Phosphoramidite Market Size, Share & Trends Analysis Report By Type (DNA Phosphoramidites, RNA Phosphoramidites), By Application (Drug Discovery & Development, Diagnostics Development), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-310-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Phosphoramidite Market Size & Trends

The global phosphoramidite market size was estimated at USD 1.08 billion in 2023 and is expected to grow at a CAGR of 7.37% from 2024 to 2030. The growth of the market can be attributed to the increasing demand for phosphoramidite in the production of oligonucleotides, the rising prevalence of genetic disorders and infectious diseases has led to a surge in research and development activities in the biotechnology and pharmaceutical industries, which further fuels the demand for phosphoramidite. Moreover, the growing geriatric population and increasing healthcare expenditure are also expected to drive the market growth in the coming years.According to the United Nations's World Population Prospects 2022, the global population is expected to grow around 8.5 billion in 2030, 9.7 billion in 2050, and 10.4 billion in 2100.

Custom DNA and RNA synthesis have applications in various fields, such as basic research, drug discovery, molecular diagnostics, and therapeutic development. The versatility of these applications contributes to a broadening customer base, academic institutions, pharmaceutical companies, biotech startups, and clinical laboratories. This diversification in demand for custom sequences is boosting the phosphoramidite market from multiple sectors. The ability to obtain custom-designed DNA and RNA sequences tailored to specific research or commercial needs is a significant driver for the market. Phosphoramidite chemistry enables the precise and flexible synthesis of oligonucleotides with desired modifications, lengths, and sequences. This customization capability attracts customers seeking unique and specialized oligonucleotides, further boosting the market growth.

Moreover, the growth in synthetic biology significantly drives the market growth. Synthetic biology involves the de novo synthesis of genes and genetic constructs for various purposes, including metabolic engineering, pathway optimization, and gene circuit design. Phosphoramidite chemistry enables the efficient and precise assembly of DNA fragments, facilitating gene synthesis workflows. The growth in synthetic biology drives an increased demand for gene synthesis services and boosts the consumption of phosphoramidites. Techniques such as CRISPR-Cas9 genome editing enable precise modifications of DNA sequences in living organisms. Phosphoramidites play a crucial role in synthesizing guide RNAs (gRNAs) and other oligonucleotides used in CRISPR-based genome editing experiments. The expanding applications of genome editing in synthetic biology and biomedicine drive the demand for phosphoramidites.

Market Concentration & Characteristics

The degree of innovation in the phosphoramidite industry is significant, with new technologies and processes constantly being developed to improve efficiency and effectiveness. This has resulted in the production of high-quality products that meet the diverse needs of consumers. Advances in research and development have led to the discovery of new applications for Phosphoramidite, making it a valuable product for a wide range of industries.

Collaboration and partnership activities can have a significant impact on the growth of the phosphoramidite industry. Partnerships help companies to reduce costs and increase efficiency. In February 2023, Fluor Corp., based in Irving, Texas, was chosen by Agilent Technologies, Inc. to enhance its oligonucleotide therapeutics manufacturing facility in Frederick, Colorado, situated just north of Denver. Under this collaboration, Fluor will support the project's engineering and procurement. The total value of the project is estimated at USD 725 million. This project is expected to expand Agilent's manufacturing capacity, which lead to an increased demand for phosphoramidites.

Regulations set standards for the quality, purity, and safety of phosphoramidite compounds. Compliance with these standards is essential for manufacturers to ensure that their products meet regulatory requirements. This necessitates investments in quality control measures, adherence to good manufacturing practices, and stringent testing protocols to verify compliance. Regulatory approval processes and compliance requirements can serve as entry barriers for new entrants in the phosphoramidite industry.

The market for phosphoramidites is experiencing growth due to the increasing demand for phosphoramidite-based products in various applications such as DNA synthesis, pharmaceuticals, and agrochemicals. To cater to this demand, manufacturers are expanding their product portfolios by introducing novel phosphoramidite-based products with enhanced features and functionalities. This includes the development of new phosphoramidite reagents, nucleosides, and phosphoramidite linkers that can be used in a variety of applications.

The market has witnessed significant regional expansion in recent years. The increasing demand for phosphoramidite from various end-use industries has led to market growth across different regions. For instance, in May 2023, GenScript expanded its life sciences facility in Zhenjiang, Jiangsu, China, to offer a rapid, high-purity oligonucleotide and peptide synthesis service tailored for research & development as well as preclinical applications. This expansion is expected to fuel the industry growth of phosphoramidite.

Type Insights

The DNA phosphoramidites segment dominated the market with a revenue share of 36.57% in 2023. This type of phosphoramidite is commonly used in the production of DNA oligonucleotides, which are short DNA sequences that can be used for a variety of applications, such as gene synthesis, PCR, and DNA sequencing. The increasing demand for DNA oligonucleotides in various fields such as research, diagnostics, and therapeutics has been a major factor driving the growth of the DNA phosphoramidite segment. In addition, companies in this segment are expanding their presence in the market through different initiatives such as expansion, collaboration, and partnership, which further fuel the market expansion. For instance, in October 2023, Integrated DNA Technologies inaugurated a new therapeutic oligonucleotide manufacturing facility in Iowa, U.S., with an area of 41,000 square feet. This new facility provides customer support through enhanced research and manufacturing capabilities and specialized expertise.

The RNA phosphoramidites segment is anticipated to grow at the fastest CAGR of 8.96% during the forecast period. RNA phosphoramidites encompass a range of phosphoramidites utilized to modify RNA oligonucleotides, tailoring their properties for specific applications. The rising need for modified RNA oligonucleotides in areas like RNA therapeutics, functional genomics, and RNA-based diagnostics is poised to propel the expansion of this segment. Furthermore, advancements in RNA synthesis technologies have facilitated the production of modified RNA oligonucleotides with enhanced efficiency and precision, further boosting the growth of this segment.

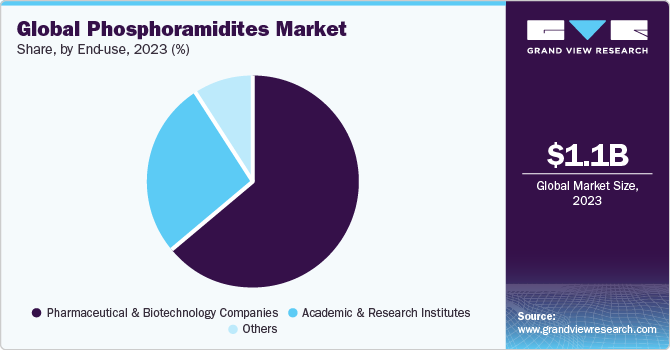

End-use Insights

The pharmaceutical & biotechnology companies segment dominated the market with a share of 63.82% in 2023 and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing demand for innovative drugs and therapies, the rising prevalence of chronic diseases such as cancer and diabetes. In addition, many pharmaceutical and biotech companies are actively engaged in developing nucleic acid-based therapeutics, such as antisense oligonucleotides, siRNA, and mRNA-based drugs. Phosphoramidites are essential reagents in the synthesis of these therapeutic nucleic acids. This factor is expected to support segment growth in the forecast years.

The academic and research institutes segment is expected to register the significant CAGR over the forecast period. Academic and research institutes are hubs of scientific research in fields such as molecular biology, genetics, and drug discovery. As research in these areas continues to expand, the demand for phosphoramidites as key reagents in nucleic acid synthesis and related experiments is expected to grow. Academic institutions also serve as training grounds for future scientists and researchers. As curricula evolve to incorporate the latest techniques and technologies, there is an increased emphasis on hands-on experience with nucleic acid synthesis and molecular biology techniques, further driving the demand for phosphoramidites. In addition, many academic and research institutes collaborate with pharmaceutical, biotechnology, and other industries. For instance, in March 2023, CPI, AstraZeneca, Novartis, and The University of Manchester collaborated to enable the large-scale manufacture of oligonucleotides. In the collaboration, the university's role is in research and development. They contribute their knowledge in areas in biocatalysis, which is a technique for oligonucleotide synthesis and is expected to support the market growth.

Application Insights

The drug discovery & development segment dominated the market with a revenue share of 56.49% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. The demand for phosphoramidites in this segment is driven by the increasing focus on developing new drugs and therapies for various diseases. In drug discovery, researchers target specific genes or genetic sequences implicated in diseases. Phosphoramidites enable the synthesis of oligonucleotides tailored to these specific targets, allowing for the development of targeted therapies with potentially higher efficacy and fewer side effects compared to traditional small-molecule drugs. In addition, the increasing prevalence of chronic diseases and the need for effective treatments further drive the demand for phosphoramidites in the drug discovery and development segment.

The diagnostics development segment is expected to register a significant CAGR over the forecast period. Phosphoramidites play a crucial role in enabling the synthesis of custom oligonucleotides for various diagnostic applications. The growing prevalence of infectious diseases and genetic disorders worldwide is driving the demand for accurate and sensitive diagnostic tests and supporting the market growth of phosphoramidites. Phosphoramidites enable the synthesis of oligonucleotide probes and primers used in the development of diagnostic assays for detecting pathogens, identifying genetic mutations, and characterizing disease biomarkers. In addition, advancements in diagnostic technologies, such as digital PCR, droplet digital PCR, and loop-mediated isothermal amplification, require custom-designed oligonucleotides synthesized using phosphoramidites. These technologies offer enhanced sensitivity, specificity, and multiplexing capabilities for various diagnostic applications. These factors are expected to support segment growth in the forecast years.

Regional Insights

North America accounted for the largest market share of 39.71% in 2023 for the phosphoramidites market owing to the increasing demand for oligonucleotides in research and development activities related to genetics and molecular biology. The U.S. is the largest market for phosphoramidites in North America due to the presence of major pharmaceutical and biotechnology companies, research institutions, and academic centers. Rising investments in drug discovery and development and technological advancements in the field of DNA sequencing and synthesis are driving the market in the region.

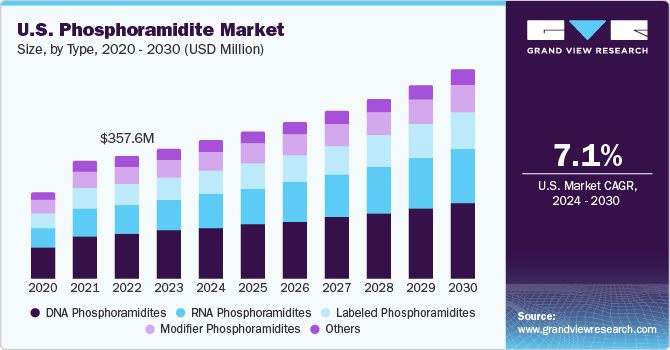

U.S. Phosphoramidites Market Trends

The phosphoramidite market in the U.S. is expected to grow over the forecast period due to presence of large number of market players in the U.S., undergoing various strategic initiatives such as collaborations and new product launches. For instance, in June 2022, Amerigo Scientific introduced extra-large drying traps designed for research purposes. These DNA moisture traps are used for creating moisture-free environments during oligonucleotide synthesis. They remove moisture from phosphoramidite solutions in acetonitrile, tetrazole solutions in acetonitrile, and dry acetonitrile.

Europe Phosphoramidites Market Trends

Europe phosphoramidite market was identified as a lucrative region in this industry. Europe has a robust healthcare sector with a growing demand for pharmaceuticals and biotechnology products. European countries invest significantly in research and development across various sectors, including life sciences. Phosphoramidites are critical reagents for academic and industrial research institutions engaged in genomics, proteomics, and molecular biology studies. Europe has a well-established regulatory framework governing the development and commercialization of pharmaceuticals and biotechnology products. The regulatory bodies ensure product quality, safety, and efficacy standards, assuring manufacturers and end-users in the phosphoramidites market. These factors are expected to support the phosphoramidites market in the region.

The phosphoramidite market in the UK held a significant share in 2023. The UK government's investment in research and development is one of the major factors driving the growth of the phosphoramidites market in the country. With increasing focus on developing innovative technologies and products, the demand for high-quality phosphoramidites has been on the rise. The government's support in the form of funding for research and development activities, tax incentives, and favorable policies has encouraged companies to invest in this sector. For instance, in November 2023, the UK government announced investments of USD 652.9 million for life sciences funding, changes to R&D tax credits, and a clinical trials accelerator scheme. This growing investment are anticipated to boost the demand for phosphoramidite over the forecast period.

The France phosphoramidite market is expected to grow remarkably over the forecast period. The French government provides support for life sciences research and innovation through funding programs, tax incentives, and infrastructure development. This support encourages investment in biotechnology, genomics, and personalized medicine, driving the demand for phosphoramidites in these sectors.

The phosphoramidite market in Germany is anticipated to grow significantly over the forecast period. Germany is one of the global leaders in scientific research, with renowned institutions and multiple biotechnology companies actively developing oligonucleotide-based diagnostics, research tools, and novel therapeutics. This advancement is predicted to facilitate phosphoramidites market growth by creating demand for high-quality oligonucleotide synthesis services.

Asia Pacific Phosphoramidites Market Trends

The Asia Pacific phosphoramidite market is projected to grow at the highest CAGR of 9.38% over the forecast period. Countries in the Asia Pacific region, such as China, India, Japan, South Korea, and Singapore, are experiencing rapid industrialization and economic growth. This growth fuels demand across various industries, including pharmaceuticals and biotechnologies, all of which require phosphoramidites. Governments and private companies in the Asia Pacific are investing significantly in healthcare infrastructure, pharmaceutical research, and life sciences. This investment boosts the demand for phosphoramidites, which are essential in drug discovery. The Asia Pacific region is home to a rapidly growing population coupled with rising urbanization. This drives the demand for healthcare services, leading to increased pharmaceutical production and research activities and boosting the market growth.

The phosphoramidite market in China is expected to grow over the forecast period. The Chinese government is actively promoting the development of the domestic pharmaceutical industry, including oligonucleotide therapies. These government initiatives translate into funding for research and development, which can benefit the market. Furthermore, China's aging population is a factor as it creates a greater demand for treatments for chronic diseases, a category where oligonucleotide therapies are used. This increased need for treatments is expected to fuel the market growth.

The Japan phosphoramidite market is witnessing significant growth over the forecast period. Japan investing significantly in biotechnology research and development. Phosphoramidites find application in the synthesis of oligonucleotides, which are essential tools in biotechnology for research, diagnostics, and therapeutics. Thus, advancements in biotechnology drive the demand for phosphoramidites. For instance, in 2019, the government of Japan funded approximately USD 56 million to promote bio-manufacturing technologies, including the examination and demonstration of bio-manufacturing data linkages.

MEA Phosphoramidites Market Trends

The phosphoramidite market in MEAis expected to grow exponentially over the forecast period. MEA region is witnessing an increase in investments in the healthcare sector, mainly in the development of healthcare infrastructure and capabilities. This trend is expected to fuel the demand for phosphoramidites in the region, as these reagents are essential for the synthesis of custom oligonucleotides used in diagnostics and therapeutics. However, the MEA region is a relatively small market for phosphoramidites compared to other regions, and the market growth is limited by factors such as stringent regulatory standards and quality requirements for pharmaceutical and biotechnology products.

The Saudi Arabia phosphoramidite market is expected to grow over the forecast period. Saudi Arabia has been investing significantly in developing its biotechnology and healthcare sectors. With a growing focus on research and innovation in life sciences, there is increasing demand for phosphoramidites, which are essential in nucleic acid synthesis for applications such as drug discovery, diagnostics, and personalized medicine.

The phosphoramidite market in Kuwait is anticipated to grow over the forecast period. The growth of the biotechnology and healthcare sectors in Kuwait fuels the demand for phosphoramidites. As the country focuses on advancing its healthcare infrastructure and capabilities, there is a greater need for nucleic acid-based diagnostics and therapeutics, which rely on phosphoramidites for synthesis.

Key Phosphoramidite Company Insights

The market players are leveraging product approvals to broaden their product distribution and enhance availability across various regions. Expansion is also being used to boost production and research activities. Moreover, several market participants are engaging in acquisitions of smaller firms to improve their market position, thereby increasing their capabilities, diversifying their product offerings, and enhancing their overall competencies.

Key Phosphoramidite Companies:

The following are the leading companies in the phosphoramidite market. These companies collectively hold the largest market share and dictate industry trends.

- BOC Sciences

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Glen Research

- LGC Biosearch Technologies

- Biosynth

- BIONEER CORPORATION

- QIAGEN

- PolyOrg, Inc

- Lumiprobe Corporation

Recent Development

-

In March 2023, Oligo Factory, a manufacturer specializing in custom oligonucleotides, inaugurated a new manufacturing facility of 13,000 square feet, incorporating office spaces, bench areas, and laboratories, located in Holliston, U.S. This intavtives expected to propel the phosphoramidites market.

-

In May 2023, Twist Bioscience and CeGaT GmbH have launched the Twist Alliance CeGaT RNA Fusion Panel. This collaborative effort aims to provide a specialized tool for oncology research, facilitating the detection of RNA fusions and enabling transcript variant analysis. RNA fusions, a result of chromosomal arrangements often seen in cancers, can now be efficiently studied using this newly introduced panel.

-

In April 2022, Ansa Biotech raised a funding of USD 68 million to launch customizable DNA synthesis service and strengthen its market position. Such initiatives are expected to boost the demand for phosphoramidite used for DNA synthesis.

Phosphoramidites Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.15 billion |

|

Revenue forecast in 2030 |

USD 1.76 billion |

|

Growth rate |

CAGR of 7.37% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

BOC Sciences; Thermo Fisher Scientific Inc.; Merck KGaA; Glen Research; LGC Biosearch Technologies; Biosynth; BIONEER CORPORATION; QIAGEN ; PolyOrg, Inc; Lumiprobe Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

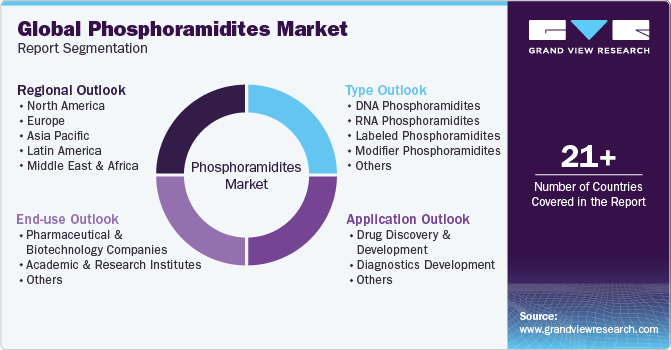

Global Phosphoramidite Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global phosphoramidite market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Phosphoramidites

-

RNA Phosphoramidites

-

Labeled Phosphoramidites

-

Modifier Phosphoramidites

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Diagnostics Development

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global phosphoramidite market size was estimated at USD 1.08 billion in 2023 and is expected to reach USD 1.15 billion in 2024.

b. The global phosphoramidite market is expected to grow at a compound annual growth rate of 7.37% from 2024 to 2030 to reach USD 1.76 billion by 2030.

b. North America dominated the phosphoramidite market with a share of 39.71% in 2023. This is attributable to the well-developed research and development infrastructure and the rising adoption of synthetic DNA for the development of therapeutics.

b. Some key players operating in the phosphoramidite market include BOC Sciences; Thermo Fisher Scientific Inc.; Merck KGaA; Glen Research; LGC Biosearch Technologies; Biosynth; BIONEER CORPORATION; QIAGEN ; PolyOrg, Inc; Lumiprobe Corporation

b. Key factors that are driving the market growth include the increasing demand for phosphoramidite in the production of oligonucleotides and the rising prevalence of genetic disorders and infectious diseases which has led to a surge in research and development activities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."