Piston Market Size, Share & Trends Analysis Report By Material (Aluminum, Steel), By Component (Piston Head, Piston Ring), By Vehicle, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-429-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

“2030 piston market value to reach USD 3.37 billion.”

Piston Market Size & Trends

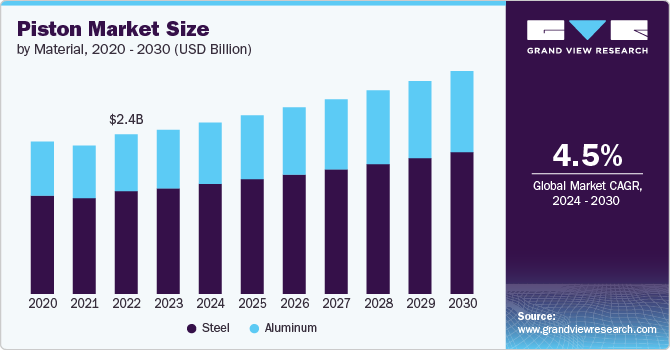

The global piston market size was estimated at USD 2.49 billion in 2023 and is estimated to grow at a CAGR of 4.5% from 2024 to 2030. The primary driver for the piston market is the escalating demand for fuel-efficient and high-performance engines. As automotive and industrial sectors strive to meet stricter emission regulations and enhance overall engine efficiency, there is a growing need for advanced piston technologies.

Innovations such as lightweight materials, improved designs, and enhanced durability are crucial in optimizing engine performance and reducing fuel consumption, thereby driving the market. This trend is further amplified by the increasing emphasis on sustainability and regulatory compliance across global markets.

Drivers, Opportunities & Restraints

The piston market is driven by increasing demand for high-performance and fuel-efficient engines across automotive and industrial applications. Technological advancements, such as developing lightweight and durable materials, are enhancing piston performance and efficiency. In addition, stricter emission regulations globally are pushing manufacturers to innovate and integrate advanced manufacturing technologies, fueling market growth.

Key restraints in the piston market include the high costs associated with advanced materials and manufacturing processes. The complexity and expense of integrating new technologies can be prohibitive for smaller manufacturers. Moreover, the growing adoption of electric vehicles, which do not require traditional pistons, poses a potential threat to the market's long-term growth.

The market presents significant opportunities in emerging markets, where increasing vehicle ownership and industrialization are driving demand. There is also potential for growth through advancements in piston technology, such as smart pistons with integrated sensors. As the automotive industry continues to shift towards hybrid and high-performance vehicles, opportunities for innovation and market expansion in these segments are substantial.

Material Insights & Trends

“Aluminum segment is anticipated to grow at fastest CAGR over the forecast period ranging from 2024-2030.”

Steel pistons dominate the market due to their robustness and durability under extreme conditions. Their high tensile strength and resistance to thermal and mechanical stress make them suitable for a broad range of applications, from passenger vehicles to heavy-duty machinery. Recent advancements in steel alloys have further enhanced their performance, maintaining their status as the leading choice across various vehicle types.

Aluminum pistons are the fastest-growing segment, driven by their lightweight nature and excellent thermal conductivity. The automotive industry's focus on fuel efficiency and emissions reduction has spiked demand for aluminum pistons, which contribute to lighter engines and improved performance. Innovations in aluminum alloys and manufacturing are accelerating this segment's growth, making it increasingly popular in high-performance engines.

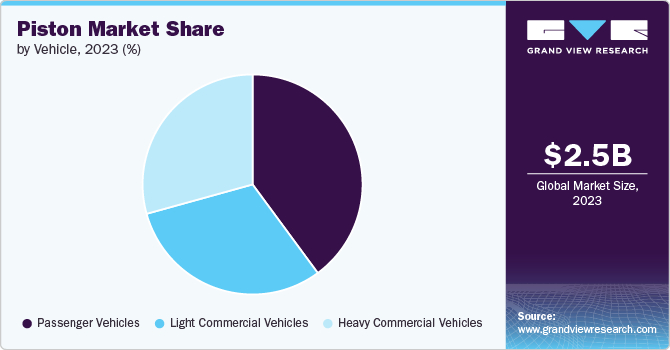

Vehicle Insights & Trends

“Passenger vehicles vehicle held the largest revenue share of piston market in 2023.”

With a steady rise in vehicle ownership in emerging markets and continuous improvements in automotive technology, the demand for pistons in passenger vehicles is robust. The expansion of urban areas and the increasing focus on fuel efficiency and emission reductions are driving factors behind the sustained demand for pistons in this segment.

The piston market is witnessing rapid growth, driven by the rising demand for light commercial vehicles (LCVs) fueled by e-commerce and delivery services. With a push towards fuel efficiency and lower emissions, companies such as Ford and Daimler are innovating in engine and piston technologies. This surge in LCV use reflects the broader expansion in logistics and delivery operations, marking it as a fast-growing sector.

Component Insights & Trends

“Piston ring segment held the largest revenue share of piston market in 2023.”

Piston rings are vital for engine efficiency and emission reduction. Recent developments in materials like low-friction alloys have improved their performance. Automotive leaders are adopting these innovations, driven by strict emission standards. Companies like Mahle and Federal-Mogul are investing in R&D to enhance piston ring durability and functionality.

The piston head segment is the fastest-growing part of the piston market, driven by the demand for high-performance engines and technological advancements. Modern engines, especially in vehicles and aerospace, require innovation in piston design to enhance performance and efficiency. The trend towards turbocharged engines and the need for better thermal management are accelerating the development of advanced piston heads. Leading companies such as Toyota Motor Corporation and Cummins Inc. are investing in next-generation piston heads for higher compression ratios and improved fuel efficiency.

Regional Insights

“U.S. dominated the revenue share of the North America piston market.”

The North American piston market has experienced steady growth, driven by robust automotive manufacturing and technological advancements. In 2022, the integration of advanced piston technologies in vehicles to meet stricter emission standards played a significant role. For instance, the shift towards electric and hybrid vehicles by major manufacturers such as General Motors and Ford has increased demand for high-performance pistons. In addition, investments in R&D by companies such as Mahle have further propelled market growth.

U.S. Piston Market Trends

In the U.S., the piston market has been sustained by a strong automotive sector and a focus on performance and efficiency. Key trends have been the launch of new, high-performance vehicle models and the adoption of advanced piston materials. For instance, in 2023, Ford’s introduction of high-efficiency engines in its new lineup has driven demand for advanced piston components. The emphasis on reducing emissions and improving fuel economy has led to increased innovation and market expansion.

Asia Pacific Piston Market Trends

The Asia Pacific region has emerged as a major growth hub for the piston market, driven by rapid industrialization and automotive production expansion. In 2022, the region saw significant investments in advanced piston technologies. A major trend has been the increasing adoption of lightweight materials, including aluminum pistons, in vehicles aimed at improving fuel efficiency. The region's booming automotive sector continues to fuel market growth.

Europe Piston Market Trends

Europe's piston market has been influenced by stringent environmental regulations and a strong push towards sustainable automotive solutions. In 2023, European automakers adopted advanced technologies to comply with stricter emission standards. The market has also seen growth due to innovations in piston design and materials, driven by the EUs emphasis on reducing carbon footprints and enhancing vehicle performance.

Key Piston Company Insights

Some of the key players operating in the market include MAHLE GmbH. and Hitachi, Ltd.

-

Hitachi, Ltd., a global industrial and technological solution provider, has a notable presence in the piston market through its extensive automotive components division. It focuses on producing high-quality pistons for various engine applications. The company utilizes advanced materials and manufacturing technologies to enhance piston performance and durability, serving the automotive and industrial machinery sectors.

-

MAHLE GmbH is a leading automotive supplier renowned for its expertise in engine components, including pistons, specializing in high-performance pistons for automotive engines. The company emphasizes innovation in materials and design to improve engine efficiency and meet stringent emission standards.

Key Piston Companies:

The following are the leading companies in the piston market. These companies collectively hold the largest market share and dictate industry trends.

- MAHLE GmbH

- Tenneco Inc.

- Rheinmetall AG

- AISIN CORPORATION

- RIKEN CORPORATION

- Aditya Birla Nuvo

- Art-Serina Piston Co., Ltd.

- Shriram Pistons & Rings Ltd.

- Hitachi, Ltd.

- Dongsuh Federal-Mogul Co., Ltd.

- PMG Holding

- Honda Foundry Co., Ltd.

Recent Developments

-

In May 2023, Nippon Piston Ring and Riken Corporation announced planned to merge, creating a new entity called NPR Riken Corporation. This strategic move for a merger is expected to leverage synergies between the two companies, improving their technological capabilities and market reach while streamlining operations and expanding their global footprint in the automotive components industry.

-

In May 2023, Shriram Pistons & Rings Ltd. announced a strategic investment of INR 222 crore (~USD 26.5 million) in Takahata Precision India, a subsidiary of the Japanese precision components manufacturer Takahata Group. This investment aims to bolster Shriram’s production capabilities and expand its product offerings in the piston market.

Piston Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.60 billion |

|

Revenue forecast in 2030 |

USD 3.37 billion |

|

Growth rate |

CAGR of 4.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, vehicle, component, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

MAHLE GmbH; Shriram Pistons & Rings Ltd.; Rheinmetall AG; RIKEN CORPORATION; Aditya Birla Nuvo; AISIN CORPORATION; Art-Serina Piston Co., Ltd.; Dongsuh Federal-Mogul Co.,Ltd.; Hitachi, Ltd.; Tenneco Inc.; Honda Foundry Co., Ltd.; PMG Holding |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

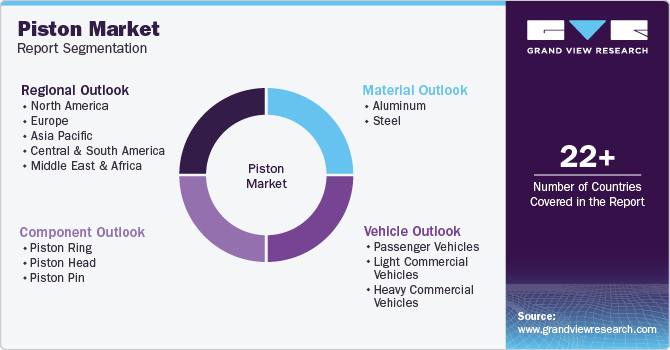

Global Piston Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global piston market report on the basis of material, vehicle, component, and region.

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aluminum

-

Steel

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Piston Ring

-

Piston Head

-

Piston Pin

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global piston market size was estimated at USD 2.49 billion in 2023 and is expected to reach USD 2.60 billion in 2024.

b. The global piston market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 3.37 billion by 2030.

b. By vehicle, passenger vehicles dominated the market with a revenue share of over 40.0% in 2023.

b. Some of the key vendors in the global piston market are MAHLE GmbH, Shriram Pistons & Rings Ltd., Rheinmetall AG, RIKEN CORPORATION, Aditya Birla Nuvo, AISIN CORPORATION, Art-Serina Piston Co., Ltd., Dongsuh Federal-Mogul Co.,Ltd., Hitachi, Ltd., Tenneco Inc., PMG Holding, and Honda Foundry Co., Ltd.

b. The key factor driving the growth of the global piston market is attributed to the significant growth driven the escalating demand for fuel-efficient and high-performance engines. As automotive and industrial sectors strive to meet stricter emission regulations and enhance overall engine efficiency, there is a growing need for advanced piston technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."