Photoelectric Sensors Market Size, Share & Trends Analysis Report By Technology (Diffused, Retro-Reflective, Thru-Beam), By End-use (Automotive, Military & Aerospace, Electronics & Semiconductor, Packaging, Others), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-312-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Photoelectric Sensors Market Size & Trends

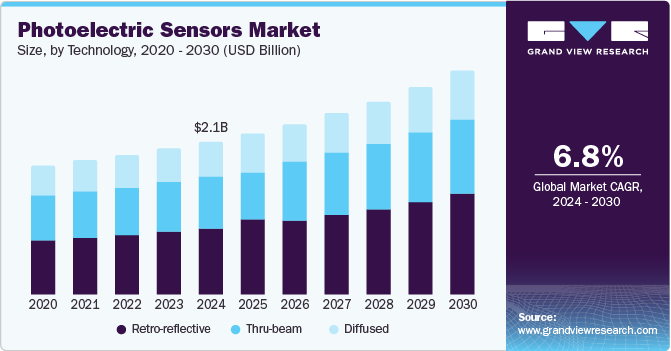

The global photoelectric sensors market size was valued at USD 2.06 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. The growth is attributed to increasing demand for automation in various industries. As businesses strive for greater efficiency and productivity, photoelectric sensors play a crucial role in automating object detection and position verification processes. This growing reliance on automation is a fundamental factor contributing to the market's expansion.

The rise of smart technologies and the Industrial Internet of Things (IIoT) is further propelling the photoelectric sensors industry. Integrating advanced sensors into manufacturing systems allows for real-time monitoring and data analysis, improving operational efficiency. Smart photoelectric sensors equipped with communication interfaces can adapt to changing conditions and provide valuable insights into production processes. This technological advancement boosts productivity and supports safety protocols in workplaces where human-robot collaboration is becoming more common.

The food and beverage industry is also a significant contributor to the growth of the photoelectric sensors industry. As consumer demand for packaged foods rises, manufacturers are increasingly adopting these sensors for quality control and process automation. For instance, photoelectric sensors can detect the presence or absence of products on conveyor belts, ensuring that packaging processes run smoothly without interruptions. This application enhances efficiency and helps maintain high product safety and quality standards.

Furthermore, the growing emphasis on safety regulations across various sectors further propels the growth of the photoelectric sensors industry. Industries are increasingly required to comply with stringent safety standards, which often necessitate the use of reliable sensing technologies. Photoelectric sensors help monitor critical parameters in manufacturing environments, contributing to safer operations. As companies invest in compliance measures to meet these regulations, the demand for photoelectric sensors is expected to rise, solidifying their role in modern industrial applications.

Technology Insights

The retro-reflective segment held the largest revenue share of 43.1% in the photoelectric sensors industry in 2024 due to its unique advantages and widespread applicability in various industries. Furthermore, ease of installation; retro-reflective sensors combine the light emitter and receiver into a single unit, requiring only a reflector to be aligned, simplifying setup and reducing labor costs. This feature is particularly beneficial in dynamic environments such as manufacturing lines, where quick deployment is essential. Moreover, retro-reflective sensors exhibit high sensitivity and can detect a wide range of objects, regardless of color or material, making them versatile for applications such as packaging and robotics.

The thru-beam segment is expected to grow at the highest CAGR over the forecast period due to its long sensing range and high object detection accuracy. Unlike other sensor types, thru-beam sensors consist of separate transmitter and receiver units that create a direct light beam between them, allowing for reliable detection over greater distances. This capability is particularly advantageous in environments where precise object detection is critical, such as in automated assembly lines or logistics operations. In addition, the increasing emphasis on automation and efficiency in various industries further drives demand for these sensors as businesses seek dependable solutions to enhance operational performance while minimizing errors.

End-use Insights

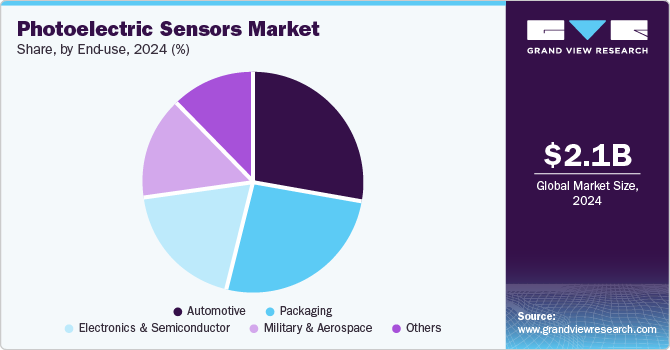

The automotive segment held the largest revenue share of 28.2% in the photoelectric sensors industry in 2024 due to the critical role these sensors play in enhancing vehicle safety and manufacturing efficiency. Moreover, the integration of photoelectric sensors into advanced driver assistance systems (ADAS) improves safety features such as collision avoidance and adaptive cruise control. In addition, automotive manufacturing in photoelectric sensors is essential for ensuring precision on assembly lines by verifying components' correct positioning before assembly. This capability reduces errors and waste, ultimately leading to higher-quality vehicles.

The packaging segment is expected to grow at the highest CAGR over the forecast period due to the increasing demand for automation and efficiency in packaging processes. As industries strive to enhance productivity and reduce operational costs, photoelectric sensors are essential for automating tasks such as sorting, counting, and quality control. For instance, in a food packaging line, photoelectric sensors can accurately detect the presence of packages and ensure they are correctly aligned for sealing, which minimizes errors and waste.

Regional Insights

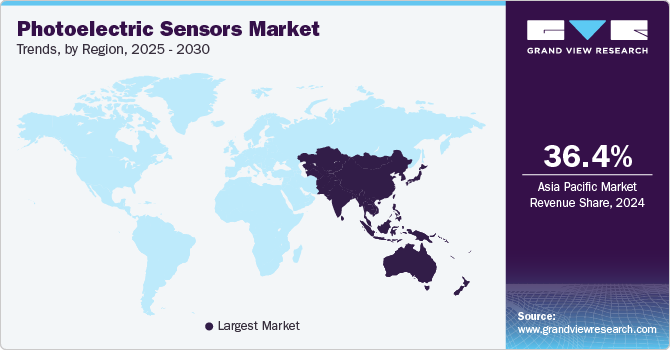

The Asia Pacific photoelectric sensors market dominated with the largest revenue share of 36.4% in 2024, driven by rapid industrialization and technological advancements in the region. Moreover, the strong presence of manufacturing industries, particularly in countries such as China, Japan, and India, where photoelectric sensors are extensively used for automation in automotive, electronics, and food processing sectors. For instance, these sensors enhance operational efficiency in automotive assembly lines by ensuring precise component placement and reducing production errors. In addition, the growing penetration of the Industrial Internet of Things (IIoT) facilitates the integration of smart sensors into manufacturing processes, allowing for real-time monitoring and data analysis. This trend improves productivity and meets stringent safety regulations that are increasingly being enforced across industries.

China Photoelectric Sensors Market Trends

The China photoelectric sensors market dominated the Asia Pacific in 2024 with the largest revenue share. This growth is due to significant investment in automation and smart manufacturing technologies, which enhance production efficiency across various sectors, including automotive and electronics. In addition, China’s push toward Industry 4.0 has led to the integration of advanced sensor technologies that facilitate real-time monitoring and data analysis, further driving demand. The government’s initiatives to modernize industrial processes and promote technological advancements also play a vital role in bolstering the market.

North America Photoelectric Sensors Market Trends

The North America photoelectric sensors market is expected to grow significantly over the forecast period due to the increasing adoption of automation technologies across various industries. Moreover, rising demand for industrial automation, which enhances operational efficiency and accuracy in manufacturing processes. In addition, the integration of smart technologies and the Industrial Internet of Things (IIoT) is further propelling market growth, as these sensors enable real-time monitoring and data collection that optimize manufacturing workflows. Emphasizing safety regulations and compliance drives demand as companies seek reliable sensing solutions to enhance workplace safety.

The U.S. photoelectric sensors market dominated North America, driven by the rapid adoption of automation across various industries and a strong emphasis on technological innovation. In addition, government initiatives aimed at promoting advanced manufacturing technologies have created a favorable environment for sensor manufacturers. These initiatives often include funding for research and development, tax incentives, and partnerships between industry and academia to foster innovation. The increasing focus on safety regulations further drives demand for photoelectric sensors, which are essential for applications such as machine guarding and perimeter protection, ensuring compliance with stringent safety standards.

Europe Photoelectric Sensors Market Trends

Europe photoelectric sensors market is expected to grow significantly over the forecast period due to the increasing emphasis on industrial automation and stringent regulatory requirements across various sectors. In addition, there is a rising demand for efficient manufacturing processes, where photoelectric sensors play a crucial role in detecting the presence and position of objects, thereby enhancing operational accuracy. Furthermore, integrating smart technologies, including IoT and AI, fosters innovation in sensor applications, enabling real-time monitoring and data analysis. This trend enhances productivity and supports compliance with safety regulations, further propelling market growth as industries seek reliable solutions to optimize their operations and maintain competitive advantages.

Key Photoelectric Sensors Company Insights

Some key players in the photoelectric sensors market are Autonics Corporation, Baumer Group, Omron Corporation, Keyence Corporation, Eaton Corporation PLC, and others. These companies in the photoelectric sensors market employ various strategies to maintain a competitive edge, including the development of innovative sensing technologies that enhance automation and efficiency across multiple industries. They focus on expanding their product portfolios to include advanced features such as IoT connectivity and real-time monitoring capabilities, catering to the growing demand for smart manufacturing solutions.

-

Omron Corporation specializes in providing advanced photoelectric sensors that enhance automation and efficiency across various industries. By integrating cutting-edge technology with a focus on reliability, Omron offers a diverse range of sensor solutions designed to meet the unique needs of sectors such as automotive, food processing, and packaging.

-

Rockwell Automation, Inc. offers a wide array of innovative sensing solutions tailored for industrial applications. The company emphasizes technological advancement by developing sensors that facilitate automation in manufacturing processes, thereby enhancing efficiency and precision. Rockwell's products are designed to integrate seamlessly with existing systems, providing real-time monitoring and control capabilities.

Key Photoelectric Sensors Companies:

The following are the leading companies in the photoelectric sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Autonics Corporation

- Baumer Group

- Balluff Inc.

- Omron Corporation

- Keyence Corporation

- Eaton Corporation PLC

- Schneider Electric SE

- SICK AG

- IFM Electronic Ltd

- Rockwell Automation Inc.

Recent Developments

-

In December 2024, Keyence introduced the LM-X Series Multisensor measurement system to enhance quality control and metrology applications. This advanced system offers three distinct measurement methods, enabling fast and highly accurate assessments with an impressive accuracy of ±0.7 μm. It features an ultra-high-resolution camera for detailed inspections, a multi-color laser for noncontact height measurements, and a touch probe for complex 3D features.

Photoelectric Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.16 billion |

|

Revenue forecast in 2030 |

USD 3.01 billion |

|

Growth Rate |

CAGR of 6.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Autonics Corporation; Baumer Group; Balluff Inc.; Omron Corporation; Keyence Corporation; Eaton Corporation PLC; Schneider Electric SE; SICK AG; IFM Electronic Ltd; Rockwell Automation Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Photoelectric Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global photoelectric sensors market report based on technology, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Diffused

-

Retro-reflective

-

Thru-beam

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Military & Aerospace

-

Electronics & Semiconductor

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."