- Home

- »

- Electronic Devices

- »

-

Philippines E-cigarette And Vape Market Size Report, 2030GVR Report cover

![Philippines E-cigarette And Vape Market Size, Share & Trends Report]()

Philippines E-cigarette And Vape Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Disposable, Rechargeable, Modular Devices), By Category, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-184-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

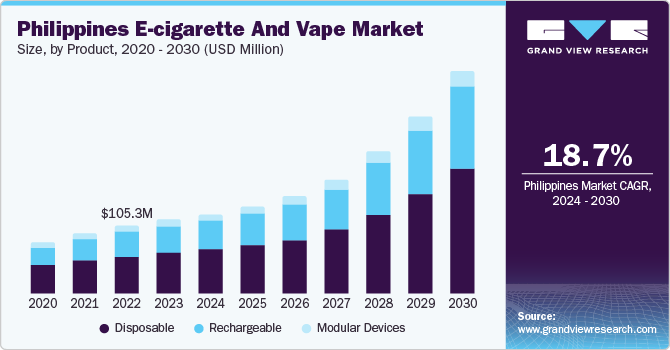

The Philippines e-cigarette and vape market size was valued at USD 113.6 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 18.7% from 2024 to 2030. The growth of the Philippines e-cigarette and vape industry can be primarily attributed to the perception of vaping being a less harmful alternative to conventional smoking, which has triggered the adoption of e-cigarettes and vaping products among individuals seeking a tobacco-free option. The availability of a wide range of flavored e-liquids and the social appeal associated with vaping is also contributing to the widespread use of e-cigarettes and vaping products, particularly among the younger demographic, thereby driving the growth of the market.

One of the key features contributing to this perception is the availability of ENDS in various nicotine strengths. This allows users to have greater control over their nicotine intake, providing a gradual and customizable approach to reducing dependence on nicotine. In the Philippines, where concerns about the health impacts of traditional tobacco products have been on the rise, the idea of using ENDS as a smoking cessation aid has gained traction. The Philippines is increasingly recognizing the dangers associated with conventional smoking. The marketing of e-cigarettes as a potentially less harmful alternative has resonated with those who are motivated to quit smoking but find it challenging to do so through traditional methods alone.

Despite scientific evidence suggesting that e-cigarettes are less harmful than traditional cigarettes, the societal perception often lumps them together with their combustible counterparts. This stigma creates a barrier to widespread acceptance and usage, as potential users may be deterred by the negative connotations attached to these products. Public misconceptions about the health risks and the perceived similarity to smoking can result in a reluctance among consumers to adopt e-cigarettes and vapes as alternatives to traditional tobacco products. Moreover, the stigma surrounding e-cigarettes and vapes has a ripple effect on regulatory frameworks. Policymakers, influenced by public opinion and health concerns, may be inclined to impose stricter regulations on these products. The fear of normalizing smoking behavior and the potential impact on public health can lead to measures that hinder the growth of the e-cigarette and vape industry. Stringent regulations may include limitations on advertising, flavor restrictions, and higher taxes, making it more challenging for businesses in this sector to thrive. Hence, such factors may restrain the growth of the market.

Moreover, government regulations on nicotine concentration, packaging, and advertising impact the choice of materials used in manufacturing these products. Manufacturers are adapting to comply with these regulations, leading to innovations in raw material selection. As the industry strives for compliance and consumer satisfaction, the e-cigarette and vape market in the Philippines continues to witness dynamic shifts in raw material trends, reflecting a balance between regulatory requirements and consumer preferences. Regulations are expected to accept e-cigarettes as a healthy alternative to tobacco consumption, thereby contributing to the technology's safe distribution and usage. In July 2022, ICCPP, a vape manufacturing company, developed the “Gene Tree” nano-microcrystalline ceramic core technology, which prioritizes "harm reduction and substitution" in its research and development. It has accomplished a breakthrough in the second-generation powder-free ceramic core technology in the ultra-thin disposable pod solution by inventing a combustion process, ceramic structure, and smoke bomb structure.

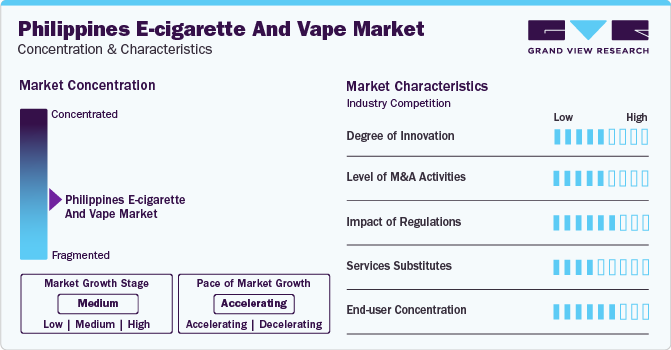

Market Concentraion & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The Philippine e-cigarette and vape market is characterized by a medium degree of innovation, diversified product choices, and a new level of innovation in electronic atomization. Ongoing technological advancements and resulting innovations, including advanced pod systems, temperature control capabilities, and various intelligent features, contribute to enhancing the safety of e-cigarettes and vaping products. These developments are favorable for the market's expansion.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Numerous e-cigarette brands and manufacturers are actively promoting their products through specialized retail outlets and convenience stores. In this larger context, the Philippines has become an emerging participant in the regional market, boasting a growing vaping community and favorable regulatory conditions. The nation has witnessed a marked change in consumer preferences, marked by an increasing desire for cutting-edge and technologically advanced vaping devices.

The Philippines e-cigarette and vape industry is also subject to several regulatory considerations. The government, particularly the Food and Drug Administration (FDA), implemented stringent regulations to address these issues. In February 2022, the Philippines Vape Bill version 2022 was introduced in the House of Representatives. The bill is officially titled the Vaporized Nicotine and Non-Nicotine Products Regulation Act of 2022. It is a measure intended to regulate the manufacture, importation, sale, distribution, and use of vaporized nicotine and non-nicotine products in the Philippines. The first-of-its-kind bill in the country is a significant step forward in the regulation of vaporized nicotine and non-nicotine products.

The threat of substitutes for Philippines e-cigarette and vape is moderate in the market. The ongoing challenge posed by potential substitutes, such as traditional tobacco items and alternative nicotine delivery systems, persists. Cultural norms supporting smoking and the cost-effectiveness of regular cigarettes still shape consumer choices, impeding the widespread acceptance of e-cigarettes and vaping.

End-user concentration is a significant factor in the Philippines e-cigarette and vape market. End-users contribute to industry growth by providing feedback to manufacturers and influencing product development and marketing strategies. In addition, they bear the responsibility of adhering to local regulations and promoting responsible usage to mitigate potential health risks associated with vaping.

Product Insights

The disposable segment led the market and accounted for 17.6% in 2023. The rise of the disposable segment can be attributed to the country's growing awareness and acceptance of vaping as an alternative to traditional tobacco smoking. Disposable e-cigarettes are compact e-cigarettes featuring pre-filled cartomizers. They typically eliminate the need for charging the device and rather allow hygiene-aware customers to switch to a new device. Many individuals perceive e-cigarettes as a potentially less harmful option, driving the demand for convenient and discreet disposable devices.

The marketing strategies employed by manufacturers often highlight the diverse flavors available, creating a trend-driven consumer culture that fosters experimentation and interest in disposable vaping products. For instance, in June 2022, vape company ZOVOO launched the DRAGBAR R6000, a Restricted Direct Lung (RDL) disposable vape with a sufficient e-liquid capacity of 18mL and an output of 18W. It marked the first 3mg sub-ohm disposable by the company. It also featured an airflow adjustment function for comfortable vaping. It offered an alternative for cloud chasers using conventional RDL vaping devices. Such strategic initiatives bode well for the growth of the segment.

The rechargeable segment is expected to grow at a considerable growth rate over the forecast period. Rechargeable devices eliminate the necessity of repurchasing consumables, such as cartridges, and the cost-effectiveness associated with them is expected to propel the growth of this segment. Furthermore, individuals involved in DIY (Do-it-Yourself) e-liquid production can bypass the purchase of pre-filled cartridges. Rechargeable e-cigarettes, particularly favored by experienced vapers, offer economic advantages. Through DIY, vapers can customize the flavor, nicotine strength, and overall composition of their e-liquids to align with personal preferences.

This level of control and individuality may surpass what is attainable with commercially available alternatives. The emphasis on personalization resonates strongly with the vaping community in the Philippines, where there is an increasing demand for unique and diverse vaping experiences. Additionally, the convenience of rechargeable devices, which eliminate the need for constant repurchase of disposable alternatives, makes them a cost-effective choice for long-term users. The relatively lax regulations surrounding vaping products in the Philippines have further contributed to their widespread adoption, allowing for a burgeoning market with increased accessibility and acceptance among consumers.

Category Insights

The closed vape systems segment led the market in 2023. Closed vaping systems have gained popularity in the Philippines, with the convenience and simplicity of closed vaping systems particularly appealing to a wide range of consumers, especially those new to vaping. Pre-filled pods or cartridges eliminate the need for manual refilling and provide a hassle-free experience. Additionally, closed vaping systems often have a more user-friendly design, making them accessible to a broader demographic. In addition, the discreet nature of closed vaping systems, with minimized maintenance and leakage risks, further contributes to their popularity in the Philippine market, as users seek a convenient and inconspicuous vaping experience.

The open vaping systems segment is expected to grow at a considerable growth rate over the forecast period. The open vaping systems segment in the Philippines is witnessing significant growth, driven by the increasing demand for customizable and user-friendly vaping devices. Open vaping systems allow users to refill their e-liquids and replace coils, providing a more personalized vaping experience compared to closed systems. The versatility and customization options offered by open vape systems play an essential role. Unlike closed pod systems that limit users to pre-filled cartridges, open systems allow vapers to choose from a wide range of e-liquids and experiment with different flavors and nicotine strengths. This flexibility caters to diverse consumer preferences, contributing to the widespread appeal of open vape systems. Moreover, the affordability and accessibility of open vape devices and e-liquids contribute significantly to their prevalence in the Philippine market. Open systems often come at a lower initial cost compared to closed pod systems, making them more accessible to a broader demographic.

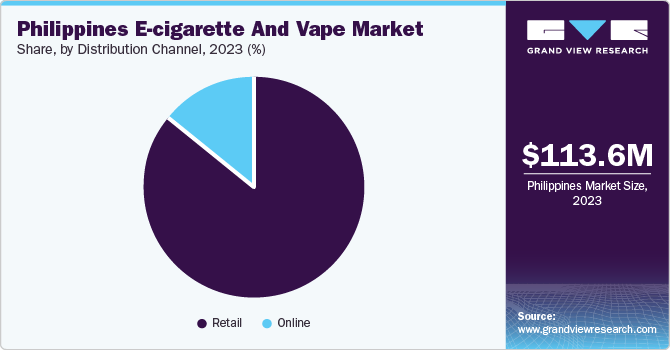

Distribution Channel Insights

The retail segment led the market in 2023. Retail stores, also known as vape shops, have witnessed a phenomenal rise in the Philippines over the past few years. They allow customers to test various e-cigarette products before making a purchase. The rising popularity of e-cigarettes has also contributed to the rising number of vape shops across the country. Prominent players in the e-cigarette market choose retail stores as their primary distribution channel for e-cigarettes and vapes. For instance, Juul Labs, Inc., an e-cigarette and vape manufacturer, launched its own branded stores and kiosks in the Philippines. These outlets offer a free engraving option on the company’s devices as a marketing strategy to offer personalized experiences to consumers.

The online segment is expected to register the highest CAGR over the forecast period. The online segment in the Philippines has witnessed significant growth, driven by the increasing adoption of digital technology, and internet penetration has played a pivotal role. With a large portion of the population gaining access to smartphones and the internet, consumers find it more convenient to shop online, including e-cigarettes and vapes. Online vape shops, which have emerged recently, encourage customers to purchase e-cigarettes online. The smaller packaging size of e-cigarettes attracts lower shipping rates, thereby adding to buyers’ preference. Online marketplaces offer a wide variety of e-cigarettes and vaping products for customers to choose from. Moreover, the COVID-19 pandemic has accelerated the shift towards online shopping, as people prioritize safety and convenience. With lockdowns and social distancing measures in place, consumers turned to e-commerce platforms for their shopping needs, further boosting the sales of e-cigarettes and vapes in the Philippines.

Key Companies & Market Share Insights

Some of the key players operating in the market include Imperial Brands plc; Japan Tobacco Inc.; Juul Labs, Inc.; Altria Group Inc.; Philip Morris International Inc.; and Voopoo.

-

Imperial Brands plc operates through the Tobacco & Next Generation Products (NGP) and Distribution segments. The company’s business is built upon brands such as Imperial Tobacco, Fontem Ventures, ITG, and Logista.

-

Philip Morris International Inc. manufactures and distributes smoke-free products, cigarettes, associated electronic devices and accessories, and other nicotine-containing products in markets outside the U.S. The company has two business segments, namely combustible products, and Reduced-Risk Products (RRP).

-

Geekvape; Shenzhen Nevoks Technology Co., Ltd (Nevoks); RELX International Enterprise HK Limited; British American Tobacco plc are some of the emerging market participants in the Philippines e-cigarette and vape market.

-

Geekvape, is engaged in creating vape innovation and provides best user experience for e-cigarette industry. The company manufactures electronic cigarette products, focusing on advanced vape mods, tanks, kits, and pod systems.

- Shenzhen ThinkVape Technology Co., Ltd. is engaged in providing e-cigarette products in the market. The company has two major business sectors: private brand business and ODM/OEM services, with footprints all over the globe.

Key Philippines E-cigarette And Vape Companies:

- Altria Group Inc.

- British American Tobacco plc

- Geekvape

- Imperial Brands plc

- Japan Tobacco Inc.

- Juul Labs, Inc.

- Philip Morris International Inc.

- RELX International Enterprise HK Limited

- Shenzhen Nevoks Technology Co., Ltd (Nevoks)

- Voopoo

Recent Developments

-

In November 2023, Voopoo launched DRAG S2, and DRAG X2, with the PnP X platform. The DRAG X2 and DRAG S2 are POD MOD devices that introduce VOOPOO's PnP X atomization technology for the first time. This technology promises outstanding performance within a compact design, ensuring a satisfying and consistent vaping experience. It enables users to enjoy vaping up to 100 mL of e-liquid without encountering flavor degradation or coil burnout

-

In October 2023, Voopoo announced the release of ARGUS P1s, a revolutionary vaping device. Featuring a cutting-edge combination of features, such as fast charging and ultimate flavor experience with iCOSM CODE, the ARGUS P1s establishes a new standard for users seeking improved convenience and performance

-

In June 2023, RELX International announced a partnership with the Philippine Department of Trade and Industry (DTI) to regulate the sales of e-cigarette products with a particular emphasis on prioritizing consumer safety by cracking down on illegal products

-

In April 2023, Geekvape unveiled VPU, the company’s innovative vaping technology solution integrated with the latest advances in fluid and thermal transmission. Based on advanced material research and prioritizing material safety, VPU offers a comprehensive solution for customers

Philippines E-cigarette And Vape Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 123.5 million

Revenue forecast in 2030

USD 345.6 million

Growth rate

CAGR of 18.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in Thousand Units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, distribution channel

Key companies profiled

Altria Group Inc.; British American Tobacco plc; Geekvape; Imperial Brands plc; Japan Tobacco Inc.; Juul Labs, Inc.; Philip Morris International Inc.; RELX International Enterprise HK Limited; Shenzhen Nevoks Technology Co., Ltd (Nevoks); Voopoo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Philippines E-cigarette and Vape Market Report Segmentation

The report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Philippines e-cigarette and vape market report based on product, category, and distribution channel.

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Disposable

-

Rechargeable

-

Pod Mode

-

Refill Mode

-

-

Modular Devices

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Vaping Systems

-

Closed Vaping Systems

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail

-

Convenience Store

-

Drug Store

-

Newsstand

-

Tobacconist Store

-

Specialty E-cigarette Store

-

-

Frequently Asked Questions About This Report

b. The Philippines e-cigarette and vape market size was estimated at USD 113.6 million in 2023 and is expected to reach USD 123.5 million in 2024.

b. The Philippines e-cigarette and vape market is expected to grow at a compound annual growth rate of 18.7% from 2024 to 2030 to reach USD 345.6 million by 2030

b. The disposable segment led the market and accounted for 17.6% in 2023. The rise of the disposable segment can be attributed to the country's growing awareness and acceptance of vaping as an alternative to traditional tobacco smoking.

b. Some key players operating in the Philippines e-cigarette and vape market include Altria Group Inc.; British American Tobacco plc; Geekvape; Imperial Brands plc; Japan Tobacco Inc.; Juul Labs, Inc.; Philip Morris International Inc.; RELX International Enterprise HK Limited; Shenzhen Nevoks Technology Co.,Ltd (Nevoks); Voopoo

b. The growth of the Philippines e-cigarette and vape market can be primarily attributed to the perception of vaping being a less harmful alternative to conventional smoking, which has triggered the adoption of e-cigarettes and vaping products among individuals seeking a tobacco-free option.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.