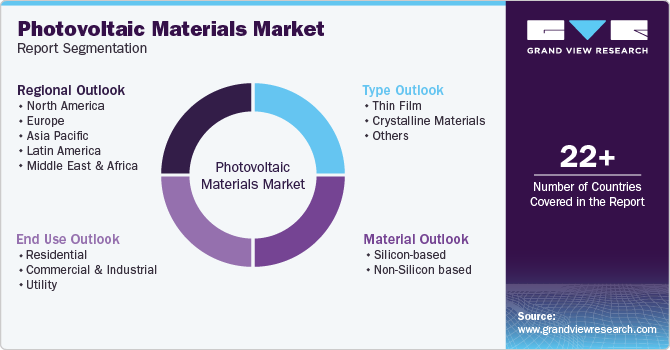

Photovoltaic Materials Market Size, Share & Trends Analysis Report By Type (Thin Film, Crystalline Materials, Others), By Material (Silicon-based, Non-Silicon-based), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-546-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Photovoltaic Materials Market Size & Trends

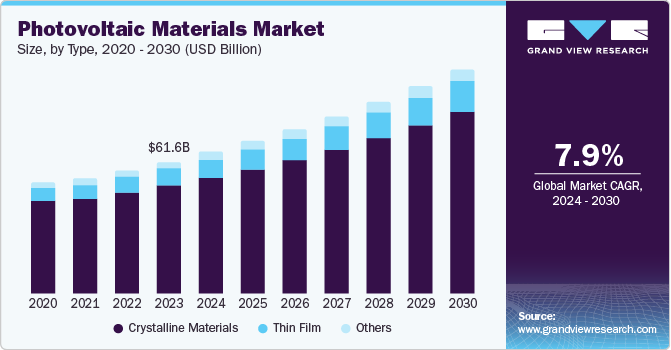

The global photovoltaic materials market size was valued at USD 61.57 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030. Rising global energy requirements, a rapid transition towards sustainable energy alternatives, technological advancements in PV materials, and increased affordability of solar energy solutions have led to strong market growth.

With increasing economic activities and production capacities, industries worldwide are seeking affordable and scalable energy sources. According to the Solar Energy Industries Association, in the past decade, about 200 GW of solar capacity has been installed in the United States. As the costs associated with installation and generation of solar energy decline, a significant rise in the demand for solar energy is anticipated from utility and residential sectors over the forecast period, driving developments in the PV materials industry.

Innovations in solar PV materials and energy storage solutions have reduced production costs of solar energy by about 40% over the past decade, which has led to widespread adoption of solar energy by a majority of the developed economies in North America and Europe. This has contributed to their efforts towards developing clean energy technologies. For instance, according to the International Energy Agency’s Tracking Clean Energy Progress (TCEP) 2023 report, progress in solar PV was found satisfactory and at par with the Net Zero 2050 targets. Rising concerns over global warming and climate change have compelled nations worldwide to take swift action regarding energy transition from fossil fuels to renewable sources. Solar energy has emerged as a highly sought-after renewable energy solution in recent years, surpassing the demand for wind energy.

The escalating energy demands of emerging economies, including China, India, and Brazil, coupled with increasing global pressure to mitigate fossil fuel emissions, have spurred a significant shift towards renewable energy solutions. These countries have committed to net-zero carbon neutrality and substantial reductions in their CO2 emissions in the coming years, necessitating the adoption of alternative sources such as solar and wind power. To achieve energy independence and address the limitations of fossil fuels, governments in these regions are prioritizing large-scale solar projects. This transition has driven a substantial increase in the demand for PV materials.

Type Insights

Crystalline materials dominated the market with a revenue share of 82.3% in 2023. This is attributed to their superior efficiency, durability, and cost-effectiveness. Crystalline silicon, the most widely used material in solar panels, offers high conversion efficiency rates, resulting in increased energy output and reduced material requirements. A well-established manufacturing infrastructure and economies of scale have driven down the cost of crystalline silicon globally, making it a more viable option compared to alternative materials. Additionally, crystalline materials are known for their reliability and longevity, with a lifespan of up to 30 years, reducing maintenance and replacement costs. These factors have led to this segment’s dominance in the global market.

The thin film segment is anticipated to register the fastest CAGR over the forecast period. The use of thin film technology results in reduced material costs, lower manufacturing complexity, and improved flexibility, making it an attractive option for applications such as building-integrated photovoltaics (BIPV) and portable solar energy solutions. The growing demand for flexible and lightweight solar panels, particularly in the residential and commercial sectors, has boosted the adoption of thin film materials. Additionally, advancements in thin film technology have led to improved efficiency rates, narrowing the gap with crystalline silicon-based solar panels.

Material Insights

Silicon-based photovoltaic materials held the highest market share in 2023. This is owing to the higher efficiency rates, durability, and cost-effectiveness of these materials. The maturity of silicon technology, coupled with economies of scale achieved through large-scale manufacturing, has resulted in significant cost reductions, making silicon-based solar panels a more beneficial option financially. Additionally, extensive research and development activities in silicon-based technology have led to continuous efficiency improvements, further solidifying this segment’s position as a leading material in the solar energy sector.

The non-silicon-based materials segment is expected to register the fastest growth from 2024 to 2030. This is attributed to the increasing demand for alternative materials that offer improved efficiency, better light absorption, reduced costs, and enhanced sustainability. Materials such as perovskite, cadmium telluride (CdTe), and copper indium gallium (di)selenide (CIGS) have gained significant traction in this industry, driven by their potential to surpass silicon-based materials in terms of efficiency and cost-effectiveness. A number of non-silicon-based materials have higher power conversion efficiency rates, thinner film requirements, and lower manufacturing costs, making them attractive options for next-generation solar panels.

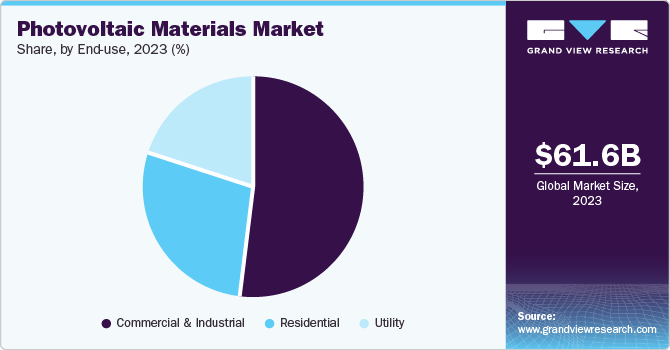

End Use Insights

The commercial and industrial sector accounted for a leading revenue share in 2023. This is owing to the increasing adoption of solar energy solutions by businesses and organizations seeking to reduce energy costs and carbon emissions. The demand for PV materials is also fueled by the increasing pace of installation of rooftop solar panels, solar carports, and ground-mounted solar systems, which offer substantial savings on electricity bills and help in meeting sustainability objectives. Government policies, tax credits, and rebates have incentivized commercial and industrial entities to invest in solar energy, leading to a surge in product demand. Additionally, the reduced cost of solar energy has made it more competitive with conventional energy sources, accelerating its rate of adoption. Large corporations, in particular, have set ambitious renewable energy goals, driving substantial demand for PV materials.

The utility sector is expected to register the fastest CAGR during the forecast period. This is attributed to the rapid expansion of large-scale solar energy projects and the increasing adoption of solar power as a primary source of electricity generation. Utilities have been driven to invest in solar energy to meet renewable portfolio standards, reduce greenhouse gas emissions, and diversify their energy mix. The reduced cost of solar energy has made it more competitive with fossil fuels, leading to a surge in demand for PV materials from utility-scale solar projects. Additionally, government policies and regulations, such as tax credits and feed-in tariffs, have incentivized utilities to adopt solar energy, further fueling growth. The development of large-scale solar parks and farms, which require large quantities of PV materials, has also led to accelerated market growth.

Regional Insights

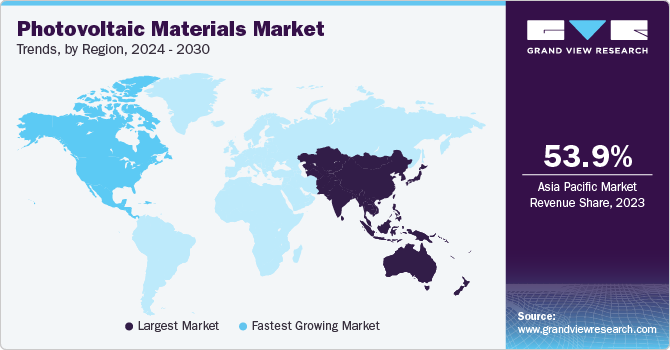

Asia Pacific dominated the global market with a revenue share of 53.9% in 2023. The region's large population, rapidly expanding production sector, and associated energy requirements have created a substantial market for solar energy solutions. Moreover, the region's favorable topography has made it an ideal location for large-scale solar PV projects. Favorable government policies, decreasing technology costs, and rising energy demand have further elevated the demand for these renewable solutions. Countries within the region, such as China, Japan, and India, have set ambitious renewable energy targets and are offering attractive incentives and subsidies to promote solar PV adoption.

China Photovoltaic Materials Market Trends

China has emerged as a prominent economy in the manufacturing and adoption of solar energy solutions worldwide. This is owing to the presence of a robust advanced material manufacturing ecosystem in the economy, supported by favorable government policies. The country has vast reserves of silicon, being the leading global producer in 2023, which has created competitive advantages for the economy in this industry. Additionally, China has been exporting solar energy solutions to other nations through its well-established logistics channels. Countries in the Asia Pacific region, such as India, Malaysia, Indonesia, and others, have been major consumers of Chinese solar energy solutions.

North America Photovoltaic Materials Market Trends

North America is expected to register the fastest growth over the forecast period in this market. The region has implemented comprehensive incentive programs, including tax credits and subsidies, to encourage the adoption of solar energy technologies. Rising concerns over global warming have encouraged the residential sector to opt for sustainable energy alternatives such as solar and wind energy. Additionally, significant investments in research and development have led to advancements in PV technology, resulting in improved efficiency and reduced costs. The presence of well-established manufacturing facilities and a skilled workforce in North America has further contributed to its rapid growth in this industry.

U.S. Photovoltaic Materials Market Trends

The U.S. accounted for a majority share of the regional market in 2023. This is owing to the country's rapid adoption of renewable energy solutions during the past decade. According to the ‘Spring 2024 Quarterly Solar Industry Update’ report by the Office of Energy Efficiency and Renewable Energy under the U.S. Department of Energy, about 54% of the new energy generated in 2023 comprised solar PV energy, which was significantly more than in preceding years. As there is scope for further growth in this regard, the market for PV materials in the country is expected to advance substantially. Additionally, supportive government policies and increased imports of solar PV modules have ensured availability of affordable solar energy solutions for residential as well as corporate sectors.

Europe Photovoltaic Materials Market Trends

The European region accounted for a notable share of the global market in 2023. This is owing to a series of initiatives undertaken by the European Union (EU) towards environmental protection. For instance, the Net-Zero Industry Act (2024), a component of the Green Deal Industrial Plan, seeks to expand the production of clean technologies within the EU. This initiative aims to enhance the region’s manufacturing capabilities for technologies that facilitate the transition to clean energy. Furthermore, regional cooperation initiatives, such as the European Solar PV Industry Alliance, have created a conducive atmosphere for market growth in this region.

The UK government has implemented legally binding targets to reduce greenhouse gas (GHG) emissions and achieve a 100% reduction compared to 1990 emission levels. To achieve such targets, the government has set an objective to generate 70 GW of energy through solar energy by 2035. Moreover, rapid demand growth for rooftop and ground-mounted PV modules has been observed in the economy in recent years, presenting favorable market growth prospects over the forecast period. According to government data, the installed solar capacity in the UK stood at 16.9 GW in June 2024, which is an increase of 18,000% since 2010. This showcases the country’s positive standing on renewable energy, which is expected to enable industry expansion.

Key Photovoltaic Materials Company Insights

Some key companies involved in the photovoltaic (PV) materials market include COVEME s.p.a., Jinko Solar, and SunPower Corporation, among others.

-

SunPower Corporation is a manufacturer of solar PV and energy storage systems. The company's product portfolio includes a range of solar panels, solar cells, and solar energy systems designed for residential, commercial, and utility-scale applications. SunPower's flagship product, the X-Series Residential Solar Panel, claims to offer an industry-leading efficiency rate of up to 22.8%, maximizing energy production and reducing costs for customers. Additionally, the company offers Equinox systems for residential solar energy generation. In May 2024, SunPower announced the addition of Tesla Powerwall 3 to its energy storage solutions portfolio to address the surging demand for efficient energy storage systems in the U.S.

-

Jinko Solar is a China-based solar PV module manufacturing company headquartered in Shanghai. The company is among the leading global solar energy solution providers, specializing in the design, development, and manufacturing of high-efficiency solar photovoltaic (PV) products and energy storage systems (ESS). The Tiger Neo series is the company’s latest solar PV module offering, offering enhanced efficiency and 30 years of liner power warranty. In May 2024, the company announced that over 1.1 million of its Tiger Neo Modules were deployed in Germany’s Witznitz Solar Park, which is one of the largest solar projects in Europe.

Key Photovoltaic Materials Companies:

The following are the leading companies in the photovoltaic materials market. These companies collectively hold the largest market share and dictate industry trends.

- Wacker Chemie AG

- DuPont

- Honeywell International Inc.

- COVEME s.p.a.

- Mitsubishi Materials Corporation

- Targray

- HANGZHOU FIRST APPLIED MATERIAL CO.,LTD.

- Ferrotec Holdings Corporation

- Jinko Solar

- SunPower Corporation

Recent Developments

-

In July 2024, Jinko Solar announced that it had become the largest solar panel supplier for a solar energy project in India developed by Adani Green Energy Ltd (AGEL) in the Kutch region in the state of Gujarat. The company has delivered about 2381 MW of solar panels to this project, which includes the Tiger Neo Bifacial (1370 MW) and Tiger Pro Bifacial modules (1011 MW). These deliveries started in August 2023 and were completely fulfilled by January 2024.

-

In June 2024, DuPont introduced its latest Tedlar frontsheet at the 2024 SNEC International Photovoltaic Power Generation and Smart Energy Exhibition event held in Shanghai, China. The new frontsheet offers enhanced protection to the solar panel surface and can be used in various applications, including emergency power supply, mobile charging, and recreational vehicles. The frontsheet includes features such as better service life, easy handling, and adaptability to milder environments.

Photovoltaic Materials Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 66.05 billion |

|

Revenue Forecast in 2030 |

USD 104.31 billion |

|

Growth rate |

CAGR of 7.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Type, material, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, Japan, Australia, India, Brazil, Argentina, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Wacker Chemie AG; DuPont; Honeywell International Inc.; COVEME s.p.a.; Mitsubishi Materials Corporation; Targray; HANGZHOU FIRST APPLIED MATERIAL CO.,LTD.; Ferrotec Holdings Corporation; Jinko Solar; SunPower Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Photovoltaic Materials Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the photovoltaic (PV) materials market report based on type, material, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Thin Film

-

Crystalline Materials

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicon-based

-

Non-Silicon based

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial & Industrial

-

Utility

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."