Pipe Coatings Market Size, Share & Trends Analysis Report By Type, (Thermoplastic Polymer Coatings, Bituminous, Fusion Bonded Epoxy Coatings), By Form, By Application, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-351-2

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Pipe Coatings Market Size & Trends

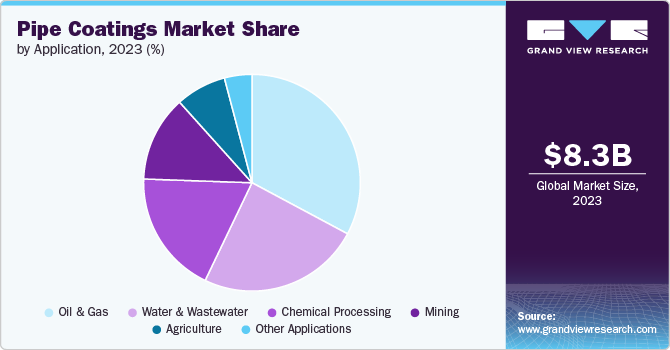

The global pipe coatings market size was estimated at USD 8.30 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The growth of infrastructure development and industrialization, particularly in developing countries. The expansion of industries and the rise in irrigation and agricultural activities have increased the demand for pipes, thereby boosting the pipe coating market. Additionally, the shale gas development sector has witnessed a surge in demand for pipe coatings, further contributing to market growth.

The growth of infrastructure development and industrialization in developing countries has led to an increased need for reliable and durable pipelines. As industries expand and new infrastructure projects are undertaken, the demand for pipes and pipe coatings has risen. This growth is particularly evident in regions such as Asia-Pacific, where the construction sector is witnessing strong growth, and countries like India, Indonesia, China, Vietnam, and Singapore are experiencing increased demand for construction pipes.

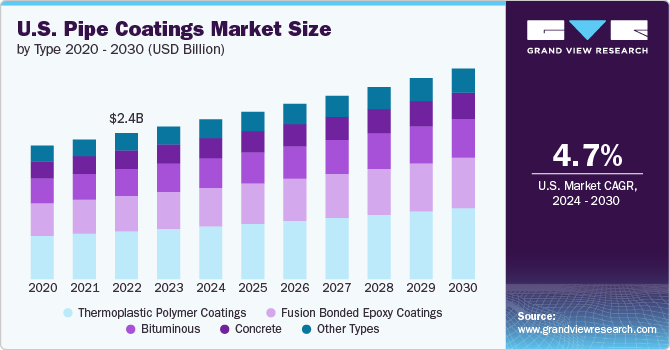

The expansion of infrastructure development and industrialization in the U.S. has led to a higher demand for reliable and durable pipelines. As industries expand and new infrastructure projects are undertaken, the need for pipes and pipe coatings has increased. This growth is particularly evident in sectors such as oil and gas, water and wastewater treatment, chemical processing, and mining, where the demand for product is driven by the need for corrosion protection and improved flow efficiency.

The rise in irrigation and agricultural activities has also contributed to the demand for market in the U.S. The agricultural sector requires a constant water supply through irrigation to ensure regular production and supply of raw materials. As a result, the demand for product that can withstand the demands of irrigation systems has increased.

Furthermore, the shale gas development sector has emerged as a significant driver for the pipe coating market in the United States. The exploration and production activities in shale gas reserves have led to an increased need for coated pipelines to ensure the safe transport of hydrocarbons. This has resulted in a surge in demand for product in the oil and gas sector.

Type Insights

Thermoplastic polymer coatings type dominated the market with a revenue share of 32.82% in 2023 owing to the thermoplastic polymer coatings have high demand in the pipe coating market due to their excellent properties and wide range of applications in various industries. According to multiple sources, thermoplastic polymer coatings, such as PE (polyethylene), PP (polypropylene), and PU (polyurethane) coatings, are the most commonly used type of pipe coatings. These coatings offer several advantages, including superior resistance to corrosion, abrasion, and protection against environmental factors.

Furthermore, the segment is favored due to their additional advantages over other types of coatings, such as fusion-bonded epoxy coatings. The combination of thermoplastic polymer coatings and fusion-bonded epoxy coatings, known as 3LPE or 3LPP coatings, is preferred on a wide scale. These products provide enhanced protection and durability to pipelines, making them a popular choice in the market.

Fusion Bonded Epoxy (FBE) are epoxy-based powder coatings that are widely used in pipeline construction, as well as on reinforcing bars and various piping connections. These products provide excellent corrosion protection, durability, and ease of application, making them a popular choice in the industry. Additionally, the construction of water treatment facilities and extensive construction activities also contribute to the demand for FBE coatings in the pipe coating market. The need for corrosion protection in water and wastewater pipelines, as well as in various industrial applications, drives the adoption of FBE coatings.

Bituminous coatings can be applied using various methods, including cold-applied coatings, which utilize solvents and water to achieve the desired application viscosity. These coatings can be formulated from different combinations of bitumens, solvents, dispersing agents, and fillers, allowing for a wide range of end products to meet specific application and service requirements.

Form Insights

Powder dominated the market with a revenue share of 78.27 in 2023 owing to the demand for powder coatings formulated in a powder form, consisting of additives, pigments, and resins. These coatings are applied electrostatically to the surface of the pipes and then cured under heat or with ultraviolet light. The powder coating process involves the following steps: electrostatically charging the powder particles, applying the charged powder to the grounded pipe surface, and then heating the pipe to melt the powder into a solid coating.

Liquid coatings, as the name suggests, are in liquid form and are typically applied using spray guns or other application methods. These products can be solvent-based or water-based, depending on the formulation. Liquid coatings offer the following advantages such as ease of application, adhesion, flexibility, and versality.

Application Insights

Oil & gas dominated the market with a revenue share of 32.82 in 2023 owing the oil and gas industry is one of the major sectors that extensively utilizes pipe products for various applications. Pipe products play a crucial role in protecting pipelines from corrosion, extending their lifespan, and ensuring the safe transportation of oil and gas. One of the primary purposes of pipe products in the oil and gas industry is to provide corrosion protection. Pipelines are exposed to harsh environments, including moisture, chemicals, and soil conditions, which can lead to corrosion. Coatings act as a barrier between the pipe surface and the surrounding environment, preventing corrosion and maintaining the integrity of the pipeline.

Pipe products are essential for preventing corrosion in water and wastewater pipelines. These pipelines are exposed to various corrosive elements, including chemicals, moisture, and soil conditions. Coatings act as a protective barrier, preventing corrosion and maintaining the integrity of the pipelines. Coatings help protect water and wastewater assets, including treatment facilities, storage tanks, and transmission pipelines. By providing a resilient barrier, coatings support long-term asset protection and decrease maintenance costs. They are particularly important in areas such as treatment facilities, water storage tanks, storm sewers, and wastewater transmission pipelines.

Market provides chemical resistance, safeguarding pipelines from the damaging effects of harsh chemicals used in the processing industry. These product help prevent chemical reactions, leaks, and contamination, ensuring the safety and efficiency of the chemical processing operations. Chemical processing plants may involve the transportation of abrasive materials through pipelines. Product with high abrasion resistance help protect the pipes from wear and extend their service life. Coatings like fusion bonded epoxy (FBE) and polyurethane are known for their excellent abrasion resistance.

Regional Insight

The market in North America is also influenced by stringent regulations regarding the use of eco-friendly and low-VOC (volatile organic compounds) products. This has led to the adoption of advanced pipe coatings that meet environmental standards.

U.S. Pipe Coatings Market Trends

The pipe coatings market of the U.S. is influenced by the growth in oil and gas production, the extensive use of product for corrosion protection, and the increasing demand in shale gas development. These factors are contributing to the growth and dynamics of the market in the U.S.

Asia Pacific Pipe Coatings Market Trends

Asia Pacific pipe coatings market is expected witness a considerable rate of growth during the forecast period. The increasing demand for pipeline infrastructure from various industries such as oil and gas, chemical, mining, water and wastewater, agriculture, and construction.The fast industrialization, urbanization, and infrastructural growth in nations like China, India, Japan, South Korea, and Southeast Asian countries are the main factors driving the need for product in this region

Europe Pipe Coatings Market Trends

The pipe coatings market of Europe is a mature market with significant demand from industries such as oil and gas, chemical processing, and water and wastewater treatment. The region has a well-developed pipeline network, and stringent regulations related to environmental protection and safety drive the adoption of process pipe coatings.

Key Pipe Coatings Company Insights

Some of the key players operating in the market include PPG Industries, Inc., Akzo Nobel N.V. The Sherwin-Williams Company , Valspar Industrial. , Axalta Coating Systems, LLC , WASCO ENERGY GROUP OF COMPANIES, Arkema Group, 3M, SHAWCOR, Berry Plastics Cpg, Tenaris, Winn & Coales (Denso) Ltd, Aegion Corporation, Dura-Bond Industries, Eupec Pipecoatings France, L.B. Foster Company, Arabian Pipe Coating Company, Perma-Pipe, Inc, Jotun, and DuPont, among others.

-

Akzo Nobel is a Dutch multinational company that creates paints and performance coatings for both industry and consumers worldwide. It is the world's third-largest paint manufacturer by revenue after Sherwin-Williams and PPG Industries. The company has a long history of mergers and divestments and has activities in more than 150 countries.

-

The Sherwin-Williams Company is a major player in the protective coatings market, with a significant share in global production. It is one of the top five players dominating global production in the protective coatings market.

Key Pipe Coatings Companies:

The following are the leading companies in the pipe coatings market. These companies collectively hold the largest market share and dictate industry trends.

- PPG Industries, Inc.

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- Valspar Industrial.

- Axalta Coating Systems, LLC

- WASCO ENERGY GROUP OF COMPANIES

- Arkema Group

- 3M

- SHAWCOR

- Berry Plastics Cpg

- Tenaris

- Winn & Coales (Denso) Ltd

- Aegion Corporation

- Dura-Bond Industries

- Eupec Pipecoatings France

- L.B. Foster Company

- Arabian Pipe Coating Company

- Perma-Pipe

- Jotun

- DuPont.

Recent Developments

-

In March 2024, Hardide Coatings has introduced the first product in a new range of ready coated and enhanced components. The launch involves a JP-5000 4 copper nozzle used in High-Velocity Oxy Fuel (HVOF) thermal spray coating.

-

In November 2023, POWERCRETE, has unveiled a new ARO coating, DD 410. This product is part of a line-up of liquid epoxy polymer concrete coatings specifically designed to safeguard the pipeline industry.

-

In June 2023, Fayette Pipe announced the launch of FayetteGuard, an LED UV-cured paint system designed for black steel pipe exteriors. This coating process employs advanced LED UV-coating technology to ensure enhanced protection, energy efficiency, durability, long-lasting performance, and aesthetic appeal for the rigorous demands of fire protection, plumbing, and HVAC applications.

Pipe Coatings Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.65 billion |

|

Revenue forecast in 2030 |

USD 11.09 billion |

|

Growth rate |

CAGR of 4.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, form, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

PPG Industries, Inc.; Akzo Nobel N.V. The Sherwin-Williams Company; Valspar Industrial. ; Axalta Coating Systems, LLC ; WASCO ENERGY GROUP OF COMPANIES; Arkema Group; 3M; SHAWCOR; Berry Plastics Cpg; Tenaris; Winn & Coales (Denso) Ltd; Aegion Corporation; Dura-Bond Industries; Eupec Pipecoatings France; L.B. Foster Company; Arabian Pipe Coating Company; Perma-Pipe, Inc; Jotun; DuPont |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pipe Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pipe coatings market report based on type, form, application & region.

-

Type Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Thermoplastic Polymer Coatings

-

Fusion Bonded Epoxy Coatings

-

Bituminous

-

Concrete

-

Other Types

-

-

Form Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Liquid

-

Powder

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Oil & Gas

-

Water & Wastewater

-

Chemical Processing

-

Mining

-

Agriculture

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the pipe coatings market include PPG Industries, Inc., Akzo Nobel N.V. The Sherwin-Williams Company , Valspar Industrial. , Axalta Coating Systems, LLC , WASCO ENERGY GROUP OF COMPANIES, Arkema Group, 3M, SHAWCOR, Berry Plastics Cpg, Tenaris, Winn & Coales (Denso) Ltd, Aegion Corporation, Dura-Bond Industries, Eupec Pipecoatings France, L.B. Foster Company, Arabian Pipe Coating Company, Perma-Pipe, Inc, Jotun, and DuPont, among others.

b. Key factors that are driving the market growth include the growth of infrastructure development and industrialization, particularly in developing countries. The expansion of industries and the rise in irrigation and agricultural activities have increased the demand for pipes, thereby boosting the pipe coating market.

b. The global pipe coatings market was valued at USD 8.30 billion in 2023 and is projected to reach USD 8.65 billion by 2024

b. The global pipe coatings market is projected to reach USD 11.09 billion by 2030, growing at a CAGR of 4.2% from 2024 to 2030

b. North America dominated the pipe coatings market with a share of 46.72% in 2023. The market in North America is also influenced by stringent regulations regarding the use of eco-friendly and low-VOC (volatile organic compounds) products

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."