Whole Foods Market locations nationwide and can also be purchased directly from the company's website.

-

In April 2024, Yeo Hiap Seng, a Singapore-based brand, has introduced Yeo’s Immuno Soy Milk fortified with vitamin B6 and zinc, designed to bolster the immune system. Endorsed as a Healthier Choice in Singapore and Malaysia, it provides a lactose-free and nutritious alternative to traditional breakfast beverages. This soy milk range is rich in protein and calcium, available in original and chocolate flavors, with additional variations expected in the future.

Plant-based Milk Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.66 billion

Revenue forecast in 2030

USD 32.35 billion

Growth rate (Revenue)

CAGR of 7.4% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

7.6Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Danone S.A.; Blue Diamond Growers; The Hain Celestial Group, Inc.; Califia Farms, LLC; SunOpta Inc.; Ripple Foods, PBC; Elmhurst Milked Direct, LLC; Pacific Foods of Oregon, LLC; Oatly AB; Daiya Foods Inc.; Dohler GmbH; Horizon Organic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based Milk Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plant-based milk market report based on product, nature, flavor, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Almond Milk

-

Oat Milk

-

Soy Milk

-

Coconut Milk

-

Rice Milk

-

Pea Milk

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored Milk

-

Non-Flavored Milk

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors driving market growth include rise in health consciousness, increasing vegan and flexitarian populations, innovations in product offerings, environmental concerns, and expanding retail availability.

b. The global plant-based milk market size was estimated at USD 19.42 billion in 2023 and is expected to reach USD 20.84 billion in 2024.

b. The global plant-based milk market market is expected to grow at a compounded growth rate of 7.6% from 2024 to 2030 to reach USD 32.35 billion by 2030.

b. Almond milk dominated the plant-based milk market with a share of 56.0% in 2023. Compared to other plant-based milks, almond milk is low in calories, making it an attractive option for weight-conscious consumers. Furthermore, almond milk is rich in vitamins and minerals, particularly vitamin E, known for its antioxidant properties.

b. Some key players operating in the plant-based milk market include Danone S.A.; Blue Diamond Growers; The Hain Celestial Group, Inc.; Califia Farms, LLC; SunOpta Inc.; Ripple Foods, PBC; Elmhurst Milked Direct, LLC; Pacific Foods of Oregon, LLC; Oatly AB; Daiya Foods Inc.; Dohler GmbH; and Horizon Organic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.