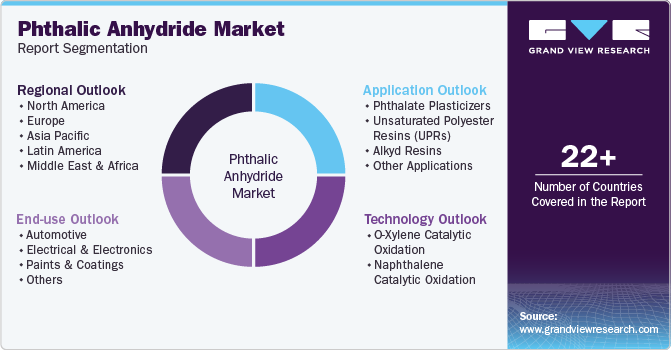

Phthalic Anhydride Market Size, Share & Trends Analysis Report By Technology (O-Xylene Catalytic Oxidation), By Application (Phthalate Plasticizers), By End- use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-198-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Phthalic Anhydride Market Size & Trends

The global phthalic anhydride marketsize was valued at USD 4.52 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. This growth is driven by significant industrial chemicals used as starting materials for manufacturing various chemicals and polymers. In addition, the increasing use of PVC in building and construction applications such as flooring, wiring, and plumbing is a significant factor driving the demand for phthalic anhydride, widely used in producing plasticizers for PVC. Furthermore, the rise in automobile production, especially electric vehicles, has led to increased demand for PVC from the automotive industry for manufacturing automotive body parts, further propelling the growth of the market.

Phthalic anhydride is utilized worldwide for a wide range of applications in the plastic industry, resin synthesis, and agricultural fungicides. The development of chemicals manufactured from renewables has been receiving increasing interest not only due to environmental policies but also due to initiatives of private companies. Moreover, the implementation of phthalic anhydride highly influences leading world economies.

In addition, the consumption of phthalic anhydride depends heavily on construction, automobile production, and equipment manufacturing.There is a vast market demand for phthalate plasticizers, unsaturated polyester resins, and alkyd resins for surface coatings. Furthermore, one primary use is producing polyvinyl chloride (PVC), a plastic utilized in multiple applications and various sectors, including pipes and flooring. It is also used to produce alkyd resins, which are adopted for making varnishes, paints, and coatings.

Technology Insights

The naphthalene catalytic oxidation dominated the market in 2023 with a largest revenue share of 83.5%. This growth is attributed to several factors, such as the purity of naphthalene, which is crucial, as it ensures better outcomes and quality of phthalic anhydride by minimizing impurities and maximizing final output. In addition, adherence to environmental regulations about emissions and waste disposal is essential for sustainable operation, as seen by rising regulatory scrutiny. It is often economical because of lower feedstock costs and optimized reaction nature, lowering operational expenses, thereby fueling the segment’s growth.

O-xylene catalytic oxidation is expected to grow at a CAGR of 4.5% over the forecast period.The higher concentration of o-xylene in the feed gas removes unnecessary by-products and reduces the burning of phthalic anhydride, which allows lower capital costs and energy savings. In addition, due to its liquid state, the process allows for a more straightforward feed system, which is the main factor for the rising demand for the o-xylene process in the phthalic anhydride.

Application Insights

Phthalate plasticizers led the market and accounted for the largest revenue share of 54.0% in 2023. This growth is driven by its characteristics, such as making plastic flexible, bendable, and durable, which ensures its better performance for a more extended period. In addition, there is a growing demand for phthalic anhydride from paint & coating, medical industries, wire & cable, transportation, and film & sheet for manufacturing PVC pipes, medical devices, cables & wire insulations, the automotive industry, and synthetic leather. Therefore, implementing plasticizers at lower costs and broad applications in various sectors significantly increases the phthalic anhydride market.

Unsaturated polyester resins (UPRs) are expected to grow at a CAGR of 5.0% over the forecast period.Unsaturated polyester resins are used in various applications because of their extensive characteristics, such as versatility, flexibility, bendability, and durability, which ensure high performance. These resins can create molded parts, laminates, and coatings because of their properties, such as heat or UV resistance.The market is driven by the growing demand for unsaturated polyester resins in the construction and automotive industries, whereas the construction industry is the largest market for unsaturated polyester resins.

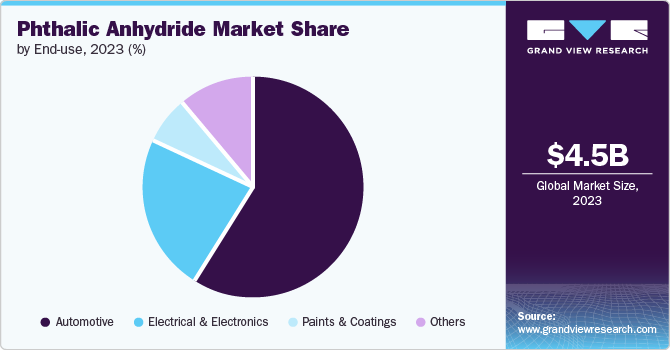

End-use Insights

The automotive segment dominated the market and accounted for the largest revenue share of 59.4% in 2023, owing to its widespread utilization in the manufacturing of polyester fiberglass-reinforced composites, which are vital in the manufacture of automotive components. These composites enhance safety and durability and resist corrosion.

The electrical and electronics segment is expected to grow at a CAGR of 4.3% over the forecast period. Phthalic anhydride is a versatile chemical broadly used in the electrical sector because of its extravagant properties, adopted to manufacture durable and high-strength electronic components, such as polyester fibers, electronic substrates, wires, cables, and other parts, enabling them to use high-quality material.

Regional Insights

The North America phthalic anhydride marketregistered a significant revenue share in 2023. This growth is attributed to its essential use in various sectors. Furthermore, phthalic anhydride-derived plasticizers are widely used to produce PVC pipes, automotive industry materials, and construction.

U.S. Phthalic Anhydride Market Trends

The phthalic anhydride market in the U.S. dominated the North America market with the largest revenue share of 86.2% in 2023. Phthalic anhydride is widely used in plastics, paints and coatings, dyes, building and construction, pharmaceuticals, and rubber industries, which drives the market’s growth. Furthermore, the varied applications of phthalic-based plasticizers in a broad range of sectors are among the significant factors for the high requirement for phthalic anhydride in the region and also boost the expansion of the market in the country.

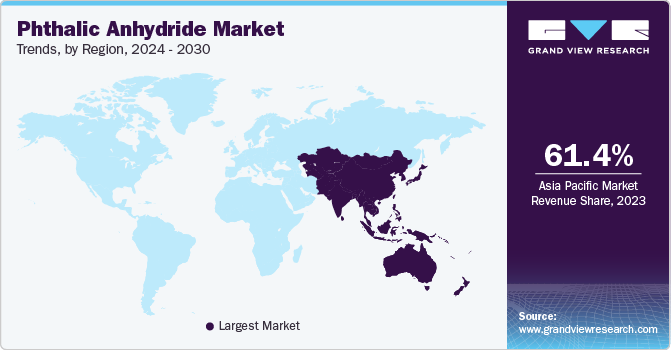

Asia Pacific Phthalic Anhydride Market Trends

The Asia Pacific phthalic anhydride market dominated the global market and accounted for the largest revenue share of 61.4% in 2023. Asia ranks and leads in the consumption and production of phthalic anhydride for plasticizers. Asia-Pacific sustains its position as the most significant tie, which accounts for high demand in countries such as China, India, and Southeast Asia. In addition, the growth of the market in the region is driven by the increasing demand for PVC products in the building and construction industry.

The phthalic anhydride market in China dominated the Asia Pacific market and accounted for the largest revenue share of 29.5% in 2023. This growth is driven by declining prices of naphthalene, an essential raw material used in phthalic anhydride production, and low operating costs at production plants. In addition, its wide use in the automotive sector, the manufacturing of pipes, paints, coatings, etc., further boosts market expansion in the country.

The India phthalic anhydride market is expected to experience significant growth over the forecast year, owing to a major industrial presence, advantages from economies of scale, and a suitable production environment, including sufficient labor resources and infrastructure.Government initiatives and programs that promote domestic manufacturing and industrial growth encourage investment in phthalic anhydride production plants.

Europe Phthalic Anhydride Market Trends

The European phthalic anhydride market is expected to grow significantly over the forecast years due to its applications, which have experienced growth in the past few years. It is mainly used in manufacturing plastic, paints and coatings, dyes, building and construction, pharmaceuticals, and rubber.

The phthalic anhydride market in the UK is expected to witness substantial growth owing to various factors, such as significant innovations and wide use in the automotive industry and various other automotive body parts, such as doors and instrument panels. Furthermore, different market strategies made by the market players, such as acquisitions and collaborations, enhance the product applications and raise the demand, thereby boosting the market’s growth in the country.

Latin America Phthalic Anhydride Market Trends

The phthalic anhydride market in Latin America is expected to grow at a CAGR of 3.6% over the projected years. This growth is attributed to the rapid increase in the construction and automotive industries. In addition, an increasing demand for PVC products in construction, particularly for applications such as flooring, wiring, and plumbing, is contributing to the market's expansion in the region. Furthermore, the growing production of electric vehicles in Brazil and Argentina is boosting demand for phthalic anhydride in the automotive sector.

Key Phthalic Anhydride Company Insights

The key players in the market are adopting various strategies to stay ahead of the competition. These strategies include launching new products, making strategic acquisitions, and investing in research and development to develop innovative products and technologies. These strategies allow them to cater to evolving customer demands and maintain their market position.

-

NAN YA PLASTICS CORPORATION manufactures and markets secondary plastic, polyester fibers, and copper-clad laminates for electronic materials and chemical fiber products. The company's four product categories are plastic materials, electronics materials, plastics processing, and polyester products.

-

Exxon Mobil Corporation is an incorporated oil and gas company that produces crude oil, natural gas liquids, and natural gas. The company is also an energy provider and chemical manufacturer, developing and applying next-generation technologies. It manufactures commodity petrochemicals, including aromatics, olefins, polypropylene plastics, and polyethylene.

Key Phthalic Anhydride Companies:

The following are the leading companies in the phthalic anhydride market. These companies collectively hold the largest market share and dictate industry trends.

- NAN YA PLASTICS CORPORATION

- Exxon Mobil Corporation.

- MITSUBISHI GAS CHEMICALS COMPANY, INC.

- I.G. PETROCHEMICALS LTD.

- UPC Technology Corporation.

- Thirumalai Chemicals.

- Koppers Inc.

- C-CHEM CO. LTD

- POLYNT SPA

- Stepan Company

Recent Developments

-

In March 2024, Polyprocess and its minority shareholders entered a non-binding MoU to sell Polyprocess to Polynt S.p.A. The parties have agreed to exclusivity undertakings while they finalize the negotiations, and Polyprocess checks with its representatives on the proposed transaction.

-

In March 2024,Mitsubishi Gas Chemical sold half of its stake in CG Ester, a plasticizer manufacturer, to its partner JNC Corp. The deal was valued at approximately USD 4.9 million. This strategic decision marks Mitsubishi Gas Chemical's withdrawal from the plasticizers business, allowing it to focus on its core operations and pursue higher development opportunities.

Phthalic Anhydride Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.64 billion |

|

Revenue forecast in 2030 |

USD 5.82 billion |

|

Growth Rate |

CAGR of 3.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Belgium, Russia, China, India, Japan, South Korea, South East Asia, Brazil, Argentina, South Africa, Saudi Arabia |

|

Key companies profiled |

NAN YA PLASTICS CORPORATION; Exxon Mobil Corporation.; MITSUBISHI GAS CHEMICALS COMPANY, INC.; I.G. PETROCHEMICALS LTD.; UPC Technology Corporation.; Thirumalai Chemicals.; Koppers Inc.; C-CHEM CO. LTD; POLYNT SPA; Stepan Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Phthalic Anhydride Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global phthalic anhydride market report based on technology, application, end-use, and region.

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

O-Xylene Catalytic Oxidation

-

Naphthalene Catalytic Oxidation

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Phthalate Plasticizers

-

Unsaturated Polyester Resins (UPRs)

-

Alkyd Resins

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Paints & Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

South East Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."