Pipeline Pigging Services Market Size, Share & Trends Analysis Report By Service (Pigging, Intelligent Pigging), By Application (Metal Loss, Crack & Leakage Detection), By Industry, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-899-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Pipeline Pigging Services Market Trends

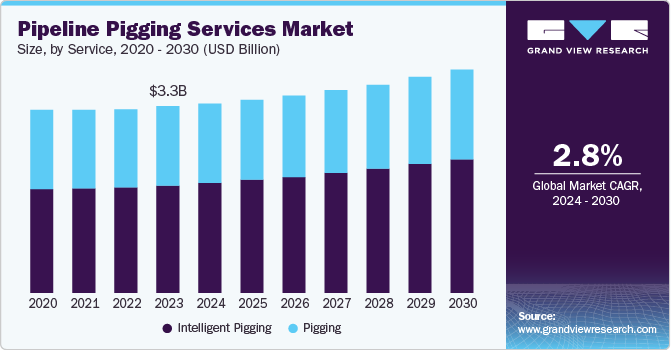

The global pipeline pigging services market size was valued at USD 3.26 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 2.8% from 2024 to 2030. Pipeline pigging uses a device known as a “pig” to clean the pipes and perform maintenance activities. These services reduce high-cost repair expenditure, extending the product life and minimizing safety risks. Growing concern regarding pipeline safety and energy infrastructure, along with stringent government policies and regulations for safe and secure oil and gas transportation, is projected to boost market growth. The rise in applications in various end-use industries, including oil and gas, lube oil, and chemicals, is anticipated to drive further growth.

Pipeline inspection and maintenance programs are vital in the oil and gas industry. Negligence or failure can lead to debris accumulation, resulting in revenue losses to the operator. Pipeline pigging services help maintain the integrity of the asset, underlining their significance in the operation and maintenance system.

Advancements in technology and an increasing focus on research and development have driven the expansion of the pipeline pigging services market. Innovative pigging technologies have enhanced the precision and effectiveness of pipeline inspection and maintenance activities. These advancements include smart pigging systems with sensors and data analysis features, enabling real-time monitoring and analysis of pipeline conditions.

Furthermore, rising demand for gas energy sources and growth in trade dynamics offer major pipeline companies new opportunities. Pipeline services are important as they help maintain the integrity and management of supply systems. This service also helps with corrosion management of the pipeline network and drives the regulatory bodies to conduct timely pipeline inspections to reduce failure risks. Hence, these factors help in the pipeline pigging services market growth.

Service Insights

The intelligent pigging segment dominated the market in 2023 with a share of 58.0%. Smart pigs perform advanced inspection activities and gather data on pipeline curvature, diameter, bends, and temperature. It provides non-destructive examination techniques such as magnetic flux leakage testing to inspect metal loss, hydrogen-induced cracking, pitting, and weld anomalies that will further stimulate segment growth. Furthermore, intelligent pigging offers targeted maintenance, which aids in reducing downtime and unnecessary operations. Advanced sensors, real-time data, and data analytics provide better risk identification. Hence, these factors encourage the segment growth.

The pigging composite segment is expected to grow at a CAGR of 3.3% during the forecast period. The market growth is attributed to the properties of pigging composites such as durability and corrosion resistance. The pigging composites are made from materials such as carbon fiber and fiberglass. These materials resist harsh environments such as high pressures, high temperatures, and corrosion. Hence, pipelines have been implemented to transport various products.

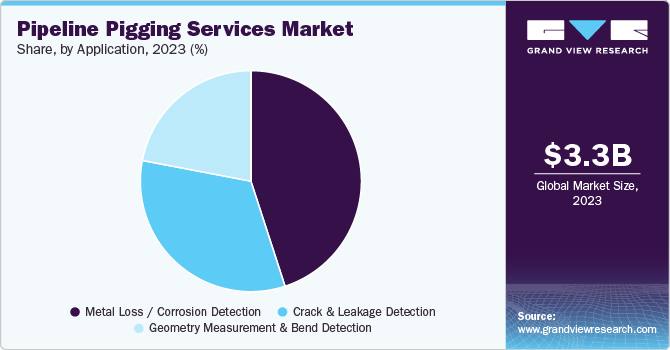

Application Insights

The metal loss/corrosion detection segment dominated, with a share of 45.0% in 2023. Corrosion is a major issue affecting the operability of oil and gas pipeline systems, and vendors use pigging as a preliminary step for pipeline inspection. The rise in pipeline networks and increased awareness regarding corrosion and failures have led to an increasing number of inspection operations. Governments and regulatory bodies have implemented strict rules regarding inspection and maintenance.

The crack and leakage detection segment is expected to grow at a CAGR of 2.9% during the forecast period. The market growth is due to the rising focus on pipeline safety, as cracks and leaks lead to major failures, resulting in heavy damage and environmental hazards. Technological development in the pigging sector has led to pigging tools equipped with sensors and software that detect cracks and leaks. The tools also allow early detection of cracks and leaks, which helps to implement preventive maintenance measures.

Industry Insights

The oil segment dominated the market in 2023 with a share of 68.0%. The market growth is high due to the rise in oil demands and growth in the oil-based industries. This has resulted in a growing network of pipelines to improve transportation. Oil pipelines require regular maintenance as risks such as corrosion and leaks can occur and lead to heavy damage and oil spills. Furthermore, technological advancements drive accuracy in the inspection and maintenance of pipelines. Hence, these factors contribute to the segment growth.

The gas segment is expected to grow at a moderate CAGR during the forecast period. Rising demand for gas due to awareness regarding eco-friendly fuel alternatives has led to an increase in the number of gas pipelines. Gas pipelines require inspections and maintenance to avoid hazards and leaks. Furthermore, governments and regulatory institutes are actively overseeing pipeline regulations to improve the safety of pipeline transportation.

Regional Insights

North America dominated the pipeline pigging services market with a share of 49.8% in 2023. The market is growing as most of the oil and gas fields in North American countries such as the U.S. and Canada are located in remote areas. Thus, resulting in higher deployment of oil & gas distribution networks. The need for efficient transportation of petroleum products from production sites to storage locations will increase the regional demand for pipeline pigging services.

U.S. Pipeline Pigging Services Market Trends

The U.S. pipeline pigging services market held a substantial market share in North America. The presence of vast networks of oil and gas pipelines and increased awareness regarding timely maintenance have shaped the market growth. There are stringent rules regarding environmental protection and pipeline safety in the U.S.

Europe Pipeline Pigging Services Market Trends

Europe pipeline pigging services market held a significant market share in 2023, due to the growing demand for pipeline maintenance. Many regional pipelines are aging, increasing the risk of major damage. Hence, there is an increase in the need for pigging inspections, as they help identify potential issues regarding leaks or cracks. Furthermore, the transition towards clean energy has increased gas demand. This has led to growth in the region's pipeline network.

The German pipeline pigging services market has grown rapidly due to the rising demand for oil and gas energy sources and increasing awareness of timely maintenance. The presence of major companies has led to market growth, as the companies are targeting the development of advanced pigging technologies. The stringent government policies and regulations for pipeline maintenance also generate awareness.

Asia Pacific Pipeline Pigging Services Market Trends

Asia Pacific pipeline pigging services market is expected to grow at a lucrative rate with a CAGR of 4.4% over the forecast period. Growing energy demand from emerging countries such as China, Australia, and India will bolster the oil and gas industry growth in the coming years, eventually driving the market growth in the Asia Pacific. Rapid industrialization has also increased the demand for pipeline infrastructure in the region.

The China pipeline pigging services market has grown rapidly due to rising government investment in improving pipeline infrastructure, increasing demand for green energy sources, and the growth in the population. This has led to increased demand for pipeline safety measures. Hence, government and regulatory bodies ensure timely maintenance of pipelines to avoid hazards such as leaks or spillage.

Key Pipeline Pigging Services Company Insights

Some major companies in the pipeline pigging services market are American Pipeline Solutions, Applus+, Baker Hughes Company, Dexon Technology PLC, PIPECARE Group, and others. Companies are focusing on expanding their market presence through various growth strategies, collaborations, mergers, acquisitions, and more.

-

American Pipeline Solutions specializes in pigging and offers various pipeline services. The company provides cleaning, coating, mapping, and assessing several pipelines.

-

Pigtek Ltd. specializes in pipeline pigging services. The company also offers cleaning services to the oil and gas industries. It provides pigging, pipeline tracking, pig signalers, pig testing, and more.

Key Pipeline Pigging Services Companies:

The following are the leading companies in the pipeline pigging services market. These companies collectively hold the largest market share and dictate industry trends.

- American Pipeline Solutions

- Applus+

- Baker Hughes Company

- Dexon Technology PLC

- PIPECARE Group

- MISTRAS Group

- Pigtek Ltd.

- ROSEN Group

- SGS Société Générale de Surveillance SA.

- T.D. Williamson, Inc.

Recent Developments

-

In May 2024, Applus+ announced the partnership with JST Group by launching Pipeline Inspection Tool (PIT). The tool is equipped with ultrasonic measurements to determine the pipeline condition. It has a self-propelled crawler aiming to provide full coverage measurement of the pipe wall.

-

In November 2023, Gulf Investment Corporation, G.S.C. (GIC), bought a minority stake in PIPECARE Group. The investment is expected to enhance the company’s position at the global level. PIPECARE planned to use GIC’s capital to improve its regional and global expansion by offering high-quality in-line inspection technologies.

Pipeline Pigging Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.32 billion |

|

Revenue forecast in 2030 |

USD 3.93 billion |

|

Growth Rate |

CAGR of 2.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, application, industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

American Pipeline Solutions; Applus+; Baker Hughes Company; Dexon Technology PLC; PIPECARE Group; MISTRAS Group; Pigtek Ltd.; ROSEN Group; SGS Société Générale de Surveillance SA.; T.D. Williamson; Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

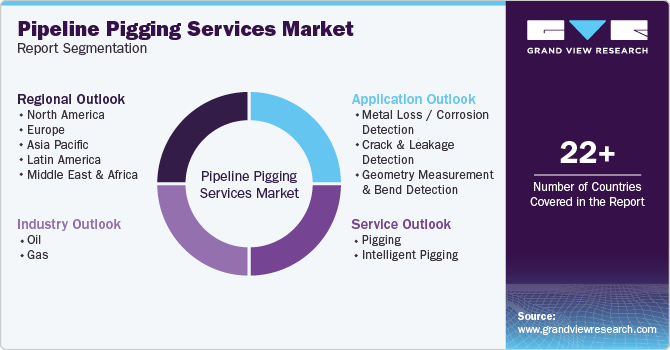

Global Pipeline Pigging Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pipeline pigging services market report based on service, application, industry, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Pigging

-

Intelligent Pigging

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Loss / Corrosion Detection

-

Crack & Leakage Detection

-

Geometry Measurement & Bend Detection

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil

-

Gas

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."