- Home

- »

- Consumer F&B

- »

-

Plant-based Butter Market Size, Share & Growth Report 2030GVR Report cover

![Plant-based Butter Market Size, Share & Trends Report]()

Plant-based Butter Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Almond, Oat, Soy, Coconut, Others), By Nature (Organic, Conventional), By Flavor (Flavored, Non-Flavored), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-360-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range:

- Forecast Period: 1 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant-based Butter Market Size & Trends

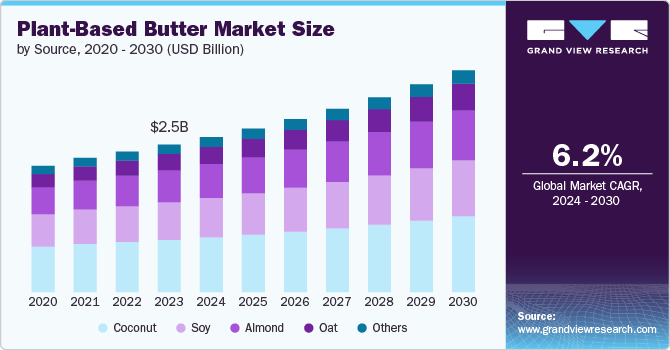

The global plant-based butter market size was estimated at USD 2.47 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. Consumers are increasingly seeking dairy alternatives due to lactose intolerance, allergies, and the desire for lower-calorie, nutrient-rich options. Furthermore, technological advancements and innovation in product development have improved the taste and texture of plant-based butters, making them more appealing. In addition, the rising popularity of veganism and flexitarianism, as more people around the world switch to plant-based diets, has expanded the consumer base. Additionally, supportive government policies and regulations promoting plant-based diets in some regions have contributed to market expansion, creating a favorable environment for the growth of the plant-based butter industry.

Rising Health Consciousness and Dietary Shifts is one of the primary drivers of the market is the increasing health consciousness among consumers. People are becoming more aware of the potential health risks associated with consuming high amounts of animal fats, which are prevalent in traditional butter. Studies have linked excessive intake of saturated fats found in animal products to cardiovascular diseases, obesity, and diabetes. In contrast, plant-based butters often contain healthier fats, such as those derived from nuts and seeds, which can contribute to better heart health and lower cholesterol levels. A 2019 report by the International Food Information Council (IFIC) found that 77% of consumers are actively trying to improve their health by making dietary changes, with many opting for plant-based alternatives to reduce their intake of unhealthy fats.

Manufacturers are continually investing in research and development to improve the taste, texture, and nutritional profile of plant-based butters. Advances in food technology have enabled the creation of plant-based butters that closely mimic the creaminess and mouthfeel of cow's butter, further contributing to its increasing acceptance among consumers.

The market is seeing a significant expansion in product varieties and flavors. Companies are introducing a wide range of options to cater to diverse consumer preferences and dietary needs. Innovations include butters made from various nuts and seeds such as almonds, cashews, macadamia nuts, and sunflower seeds. Additionally, manufacturers are experimenting with unique flavors like garlic herb, honey almond, and cinnamon to appeal to different taste profiles. This diversification helps attract a broader consumer base and keeps the market dynamic and exciting.

For instance, in February 2023, Kagome, a global food and beverage manufacturer, is introducing a new line of plant-based butter blends in the United States. These butter alternatives feature both sweet flavors such as Cinnamon & Brown Sugar, and Hot Honey and savory options like Chipotle & Sun-Dried Tomato, and Miso Ginger. They can seamlessly replace conventional butter in a 1:1 ratio and offer health advantages including reduced saturated fat and zero cholesterol. Crafted from a blend of sunflower oil, cocoa butter, and coconut oil, these products boast a lower melting point and higher smoke point compared to dairy butter. This makes them versatile for various culinary uses like baking, sautéing, and basting.

There is a growing emphasis on enhancing the nutritional profile of plant-based butter products. Manufacturers are incorporating ingredients that boost the health benefits of their products, such as omega-3 fatty acids, fiber, and probiotics. These nutritional enhancements make plant-based butter not only a healthier alternative to traditional butter, but also a functional food that can contribute to overall well-being. This trend is particularly appealing to health-conscious consumers who seek to derive more benefits from the foods they consume.

Source Insights

Coconut butter accounted for a revenue share of 35.50% in 2023. Coconut oil, a primary ingredient in coconut-based butter, possesses a naturally creamy texture and mild flavor that closely resembles traditional dairy butter. This makes it a popular choice among consumers seeking a familiar taste and mouthfeel in plant-based alternatives. Additionally, coconut oil is solid at room temperature, providing a suitable base for spreads and baking applications. Moreover, coconut-based products often appeal to health-conscious consumers due to their perceived health benefits, such as being rich in medium-chain triglycerides (MCTs), which are believed to offer various health advantages. The versatility and consumer acceptance of coconut-based butters have contributed significantly to its dominant position in the market.

The oat butter market is expected to grow at a CAGR of 7.7% from 2024 to 2030. Oat-based butters appeal to consumers for their creamy texture and neutral taste, making them a versatile option in cooking, baking, and spreading. Moreover, oats are often associated with health benefits, including being high in fiber and beta-glucan, which can help reduce cholesterol levels. This health halo has attracted health-conscious consumers looking for nutritious alternatives to dairy butter. Additionally, oats are a sustainable crop with a relatively low environmental impact compared to some other sources, aligning with the growing consumer demand for eco-friendly products. As consumer awareness of health and sustainability continues to rise, oats are positioned to expand their market share significantly in the coming years, making them the fastest-growing segment in the plant-based butter market.

Nature Insights

Conventional plant-based butter accounted for a revenue share of 85.23% in the market in 2023. Conventional plant-based butter have a broader distribution network and are more widely available in supermarkets, grocery stores, and convenience stores. The ease of access to conventional products makes them the go-to choice for many consumers. Furthermore, conventional plant-based butters are generally more affordable than their organic counterparts, further making them more accessible to consumers. This easy accessibility to conventional plant-based butter is expected to keep the dominance of conventional plant-based butter during the forecast period.

On the other hand, the organic market is expected to grow with a CAGR of 9.9% from 2024 to 2030. There is a growing consumer preference for organic products due to perceived health benefits. Organic plant-based butter is free from synthetic pesticides, fertilizers, and genetically modified organisms (GMOs), which appeals to health-conscious consumers. The increasing awareness of potential health risks associated with synthetic additives drives the demand for organic alternatives.

Flavor Insights

Non-flavored plant-based butter accounted for a revenue share of 64.96% in 2023 in the plant-based butter market, due to their versatility and ability to mimic the taste and functionality of traditional dairy butter. These products typically aim to replicate the neutral, creamy taste of butter without additional flavors, appealing to consumers who seek a familiar taste for general cooking, baking, and spreading purposes. Non-flavored plant-based butters are often preferred by consumers who prioritize authenticity and simplicity in their culinary choices. Moreover, they serve as a foundational ingredient that can be easily incorporated into various recipes without altering the intended flavors of dishes, maintaining their appeal across a broad consumer base.

The flavored market is expected to grow at a CAGR of 7.2% from 2024 to 2030,driven by evolving consumer preferences for culinary experimentation and unique taste experiences. These products are infused with herbs, spices, fruits, or other natural flavors to enhance their appeal and cater to diverse palates. Flavored varieties offer a distinct advantage in providing consumers with a range of options to complement specific dishes or create new flavor profiles in both home cooking and professional culinary settings. Additionally, flavored plant-based butters align with the growing trend of consumers seeking innovative and gourmet food products that enhance dining experiences.

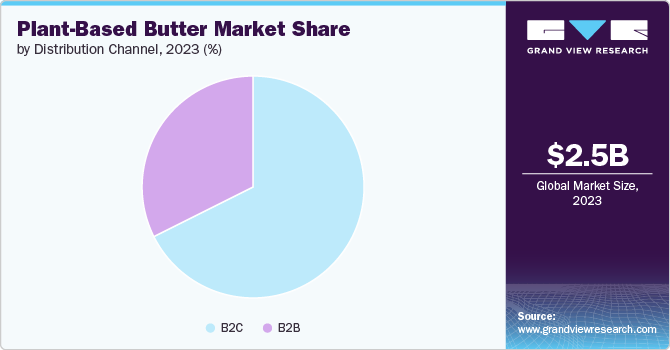

Distribution Channel Insights

Sales through B2C accounted for a revenue share of 67.62% in 2023 in the plant-based butter market, due to the widespread availability of these products in retail outlets such as supermarkets, specialty food stores, and online platforms. B2C channels cater directly to individual consumers who purchase plant-based butters for personal use at home. This dominance is bolstered by increasing consumer awareness and accessibility to plant-based alternatives, driven by rising health consciousness, ethical considerations, and dietary preferences such as veganism. The convenience and variety offered through B2C channels make them a preferred choice for consumers seeking plant-based butter options that align with their lifestyle choices and dietary needs.

Sales of plant-based butter through B2B are expected to grow with a CAGR of 7.0% from 2024 to 2030. This growth is driven by expanding adoption among food service providers, restaurants, bakeries, and institutional buyers who seek plant-based alternatives for use in food preparation and menu offerings. B2B channels offer bulk purchasing options, customized solutions, and partnerships that cater to the specific needs of food industry professionals.

The increasing demand for plant-based ingredients in commercial food production, coupled with efforts to meet consumer preferences for healthier and sustainable options, positions B2B channels for significant growth. As the food service industry continues to embrace plant-based trends and innovation, B2B distribution channels are expected to play a pivotal role in driving the expansion of plant-based butter products globally.

Regional Insights

North America plant-based butter market accounted for a revenue share of over 34.58% in 2023. There is a robust consumer demand for plant-based alternatives driven by increasing health consciousness, dietary restrictions, and environmental concerns. The region has a strong culture of health and wellness, with a significant population opting for vegan and vegetarian diets. Moreover, North American consumers are early adopters of food trends and innovations, contributing to the rapid adoption of plant-based butter products. The presence of established manufacturers, extensive retail networks, and supportive regulatory frameworks further bolster market growth.

U.S. Plant-based Butter Market Trends

The plant-based butter market of the U.S. is expected to grow at a CAGR of 5.6% from 2024 to 2030. The U.S. market is driven by increasing health consciousness, concerns about animal welfare, and environmental sustainability. The rise of flexitarian diets, where consumers reduce but don't eliminate animal products, has boosted demand. Additionally, improved taste and texture of plant-based alternatives, coupled with aggressive marketing campaigns by major food companies, have contributed to market growth. Regulatory support for plant-based alternatives and the strong influence of social media in promoting plant-based lifestyles are also significant factors.

Asia Pacific Plant-based Butter Market Trends

Asia Pacific plant-based butter market is expected to grow with a CAGR of 6.8% from 2024 to 2030. This growth is driven by several factors, including shifting dietary preferences towards healthier alternatives, rising disposable incomes, and increasing awareness of animal welfare and environmental sustainability. Countries in APAC, such as China, India, Japan, and South Korea, are witnessing a surge in demand for plant-based foods due to urbanization, changing lifestyles, and a growing middle-class population. Moreover, government initiatives promoting sustainable agriculture and dietary diversification are encouraging the adoption of plant-based diets across the region. As multinational and local manufacturers expand their product offerings and distribution networks in APAC, the market for plant-based butter is poised for rapid expansion.

Europe Plant-based Butter Market Trends

The plant-based butter market of Europe is expected to grow at a CAGR of 6.2% from 2024 to 2030.The European market benefits from a well-established organic food sector, which aligns well with plant-based products. Stringent regulations on health claims have pushed manufacturers to innovate and improve nutritional profiles. Cultural diversity across European countries has led to a wide variety of plant-based butter options, catering to different culinary traditions. There's also a growing focus on clean label products and natural ingredients.

Key Plant-based Butter Company Insights

The market is characterized by the presence of numerous well-established and emerging players. Manufacturers are expanding their portfolios to include a wide variety of plant-based butter, such as almonds, oats, coconut, soy, rice, hemp, and pea butter. By offering diverse options, they cater to different taste preferences, dietary needs, and allergy considerations. Furthermore, to compete with dairy butter, many plant-based butter manufacturers fortify their products with essential nutrients like calcium, vitamin D, vitamin B12, and protein. This ensures that their products meet consumers' nutritional needs and appeal to those looking for dairy butter alternatives.

Key Plant-based Butter Companies:

The following are the leading companies in the plant-based butter market. These companies collectively hold the largest market share and dictate industry trends.

- Upfield

- Miyoko’s Creamery

- Conagra, Inc.

- Califia Farms, LLC

- Kite Hill

- Ripple Foods, PBC

- Elmhurst Buttered Direct, LLC

- Milkadamia

- Fora Foods

- Naturli’ Foods A/S

Recent Developments

-

In June 2024, Bunge launched Beleaf PlantBetter, a plant-based butter alternative in North America. Designed for food manufacturers and bakers, it uses all-natural ingredients like rapeseed, coconut, and cocoa butter to match traditional dairy butter's sensory qualities. Beleaf PlantBetter is vegan, lactose-free, dairy-free, and free from soy and palm. Blind sensory studies show it performs on par with premium butter brands, offering significant cost savings and reduced-price volatility. Suitable for baking and cooking, it mimics traditional butter's melting point, volume, plasticity, lamination, and emulsification.

-

In October 2023, Wesson, a 124-year-old American brand known for its cooking oil, has launched Wesson Plant Butter (Original) and Plant Butter (with Olive Oil) in the refrigerated aisles of select northeastern U.S. retailers. This plant-based, dairy-free, and preservative-free butter has received positive feedback, with 91% of blind taste testers likely to purchase it. The new product aligns with Wesson's brand refresh by Richardson International Ltd., which acquired the brand in 2019. With canola oil as the primary ingredient, Wesson Plant Butters offer a healthier alternative with no cholesterol or trans fats.

-

In September 2023, Dutch plant-based dairy start-up Willicroft launched its first non-cheese product, a plant-based fermented butter. Unlike margarine, this butter spreads, bakes, and cooks like dairy butter. Developed using precision fermentation, it replicates the taste of high-end dairy butter without artificial flavorings, including butyric acid. The product, made with beans and European soybeans from Austria, has less saturated fat than other plant-based butters while being equally spreadable and meltable.

Plant-based Butter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.60 billion

Revenue forecast in 2030

USD 3.72 billion

Growth rate (Revenue)

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

7.6Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, nature, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Upfield; Miyoko’s Creamery; Conagra, Inc.; Califia Farms, LLC; Kite Hill; Ripple Foods, PBC; Elmhurst Buttered Direct, LLC; Milkadamia; Fora Foods; Naturli’ Foods A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based Butter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plant-based butter market report based on source, nature, flavor, distribution channel, and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Almond

-

Oat

-

Soy

-

Coconut

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored Butter

-

Non-Flavored Butter

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plant-based butter market size was estimated at USD 2.47 billion in 2023 and is expected to reach USD 2.60 billion in 2024.

b. The global plant-based butter market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 3.72 billion by 2030.

b. Coconut butter accounted for a revenue share of 35.5% in 2023. Coconut oil, a primary ingredient in coconut-based butters, possesses a natural creamy texture and mild flavor that closely resembles traditional dairy butter. This makes it a popular choice among consumers seeking a familiar taste and mouthfeel in plant-based alternatives. Additionally, coconut oil is solid at room temperature, providing a suitable base for spreads and baking applications. Moreover, coconut-based products often appeal to health-conscious consumers due to their perceived health benefits, such as being rich in medium-chain triglycerides (MCTs), which are believed to offer various health advantages

b. Some key players operating in plant-based butter market include Upfield; Miyoko’s Creamery; Conagra, Inc.; Califia Farms, LLC; Kite Hill; Ripple Foods, PBC; Elmhurst Buttered Direct, LLC; Milkadamia; Fora Foods; Naturli’ Foods A/S

b. The plant-based butter market is primarily driven by increasing health consciousness among consumers, growing awareness of environmental sustainability, and rising prevalence of lactose intolerance and dairy allergies. Technological advancements improving taste and texture, coupled with the expanding vegan and flexitarian population, are fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.