Pickup Trucks Market Size, Share & Trends Analysis Report By Fuel Type (Diesel, Petrol, Electric), By Vehicle Type (Light-duty, Heavy-duty), By Region (North America, Asia Pacific), And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-939-5

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Technology

Report Overview

The global pickup trucks market size was valued at USD 222.79 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 1.6% from 2022 to 2028. The global market is majorly driven by the rising affordability due to growing disposable income, a high number of product launches, and increasing spending on passenger vehicles. Increasing spending on research and development by key companies enables product launches of new-generation pickup trucks with enhanced functionality, such as better torque, higher payload capacity, and increased fuel efficiency. An increasing number of product launches of improved and attractive pickup trucks by the key manufacturers creates buzz around the customers in the market and encourage consumers’ impulsive buying nature.

The main characteristics that influence the customers’ purchase decision include greater general utility, large cargo area, and a high towing capacity of these trucks. Global market growth is substantially restrained by the sluggish demand in some areas due to lower consumer reach and stringent rules & regulations. In some regions, parking and driving lanes of passenger cars do not provide enough space for safe operations, which affects the lower preference of the consumers for pickups in the area and fails to generate desired revenues. Also, strict government rules and regulations for greenhouse Gas(GHG) emission control hinders market entry. The majority of the pickup trucks run on diesel, and CO2 emission by the vehicle also soars higher.

High retail prices of these trucks are also one of the restraining factors of the market in some developing economies. The COVID-19 pandemic negatively impacted the overall production and sales of passenger cars around the world. Pandemic-induced lockdowns and other restrictions caused unprecedented challenges in the supply chain of the automotive industry. Shortages of auto parts and semiconductor chips as well as the lack of labor halted production lines and plummeted product sales. The shortage of semiconductor chips is likely to continue in the future also. According to The Economist Intelligence Unit of Economist Group, the semiconductor chip shortage is likely to continue well into 2022. The market is expected to recover and register a considerable growth rate post-pandemic.

Fuel Type Insights

Based on fuel type, the diesel segment dominated the market in 2021 and accounted for the maximum revenue share of more than 95.5%. The highest market share of the segment is attributed to the majority of the pickup truck models available being diesel engine-based. Leading players, such as Ford, GM, Toyota, FCA, and Nissan, offer a wide range of portfolio of pickup trucks with a majority of the diesel engine. In addition, consumer preference for diesel engine-based pickup trucks over other fuel types, due to the higher torque and higher calorific value provided by diesel, also supports the segment growth. Moreover, diesel engines run more efficiently and have a long life when towing heavy loads than other fuel types.

The electric segment is expected to witness the fastest growth rate over the forecast period. A diesel engine has many perks when it comes to pickup truck efficiency; however, it also leads to the higher emission of GHG & CO2 and increased air pollution. Due to the increasing global warming, automakers are obliged to and keen on developing and manufacturing clean and green fuel-based vehicles. Government initiatives and manufacturers are increasing product launches in Electric Vehicles (EVs), which is also projected to drive the segment growth in the near future. For instance, as reported on 27th September 2021, Ford announced the establishment of a new electric pickup truck factory in Tennessee, U.S.

Vehicle Type Insights

Light-duty pickup trucks dominated the global market and accounted for the largest revenue share of more than 91.00% in 2021. The higher market revenue share of the segment is attributed to the higher product portfolio offered by the manufacturers. In addition, higher consumer preference and rising popularity of light-duty pickup trucks due to their appearance and compact space & size will boost the segment growth. Leading models with higher unit sales in the market are light-duty trucks, which include, Ford F-150, Ram 1500, Toyota Hilux, Ford Ranger, Chevrolet Silverado, etc. The higher popularity of these models across the world contributed to the dominance of the light-duty vehicle type segment.

The heavy-duty vehicle type segment is anticipated to witness the fastest CAGR over the forecast period. The increasing interest of consumers in the newly launched models and increasing product launches by the key manufacturers are credited to the segment’s growth. For instance, Stellantis Group is planning to launch a new advanced RAM 3500 HD in 2023, which will have updated aesthetics and increased technological amenities in the cabin. The General Motors Company is planning to launch its heavy-duty pickup truck, the 2022 GMC Sierra 3500HD with 401 horsepower and 464 lb-ft of torque.

Regional Insights

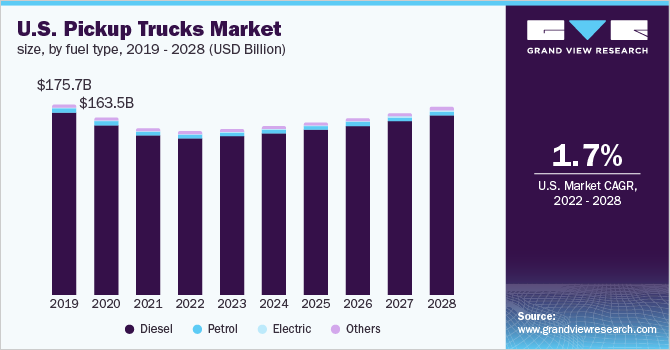

North America accounted for the largest market revenue share of more than 74.00% in 2021 and is expected to retain the leading position growing at the fastest CAGR from 2022 to 2028. The industry is highly concentrated in North America owing to the strong and well-established market, majorly in the U.S. Key players have a strong presence and market penetration in the region, with leading players, such as Ford Motor Company, General Motors, and FCA, headquartered in the U.S. Moreover, higher product awareness, consumer spending & disposable income along with favorable market dynamics are credited to the region’s growth. Central &South America is anticipated to witness the second-fastest CAGR from 2022 to 2028.

The higher growth of the regional industry is attributed to the increasing popularity of pickup trucks among consumers in this region for daily transport as well as for heavy utility purposes. The rising middle-income class, increasing consumer spending & disposable income, and rapid expansion of key players in the region are expected to drive the regional market growth. The rising number of product launches from key manufacturers is also projected to propel the overall sales and increased the revenue during the forecast period. For instance, as reported in August 2021, Ford is planning to launch a new-generation Ford Ranger pickup truck in Brazil in 2022. It will have basic and advanced versions with different horsepower and different diesel engine capacities.

Key Companies & Market Share Insights

The global market is characterized by the presence of large, prominent key players and is partially consolidated. Top players in the market are focusing on new product launches and expansion into untapped regions. Key players are also focusing on research and development activities to launch better truck models with enhanced functionality and optimum performance. For instance, on 11th January 2022, Toyota launched the luxury Tundra Capstone, a high-end version of a full-size pickup truck. Also, General Motors is planning to launch its first all-electric pickup truck by 2035 for heavy-duty hauling and towing. Some of the prominent players in the global pickup trucks market are:

-

Stellantis N.V.

-

Ford Motor Company

-

Toyota Motor Corp.

-

Nissan Motor Co. Ltd.

-

Volkswagen Group

-

Tata Motors Ltd.

-

Ashok Leyland Ltd.

-

General Motors Company

-

Hyundai Motor Company

-

Suzuki Motor Corp.

-

Kia Corporation

-

Mahindra & Mahindra Ltd.

Pickup Trucks Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 218.33 billion |

|

Revenue forecast in 2028 |

USD 249.71 billion |

|

Growth rate |

CAGR of 1.6% from 2022 to 2028 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Fuel type, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Stellantis N.V.; Ford Motor Company; Toyota Motor Corporation; Nissan Motor Co. Ltd.; Volkswagen Group; Tata Motors Limited; Ashok Leyland Ltd.; General Motors Company; Hyundai Motor Company; Suzuki Motor Corp.; Kia Corp.; Mahindra & Mahindra Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global pickup trucks market report on the basis of fuel type, vehicle type, and region:

-

Fuel Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Diesel

-

Petrol

-

Electric

-

Other

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Light-duty

-

Heavy-duty

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pickup trucks market size was estimated at USD 222.79 billion in 2021 and is expected to reach USD 218.33 billion in 2022.

b. The global pickup trucks market is expected to grow at a compound annual growth rate of 1.6% from 2022 to 2028 to reach USD 249.71 billion by 2028.

b. North America dominated the pickup trucks market with a share of 77.0% in 2021. This is attributable to the strong and well-established market, majorly in the U.S., higher consumer spending, higher disposable income, favorable market dynamics, and higher product awareness.

b. Some key players operating in the pickup trucks market include Stellantis N.V.; Ford Motor Company; Toyota Motor Corporation; Nissan Motor Co. Ltd.; Volkswagen Group; Tata Motors Limited; Ashok Leyland Ltd.; General Motors Company; Hyundai Motor Company; and Suzuki Motor Corporation.

b. Key factors that are driving the pickup trucks market growth include increasing spending on passenger vehicles, increasing spending on research and development by the key companies, increasing affordability and increasing product launches across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."