- Home

- »

- Healthcare IT

- »

-

Physical Therapy Software Market Size, Share Report, 2030GVR Report cover

![Physical Therapy Software Market Size, Share & Trends Report]()

Physical Therapy Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Interface (Desktop & Laptop, Mobile & Tablet), By Deployment (Server-based, Cloud-based), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-970-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Physical Therapy Software Market Summary

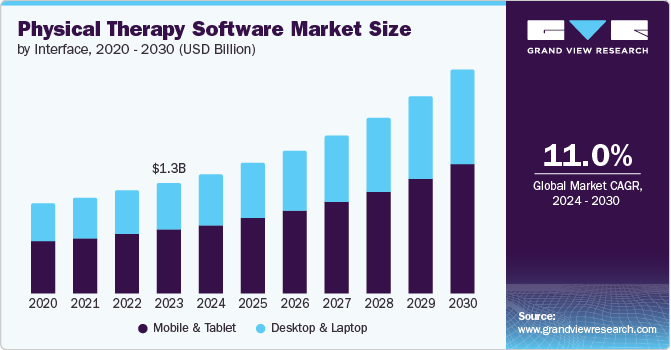

The global physical therapy software market size was valued at USD 1.25 billion in 2023 and is projected to reach USD 2.52 billion by 2030, growing at a CAGR of 11.0% from 2024 to 2030. Increased investments in the healthcare industry and combining practice management systems with other health IT solutions are anticipated to propel market expansion.

Key Market Trends & Insights

- The North America region accounted for the largest share of the global market with a revenue share of 53.4% in 2023.

- By interface, the mobile & tablet dominated the market and accounted for a share of 58.05% in 2023.

- By deployment, the cloud-based segment held the largest share of 60.3% in 2023.

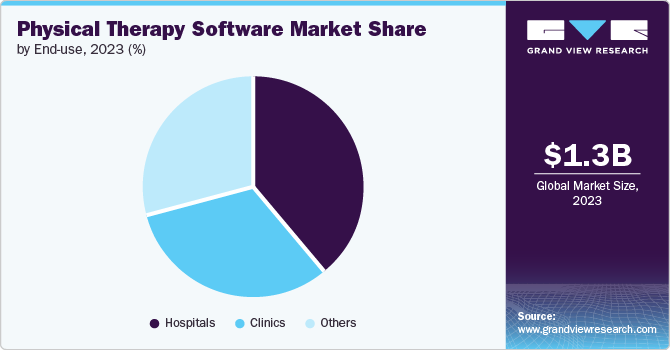

- By end use, the hospital segment held the largest share of 39.27% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.25 Billion

- 2030 Projected Market Size: USD 2.52 Billion

- CAGR (2024-2030): 11.0%

- North America: Largest market in 2023

Adopting physical therapy software is supported by its advantages, including reduced paperwork and decreased billing errors, among other positives. Technological advancements have recently transformed the healthcare sector significantly, notably by integrating software deployment modes with embedded tools for efficient patient data management. A February 2024 StatPearls Publishing LLC report highlighted a Norwegian study showing that 5.2% of medication errors caused severe patient harm, with 0.8% leading to deaths.

Operational efficiency, interface ability, integrated billing, and time-saving are some of the key drivers of the increasing demand for these kinds of software in the market. Billing software programs are also equipped with other innovative features that permit physical therapists to access significant patient information and enable appropriate storage and retrieval of patient records. This kind of automation safeguards patient records. These are updated and can produce suitable invoices.

Thus, it benefits the adoption of such software. Changing dynamics of the hospital industry are expected to involve centralization and digitalization of back-end processes, thereby boosting demand for the implementation of software systems, which is anticipated to positively impact market growth.In April 2022, Netsmart acquired TheraOffice, a physical therapy EMR software, to enhance its CareFabric platform. This acquisition aimed to support physical therapy, rehabilitation, and wellness providers by improving workflow connections across different healthcare venues.

Physical therapists can prescribe medication in some countries, such as the UK. Systems 4PT is a software solution that helps professionals perform assessments, including family history, patient questions, drug prescription, need for qualified therapy, job status, etc. This supports overall market growth. Physical therapists successfully incorporate apps, virtual reality (VR), and other technologies into their treatments, presenting their new proficiencies and delivering patients with new opportunities. In September 2023, NextGen Healthcare Inc. and Athletico Physical Therapy renewed their agreement. Athletico will use NextGen Enterprise EHR and PM software to improve clinical and financial performance across its expanded locations.

Furthermore, increasing healthcare expenditure and high digital literacy rates are expected to enhance the possibility of more usage of software solutions in the coming years. Furthermore, various initiatives are being undertaken by the government and private organizations to enhance healthcare facilities, which are expected to boost the market. In March 2023, Luna, an in-home physical therapy provider, announced a partnership with Providence in the Western U.S. This collaboration extends outpatient physical therapy services through Luna's technology platform, which matches Providence patients with therapists based on specialty, geography, and schedule availability. Luna's network of local physical therapists aims to deliver care comparable to traditional outpatient clinics in patients' homes.

The healthcare system is constantly facing challenges in providing quality care. They are integrating workflows for managing tedious documentation and facilitating easy access to patient's clinical data in all their departments. In October 2022, Professional Physical Therapy rolled out WelcomeWare, a virtual front desk solution, in over 190 clinics across the Northeastern US. This technology, introduced after a successful 3-month pilot, enables remote check-ins and supports the company's growth strategy by improving efficiency, reducing costs, and enhancing patient experience.

Market Concentration & Characteristics

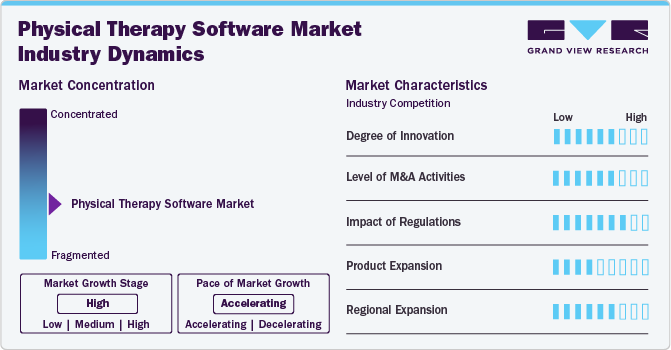

The degree of innovation in the market is high due to recent advancements, including telehealth, artificial intelligence (AI) for personalized treatments, virtual reality for rehab, wearable remote monitoring devices, and cloud platforms for data management. These technologies transform patient care, making it efficient and effective. The market remains competitive as companies strive to meet the healthcare industry's evolving needs.

Numerous firms undertake mergers and acquisitions to fortify their position in the market. These endeavors augment their domain expertise, allow for an expanded portfolio of offers, and enhance their skill set.

Regulatory measures significantly influence the physical therapy software industry. This sector, part of the larger healthcare field, adheres to strict guidelines for patient safety, data protection, and compliance with standards such as the Health Insurance Portability and Accountability Act (HIPAA). These rules affect software development, deployment, and physical therapy usage, necessitating firms to allocate resources for compliance. This results in higher costs and delays in market entry. Moreover, strict regulations can deter new entrants, hampering competition and innovation in the industry.

In the market, substitutes such as generic practice management software, basic EHR systems, or manual methods have a low presence due to the specialized needs of physical therapy practices. These include managing patient care, scheduling, billing, and documentation. Specialized features such as exercise libraries, outcome tracking, telehealth, and wearable device integration make dedicated physical therapy software hard to replace, limiting the effectiveness of alternatives.

The market is experiencing high growth in regions such as North America and Europe, where the adoption of electronic health records (EHRs) and telerehabilitation solutions is rising. Factors driving this growth include the increasing prevalence of chronic diseases, an aging population, and the need for efficient and cost-effective healthcare solutions. Government initiatives to promote digital health technologies and telemedicine services contribute to the market’s expansion.

Interface Insights

Mobile & tablet dominated the market and accounted for a share of 58.05% in 2023 and is expected to grow at the fastest CAGR during the forecast period. A mobile health app software improves the efficiency of hospital procedures, adding significant value for patients. Many healthcare settings already adopt custom mobile apps tailored to their needs. The shift towards mobile devices overtook the use of desktops and laptops quickly. In addition, the use of tablets and mobiles saw a rise in hospitals and clinics, providing healthcare providers with a portable device they could carry during consultations and home visits, which supports market growth.

The desktop & laptop segment is projected to grow significantly over the forecast period. Management software intended for desktop and laptop use is designed to operate within a single physical location, where multiple healthcare facility employees can access it from a single computer. With the advent of mobile and cloud enhancements, this software model now supports remote access via mobile technology. The IMS by 1st Provider's Choice, specifically aimed at Physical Therapy services, supports compatibility with a range of devices, including iPads, iPhones, tablets running Windows, Android devices, and various other handheld devices, in addition to the traditional desktop and laptop computers.

Deployment Insights

The cloud-based segment held the largest share of 60.33% in 2023. It is predicted to retain the biggest market share and achieve significant growth due to the escalating adoption and surging popularity of cloud-based solutions in healthcare. Cloud-based systems offer a more economical deployment option than their server-based counterparts and remove the need for internal maintenance, which is a principal reason behind their preference. In addition, the cloud deployment method provides enhanced flexibility, thereby fostering market expansion. In June 2022, Spry, a comprehensive SaaS platform for physical therapists, announced it secured new funding, surpassing USD 10 million. This investment aims to advance its vision for the future of rehab practice management. Eight Roads Ventures spearheaded the round, with contributions from F-Prime Capital and Together Fund.

The server-based segment is anticipated to grow significantly during the forecast period. These solutions, which are installed and operated directly at the practice's location, continue to be widely used, although this trend is shifting because of their disadvantages. Such disadvantages include a high initial purchase cost and ongoing maintenance expenses, which encompass annual software upgrades and network maintenance.

End-use Insights

The hospital segment held the largest share of 39.27% in 2023. Hospitals are an essential component of the healthcare industry, representing the sector's primary source of income and driving research and innovation. Several companies actively use revenue and marketing to promote their interfaces/services in these facilities. Due to their critical role in providing care for various health conditions, hospitals are projected to occupy the largest market share globally.

The others segment is anticipated to witness significant growth over the forecast period. This category encompasses a variety of establishments such as sports & fitness centers, nursing homes, home health care providers, and rehabilitation centers. According to the American Academy of Physical Therapy, physical therapists find employment across a range of environments, notably in private practices and clinics. Hospitals (including state, local, and private) represent approximately 28% of employment, home healthcare services make up about 11%, nursing and residential care facilities account for 7%, and physician offices constitute around 5%.

Regional Insights

North America physical therapy software market accounted for a share of 53.44% in 2023 owing to high awareness levels and improved healthcare infrastructure. The widespread adoption of cutting-edge technologies and increased investments in healthcare contribute to market expansion in this region. The healthcare sector represents one of the largest industry segments in the U.S., further stimulating market development. The region's growth is also boosted by well-established market participants and the initiatives they undertake, thereby fostering regional advancement and catalyzing market growth.

U.S. Physical Therapy Software Market Trends

The physical therapy software market in the U.S. held the largest share of 78.00% in the North American region in 2023. Adopting electronic health records (EHR) and telehealth is a major catalyst. The region's aging population, projected to see one in five Americans over 65 by 2040, is increasing the demand for physical therapy services and the software needed to manage this demand. Regulatory mandates, such as those from the HITECH Act and the Affordable Care Act, require the use of EHR systems for reimbursement and are further accelerating the market's expansion by pushing healthcare providers towards these technological solutions to meet compliance and enhance patient care.

Europe Physical Therapy Software Market Trends

The physical therapy software market in Europe was a lucrative region in this industry. The rising adoption of digital healthcare solutions, particularly in physical therapy, is driven by Europe's advanced medical infrastructure and a focus on technology. The region's increasing elderly population demands more physical therapy services, necessitating efficient software for managing patient information and treatments. Strict data protection laws such as GDPR have also created secure, regulation-compliant software for the European market. Economic stability and government healthcare investments are key in boosting the physical therapy software sector, aiming to enhance patient care and optimize healthcare workflows.

The UK physical therapy software market is projected to expand due to technological advancement. The growing integration of digital solutions in healthcare and physical therapy is driven by the need for efficiency and improved outcomes. Influenced heavily by NHS policies, this trend is also propelled by a cultural shift towards technology, economic pressures for cost-effectiveness, and political support for healthcare innovation. These factors collaboratively foster the expansion of the physical therapy software market in the UK.

The physical therapy software market in France is expected to grow rapidly during the forecast period. Another factor influencing market growth is the increasing adoption of digital solutions in the French healthcare sector. Technological advancements improve patient care, make administrative tasks more efficient, and enable personalized treatment plans. The aging population in France and government support for digital health initiatives are driving market growth.

The physical therapy software market in Germany is expected to grow significantly due to its strong healthcare infrastructure. The country’s advanced healthcare system, emphasis on technology, aging population, and demand for efficient services drive the market. Germany's stringent data protection laws, such as the GDPR, alongside government initiatives promoting healthcare digitalization and telehealth reimbursement policies, are also significantly influencing therapists' adoption of these digital solutions.

Asia Pacific Physical Therapy Software Market Trends

The physical therapy software market in Asia Pacific is anticipated to witness the fastest growth over the forecast period or acute circumstances. Geriatric population growth in the region further propels regional demand. Many chronic conditions call for a long-term plan to help prevent and correct these conditions. For instance, iFour Techno Lab Pvt. Ltd. offers +Physio, a comprehensive and reliable physical therapy software. The firm is based in Gujarat, India.

China physical therapy software market is expected to grow significantly due to the growing focus on health and wellness within Chinese society, accelerated by an aging population and increased lifestyle-related health challenges, whichdrives the demand for advanced physical therapy solutions. This is further supported by swift technological progress specific to the Chinese market, offering software that meets the distinct needs of its patients and healthcare professionals. Government efforts to enhance healthcare infrastructure and the unique integration of traditional Chinese medicine with contemporary physical therapy practices are propelling the adoption of specialized software solutions within healthcare facilities in China.

The physical therapy software market in Japan is expected to grow over the forecast period. Japan's aging population, focus on healthcare, and tech advancements have sparked a surge in demand for cutting-edge physical therapy software. The country's cultural emphasis on health, economic stability, and governmental support for healthcare tech have fueled this market's growth. Japan's strict regulatory framework ensures these software solutions meet top-quality and data security standards.

Latin America Physical Therapy Software Market Trends

The physical therapy software market in Latin America is expected to grow rapidly. The growing focus on healthcare and increasing chronic disease rates fuel the demand for tech-enhanced physical therapy solutions. Economic improvements allow healthcare providers in Latin America to adopt sophisticated software for better operations and patient care. A cultural shift towards holistic and preventive health, along with government efforts to update healthcare systems and improve care quality, is boosting the physical therapy software market in the region. The market is further supported by political stability and positive regulatory environments, making it appealing for physical therapy software providers.

Brazil physical therapy software market is expected to grow over the forecast period because the adoption of technology in healthcare is rising in Brazil, driven by its large population and increasing healthcare needs. Due to Brazil's diverse geography, there has been a demand for digital solutions in physical therapy to reach underserved areas. The government's investments in healthcare and digital health initiatives support the physical therapy software market. A preference for convenience has spurred this software's development of easy-to-use interfaces and mobile apps. Regulatory compliance is crucial in shaping these software solutions, ensuring they meet the specific needs of the Brazilian population.

MEA Physical Therapy Software Market Trends

The physical therapy software market in MEA was identified as a lucrative region in this industry. The Middle East and Africa are increasingly embracing technology in healthcare, which is boosting the need for digital solutions in physical therapy. The region's diverse cultures and extensive geography require software to be adaptable, including language localization and customization. Economic disparities among countries, differing healthcare infrastructure development levels, and political stability and regulatory environments further influence the adoption of digital health technologies.

Saudi Arabia physical therapy software market shows opportunities. Recently, Saudi Arabia experienced a rapid increase in the use of physical therapy software, driven by the healthcare sector's growth and supported by government efforts to enhance services and infrastructure. Cultural values emphasizing health and wellness and economic initiatives such as Vision 2030 spur investments in health technology, including software for physical therapy. Political stability and a supportive innovation climate accelerate the adoption of digital healthcare solutions.

Key Physical Therapy Software Company Insights

The key players are involved in various strategies to improve their market penetration, such as new interface developments, distribution agreements, and expansion strategies. For instance, in January 2022, WebPT acquired Clinicient and its subsidiary Keet. The acquisition offers WebPT further scale and industry expertise. Such factors are likely to maintain the intensity of rivalry in the market at a high level.

In May 2021, WRS Health announced that it is expanding its footprint with the accessibility of Physical Therapy-Cloud. Physical Therapy-Cloud is an EHR that permits Physical Therapists to improve their workflows profitably and efficiently. WRS Health is a qualified and award-winning web-based provider of entirely integrated EHR and Practice Management software solutions for medical specialties. Some of the prominent players in the global physical therapy software market include:

Key Physical Therapy Software Companies:

The following are the leading companies in the physical therapy software market. These companies collectively hold the largest market share and dictate industry trends.

- Practice Fusion, Inc.

- WebPT

- Systems 4PT

- Axxess

- DrChrono Inc. (EverHealth Solutions Inc.)

- Power Diary Pty Ltd.

- BioEx Systems, Inc.

- Meditab

- OptimisCorp

- MICA Information Systems, Inc.

- Oracle

- Kareo, Inc.

- NXGN Management, LLC

Recent Developments

-

In July 2023, ATI Physical Therapy formed a strategic partnership with Genie Health, previously known as PT Genie, to integrate virtual and in-person physical therapy across more than 900 clinics in 24 states. This collaboration aims to enhance ATI's digital care offerings, including 150,000 telehealth visits for over 12,500 patients since 2020, by incorporating Genie Health's AI-driven remote monitoring into its services.

-

In June 2023, Kaia Health, the leading digital therapeutics firm with over 650,000 users, unveiled Angela. This HIPAA-compliant, AI-driven digital care assistant offers personalized patient support anytime, anywhere, enhancing the care experience with its human-like interactions.

Physical Therapy Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.35 billion

Revenue forecast in 2030

USD 2.52 billion

Growth rate

CAGR of 11.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Interface, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa;Saudi Arabia; UAE; Kuwait

Key companies profiled

Practice Fusion, Inc.; WebPT; Systems 4PT; Axxess; DrChrono Inc. (EverHealth Solutions Inc.); Power Diary Pty Ltd.; BioEx Systems, Inc.; Meditab; OptimisCorp; MICA Information Systems, Inc.; Oracle; Kareo, Inc.; NXGN Management, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Physical Therapy Software Market Report Segmentation

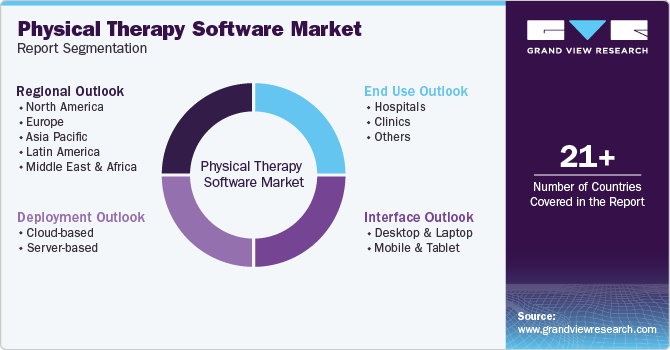

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global physical therapy software market report based on interface, deployment, end-use, and region:

-

Interface Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop & Laptop

-

Mobile & Tablet

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

Server-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global physical therapy software market size was estimated at USD 1.25 billion in 2023 and is expected to reach USD 1.35 billion in 2024.

b. The global physical therapy software market is expected to grow at a compound annual growth rate of 10.9% from 2024 to 2030 to reach USD 2.52 billion by 2030.

b. North America dominated the physical therapy software market with a share of over 53% in 2023 owing to high awareness levels and improved healthcare infrastructure. Besides, the high adoption of innovative technologies and high investments in the healthcare area drive the market growth in this region

b. Some key players operating in the physical therapy software market include Practice Fusion, Inc.; WebPT; Systems 4PT; Axxess; DrChrono Inc.; Power Diary Pty Ltd.; BioEx Systems, and others

b. Key factors that are driving the physical therapy software market growth include Advancement in technology, rising investments in the healthcare sector, and integration of practice management with other health IT solutions and benefits associated with a physical therapy software

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.