- Home

- »

- IT Services & Applications

- »

-

Plant Asset Management Market Size & Share Report, 2030GVR Report cover

![Plant Asset Management Market Size, Share, & Trends Report]()

Plant Asset Management Market (2024 - 2030) Size, Share, & Trends Analysis Report By Component (Solution, Services), By Deployment, By Asset Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-469-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant Asset Management Market Summary

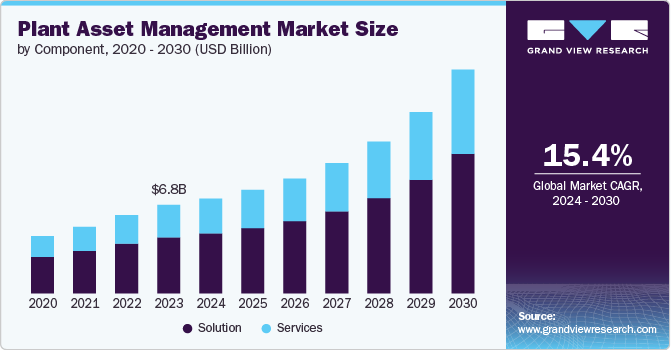

The global plant asset management market size was estimated at USD 6.80 billion in 2023 and is projected to reach USD 17.21 billion by 2030, growing at a CAGR of 15.4% from 2024 to 2030. The increasing demand for automation and digitalization in industrial sectors drives the market's growth.

Key Market Trends & Insights

- The North America plant asset management market held the largest revenue share of over 36% in 2023.

- The plant asset management market in the U.S. is growing significantly at a CAGR of 14.7% from 2024 to 2030.

- Based on component, the solution segment accounted for the largest revenue share of over 63% in 2023.

- Based on asset type, the production assets held a revenue share of over 54% in 2023 and are expected to dominate the market by 2030.

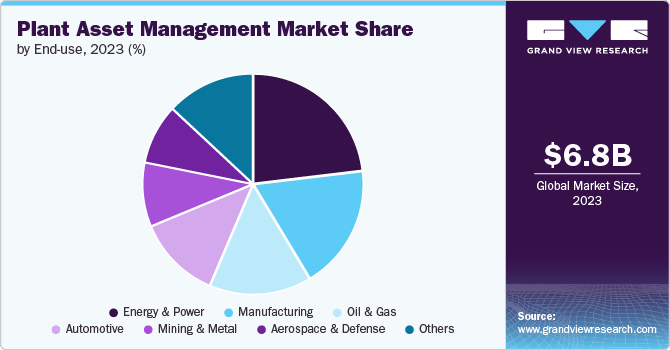

- Based on end use, the energy and power segment accounted for the largest revenue share of over 23% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.80 Billion

- 2030 Projected Market USD 17.21 Billion

- CAGR (2024-2030): 15.4%

- North America: Largest market in 2023

Industries such as oil & gas, chemicals, manufacturing, and energy are increasingly adopting digital solutions to monitor, control, and maintain their assets efficiently. Plant asset management systems enable real-time monitoring, predictive maintenance, and optimized resource allocation, reducing downtime and operational costs. This emphasis on automation and Industry 4.0 advancements propels the market forward.

The rising focus on improving operational efficiency and extending the lifespan of plant assets fuels the market's growth. Companies are recognizing the importance of predictive maintenance and condition monitoring in reducing unexpected failures and ensuring smooth operations. By utilizing PAM systems, businesses can make data-driven decisions that enhance asset performance, increase productivity, and optimize maintenance schedules. It is particularly relevant in industries where unplanned downtime can lead to costly consequences, making PAM systems a strategic investment.

Moreover, advancements in technologies like artificial intelligence (AI), the Internet of Things (IoT), and cloud computing significantly contribute to the market’s growth. These technologies enhance the capabilities of PAM systems, enabling more sophisticated monitoring, data analytics, and remote asset management. As more industries adopt IoT and AI-enabled solutions, the demand for advanced PAM systems is expected to rise, further fueling market growth.

However, the technical complexities of adopting PAM systems restrain the market's growth. PAM systems are highly sophisticated and require a deep understanding of both the technology and the plant's specific processes. Integrating these systems with legacy equipment can be difficult, leading to challenges in implementation. Companies often lack the skilled personnel to manage and optimize these systems, further slowing adoption. The complexity involved in data integration and real-time monitoring across various assets can also deter organizations from embracing PAM solutions.

Component Insights

The solution segment accounted for the largest revenue share of over 63% in 2023. The growing emphasis on predictive maintenance strategies drives the segment’s growth. Unlike traditional reactive maintenance, predictive maintenance uses PAM systems to monitor asset conditions and predict potential failures before they occur. This not only reduces unplanned downtime but also helps in minimizing maintenance costs by addressing issues proactively. Predictive maintenance has become a critical part of asset management in industries where equipment failure can lead to safety risks or large financial losses, such as in the chemical, energy, and transportation sectors.

The services segment is expected to grow at a CAGR of 15.9% during the forecast period. The growing adoption of cloud-based plant asset management solutions is another key factor driving the services market. Cloud-based systems allow for greater flexibility, scalability, and remote access, which are particularly appealing to companies with multiple sites or geographically dispersed operations. Service providers offer cloud implementation, data management, and cybersecurity services to help companies transition from on-premise systems to the cloud. The ease of deployment and lower upfront costs associated with cloud-based PAM services are further accelerating their adoption.

Deployment Insights

The cloud segment held a market share of over 50% in 2023 and is expected to dominate the market by 2030. The cost effectiveness offered by the cloud fuels the segment’s growth. Traditional on-premise systems require significant upfront investment in infrastructure, hardware, and maintenance. In contrast, cloud-based solutions operate on a subscription or pay-as-you-go model, reducing initial capital expenditure and shifting costs to operational budgets. This model appeals to small and medium-sized enterprises (SMEs) and even large organizations that aim to lower IT costs.

The on-premise segment is expected to grow at a CAGR of 14.8% over the forecast period. On-premise deployments offer greater flexibility for customization, allowing companies to tailor their PAM systems to meet specific operational requirements. Unlike cloud-based solutions, which are often standardized to cater to a wide range of users, on-premise systems provide more options for custom integration with legacy equipment and specialized workflows.

Asset Type Insights

The production assets held a revenue share of over 54% in 2023 and are expected to dominate the market by 2030. The increasing focus on equipment and performance fuels the growth of the market. In industries such as manufacturing, energy, and oil and gas, the performance of production assets directly impacts output and profitability. PAM systems provide real-time monitoring and predictive analytics that help companies proactively maintain equipment, detect potential failures, and optimize performance.

The automation assets segment is expected to grow at a CAGR of 15.8% over the forecast period. The widespread adoption of industrial automation across various sectors, including manufacturing, oil and gas, chemicals, and pharmaceuticals, is further propelling the growth of the automation assets segment. Automation technologies such as robotics, automated material handling systems, and advanced control systems are becoming essential for companies looking to scale their operations, improve safety, and meet high production demands. With more automation assets being deployed, companies require robust PAM systems to track and manage these assets, ensuring they remain fully operational and deliver consistent performance.

End Use Insights

The energy and power segment accounted for the largest revenue share of over 23% in 2023. The need for reducing operational costs drives the growth of the market. The energy and power sector is capital-intensive, and companies are constantly seeking ways to reduce operational and maintenance costs. Plant asset management solutions enable companies to optimize the performance of critical assets, such as boilers, turbines, and cooling systems, by providing predictive maintenance, performance monitoring, and analytics capabilities.

The manufacturing segment is expected to grow at a CAGR of 16.7% over the forecast period. The growing need to increase operational efficiencies propels the growth of the market. Manufacturing companies are constantly striving to enhance operational efficiency to remain competitive in a global market. Plant asset management systems help manufacturers optimize asset performance, reduce energy consumption, and minimize downtime. By providing real-time monitoring and analysis of critical equipment and machinery, PAM systems allow manufacturers to detect inefficiencies and bottlenecks in production processes.

Regional Insights

The North America plant asset management market held the largest revenue share of over 36% in 2023. The adoption of Industry 4.0 initiatives, integrating IoT, AI, and advanced analytics, is accelerating the demand for Plant Asset Management (PAM) solutions in North America. As industries embrace digital transformation, companies are deploying smart technologies to automate processes, monitor equipment in real-time, and enhance asset performance. Predictive maintenance powered by IoT sensors and AI-driven analytics helps reduce downtime, optimize operational efficiency, and extend asset life cycles. The transition to these advanced digital tools enables businesses to gain better visibility into asset health, ultimately driving productivity and reducing maintenance costs in industries like manufacturing, energy, and oil & gas.

U.S. Plant Asset Management Market Trends

The plant asset management market in the U.S. is growing significantly at a CAGR of 14.7% from 2024 to 2030. In the U.S., industries such as oil & gas, manufacturing, and energy are increasingly adopting predictive maintenance to improve operational efficiency. Predictive maintenance uses IoT sensors, AI, and data analytics to monitor equipment health in real time, allowing companies to predict potential failures before they occur. This reduces unplanned downtime, lowers maintenance costs, and extends the life of critical assets. By optimizing performance and minimizing disruptions, predictive maintenance enhances productivity, ensuring continuous operation. Its growing implementation reflects the broader trend of digital transformation aimed at maximizing asset reliability and overall operational performance.

Asia Pacific Plant Asset Management Market Trends

The plant asset management market in Asia Pacific is growing significantly at a CAGR of 16.4% from 2024 to 2030. Countries such as China, India, and Southeast Asian nations are witnessing rapid industrial expansion, fueling the demand for Plant Asset Management (PAM) solutions. This industrial growth leads to increased complexities in managing large-scale infrastructure, making PAM systems crucial for optimizing operational efficiency, minimizing downtime, and ensuring seamless production. Rising investments in manufacturing and infrastructure across the region are driving the adoption of PAM systems. Industries, particularly in automotive, construction, and utilities, use these solutions to monitor and manage critical assets, extending their lifecycle and improving reliability. PAM systems help streamline operations, enhance productivity, and maintain high-performance standards in these capital-intensive sectors.

Europe Plant Asset Management Market Trends

The plant asset management market in Europe is growing significantly at a CAGR of 15.3% from 2024 to 2030. In Europe, stringent environmental regulations and a focus on sustainability are key drivers for the adoption of Plant Asset Management (PAM) solutions. Industries are increasingly integrating PAM systems to optimize energy consumption, reduce carbon emissions, and comply with EU green energy goals. These solutions help businesses monitor and manage assets efficiently, ensuring that they meet sustainability targets while minimizing environmental impact. PAM systems also support renewable energy initiatives by improving asset performance, enhancing operational efficiency, and ensuring regulatory compliance in sectors such as energy, manufacturing, and utilities, contributing to Europe's overall sustainability objectives.

Key Plant Asset Management Company Insights

Key players operating in the market include Siemens AG, ABB Ltd., Schneider Electric, Honeywell International Inc., Emerson Electric Co., Rockwell Automation, Inc., General Electric (GE), IBM Corporation, Bentley Systems, Inc., and Yokogawa Electric Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Plant Asset Management Companies:

The following are the leading companies in the plant asset management market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG, ABB Ltd.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- General Electric (GE)

- IBM Corporation

- Bentley Systems, Inc.

- Yokogawa Electric Corporation

Recent Developments

-

In March 21, 2024, Yokogawa Electric Corporation announced the launch of its new OpreX Control Performance Management solution. This advanced software tool enhances control performance and operational efficiency by offering real-time monitoring, diagnostics, and optimization for control systems. The solution is designed to help industries improve process stability and performance, reduce operational costs, and enhance overall productivity through more effective control and management

-

In November 2023, ABB launched its new Digital Asset Performance Management platform for instrumentation on September 5, 2024. This innovative platform offers advanced analytics and real-time monitoring to optimize asset performance and lifecycle management. It aims to enhance operational efficiency, reduce downtime, and extend the life of instrumentation assets. By integrating data from various sources, the platform provides actionable insights to improve decision-making and overall asset reliability

-

In March 28, 2023, Yokogawa Electric Corporation launched OpreX Asset Health Insights (2.0), an upgraded cloud-based plant asset monitoring service. This new version integrates advanced asset monitoring and management features and supports Alibaba Cloud, marking Yokogawa's first technical partnership with the platform. It aggregates and refines operational and process data, providing a comprehensive view of assets for improved management, efficiency, and decision-making.

Plant Asset Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.29 billion

Revenue forecast in 2030

USD 17.21 billion

Growth rate

CAGR of 15.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, asset type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Siemens AG; ABB Ltd.; Schneider Electric; Honeywell International Inc.; Emerson Electric Co.; Rockwell Automation, Inc.; General Electric (GE); IBM Corporation; Bentley Systems, Inc.; Yokogawa Electric Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant Asset Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global plant asset management market report based on component, deployment. Asset type, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Asset Lifecycle Management

-

Predictive Maintenance

-

Work Order Management

-

Inventory Management

-

-

Services

-

Professional Service

-

Managed Service

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Asset Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Production Assets

-

Automation Assets

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy & Power

-

Oil & Gas

-

Manufacturing

-

Mining & Metal

-

Aerospace & Defense

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plant asset management market was valued at USD 6.80 billion in 2023 and is expected to reach USD 7.29 billion in 2024.

b. The global plant asset management market is expected to grow at a compound annual growth rate of 15.4% from 2024 to 2030 to reach USD 17.21 billion by 2030.

b. The solution segment accounted for the largest market share of over 63% in 2023. The growing emphasis on predictive maintenance strategies drives growth of the segment. Unlike traditional reactive maintenance, predictive maintenance uses PAM systems to monitor asset conditions and predict potential failures before they occur. This not only reduces unplanned downtime but also helps in minimizing maintenance costs by addressing issues proactively.

b. Key players operating in the plant asset management market include Siemens AG, ABB Ltd., Schneider Electric, Honeywell International Inc., Emerson Electric Co., Rockwell Automation, Inc., General Electric (GE), IBM Corporation, Bentley Systems, Inc., and Yokogawa Electric Corporation

b. The increasing demand for automation and digitalization in industrial sectors drives the market's growth. Industries such as oil & gas, chemicals, manufacturing, and energy are increasingly adopting digital solutions to monitor, control, and maintain their assets efficiently. Plant asset management systems enable real-time monitoring, predictive maintenance, and optimized resource allocation, reducing downtime and operational costs. This emphasis on automation and Industry 4.0 advancements propels the market forward

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.