- Home

- »

- Processed & Frozen Foods

- »

-

Plant-based Meat Market Size, Share & Growth Report, 2030GVR Report cover

![Plant-based Meat Market Size, Share & Trends Report]()

Plant-based Meat Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Soy, Pea, Wheat), By Product, By Type (Chicken, Pork, Beef, Fish, Others), By End-use, By Storage, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-145-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant-based Meat Market Summary

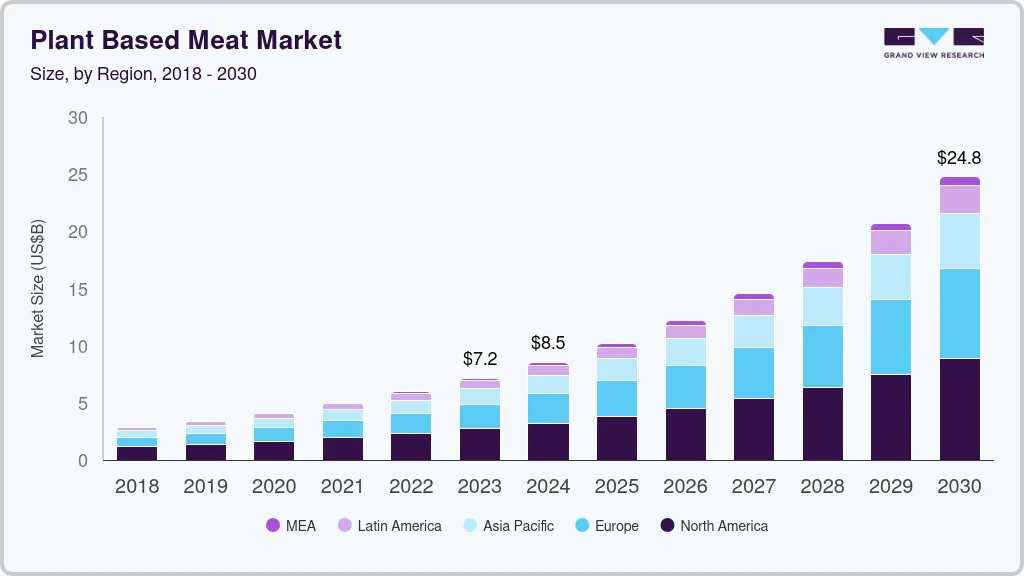

The global plant-based meat market size was valued at USD 7.17 billion in 2023 and is projected to reach USD 24.77 billion by 2030, growing at a CAGR of 19.4% from 2024 to 2030. As more individuals become aware of the health risks associated with excessive consumption of red and processed meats, they are actively seeking healthier alternatives.

Key Market Trends & Insights

- North America plant-based meat market accounted for the largest market revenue share of 38.0% in 2023.

- The U.S plant-based meat market is anticipated to grow rapidly over the forecast period.

- By source, soy accounted for the largest market revenue share of 48.0% in 2023.

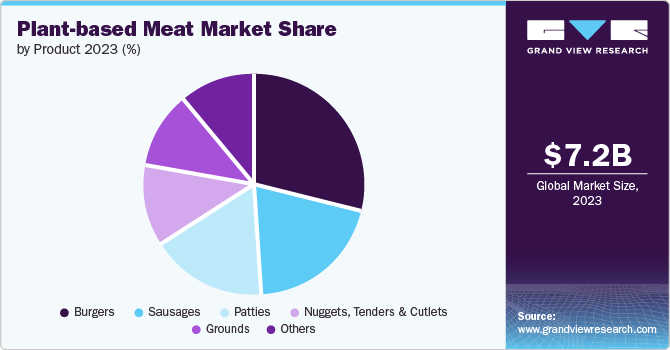

- By product, plant-based burgers accounted for the largest market revenue share in 2023.

- By type, the chicken segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 7.17 Billion

- 2030 Projected Market Size: USD 24.77 Billion

- CAGR (2024-2030): 19.4 %

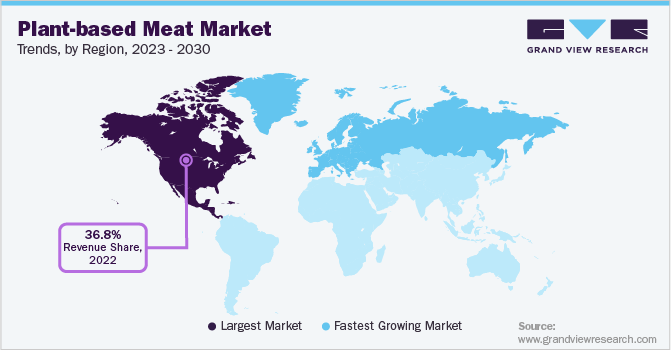

- North America: Largest market in 2024

- Europe: Fastest growing market

Plant-based meats are often perceived as lower in saturated fats and cholesterol than animal-based ones, making them an attractive option for health-conscious consumers. This shift in dietary preferences is supported by a growing body of research linking plant-based diets to various health benefits, including reduced risk of chronic diseases such as heart disease, diabetes, and certain cancers. As plant-based products become more mainstream, they are increasingly available in various formats, from ready-to-eat meals to frozen patties and deli slices. This wide range of offerings caters to different culinary preferences and lifestyles, making it easier for consumers to incorporate plant-based options into their diets. Additionally, the rise of plant-based meat in fast-food chains and restaurants has enhanced accessibility and visibility, helping to normalize these products and attract a broader audience.

Plant-based meat is becoming an integral part of a vegan diet, wherein the adoption of a vegetarian lifestyle that is devoid of animal-based foods becomes the norm. According to Redefine Meat Ltd., there are around 80 million vegans worldwide, and the number constantly increases yearly. Consumers are inclined towards veganism for health and ethical reasons, while some other consumer groups are opting for vegetarian ingredients to avoid animal cruelty and to consume sustainable food & beverage products. Furthermore, soy as a raw material consists of all the standard (nine) amino acids, which are essential for the growth of the human body. Its ability to enhance the water absorption, solubility, emulsification, viscosity, anti-oxidation, and texture of the final product is likely to drive the demand for soy in plant-based meat products over the upcoming years.

Source Insights

Soy accounted for the largest market revenue share of 48.0% in 2023. Soy protein, derived from soybeans, offers a complete protein profile containing all essential amino acids required for human nutrition. This makes it attractive for consumers seeking a nutritious alternative to animal-based proteins. Additionally, soy-based products can be formulated into various textures and flavors, making them suitable for various meat substitutes, from burgers and sausages to nuggets and ground meat.

Pea is anticipated to register the fastest CAGR of 20.6% over the forecast period. Peas offer a high-quality protein profile that includes essential amino acids, making pea protein a valuable alternative to animal-derived proteins and an attractive option for consumers seeking to meet their protein needs through plant-based sources. Additionally, pea protein is easily digestible and hypoallergenic, enhancing its appeal to people with dietary restrictions or sensitivities.

Product Insights

Plant-based burgers accounted for the largest market revenue share in 2023. As more people adopt vegetarian or vegan diets for health reasons, they actively seek satisfying and nutritious alternatives to traditional meat products. With their familiar format and meat-like qualities, plant-based burgers offer a compelling option that meets dietary goals while providing a similar sensory experience to beef burgers.

Plant-based sausages are anticipated to register the fastest CAGR over the forecast period. Sausages are a staple in many diets worldwide, and plant-based versions offer a familiar and convenient option for consumers transitioning to or maintaining a plant-based lifestyle. The availability of plant-based sausages that replicate the taste and texture of traditional meat sausages helps meet the needs of both longtime vegetarians and those exploring more flexible dietary choices.

Type Insights

The chicken segment accounted for the largest market revenue share in 2023. Consumers are increasingly seeking healthier alternatives to traditional meat products due to concerns about saturated fat, cholesterol, and other health issues associated with animal-based proteins. Plant-based chicken typically offers lower saturated fat and cholesterol levels while providing a comparable protein content. The appeal of plant-based chicken as a healthier option helps attract health-conscious consumers looking to reduce their intake of animal-derived foods while still enjoying a familiar taste.

The fish segment is anticipated to register the fastest CAGR over the forecast period. Plant-based fish products often provide essential nutrients such as omega-3 fatty acids, typically found in traditional fish but can also be derived from algae and other plant sources. Additionally, Overfishing and environmental degradation caused by traditional fishing practices have led to a growing demand for sustainable food sources. Plant-based fish products present an eco-friendly alternative that reduces pressure on marine ecosystems, providing consumers with familiar flavors and textures associated with seafood.

End-use Insights

The hotel/restaurant/café (HoReCa) segment accounted for the largest market revenue share in 2023. As more individuals adopt vegetarian or vegan diets or seek to reduce their meat consumption for health reasons, establishments in the HoReCa sector are responding by incorporating plant-based meat alternatives into their menus. This shift caters to a growing customer base and enhances brand reputation as businesses align with contemporary dietary preferences.

Retail is anticipated to register the fastest CAGR over the forecast period. Retailers are increasingly utilizing social media platforms and influencer partnerships to promote their plant-based offerings, creating buzz around new product launches and educating consumers about the benefits of switching to plant-based diets. By leveraging storytelling techniques that highlight sustainability, health benefits, and ethical considerations associated with plant-based eating, retailers can resonate with target audiences on a deeper level.

Storage Insights

Frozen plant-based meat accounted for the largest market revenue share in 2023. As consumers lead busier lifestyles, they seek products that are easy to prepare and store. Frozen plant-based meats offer a long shelf life. They can be quickly cooked from frozen, making them convenient for quick meal solutions without compromising health or dietary preferences. This convenience factor particularly appeals to millennials and Gen Z consumers who prioritize health and time efficiency in their food choices.

Refrigerated plant-based meat is anticipated to register the fastest CAGR over the forecast period. Increased availability in supermarkets, grocery stores, and convenience stores makes refrigerated plant-based meats more accessible to a broader range of consumers. Refrigerated plant-based meats offer a longer shelf life compared to fresh products while maintaining the quality and taste consumers expect.

Regional Insights

North America plant-based meat market accounted for the largest market revenue share of 38.0% in 2023. As awareness of the health risks associated with excessive consumption of red and processed meats grows in the region, many individuals turn to plant-based alternatives as a healthier option. Plant-based meats often feature lower levels of saturated fats and cholesterol and are perceived as a better choice for managing weight and reducing the risk of chronic diseases.

U.S. Plant-based Meat Market Trends

The U.S plant-based meat market is anticipated to grow rapidly over the forecast period. The U.S. has witnessed increasing demand for plant-based meat over the past few years owing to the growing awareness among consumers about the health benefits of veganism. The demand for vegetarian foods high in fiber, vitamin C, and iron and low in processed saturated fats is rising in the U.S. In addition, the round-the-clock efforts of manufacturers to create a product with a longer shelf life, better texture & aroma, and better nutritious profiles are estimated to spur market growth in the U.S. For instance, in October 2022, Beyond Meat, Inc. launched a new plant-based product, Beyond Steak, following the growing demand for plant-based meat from the meat lovers and flexitarian population in the U.S.

Europe Plant-based Meat Market Trends

Europe plant-based meat market is anticipated to register the fastest CAGR over the forecast period. European consumers are becoming more conscious of the links between red and processed meats and various health conditions, including cardiovascular diseases and cancer. As a result, there is a growing demand for plant-based meat alternatives that offer lower levels of saturated fats and cholesterol, aligning with a broader trend towards healthier eating habits.

The UK plant-based meat market is expected to grow rapidly over the forecast period. The UK government has introduced various policies aimed at promoting sustainable food systems and reducing agriculture's carbon footprint. Initiatives such as the National Food Strategy and funding for plant-based food research are helping to support the development and adoption of plant-based meat products. Additionally, public awareness campaigns and educational efforts drive consumer interest and acceptance, creating a favorable environment for growing the plant-based meat market in the UK.

Asia Pacific Plant-based Meat Market Trends

Asia Pacific plant-based meat market held a substantial market revenue share in 2023. Many Asian cultures traditionally consume plant-based foods, such as tofu and tempeh, which have long been staples in their diets. This cultural familiarity with plant-based foods creates a favorable foundation for adopting new plant-based meat alternatives.

India plant-based meat market is anticipated to grow rapidly over the forecast period. India has a long tradition of plant-based eating, with a significant portion of the population adhering to vegetarian diets for religious or cultural reasons. The acceptance of plant-based foods such as lentils, legumes, and tofu provide a solid foundation for market growth in the country. The availability of plant-based meat products is growing in supermarkets, grocery stores, and online platforms across the country. Retailers and food service providers are increasingly stocking and incorporating plant-based options into their offerings.

Key Plant-based Meat Company Insights

Some of the key companies in the plant-based meat market include Beyond Meat, Vegetarian Butcher, Amy’s Kitchen, Inc. and others.

-

Beyond Meat products include Beyond Burger, designed to replicate the flavor and juiciness of beef burgers, and Beyond Sausage, which offers a similar experience to pork sausage. Additionally, they have expanded their offerings to include ground beef alternatives and various other products that cater to consumers seeking healthier and more sustainable dietary options.

-

Amy’s Kitchen features an extensive line of plant-based meat alternatives that appeal to vegetarians, vegans, and flexitarians seeking healthier options. These products include veggie burgers, meatless meatballs, and various ready-to-eat meals that incorporate high-quality ingredients such as organic vegetables, grains, and legumes.

Key Plant-based Meat Companies:

The following are the leading companies in the plant-based meat market. These companies collectively hold the largest market share and dictate industry trends.

- Beyond Meat

- Impossible Foods Inc.

- Maple Leaf Foods (Field Roast & Maple Leaf)

- Vegetarian Butcher

- Conagra, Inc. (Gardein Protein International)

- Kellogg NA Co. (MorningStar Farms)

- Quorn

- Amy's Kitchen, Inc.

- Tofurky

- Gold&Green Foods Ltd.

- Sunfed

- VBites Foods Limited

- Kraft Foods, Inc.

- Lightlife Foods, Inc

- Trader Joe's

- Yves Veggie Cuisine (The Hain-Celestial Canada, ULC)

- Marlow Foods Ltd. (Cauldron)

- Ojah B.V.

- Moving Mountains

- Eat JUST Inc.

- LikeMeat GmbH

- Gooddot

- OmniFoods

- No Evil Foods

- DR. PRAEGER'S SENSIBLE FOODS

Recent Developments

-

In September 2023, Novozymes A/S launched the Vertera ProBite solution, which aims to transform the plant-based meat sector. This new product enhances the texture of plant-based meat alternatives, making them more appealing to consumers who may be hesitant to switch from traditional meat products. By improving these alternatives' mouthfeel and overall sensory experience, Novozymes hopes to encourage a broader audience to embrace plant-based diets.

-

In August 2023, Nestlé unveiled its first shelf-stable plant-based minced meat, marking a significant step in its commitment to expanding its vegan product offerings. This new range caters to the growing demand for meat alternatives among consumers seeking healthier and more sustainable dietary options.

-

In May 2021, Charoen Pokphand Foods PCL launched its product line called “MEAT ZERO” The MEAT ZERO range aims to provide consumers with high-quality, meat-like products that are entirely plant-based, catering to the increasing number of individuals seeking healthier and more environmentally friendly dietary options.

Plant-based Meat Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.54 billion

Revenue forecast in 2030

USD 24.77 billion

Growth Rate

CAGR of 19.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, type, end-use, storage, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; The Netherlands; China; Japan; Australia & New Zealand; Brazil; Argentina; UAE

Key companies profiled

Beyond Meat; Impossible Foods Inc.; Maple Leaf Foods (Field Roast & Maple Leaf); Vegetarian Butcher; Conagra, Inc. (Gardein Protein International); Kellogg NA Co. (MorningStar Farms); Quorn; Amy's Kitchen, Inc.; Tofurky; Gold&Green Foods Ltd.; Sunfed; VBites Foods Limited; Kraft Foods, Inc.; Lightlife Foods, Inc.; Trader Joe's; Yves Veggie Cuisine (The Hain-Celestial Canada, ULC); Marlow Foods Ltd. (Cauldron); Ojah B.V.; Moving Mountains; Eat JUST Inc.; LikeMeat GmbH; Gooddot; OmniFoods; No Evil Foods; DR. PRAEGER'S SENSIBLE FOODS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based Meat Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plant-based meat market report based on source, product, type, end-use, storage, and region

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Pea

-

Wheat

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Burgers

-

Sausages

-

Patties

-

Nuggets, Tenders & Cutlets

-

Grounds

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

HORECA (Hotel/Restaurant/Café)

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerated Plant-based Meat

-

Frozen Plant-based Meat

-

Shelf-stable Plant-based Meat

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plant-based meat market size was estimated at USD 7.17 billion in 2023 and is expected to reach USD 8.54 billion in 2024.

b. The global plant-based meat market is expected to grow at a compound annual growth rate of 19.4% from 2024 to 2030 to reach USD 24.77 billion by 2030.

b. Soy-based meat dominated the plant-based meat market as of 2023 with a share of 48.0% and is expected to advance at a substantial CAGR of 24.2% through 2030.

b. Some of the key players in the market are Beyond Meat, Impossible Foods Inc., Maple Leaf Foods (Field Roast & Maple Leaf), Vegetarian Butcher, Conagra, Inc. (Gardein Protein International), Kellogg NA Co. (MorningStar Farms), Quorn, Amy's Kitchen, Inc., Tofurky, and Gold&Green Foods Ltd.

b. The key factors that are driving the plant-based meat market include the growing adoption of a plant-based lifestyle and diet among health-conscious consumers in traditionally meat-eating developed economies, such as the U.S., Canada, UK, and France. Plant-based meat products, obtained from soy- or gluten-based sources, have juiciness, fibrous consistency, and a meaty texture resembling the traditional meat.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.