Pico Projector Market Size, Share & Trends Analysis Report By Technology, By Product (USB, Embedded, Media Player, Stand-alone), By Compatibility, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-047-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Pico Projector Market Size & Trends

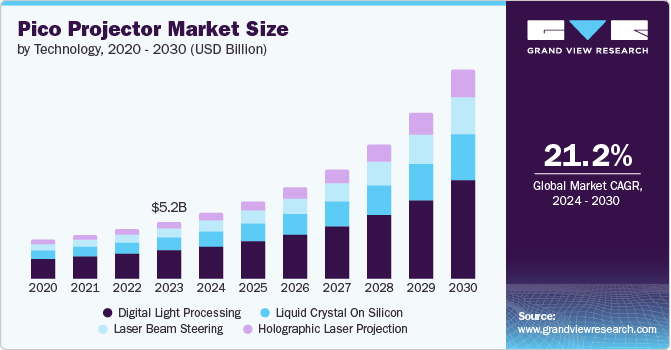

The global pico projector market size was valued at USD 5.25 billion in 2023 and is projected to grow at a CAGR of 21.2% from 2024 to 2030. A pico projector is a portable multimedia device offering projection capabilities in a miniaturized form factor. These portable and affordable compact projectors are suitable for business and education applications. Their portability, convenience, and integration with devices like smartphones, cameras, and laptops have led to significant market growth. A higher contrast ratio and enhanced pixel quality of pico projectors are expected to drive market growth.

Increased production efficiencies and continuous innovations lead to cost reductions, enabling strategic price optimization for these products. Additionally, miniaturization, high-quality projection, low power consumption, and weight reduction initiatives enhance their portability and market demand. The increasing adoption in various sectors, including corporate offices, educational institutions, and personal use, drives their market expansion. For instance, in June 2023, Zebronics launched the ZEB-PixaPlay 22, a smart LED Projector with a compact design and built-in speakers, in India. It offers advanced features such as electronic focus, dual-band connectivity, a quad-core processor, and mirroring support. It provides a screen size of 406 cm, delivering a large-screen experience in a compact form.

Pico projectors with integrated features are expected to increase product demand significantly. These features allow users to share and access videos, pictures, documents, and presentations from anywhere. Due to their low power consumption and better color performance, pico projectors are an effective solution for watching movies, playing games, and interacting with other multimedia content.

Technology Insights

The digital light processing segment accounted for the largest market revenue share at 49.9% in 2023. The segment growth is attributed to the advantages of DLP technology, which utilizes micro mirrors to control light and deliver images with color accuracy and brightness. These mirrors can frequently turn on and off, modulating the light to create sharp and clear images. The ability of the DLP technology in the pico projector to produce bright and vibrant colors makes it suitable for meetings, conferences, teaching, seminars, and others. Moreover, DLP technology in pico projectors enables manufacturers to develop smaller, lighter projectors without compromising image quality.

Holographic laser projection technology is expected to witness the fastest CAGR in the forecast period. This technology offers vivid and realistic images and an interactive experience with applications across various industries. Holographic projection enhances the viewing experience by providing more immersive and unique visuals that improve engagement. The ability to connect with small projectors makes this technology extremely helpful for demonstrating products, giving speeches, and running interactive marketing efforts. Combining these capabilities increases demand and sales of this technology in the marketplace.

Product Insights

Standalone pico projectors accounted for the largest market share in 2023. These projectors allow users to connect with laptops, smartphones, or tablets. Advanced pico projectors integrated with Wi-Fi and Bluetooth capabilities enable seamless content streaming from smartphones, tablets, or cloud services. This wireless connectivity eliminates the need for cables and expands the functionality of Pico projectors for collaborative work environments and multimedia entertainment. For instance, in June 2024, Zeemr launched the Z2 Mini 1080p projector with a brightness level of 650 ANSI lumens and a 3.5-inch BOE customized 1080P resolution LCD screen. The projector supports 4K decoding and AI features such as global focus, global auto-correction, and automatic screen.

Based on the product, the USB segment is expected to grow at the fastest CAGR during the forecast period. The market growth of this segment is attributed to the convenience of use as these projectors draw power directly from the USB port of a device such as a laptop, smartphone, or tablet. It eliminates the need for a separate power source, making them convenient for on-the-go presentations or entertainment. Additionally, many USB pico projectors are designed to be universally compatible with various operating systems and devices with a USB port. This compatibility makes them a versatile option for a wide range of users. The rise of laptops and tablets with powerful processors and high-resolution displays creates a perfect platform for USB pico projectors, contributing to high growth prospects.

Compatibility Insights

The smartphones segment dominated with the largest market share in 2023. Integrating pico projectors with smartphones allows users to mirror their smartphone screens onto the projector, enabling presentations, video playback, and sharing multimedia content directly from their mobile devices, enhancing convenience and flexibility, making pico projectors an extension of smartphones for professional and personal use. This integration enhances user convenience by providing a suitable interface to manage their projection experience without additional hardware or complex setup procedures. This widespread adoption creates sources for content projection in various applications by eliminating the need for separate devices such as laptops or tablets.

The digital camera segment is expected to witness the fastest CAGR over the forecast period. Digital camera compatibility allows photographers and videographers to instantly preview and share their captured images and videos on a larger screen without needing a computer or additional display equipment. This capability enhances workflow efficiency and facilitates real-time collaboration for professionals in journalism, events coverage, or field research. HDMI or USB connections enable data transfer, power supply, and high-definition video and audio transmission between the camera and projector, ensuring that images and videos are displayed.

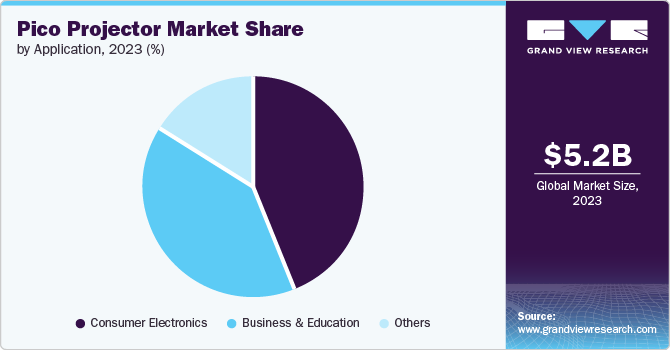

Application Insights

The consumer electronic segment dominated the market in 2023. The growing demand for portable and versatile entertainment solutions fuels the consumer electronics segment. Pico projectors provide an ideal solution by offering large-screen viewing in a compact and portable form, allowing users to transform any space into a personal theater and watch movies, play games, or stream content from their mobile devices. These projectors are becoming preferable for home entertainment, travel, and outdoor activities due to advancements such as Wi-Fi and Bluetooth connectivity, built-in streaming apps, and voice control. Moreover, the ability to quickly project content from various sources without complex setups or cables drives the pico projectors market.

The business & education segment is anticipated to witness significant CAGR over the forecast period. The rise of remote work has increased the demand for compact and portable pico projectors that facilitate professional presentations and collaborative meetings on a larger scale anywhere. These projectors are widely used for presentations, training sessions, seminars, and conferences, promoting a flexible approach to communication and interactions. Additionally, advancements in brightness and resolution have made these projectors capable of delivering clear, immersive, and impactful experiences for educators to conduct outdoor learning sessions and promote a flexible teaching environment.

Regional Insights

The North American region is anticipated to witness a significant CAGR over the forecast period. Pico projectors allow users to project content anywhere for applications such as presentations, teaching, watching videos, or sharing media with friends and family. This enhanced functionality and convenience drive its growth across various industries, including education, healthcare, business, and entertainment in the North American region. Additionally, this trend is expected to drive sustained growth in the pico projectors market as manufacturers and developers continue to innovate and expand the capabilities of these devices to meet the demands of various applications.

U.S. Pico Projector Market Trends

The U.S. pico projector market dominated the market share in 2023. The U.S. has a high disposable income and a strong consumer electronics market. As consumers increasingly desire to enhance their multimedia experiences, Pico projectors offer an effective solution due to their portability and ability to project high-quality images from compact devices. Additionally, the U.S. education sector's focus on integrating technology into classrooms further drives demand for Pico projectors. These devices support interactive and multimedia-rich teaching methods, enhancing student engagement and learning outcomes.

Asia Pacific Pico Projector Market Trends

Asia Pacific dominated the pico projector market with a revenue share of 37.5% in 2023. The rising population, rapid technological advancements, and growing consumer electronics industry in countries such as China, Japan, South Korea, and India fuel the Asia Pacific market for pico projectors. The demand for portable and versatile display solutions for home entertainment, gaming, and mobile viewing is rising, driving the adoption of Pico projectors in the region. Governments and educational institutions are investing heavily in digital infrastructure to enhance the quality of education.

India pico projector market is anticipated to witness a significant CAGR over the forecast period. Pico projectors offer a suitable option for consumers to enhance their home entertainment experience without investing in large and expensive projectors or TVs. Their portability makes them ideal for diverse applications, from family movie nights to outdoor gatherings, aligning well with the preferences of Indian consumers for flexible and mobile solutions. For instance, in November 2023, Portronics launched the Pico 12 Smart Portable LED Projector, offering a small and cordless solution for an instant movie theater experience. It comes with 120-inch screens and 4K streaming support.

The Pico projector market in China consumers are highly interested in the latest gadgets and technologies, resulting in a high demand for portable and versatile devices such as Pico projectors. These projectors project high-quality images and videos in a small, portable form, making them ideal for home entertainment, gaming, and travel. This convenience and accessibility contribute to their widespread adoption in the Chinese market. Xming, a brand associated with Xiaomi, has launched the Xming Q5 projector. The Xming Q5 features a fully enclosed PhotonX custom optical engine and 1080P resolution, offering a 1500:1 contrast ratio and 280 lumens of brightness. It also supports 4K decoding and HDR10+.

Europe Pico Projector Market Trends

The Europe market is anticipated to witness a significant CAGR over the forecast period. European companies increasingly adopt remote and hybrid work models, necessitating portable and efficient presentation tools. Pico projectors are ideal for business professionals who deliver presentations on the go, facilitating meetings and collaborations in various locations without heavy equipment. The focus on digitalization and the need for flexible, high-quality display solutions in both professional and educational contexts are key factors driving the demand for Pico projectors in Europe.

The UK pico projector market is expected to witness a significant CAGR over the forecast period. The growth is anticipated to be high due to businesses and consumers increasingly seeking solutions that offer functionality without sacrificing portability. With their small size and lightweight design, Pico projectors address this need perfectly, allowing for presentations and entertainment. Additionally, the growing adoption of smartphones, tablets, and laptops creates the need for pico projectors, as they seamlessly connect with these smart devices, enabling presentations, movie nights, or gaming sessions virtually anywhere.

The pico projector market in Germany is anticipated to witness a significant CAGR over the forecast period. The strong emphasis on innovation and engineering excellence fosters a high demand for advanced electronic devices. Pico projectors provide German professionals with a portable solution for delivering impactful presentations in various settings, whether in client meetings or conferences. Combined with features such as wireless connectivity and compatibility with mobile devices, these projectors enhance productivity and facilitate effective communication. In the education sector, German schools and universities are increasingly integrating technology into classrooms to support modern teaching methods. Pico projectors enable educators to create interactive and engaging learning environments, enhancing student participation and understanding.

Key Pico Projector Company Insights

Some key companies in the pico projector market include AAXA TECHNOLOGIES INC.; Coretronic Corp.; and LG Electronics.

-

AAXA Technologies specializes in using advanced nano-LCoS (Liquid Crystal on Silicon) systems in some of its projectors. It offers a range of pico projectors, mini projectors, and LED projectors. AAXA claims to have made the world's smallest 1080P projector. Some of its latest launches of pico projectors include SLC450, P6X, and L500.

-

Coretronic Corp. manufactures DLP projectors, interactive projection systems, image signal processing boxes, wearable display solutions, LCD backlight modules, high-lumen laser projectors, and automotive augmented reality heads-up displays. Its proprietary MCLA technology enhances the quality of its projectors.

Key Pico Projector Companies:

The following are the leading companies in the pico projector market. These companies collectively hold the largest market share and dictate industry trends.

- AAXA TECHNOLOGIES INC.

- Acer Inc.

- Coretronic Corp.

- Koninklijke Philips N.V.

- Lenovo

- Miroir USA

- Samsung

- SYNDIANT

- Texas Instruments Incorporated

Recent Developments

-

In August 2023, AAXA Technologies introduced the SLC450, a compact projector featuring short throw projection, 450 lumens of brightness, and 1080p resolution. This innovative device leverages Silicon Liquid Crystal technology to deliver exceptional image quality. Despite its small dimensions, it is expected to provide better projection quality.

-

In November 2023, Anker introduced the Nebula Capsule 3 and Mars 3 Air projectors, portable Google TV projectors, and integrated Netflix. The Nebula Capsule 3 provides 200 lumens of brightness and supports a screen size of up to 120 inches. The Mars 3 Air can display images as wide as 150 inches with a brightness of up to 400 lumens.

-

In March 2024, LG Electronics launched the Cinebeam Q mini projector, which promises maximum portability and high-quality projection quality. CineBeam Q delivers stunning 4K UHD resolution for sharp and detailed images and a high 154% DCI-P3 color gamut.

Pico Projector Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.06 billion |

|

Revenue Forecast in 2030 |

USD 19.20 billion |

|

Growth Rate |

CAGR of 21.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Technology, product, compatibility, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; Australia; South Korea; India; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

AAXA TECHNOLOGIES INC.; Coretronic Corp.; LG Electronics; Koninklijke Philips N.V.; Samsung; Miroir USA; Lenovo; Texas Instruments Incorporated; SYNDIANT; Acer Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pico Projector Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pico projector market based on technology, product, compatibility, application, and region:

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Digital Light Processing

-

Liquid Crystal on Silicon

-

Laser Beam Steering

-

Holographic Laser Projection

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

USB

-

Embedded

-

Media Player

-

Stand-alone

-

-

Compatibility Outlook (Revenue, USD Million, 2018 - 2030)

-

Laptop/Desktop

-

Smartphones

-

Digital Cameras

-

Portable Media Players

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Business and Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."