- Home

- »

- Advanced Interior Materials

- »

-

Photomask Market Size, Share And Trends Report, 2030GVR Report cover

![Photomask Market Size, Share & Trends Report]()

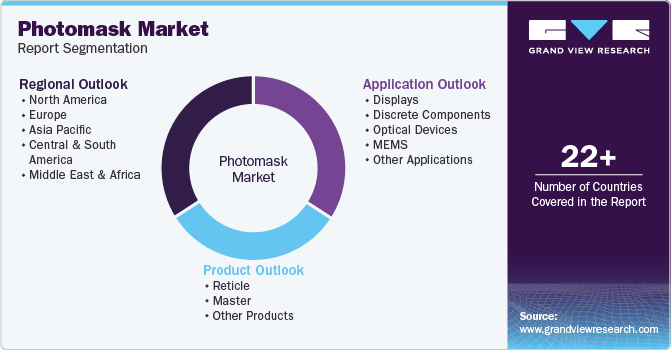

Photomask Market Size, Share & Trends Analysis Report By Product (Reticle, Master), By Application (Optical Devices, Discrete Components, Displays, MEMS), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-468-0

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Photomask Market Size & Trends

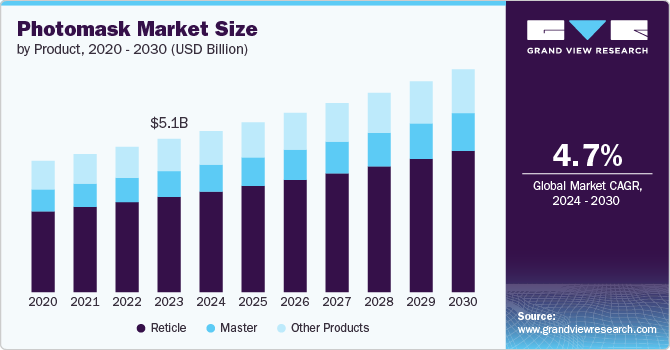

The global photomask market size was estimated at USD 5.11 billion in 2023 and is estimated to grow at a CAGR of 4.7% from 2024 to 2030. This growth is attributed to the rapid growth in industries like consumer electronics, automotive, and telecommunications which is driving the demand for semiconductors, hence fueling the market growth. Photomasks play a critical role in semiconductor fabrication, and this rising demand, especially for chips used in 5G, artificial intelligence (AI), and the Internet of Things (IoT), is driving product growth.

The development of advanced lithography techniques, such as Extreme Ultraviolet Lithography (EUV), is further boosting the photomask market. EUV is essential for manufacturing next-generation semiconductors with smaller nodes, which are used in advanced processors and memory chips. Additionally, increasing popularity of high-resolution displays, including OLED and LCD technologies for televisions, smartphones, and wearables, is driving demand for photomasks. The display sector requires precise photomasks for manufacturing cutting-edge screen technologies.

The manufacturing process of photomasks, especially for smaller technology nodes, is highly complex and requires stringent precision, which may negatively impact the market growth. Any defects in the masks can lead to costly errors in semiconductor production process, creating additional hurdles for manufacturers. Furthermore, one of the significant restraints in photomask market is the high cost of producing advanced photomasks, particularly those used in EUV lithography. The technology requires significant investment, which can limit market expansion, especially among smaller semiconductor manufacturers.

As the automotive industry moves toward electrification and autonomous driving, the demand for semiconductor components, such as sensors, cameras, and control units, is rising. The rise of electric vehicles (EVs), autonomous driving technologies, and advanced driver assistance systems (ADAS) have expanded the use of photomasks in the automotive sector. This presents an opportunity for photomask producers to expand their market share in the automotive sector over coming years.

Furthermore, photomask market is growing rapidly due to increasing demand for miniaturized and precise components across industries. Advancements in semiconductors, consumer electronics, automotive technologies, and telecommunications are driving the development and need for photomasks in optical devices, discrete components, displays, and MEMS. The ongoing innovations and expansion of these sectors are expected to continue pushing the photomask market forward.

Product Insights

Based on product, the reticle segment accounted for the largest revenue share of 62.1% in 2023 on account of being a crucial component in the semiconductor manufacturing process, serving as the blueprint for circuit patterns transferred onto wafers. Furthermore, with increasing complexity and shrinking sizes of semiconductor nodes, need for high-precision reticles has increased, thereby driving product growth. Advanced lithography technologies, especially Extreme Ultraviolet Lithography (EUV), rely heavily on reticles for accurate patterning at these tiny scales.

The growing demand for master photomask products in the photomask market is driven by advancements in semiconductor technologies and increased demand for high-precision manufacturing processes across various industries. Furthermore, rising demand for high-resolution displays such as OLED and LCD screens for smartphones, televisions, and wearables has also contributed to the demand for master photomasks over the years.

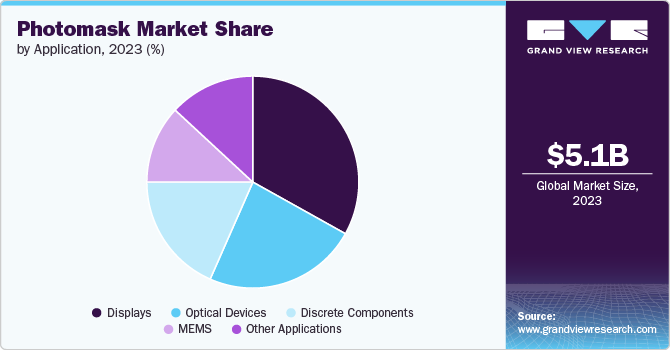

Application Insights

Based on application, displays accounted for the largest revenue share of 33.1% in 2023 and are further expected to grow at the fastest rate over the forecast period. Displays, including OLED and LCD screens, are one of the largest end-use applications for photomasks. These screens are used in smartphones, televisions, laptops, wearables, and other electronic devices. Furthermore, emerging technologies like foldable screens for smartphones and other devices require advanced photomasks for production. The demand for innovative display designs is driving growth in the photomask market.

Discrete components include individual electronic devices such as diodes, transistors, and capacitors. Ongoing expansion of the electronics industry, particularly in Asia-Pacific, is driving the demand for photomasks in this application segment. As discrete components become more miniaturized and integrated into more advanced systems, the precision offered by photomasks becomes essential. Furthermore, in automotive industry, especially with the rise of electric vehicles (EVs), the demand for discrete components has increased, which rely on accurate photomask processes to ensure functionality in complex automotive systems.

Regional Insights

North America photomask market accounted for a revenue share of 27% in 2023 and is further expected to grow at the fastest rate of 4.8% over the forecast period. North America is a leader in R&D for EUV lithography and other advanced semiconductor technologies. The demand for high-precision photomasks used in developing smaller nodes and cutting-edge chip architectures is growing as these innovations are adopted in the region.

U.S. Photomask Market Trends

The photomask market in the U.S. is growing at a significant rate over the forecast period on account of well-established consumer electronics market, driven by demand for smartphones, laptops, and wearables, further fuels the need for photomasks used in these devices' components.

Asia Pacific Photomask Market Trends

The photomask market in Asia Pacific dominated the global industry in 2023 with a revenue share of 36.6% and is further expected to grow at a significant rate over the forecast period. This growth is driven by its position as the global hub for semiconductor manufacturing and electronics production which are major consumers of photomasks. Further growing investments in electronics and semiconductor industries in countries like India and Vietnam are creating new opportunities for the photomask market in the region.

Europe Photomask Market Trends

The photomask market in Europe is growing steadily, driven by increasing investments by various European countries like Germany, France, and the Netherlands in semiconductor R&D and manufacturing. Additionally, the region’s automotive sector, which is rapidly adopting electric vehicles (EVs) and autonomous driving technologies, is driving demand for photomasks. These masks are essential for producing the semiconductor components used in vehicle electronics, sensors, and safety systems.

Key Photomask Company Insights

Some of the key players operating in the market are Applied Materials, Inc. and Nippon Filcon Co. Ltd.:

-

Applied Materials, Inc. is involved in materials engineering solutions, specializing in equipment, services, and software for the semiconductor, display, and related industries. Its products find use in industries such as consumer electronics, data centers, artificial intelligence, and communications, offering comprehensive services to both the semiconductor and display sectors. Furthermore, its product portfolio includes semiconductor manufacturing equipment, display technologies, epitaxy and ion implants, and photomasks.

-

Nippon Filcon Co. Ltd. is a Japan-based company involved in the manufacturing and supply of advanced filtration products and solutions. It serves various sectors including automotive, industrial, and environmental applications. The product portfolio of the company includes filtration systems, filter cartridges, dust collectors, oil filters, and activated carbon filters. Furthermore, photomasks sold by the company are mainly used for semiconductor production.

Photronics Inc. and Toppan Photomasks, Inc. are some of the emerging participants in the market.

-

Photronics Inc. is a U.S.-based company involved in manufacturing photomasks, mask data preparation, reticles, and advanced patterning solutions. Furthermore, it manufactures photomasks for the semiconductor and microelectronics industries where they are used for the production of integrated circuits and flat panel displays.

-

Toppan Photomasks, Inc. is a Japan-based company manufacturing various printing and communication products. Its product portfolio includes commercial printing, packaging solutions, security printing, electronics, and information and communication. They provide advanced photomask solutions for various applications within the semiconductor industry, contributing to the fabrication of integrated circuits and other electronic components.

Key Photomask Companies:

The following are the leading companies in the photomask market. These companies collectively hold the largest market share and dictate industry trends.

- Advance Reproductions Corp.

- Applied Materials Inc.

- HOYA Corporation

- Infinite Graphics Incorporated

- KLA Corporation

- LG Innotek Co. Ltd

- Nippon Filcon Co. Ltd.

- Photronics Inc.

- SK-Electronics Co. Ltd.

- Toppan Photomasks, Inc.

Recent Developments

-

In February 2024, Toppan Photomasks, Inc. entered into an agreement of joint research and development with IBM. This agreement included research and development of EUV semiconductor photomasks. Furthermore, this agreement will help bring materials and process control skills of both the companies to provide commercial solutions for 2nm node and beyond printing.

Photomask Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.38 billion

Revenue forecast in 2030

USD 7.44 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Advance Reproductions Corp.; Applied Materials Inc.; HOYA Corporation; Infinite Graphics Incorporated; KLA Corporation; LG Innotek Co. Ltd; Toppan Photomasks; Inc.; Nippon Filcon Co. Ltd.; Photronics Inc.; SK-Electronics Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Photomask Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global photomask market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reticle

-

Master

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Displays

-

Discrete Components

-

Optical Devices

-

MEMS

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global photomask market size was estimated at USD 5.11 billion in 2023 and is expected to reach USD 5.38 billion in 2024.

b. The global photomask market is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030 to reach USD 7.44 billion by 2030.

b. Reticle accounted for the largest revenue share of 62.1% in 2023 of photomask market on account of being a crucial component in the semiconductor manufacturing process, serving as the blueprint for circuit patterns transferred onto wafers.

b. Some key players operating in the photomask market include Advance Reproductions Corp., Applied Materials Inc., HOYA Corporation, Infinite Graphics Incorporated, KLA Corporation, LG Innotek Co. Ltd, Toppan Photomasks, Inc., Nippon Filcon Co. Ltd., Photronics Inc., and SK-Electronics Co. Ltd.

b. The key factors that are driving the photomask market growth is attributed to the rapid growth in industries like consumer electronics, automotive, and telecommunications which is driving the demand for semiconductors, hence fueling the photomask market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."