- Home

- »

- Clothing, Footwear & Accessories

- »

-

Pickleball Apparel & Equipment Market Size Report, 2030GVR Report cover

![Pickleball Apparel & Equipment Market Size, Share & Trends Report]()

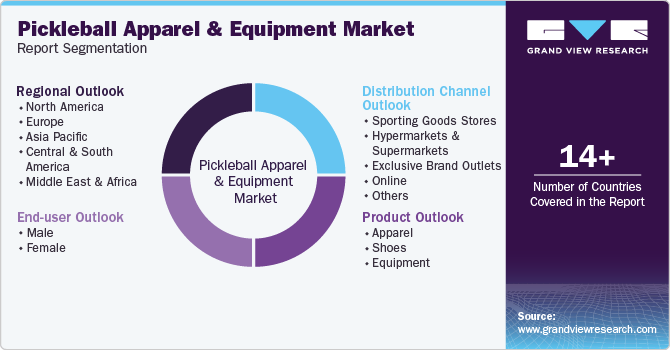

Pickleball Apparel & Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Apparel, Shoes), By End-user (Male, Female), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-367-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pickleball Apparel & Equipment Market Summary

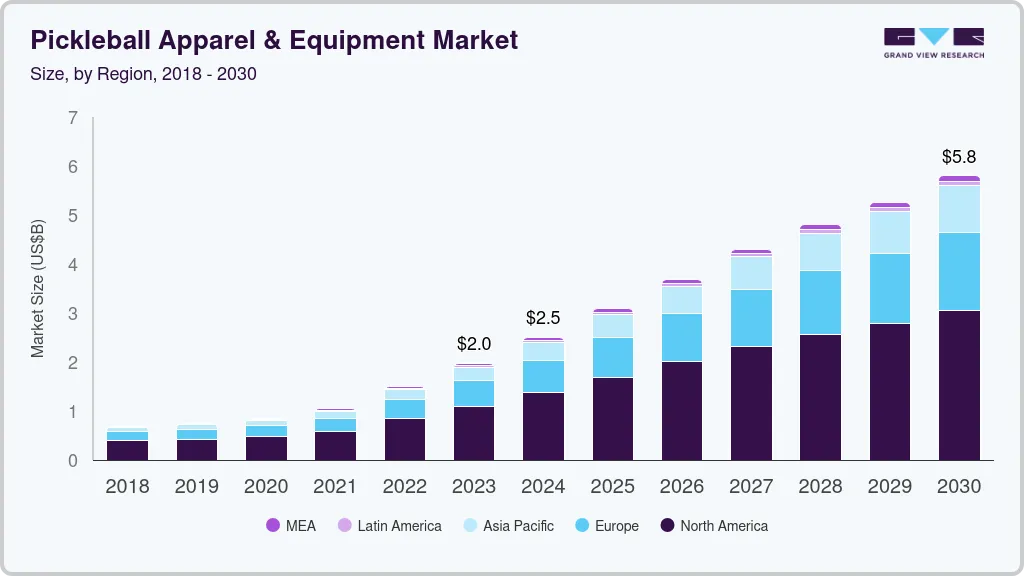

The global pickleball apparel & equipment market size was estimated at USD 1,976.6 million in 2023 and is projected to reach USD 5,804.0 million by 2030, growing at a CAGR of 15.1% from 2024 to 2030. The market is experiencing robust growth due to factors such as the sport's accessibility and ease of learning, which have increased participation across all age groups, from children to seniors.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, apparel accounted for a revenue of USD 1,976.6 million in 2023.

- Apparel is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,976.6 Million

- 2030 Projected Market Size: USD 5,804.0 Million

- CAGR (2024-2030): 15.1%

- North America: Largest market in 2023

Manufacturers are innovating with advanced materials and ergonomic designs for paddles and specialized apparel, enhancing player comfort and performance. Moreover, the rise in tournaments & media coverage has elevated pickleball's profile, while strategic marketing and community engagement have broadened its reach. Infrastructure development, particularly the construction of new courts, has made the sport more accessible. All these factors are collectively expected to drive the market growth over the forecast period.

Pickleball has evolved from a niche sport into a mainstream activity with a rapidly expanding player base. Originally invented in the mid-1960s, pickleball remained relatively unknown for several decades. However, over the past few years, its popularity has surged remarkably. This growth can be largely attributed to the sport's accessibility and ease of learning. Unlike many other sports that require a steep learning curve, pickleball can be enjoyed by beginners within a short period. This ease of entry has attracted a diverse group of participants, ranging from children to adults to seniors.

One of the notable factors driving participation is the sport’s appeal to older adults. Pickleball is a low-impact sport that is gentle on the joints, making it an ideal activity for retirees and seniors looking to stay active. The demographic shift towards an aging population in many countries, especially in North America, has led to a surge in pickleball participation among older adults. Many retirement communities and senior centers have installed pickleball courts, further encouraging participation among this age group and driving the overall pickleball apparel & equipment industry.

While pickleball is particularly popular among older adults, it is also gaining traction among younger demographics. Schools and youth programs are increasingly incorporating pickleball into their physical education curricula, introducing the sport to children and teenagers. This is further expected to drive up the demand for pickleball apparel & equipment during the forecast period. For instance, in May 2024, West Exe School in the UK introduced pickleball into its PE curriculum. The school has witnessed a surge in student participation in the elective. Similarly, in India, GD Goenka School announced in April 2024 the integration of pickleball and paddle into its physical education program.

Furthermore, the rise in the number of pickleball tournaments and competitive events is another key driver of the market growth. Local, regional, and national tournaments are being organized more frequently, drawing in participants from various skill levels. These events not only provide a platform for competitive play but also serve as a major promotional tool for the sport. High-profile tournaments attract media attention, sponsorships, and large audiences, further boosting the sport’s visibility and appeal and overall driving the pickleball apparel & equipment industry.

Moreover, municipalities, recreational centers, and private clubs are increasingly investing in the construction of pickleball courts. This surge in infrastructure development is making the sport more accessible to the general public. The availability of well-maintained courts encourages more people to take up the sport and invest in related equipment and apparel. For instance, according to the report by the Trust for Public Land released in 2024 highlighted a notable increase in the number of outdoor public park pickleball courts in major U.S. cities, growing by 650% over the past seven years. Furthermore, parks and recreation departments have been promoting the sport, leading to the installation of over 3,000 courts across 100 of the most populated cities in the country as of 2024. This installation of new courts would lead to an increase in participation and would further drive the demand for pickleball apparel & equipment during the forecast period.

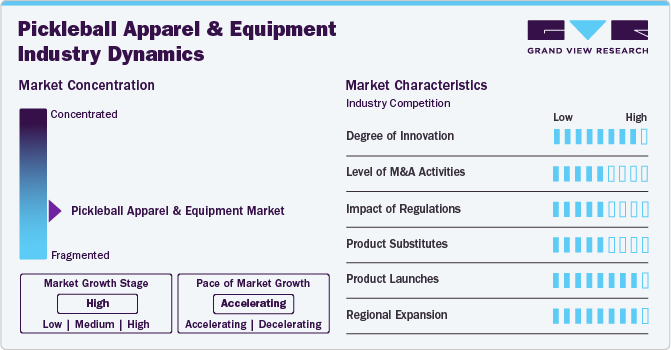

Industry Dynamics

Manufacturers in the pickleball apparel & equipment industry are actively engaged in various initiatives to meet evolving consumer demands and market trends.

The pickleball apparel & equipment industry shows a medium-to-high degree of innovation as manufacturers are constantly striving to enhance product performance, durability, and user experience through innovative technologies and designs. Manufacturers are investing heavily in research and development (R&D) to introduce paddles made of advanced materials such as carbon fiber, fiberglass, and hybrid materials to improve power, control, and responsiveness. Furthermore, manufacturers are also focusing on ergonomics and customization by offering paddles with varied grip sizes, shapes, and weight distributions to accommodate different playing styles and preferences.

Manufacturers are expanding into new geographical regions to penetrate untapped markets with growing pickleball participation. This includes entering regions where the sport is gaining popularity among recreational and competitive players alike. Furthermore, manufacturers are partnering with local distributors, retailers, and online platforms to ensure widespread availability of their products. All these factors have resulted in a high degree of regional expansion in the pickleball apparel & equipment industry.

The pickleball market is witnessing notable growth, driven by the sport's increasing popularity across all age groups. This surge in participation has prompted manufacturers to innovate and launch products specifically designed to cater to the diverse needs of players, ensuring that equipment and apparel are suitable for each demographic. Recognizing that children and teenagers have different physical requirements and preferences, companies are introducing lightweight paddles with smaller grips to accommodate smaller hands. For older adults, manufacturers are creating products that address their unique needs. Paddles designed for seniors often feature ergonomic grips, lightweight construction, and vibration-dampening technologies to reduce strain and enhance comfort. All these factors have led to a high degree of product launches in the market.

The impact of regulations is moderate on the market. Although there are no specific standards for apparel and equipment manufacturing exclusively for pickleball, manufacturers must adhere to broader regulatory standards governing product safety, performance, and materials. This includes certifications such as ASTM International standards for sports equipment, ensuring paddles meet specifications for performance and durability."

The pickleball apparel & equipment industry witnesses a moderate level of mergers and acquisitions activity. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions aiming to gain a competitive edge and achieve economies of scale in the market.

Product Insights

Pickleball equipment accounted for the largest revenue share of 48.5% in 2023. The rising popularity of pickleball has led to a surge in new players, all of whom need to purchase basic equipment to start playing. In addition, many community centers and schools are incorporating pickleball into their programs, leading to bulk purchases of equipment for group use, further driving demand and sales of pickleball equipment during the forecast period.

Players often upgrade their equipment to keep up with the latest trends and technological advancements, contributing to higher sales. Moreover, manufacturers are investing heavily in marketing campaigns that highlight the benefits of new and improved equipment, creating strong demand among players, which is expected to further boost the market growth for equipment over the forecast period.

The pickleball shoes segment is anticipated to grow at a CAGR of 15.4% from 2024 to 2030. Pickleball involves quick lateral movements, sudden stops, and rapid direction changes, necessitating specialized footwear that provides stability, support, and traction. This has driven the demand for shoes designed specifically for pickleball. Moreover, there is a growing awareness among players about the importance of wearing the right shoes for pickleball to enhance performance and prevent injuries, further driving demand for specialized footwear. All these factors are expected to drive the market growth for pickleball shoes over the forecast period.

End-user Insights

Male pickleball apparel and equipment accounted for a revenue share of 64.5% in 2023. According to the 2023 Sports Participation Report released by the National Sporting Goods Association, participation in pickleball in the U.S. was 57% male and 43% female. Furthermore, the USA Pickleball Association revealed that more than 60% of their player members are male. This high participation rate among males is expected to lead to increased sales and demand for male pickleball apparel and equipment during the forecast period.

On the other hand, the female pickleball apparel and equipment segment is expected to grow at a CAGR of 16.2% from 2024 to 2030. The 2023 Sports Participation Report released by the National Sporting Goods Association revealed that female participation has increased by around 237% from 2018 to 2023, indicating growing participation in pickleball in the U.S. This trend leads to a corresponding increase in demand for apparel and equipment tailored to their needs. Furthermore, manufacturers are focusing on designing apparel and equipment that address the specific preferences and performance requirements of female players. This is expected to drive growth in sales of female pickleball apparel and equipment during the forecast period.

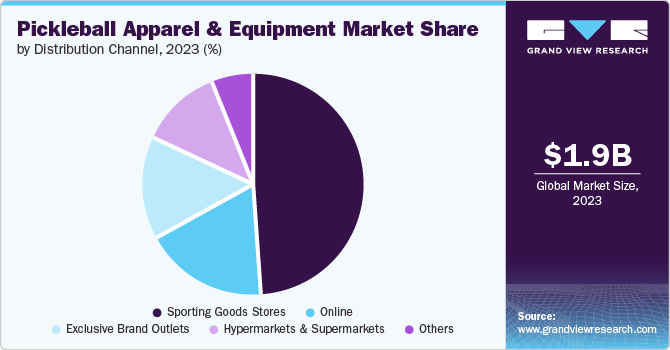

Distribution Channel Insights

Sales through sporting goods stores accounted for a revenue share of 49.4% in 2023. These retailers offer a wide range of products catering to various sporting activities, including specialized gear for pickleball. The extensive range available meets the diverse needs and preferences of pickleball sports enthusiasts, thereby driving sales through this channel. Sporting goods stores also provide a personalized retail experience tailored to the needs of their customers, often employing knowledgeable staff who offer expert advice and guidance on apparel & equipment selection.

Moreover, many leading pickleball apparel & equipment brands strategically partner with these stores to expand their market reach and make their products more accessible to consumers. This collaboration ensures that consumers have access to a wide selection of pickleball apparel and equipment from both established and emerging brands. This availability of diverse product offerings further drives sales through sporting goods stores, further contributing to the growth of the market through this channel during the forecast period.

Sales of pickleball apparel & equipment through online channels are expected to grow with a CAGR of 18.0% from 2024 to 2030. Online channels offer convenience, allowing customers to browse, compare, and purchase pickleball apparel & equipment from the comfort of their homes. Furthermore, online platforms facilitate transparent pricing and easy comparison shopping, enabling consumers to quickly compare prices, features, and customer reviews across different brands and retailers.

Moreover, changing consumer preferences, particularly among younger demographics across the world, favor online shopping due to its convenience, flexibility, and seamless user experience. As digital natives become a larger share of the consumer market, the preference for online channels is expected to drive high sales growth through this channel over the forecast period.

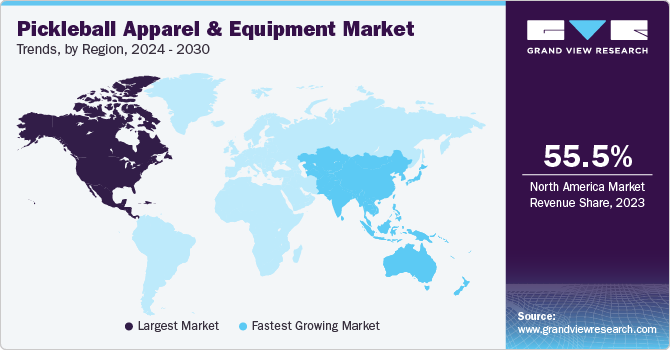

Regional Insights

North America pickleball apparel & equipment market accounted for a global revenue share of over 55.5% in 2023. Pickleball has seen a significant increase in the number of players across various age groups, from youth to seniors. Its popularity is driven by its accessibility, ease of learning, and social nature. Furthermore, many community centers, recreational facilities, and retirement communities have incorporated pickleball courts, boosting its visibility and participation rates, thus driving up the product sales in the region during the forecast period.

U.S. Pickleball Apparel & Equipment Market Trends

The pickleball apparel and equipment market in the U.S. is expected to grow at a CAGR of 13.8% from 2024 to 2030. In the U.S., organizations like the USA Pickleball Association (USAPA) in promoting the sport, organizing events, and setting standards which have significantly contributed to the growth of pickleball sport in the U.S. Furthermore, the growing emphasis on maintaining an active and healthy lifestyle among consumers in the U.S. has led more people to participate in sports like pickleball, which offers both physical and social benefits, further driving the sales of pickleball apparel & equipment in the country during the forecast period.

Asia Pacific Pickleball Apparel & Equipment Market Trends

The Asia Pacific, pickleball apparel and equipment market, is expected to grow at a CAGR of 17.5% from 2024 to 2030. The increase in the number of local, regional, and national pickleball tournaments such as Asia Pickleball Games and Asia Open Pickleball Championship has spurred interest in the sport, leading participants to invest in quality equipment, thus, expected to drive the market growth in the region over the forecast period.

The pickleball apparel and equipment market in China is expected to grow at the fastest CAGR over the forecast period in the Asia Pacific region owing to increasing participation and the rise in the construction of pickleball courts across the country. In 2023, Seymour Rifkind, President of the Pickleball Hall of Fame, organized several exhibitions of the sport and mentioned that one event garnered 4.8 million views on streaming platforms. He anticipates that China could see the establishment of 10,000 courts and attract 100 million players within the next five years. Additionally, the Association of Pickleball Players (APP Tour) partnered with ESPN in 2023 to broadcast tournament coverage in China, which is expected to boost the sport's popularity. This increase in visibility and participation is likely to drive demand for pickleball apparel & equipment in China during the forecast period.

The Australia pickleball apparel and equipment market is anticipated to grow over the forecast period. According to the Pickleball Australia Association, membership numbers in local clubs or state/territory organizations grew from 4,000 at the beginning of 2023 to 9,000 by the end of the year. The organization estimates that there are 25,000 pickleball players across the country as of 2023. Ron Shell, CEO of the National Pickleball League Australia, stated that this number could potentially reach one million within three years. This increase in participation in the sport is expected to contribute to notable demand for pickleball apparel & equipment, driving the overall market growth in the country over the forecast period.

Europe Pickleball Apparel & Equipment Market Trends

The Europe pickleball apparel and equipment market is expected to grow at a CAGR of 15.8% from 2024 to 2030. There is a growing interest and participation in pickleball as a recreational and competitive sport across European countries. This increasing popularity is generating a demand for specialized apparel and equipment tailored to the sport's unique requirements, such as lightweight paddles, durable balls, and comfortable footwear designed for agility and traction on court surfaces. Furthermore, the expansion of pickleball infrastructure, including the development of dedicated courts and facilities in various European cities and communities, is making the sport more accessible. This infrastructure development encourages more people to take up pickleball, thereby boosting the market growth for related apparel and equipment in the region.

Key Pickleball Apparel & Equipment Company Insights

The global market for pickleball apparel and equipment is characterized by the presence of numerous well-established and emerging players. Manufacturers are investing in research and development to develop and innovate paddles using high-quality, durable materials such as graphite, carbon fiber, and composite materials to improve performance and durability. Furthermore, manufacturers are incorporating technology like vibration-dampening systems, ergonomic designs, and enhanced grip textures to improve player comfort and control. Moreover, manufacturers in the market are partnering with major sports retailers to expand distribution channels and increase product availability.

Key Pickleball Apparel & Equipment Companies:

The following are the leading companies in the pickleball apparel & equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Selkirk Sport

- Paddletek, LLC

- Engage Pickleball, LLC

- Onix Sports, Inc.

- ProLite Sports, LLC

- Gamma Sports (Gamma Sports LLC)

- HEAD USA, Inc. (HEAD Pickleball)

- Franklin Sports, Inc.

- Wilson Sporting Goods Co.

- Prince Global Sports, LLC (Prince Pickleball)

Recent Developments

-

In June 2024, Selkirk Sport announced the launch of the AMPED Pro Air, a new addition to its popular range of pickleball paddles. The paddle features five color options and includes a FiberFlex+ Fiberglass Face, designed to enhance power while ensuring consistent performance. In addition, the paddle incorporates an octagonal grip shape for improved handling and comfort, essential for maintaining control during prolonged play.

-

In June 2024, Reebok introduced its first-ever pickleball shoe, the Nano Court. Designed for sports such as pickleball, padel, and tennis, the shoe prioritizes grip, stability, and durability. It features Flexweave Pro uppers, incorporating Reebok’s most resilient Flexweave knit yet, with zoned stability yarns for targeted support. In addition, the shoe includes a ToeTection Guard at the toe box for enhanced durability, along with a 360 Comfort Booty anatomical upper construction for a secure fit.

-

In June 2024, Stack Athletics, a leading brand in pickleball-specific performance apparel, unveiled its Summer 2024 performance collection tailored for pickleball enthusiasts. The collection introduces new colors, patterns, and pieces featuring innovative technology, such as the Men's Flowstate Zip Tee, Women's Rush Skirt, and Men's Tourney Short. These garments are designed to regulate body temperature and enhance agility with lightweight fabrics, keeping players swift on the court.

-

In April 2024, JOOLA Pickleball introduced two new Gen 3 paddles featuring innovative technology. These paddles provide an enhanced, vibrant edge guard and incorporate a patent-pending "Propulsion Core" technology. This technology enables powerful drives, counters, and speed-ups while maintaining precise control and feel for dinks, drops, and resets. Additionally, each paddle includes a Near Field Communication (NFC) Chip for user authentication, allowing registration on the JOOLA website.

Pickleball Apparel & Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.50 billion

Revenue forecast in 2030

USD 5.80 billion

Growth rate

CAGR of 15.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Selkirk Sport; Paddletek, LLC; Engage Pickleball, LLC; Onix Sports, Inc.; ProLite Sports, LLC; Gamma Sports (Gamma Sports LLC); HEAD USA, Inc. (HEAD Pickleball); Franklin Sports, Inc.; Wilson Sporting Goods Co.; Prince Global Sports, LLC (Prince Pickleball)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pickleball Apparel & Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pickleball apparel & equipment market report on the basis of product, end-user, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Shirts & Tops

-

Pants

-

Shorts & Skorts

-

Others

-

-

Shoes

-

Equipment

-

Paddles

-

Balls

-

Others

-

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Sporting Goods Stores

-

Hypermarkets & Supermarkets

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The pickleball apparel & equipment market size was estimated at USD 1.98 billion in 2023 and is expected to reach USD 2.50 billion in 2024.

b. The pickleball apparel & equipment market market is expected to grow at a compounded growth rate of 15.1% from 2024 to 2030 to reach USD 5.80 billion by 2030.

b. Pickleball equipment dominated the pickleball apparel & equipment market with a share of 48.5% in 2023. As pickleball gains popularity, new players typically need basic equipment like paddles and balls to start playing. This creates a consistent demand for entry-level equipment, driving up sales.

b. Some key players operating in the pickleball apparel & equipment market include Selkirk Sport; Paddletek, LLC; Engage Pickleball, LLC; Onix Sports, Inc.; ProLite Sports, LLC; Gamma Sports (Gamma Sports LLC); HEAD USA, Inc. (HEAD Pickleball); Franklin Sports, Inc.; Wilson Sporting Goods Co.; and Prince Global Sports, LLC (Prince Pickleball).

b. Key factors driving market growth include the sport's growing popularity for leisure and competition, accessibility to beginners and seasoned athletes, advancements in gear materials, expanding infrastructure, and increasing emphasis on health and wellness, leading more people to invest in high-quality, performance-oriented equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.