Physical Security Information Management Market Size, Share & Trends Analysis Report By Deployment (On-premises, Cloud, Hybrid), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-462-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

PSIM Market Size & Trends

The global physical security information management market size was estimated at USD 3.40 billion in 2023 and is estimated to grow at a CAGR of 21.3% from 2024 to 2030. The incorporation of physical security information management (PSIM) into smart city projects is fueling substantial growth in the PSIM market. PSIM is crucial for smart cities, as it integrates security and traffic systems, improves traffic management, and boosts public safety monitoring. Moreover, the increasing complexity of security systems across various sectors has further accelerated the adoption of PSIM, which consolidates diverse security elements into unified interfaces. This integration improves real-time monitoring and incident response, effectively addressing contemporary urban security needs.

The rise in urbanization and the development of smart cities have further accelerated PSIM adoption, as these environments require advanced systems to manage and coordinate security and traffic operations seamlessly. Additionally, the growing emphasis on data-driven decision-making and the need for comprehensive security strategies across various sectors are driving demand for PSIM solutions. Overall, the PSIM market is expanding rapidly, driven by the need for greater efficiency, improved safety outcomes, and the ability to adapt to evolving security threats.

The new trends in this market are diversified by technology advancement and security landscape shift. Integration with AI/ML is one of the major trends in the PSIM world, allowing integration of more predictive analytics into security and quicker automated responses to potential threats. Additionally, cloud-based PSIM solutions are gaining popularity due to their scalability, flexibility, and reduced on-premise infrastructure requirements. The focus on cybersecurity within PSIM platforms is also growing, as organizations seek to protect physical security systems from digital threats. Furthermore, the rise of IoT devices in the security domain is creating demand for more sophisticated PSIM platforms capable of managing a larger and more diverse set of inputs. These trends reflect the ongoing evolution of PSIM as a critical component in modern security strategies across industries.

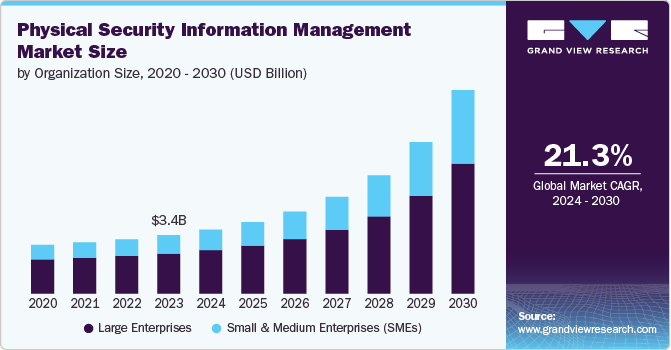

Organization Size Insights

The large enterprise segment accounted for the largest revenue share in 2023. The growth is driven by driven by the increasing complexity and scale of their security needs. As these organizations expand globally and operate in diverse environments, they require advanced PSIM solutions to integrate and manage a multitude of security systems and data streams from across their operations. Large enterprises are investing in PSIM systems that offer robust integration capabilities, allowing them to unify various security technologies-such as surveillance cameras, access control systems, and alarm systems-into a single, cohesive platform. This integration is crucial for providing a comprehensive view of security operations and improving incident response times.

The Small and Medium Enterprises (SMEs) segment is expected to grow significantly over the forecast period. SMEs are prioritizing PSIM systems that offer affordability without compromising on functionality. Providers are developing scalable and cost-effective PSIM solutions tailored to the needs of smaller businesses, allowing them to start with essential features and expand as their requirements grow. Moreover, with the growing threat of cyberattacks, SMEs are integrating cybersecurity with their physical security management through PSIM systems. This approach helps protect against both physical and digital threats, providing a more comprehensive security solution.

Application Insights

The access control system segment accounted for the largest revenue share in 2023, driven by increasing security concerns and the need for sophisticated protection measures. The segment's growth is largely attributed to the rising adoption of advanced technologies like biometric authentication, smart card systems, and integrated access solutions that enhance both security and convenience. Organizations are investing in these systems to mitigate risks, comply with stringent regulations, and ensure robust protection of sensitive areas. Additionally, the growing trend of smart buildings and the integration of IoT devices have further fueled the demand for advanced access control systems, solidifying their prominent role in the PSIM market.

The Video Management System (VMS) segment is predicted to foresee significant growth over the forecast period. Advances in AI and machine learning are enabling VMS solutions to offer sophisticated analytics, such as facial recognition, anomaly detection, and behavioral analysis, which significantly improve security effectiveness. The proliferation of high-definition cameras and the integration of VMS with other security technologies are also contributing to its growth. Furthermore, the rising need for comprehensive security solutions in both public and private sectors is accelerating the adoption of VMS, strengthening its role as a critical component of modern security infrastructure.

End-use Insights

The government & public sector segment accounted for the largest revenue share in 2023. Government entities and public institutions are increasingly adopting advanced PSIM solutions to address complex security challenges, including terrorism, cyber threats, and large-scale public events. The sector’s focus on protecting sensitive information, maintaining public safety, and complying with stringent regulations drives the demand for integrated security systems that provide real-time monitoring and comprehensive situational awareness. Additionally, ongoing modernization efforts and the implementation of smart city initiatives are further propelling the growth of PSIM solutions within this sector

The transportation segment is predicted to foresee significant growth over the forecast period. As global urbanization and travel demand rise, there is a growing need for advanced security solutions to protect airports, railways, and transit systems from potential threats, including terrorism and vandalism. The integration of PSIM systems with surveillance, access control, and incident management technologies helps streamline operations and improve response times. Additionally, smart transportation initiatives and the deployment of IoT sensors are fueling the adoption of PSIM solutions to manage complex, interconnected environments more effectively, further accelerating market growth in this sector.

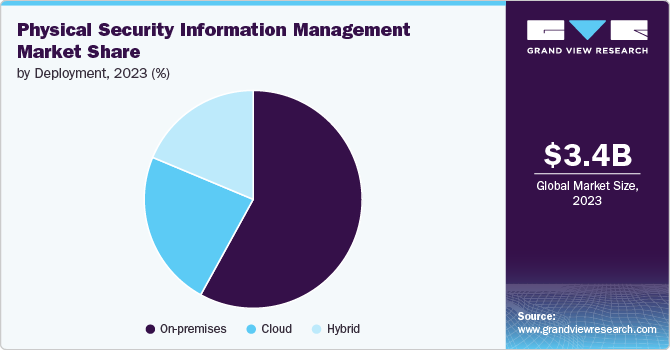

Deployment Insights

The on-premises segment led the market accounting for over 57% revenue share in 2023. Organizations that prioritize stringent data security, compliance, and control over their systems often favor on-premises deployments due to their ability to provide a secure, localized environment. This approach allows for deep customization and integration with existing infrastructure, catering to complex security requirements and providing reliability even in the absence of internet connectivity. As industries with high security needs, such as government and critical infrastructure, seek to maintain tight control over their security operations, on-premises PSIM solutions are experiencing steady growth. Additionally, advancements in hardware and network technologies are enhancing the efficiency and capabilities of on-premises systems, making them a viable option for organizations with specific security and performance needs.

The cloud segment is predicted to foresee significant growth over the forecast period. Cloud-based PSIM solutions offer significant advantages, including enhanced flexibility, scalability, and cost-efficiency compared to traditional on-premises systems. With cloud deployment, organizations can easily expand their security infrastructure, integrate diverse data sources, and access real-time information from anywhere, facilitating better coordination and faster response times. The shift to cloud-based models is driven by the increasing need for remote access, seamless updates, and reduced IT maintenance burdens. Additionally, cloud deployment supports advanced analytics and artificial intelligence capabilities, providing deeper insights and predictive capabilities for proactive security management.

Regional Insights

North America accounted to hold significant share in the market and accounted for over 30% share in 2023. The region's growth is fueled by its high adoption rate of cutting-edge solutions, including AI-driven analytics, integrated surveillance systems, and smart infrastructure. Additionally, stringent regulatory requirements and a high level of infrastructure development, including smart cities and critical facilities, further propel the demand for sophisticated PSIM systems. North America's proactive approach to enhancing public and private security, coupled with significant government and private sector funding, underscores its leading position and rapid expansion in the PSIM market.

U.S. Physical Security Information Management Market Trends

The U.S. physical security information management market is accounted to hold highest market share over the forecast period. The country’s focus on protecting critical infrastructure, including government buildings, financial institutions, and public transportation, spurs demand for sophisticated PSIM solutions. The U.S. leads in the adoption of emerging technologies such as AI, machine learning, and integrated surveillance systems, which enhance real-time threat detection and response.

Europe Physical Security Information Management Market Trends

The Europe region's growth is supported by stringent regulations and compliance requirements, as well as a push towards modernizing security infrastructure across various sectors, including transportation, critical infrastructure, and public spaces. The adoption of smart city initiatives and the integration of innovative technologies, such as IoT and AI-driven analytics, further bolster the demand for sophisticated PSIM systems.

Asia Pacific Physical Security Information Management Market Trends

The Asia Pacific physical security information management market is experiencing rapid growth. The region’s burgeoning economies are investing heavily in smart city projects, transportation networks, and critical infrastructure, driving the demand for advanced PSIM solutions. Enhanced by the proliferation of IoT devices and the adoption of AI-driven technologies, these solutions offer improved surveillance, threat detection, and incident management. Additionally, growing geopolitical tensions and the need for robust security in high-density urban areas are further propelling market growth. APAC's commitment to modernizing security frameworks and integrating cutting-edge technologies positions it as a key player in the global PSIM market expansion.

Key Physical Security Information Management Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations contracts, agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boosst their position in the competitive industry. For instance, in September 2024, Genetec Inc., a prominent provider of integrated security, operations, public safety, and business intelligence solutions, unveiled its new cloud-based work management solution, Operations Center. Designed specifically for physical security operations, this innovation is available both as a standalone product and the Security Center SaaS platform. The Operations Center is tailored to meet the needs of security operations professionals, offering a transformative approach to how physical security teams communicate, collaborate, and manage their tasks.

Key Physical Security Information Management Companies:

The following are the leading companies in the physical security information management (PSIM) market. These companies collectively hold the largest market share and dictate industry trends.

- Genetec Inc.

- Milestone Systems

- Johnson Controls International plc

- Honeywell International Inc.

- Cisco Systems, Inc.

- Avigilon (a Motorola Solutions Company)

- Axis Communications

- Seoul Semiconductor Co., Ltd.

- Bosch Security Systems

- NEC Corp

Recent Developments

-

In March 2024, Access Information Management, the world's largest privately held provider of integrated information management services, announced its acquisition of Triyam, a fast-growing software company specializing in data management solutions for healthcare organizations. This acquisition enables Access to rapidly expand its presence in the archival digital records management and electronic health records (EHR) markets, complementing its strong existing capabilities in records archiving and compliance management.

-

In March 2023, Advancis introduced its new vendor-neutral Physical Security Information Management (PSIM) software, WinGuard X5, along with a new product, the Advanced Identity Manager (AIM). According to the Advancis Management Board, these product launches are a key part of the company's growth strategy and follow a period of strong economic performance. The release of WinGuard X5 and AIM reflects Advancis’s commitment to advancing its offerings in response to market demands and positions the company for continued success.

Physical Security Information Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.72 billion |

|

Revenue forecast in 2030 |

USD 11.86 billion |

|

Growth rate |

CAGR of 21.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, organization size, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Genetec Inc.; Milestone Systems; Johnson Controls International plc; Honeywell International Inc.; Cisco Systems, Inc.; Avigilon; Axis Communications; Seoul Semiconductor Co., Ltd.; Bosch Security Systems; NEC Corp |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Physical Security Information Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global physical security information management market report based on deployment, organization size, application, end-use, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

Hybrid

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Access Control System

-

Video Management System

-

Intrusion Detection System

-

Fire Alarm System

-

Video Analytics System

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Government & Public Sector

-

Healthcare

-

BFSI

-

Educational Institution

-

Retail & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global physical security information management market size was estimated at USD 3,401.8 million in 2023 and is expected to reach USD 3,723.0 million in 2024.

b. The global physical security information management market is expected to grow at a compound annual growth rate of 21.3% from 2024 to 2030 to reach USD 11,856.9 million by 2030.

b. North America dominated the physical security information management market with a share of 31.5% in 2023. The region's growth is fueled by its high adoption rate of cutting-edge solutions, including AI-driven analytics, integrated surveillance systems, and smart infrastructure. Additionally, stringent regulatory requirements and a high level of infrastructure development, including smart cities and critical facilities, further propel the demand for sophisticated PSIM systems.

b. Some key players operating in the physical security information management market include Genetec Inc.; Milestone Systems; Johnson Controls International plc; Honeywell International Inc.; Cisco Systems, Inc.; Avigilon (a Motorola Solutions Company); Axis Communications; Seoul Semiconductor Co., Ltd.; Bosch Security Systems; and NEC Corp.

b. The incorporation of physical security information management into smart city projects is fueling substantial growth in the market. physical security information management is crucial for smart cities, as it integrates security and traffic systems, improves traffic management, and boosts public safety monitoring.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."