- Home

- »

- Medical Devices

- »

-

Pharmaceutical Impurity Synthesis And Isolation Services Market 2030GVR Report cover

![Pharmaceutical Impurity Synthesis And Isolation Services Market Size, Share & Trends Report]()

Pharmaceutical Impurity Synthesis And Isolation Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Synthesis Services, Isolation Services), By Impurity Type, By Technique, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-435-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

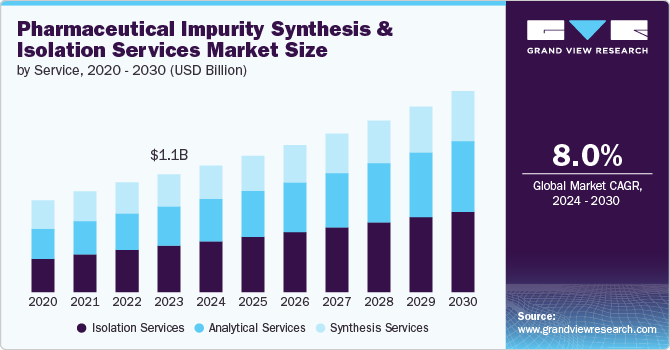

The global pharmaceutical impurity synthesis and isolation services market size was valued at USD 1.22 billion in 2024 and is projected to grow at a CAGR of 8.10% from 2025 to 2030. The growth of the market is mainly due to continuous advancements in analytical technologies and methodologies, such as high-resolution mass spectrometry, advanced chromatographic techniques, and automated analytical systems. These techniques have significantly enhanced the ability to detect and isolate impurities with greater accuracy and efficiency. Such technological advancements have expanded the capabilities of impurity synthesis and isolation service providers, enabling them to meet the evolving needs of the pharmaceutical industry and supporting the growth of the market.

Further, stringent regulatory environment governing drug development and manufacturing is also one of the factors contributing to the pharmaceutical impurity synthesis and isolation services market growth. Regulatory agencies such as the U.S. FDA and EMA have imposed rigorous standards for the identification, quantification, and control of impurities in pharmaceuticals to ensure safety and efficacy. This has led pharmaceutical companies to invest in specialized services for impurity synthesis and isolation, as these services are crucial for meeting compliance requirements and ensuring that drug products are safe for consumption.

Moreover, the demand for drugs was significantly high during the pandemic, which accelerated the clinical development process and subsequently increased the regulatory process for creating a safe and effective environment for conducting clinical trials process. In addition, the regulatory authorities demonstrated flexibility in the development of COVID-19 drugs while maintaining a high level of quality, tolerability, and effectiveness. The authorities have also released several guidelines, such as emergency use authorization for the drugs that could be used for the treatment. Thus, introduction of new guidelines while maintaining proper efficacy and quality has further contributed to the growth of the market.

In addition, with the introduction of novel drug classes, such as biologics and complex generics, the types and profiles of impurities have become more diverse and challenging to identify. These complex molecules often present unique challenges in synthesizing and isolating impurities, necessitating advanced technologies and expertise. As a result, there is a growing demand for specialized services that can handle these complicated tasks and support the development of innovative therapeutic products.

The increasing emphasis on personalized medicine is also contributing to the growth of the pharmaceutical impurity synthesis and isolation services market. Personalized medicine involves customized treatments for individual patients based on genetic, environmental, and lifestyle factors, which often leads to the development of more targeted and specialized drugs. The complexity of these personalized therapies requires precise impurity profiling to ensure their safety and effectiveness. Consequently, pharmaceutical companies increasingly rely on external service providers to deliver high-quality impurity analysis and isolation, further driving the demand for these services.

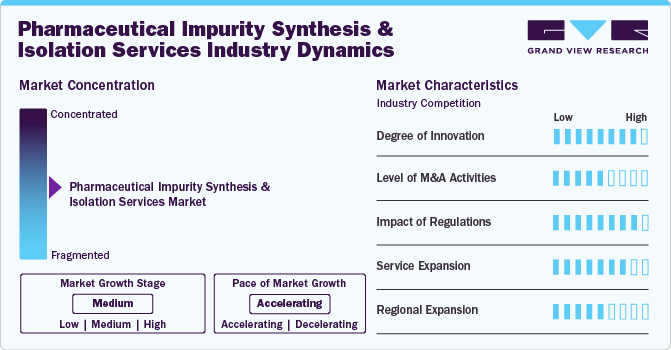

Market Concentration & Characteristics

The market for pharmaceutical impurity synthesis and isolation services is experiencing a significant degree of innovation as it adapts to the evolving demands of the drug development landscape. With increasing regulatory scrutiny and the need for higher purity standards, companies are investing in advanced technologies such as high-resolution chromatography, mass spectrometry, and automated synthesis platforms. These innovations enhance the precision and efficiency of identifying and isolating impurities, thereby accelerating drug development timelines and improving safety profiles.

The market is notably high, reflecting the sector's rapid evolution and consolidation trends. This surge in M&A is driven by several factors, including the need for enhanced technological capabilities, expanded service portfolios, and geographic reach. Major players and emerging companies are acquiring specialized firms to integrate advanced analytical techniques and streamline operations, aiming to offer comprehensive solutions that meet stringent regulatory requirements.

Stringent regulatory standards, such as those imposed by the FDA, EMA, and other global agencies, mandate rigorous testing and documentation of pharmaceutical impurities to ensure drug safety and efficacy. These regulations necessitate the adoption of advanced analytical techniques and robust quality control measures, pushing companies to invest in cutting-edge technologies and skilled expertise.

Service providers are also expanding their geographic reach to support global pharmaceutical companies and cater to regional regulatory requirements. This expansion often involves establishing new facilities, forming strategic partnerships, or acquiring local expertise.

Regional expansion in the pharmaceutical impurity synthesis and isolation services market is increasingly prominent as companies seek to capitalize on global growth opportunities and address diverse regulatory requirements.

Service Insights

The isolation services segment dominated the market with a share of 40.04% in 2024. The growth of the segment is mainly due to its important role in ensuring drug safety and efficacy. Pharmaceutical companies increasingly prioritize the identification and removal of impurities in drug formulations. Therefore, isolation services have become essential in achieving regulatory compliance and maintaining product integrity. Isolation services mainly focus on the development of specialized techniques for the isolation of trace impurities, which is crucial for both the preclinical and clinical phases of drug development. Moreover, the complexity of pharmaceuticals, including biologics and advanced therapeutics, has heightened the need for sophisticated isolation techniques, further contributing to the segment’s growth.

The analytical services segment is projected to witness highest growth during the forecast timeframe. Increasing complexity of pharmaceutical compounds and the growing need for high-resolution analysis to detect and quantify impurities are driving the demand for advanced analytical techniques. In addition, as drug formulations become more advanced, there is a corresponding need for more robust and versatile analytical methods to ensure the quality and safety of these products. Analytical services such as High-Performance Liquid Chromatography (HPLC), Mass Spectrometry (MS), and Nuclear Magnetic Resonance (NMR) are critical for characterizing impurities and verifying the purity of active pharmaceutical ingredients (APIs).

Impurity Type Insights

The inorganic impurities segment dominated the market in 2024. These are performed to control metal and mineral contaminants in drug formulations. Inorganic impurities, such as heavy metals and residual catalysts, can pose significant health risks if not adequately managed. These impurities often originate from raw materials, manufacturing processes, and the packaging materials used in drug production. Therefore, regulatory agencies such as FDA and EMA have set stringent regulatory standards to identify and control these contaminants.

The residual solvents segment is expected to witness the fastest CAGR over the forecast period, owing to the increasing regulatory scrutiny and advancements in drug formulation technologies. Residual solvents, organic chemicals used during manufacturing but not completely removed, can pose health risks if present in high concentrations. As regulatory bodies implement stricter guidelines for permissible residual solvents, pharmaceutical companies are increasingly focused on developing and employing more effective methods to detect and control these substances. This heightened regulatory environment is driving the demand for specialized services that can accurately identify and quantify residual solvents, further contributing to the growth of this segment.

Technique Insights

In 2024, the chromatography segment held the largest revenue share in the pharmaceutical impurity synthesis and isolation services industry. The growth is due to its versatility and robustness for separating and analyzing compounds. Chromatography methods, including High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC), are essential for detecting and quantifying impurities in pharmaceutical products. These techniques offer high resolution and sensitivity, allowing for the precise identification of both organic and inorganic impurities in complex drug formulations. Their ability to handle diverse sample types and complexities, coupled with their reliability and accuracy, makes chromatography crucial in ensuring the quality and safety of pharmaceuticals.

The hyphenated techniques segment is projected to grow at the fastest CAGR over the analysis period. Hyphenated techniques, such as Liquid Chromatography-Mass Spectrometry (LC-MS) and Gas Chromatography-Mass Spectrometry (GC-MS), combine the separation capabilities of chromatography with the molecular identification power of mass spectrometry. The increasing need for more sophisticated analytical tools to meet evolving regulatory requirements and the complexity of advanced pharmaceuticals is contributing to market growth. With the advancements in the drug development, there will be an increasing need for hyphenated techniques that can provide comprehensive impurity profiling and quantitative analysis. This trend is expected to continue as pharmaceutical companies seek to leverage these technologies to ensure drug safety, efficacy, and compliance with stringent regulatory standards.

Application Insights

The commercial manufacturing segment dominated the market in 2024. The growth of the segment can be attributed to its large-scale production requirements and the high volume of pharmaceutical products that need thorough impurity testing. Moreover, as pharmaceutical companies continue to expand their product lines and enter new markets, the need for reliable and compliant impurity management is also growing, further contributing to the market growth.

The drug development segment is projected to witness the significant CAGR over the forecast period. The growth of the segment is due to the increasing complexity of new drug formulations and the heightened focus on personalized medicine. Pharmaceutical companies and research institutions are continuously working towards drug discovery and development, further boosting the need for detailed impurity profiling. New drug candidates often involve novel compounds and complex synthesis routes that require advanced impurity analysis to ensure safety and efficacy.

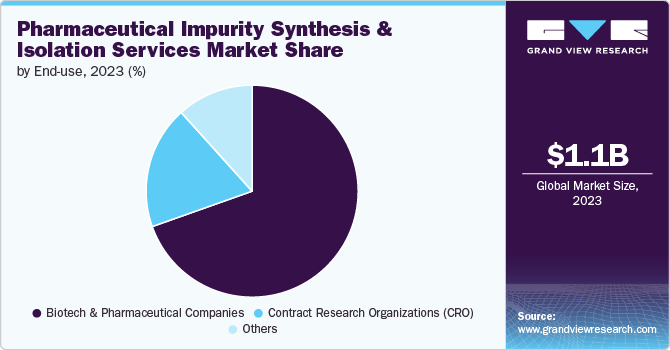

End Use Insights

The biotech & pharmaceutical companies segment dominated the market in 2024 and is projected to grow at the fastest CAGR during the forecast period. These companies are the primary developers of new drugs and are, therefore, at the forefront of identifying and managing impurities to ensure product safety and efficacy. The complexity of modern drug formulations, including biologics, gene therapies, and novel small molecules, necessitates rigorous impurity analysis and control. Therefore, these companies rely on specialized services to meet stringent regulatory requirements and to avoid potential issues that could delay or derail product approvals.

The contract research organizations (CRO) segment is projected to witness a significant CAGR over the estimated period. The growth is primarily attributed to an increasing trend of outsourcing various aspects of drug development and analytical testing. CROs offer specialized expertise and advanced pharmaceutical impurity synthesis and isolation technologies, allowing biotech and pharmaceutical companies to leverage external resources and focus on their core activities. Moreover, as drug development processes are becoming more complex and costly, outsourcing to CROs provides an efficient and cost-effective solution for managing impurity analysis and regulatory compliance.

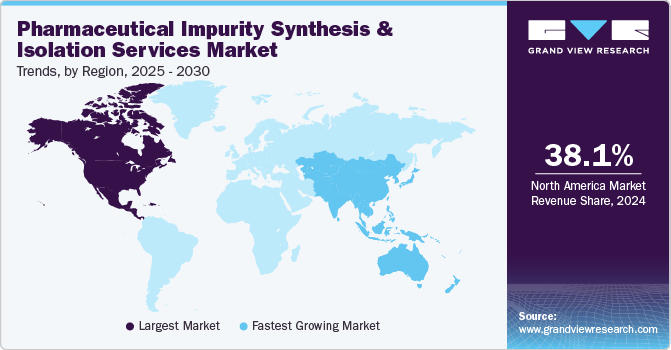

Regional Insights

North America Pharmaceutical Impurity Synthesis and Isolation Services market dominated and accounted for a 38.07% share in 2024. The growth in the region is attributed to the presence of several pharmaceutical and biotech companies in the region, coupled with increasing research and development activities, further driving the demand for high-quality impurity analysis and management. Furthermore, the region’s advanced technological infrastructure and a robust network of service providers capable of meeting complex impurity analysis requirements are also some of the factors contributing to the market growth.

U.S. Pharmaceutical Impurity Synthesis And Isolation Services Market Trends

The U.S. pharmaceutical impurity synthesis and isolation services market is projected to be driven by the rapid advancement in technology and innovation within the sector. Companies are increasingly adopting cutting-edge analytical techniques, such as high-resolution mass spectrometry and advanced chromatography methods, to enhance the accuracy and efficiency of impurity detection. These technological improvements enable more detailed and precise profiling of impurities, which is crucial for developing new and complex pharmaceutical compounds.

Europe Pharmaceutical Impurity Synthesis And Isolation Services Market Trends

Europe Pharmaceutical impurity synthesis and isolation services market is anticipated to witness lucrative growth over the projected period. A growing focus on personalized medicine and biopharmaceuticals is driving the demand for specialized impurity synthesis and isolation services. As the pharmaceutical industry is increasingly shifting towards personalized therapies and biologics, there is a corresponding need for detailed impurity analysis to address the unique challenges posed by these complex products.

The pharmaceutical impurity synthesis and isolation services market in the UK is anticipated to experience considerable growth over the forecast period. Growing investment in biotechnology and pharmaceutical research and development is driving growth in the region’s market. This further advances advanced impurity analysis to ensure the safety, efficacy, and compliance of new drugs.

The Germany pharmaceutical impurity synthesis and isolation services market is expected to grow at a considerable rate over the forecast period. The growth in the country can be attributed to the increased spending by businesses on R&D, rising healthcare awareness, and technological advancements.

Asia Pacific Pharmaceutical Impurity Synthesis And Isolation Services Market

Asia Pacific market is expected to grow at the highest CAGR over the forecast period. APAC countries, including China, Japan, India, and South Korea, are experiencing rapid economic growth and increasing healthcare expenditures. The rapid expansion of the pharmaceutical and biotechnology sectors in countries like China and India is one of the major factors driving the region’s market growth. These countries are increasingly focusing on improving drug quality and regulatory compliance. Additionally, the growing prevalence of chronic diseases and the rising demand for affordable medications are prompting pharmaceutical companies to invest in R&D and manufacturing capabilities.

The China pharmaceutical impurity synthesis and isolation services market is expected to grow during the forecast period. China has become a significant hub for pharmaceutical production, with numerous domestic and international companies establishing manufacturing facilities and R&D centers within the country. This growth is fueled by the increasing demand for pharmaceuticals, both domestically and globally, and the government's supportive policies aimed at advancing the pharmaceutical industry. As pharmaceutical companies develop more complex drug formulations and biologics, there is a growing need for comprehensive impurity synthesis and isolation services to ensure product safety and regulatory compliance. The expansion of R&D activities is also contributing to this demand, as novel drug candidates often require detailed impurity profiling.

The pharmaceutical impurity synthesis and isolation services market in Japan is expected to witness lucrative growth over the forecast period owing to advanced healthcare infrastructure. The country constantly works towards technological innovation and high pharmaceutical research and development standards. The country’s pharmaceutical companies and research institutions are increasingly adopting state-of-the-art analytical techniques, such as ultra-high-performance liquid chromatography (UHPLC) and high-resolution mass spectrometry (HRMS), to achieve more accurate and detailed impurity analysis.

The India pharmaceutical impurity synthesis and isolation services market is poised to grow in the coming years. The region’s growth is due to the emergence of advanced drug development and ongoing regulatory reforms in India. The country is investing heavily in research and development to advance its capabilities in creating innovative drugs, including biologics and personalized medicines.

MEA Pharmaceutical Impurity Synthesis And Isolation Services Market Trends

The MEA pharmaceutical impurity synthesis and isolation services is projected to grow at a lucrative rate owing to increased healthcare expenditure, rising demand for biosimilars & biologics therapies, R&D investments, and technological advancements. Several countries in the region are implementing global standards and collaborating with other global CROs to establish a presence in the market.

The pharmaceutical impurity synthesis and isolation services market in Saudi Arabia is projected to witness the fastest CAGR over the forecast period, owing to the emergence of a rapidly expanding pharmaceutical sector. The Saudi government’s Vision 2030 initiative emphasizes the development of the healthcare and pharmaceutical industries as part of its broader economic diversification strategy. This includes increasing pharmaceutical manufacturing and R&D investments to reduce import dependency and enhance local production capabilities. As the pharmaceutical sector in Saudi Arabia grows, there is an increasing need for high-quality impurity synthesis and isolation services to ensure that locally produced drugs meet international safety and efficacy standards.

Key Pharmaceutical Impurity Synthesis And Isolation Services Company Insights

Key players operating in pharmaceutical impurity synthesis and isolation services are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Companies such as Eurofins Scientific and Charles River Laboratories are providing extensive service offerings, advanced analytical capabilities, and established global presence. These companies benefit from their ability to provide high-quality, reliable services that meet stringent regulatory standards. For instance, in June 2024, Charles River Laboratories collaborated with MatTek Corporation to develop a New Approach Methodology (NAM) inhalation toxicology test that reduces dependence on animal research methods. The company received funding from the Foundation for Chemistry Research & Initiatives (FCRI).

Key Pharmaceutical Impurity Synthesis And Isolation Services Companies:

The following are the leading companies in the pharmaceutical impurity synthesis and isolation services market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific

- Charles River Laboratories

- Wuxi AppTec

- SGS Société Générale de Surveillance SA.

- Intertek Group Plc

- Almac Group

- Cambrex Corporation

- Pharmaron

- Laboratory Corporation of America Holdings

- Syngene International Limited

- PCI Pharma Services

- Catalent Inc

- Symeres

- Piramal Pharma Solutions

- Frontage Labs

- Veeda Clinical Research

Recent Developments

-

In January 2024, Eurofins CDMO Alphora announced the completion of its new pilot scale biologics development facility. The facility includes upstream & downstream development, analytical services, and process design and gap analysis, among others.

-

In January 2024, WuXi AppTec increased the peptide manufacturing capacity and launched a new taixing API manufacturing site in China. This has increased the company’s Solid-Phase Peptide Synthesis (SPPS) reactor volume.

-

In January 2023, Eurofins expanded its presence in the Indian pharmaceutical market by establishing a fully equipped laboratory. The facility supports the country’s pharmaceutical companies and small biotech companies.

Pharmaceutical Impurity Synthesis And Isolation Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.32 billion

Revenue forecast in 2030

USD 1.94 billion

Growth rate

CAGR 8.10% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, impurity type, technique, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, South Korea, Thailand, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait.

Key companies profiled

Eurofins Scientific, Charles River Laboratories, Wuxi AppTec, SGS Société Générale de Surveillance SA., Intertek Group Plc, Almac Group, Cambrex Corporation, Pharmaron, Laboratory Corporation of America, Holdings, Syngene International Limited, PCI Pharma Services, Catalent Inc, Symeres, Piramal Pharma Solutions, Frontage Labs, Veeda Clinical Research

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Impurity Synthesis And Isolation Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical impurity synthesis and isolation services report based on service, impurity type, technique, application, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthesis Services

-

Isolation Services

-

Analytical Services

-

-

Impurity Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic Impurities

-

Inorganic Impurities

-

Residual Solvents

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Chromatography

-

HPLC

-

Gas Chromatography

-

Preparative Chromatography

-

Others

-

-

Spectroscopy

-

Mass Spectroscopy

-

Nuclear Magnetic Resonance (NMR) Spectroscopy

-

Others

-

-

Crystallization

-

Hyphenated Techniques

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Development

-

Commercial Manufacturing

-

Quality Control

-

Regulatory Compliance

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotech & Pharmaceutical Companies

-

Contract Research Organizations (CRO)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

- Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical impurity synthesis and isolation services market size was estimated at USD 1.22 billion in 2024 and is expected to reach USD 1.32 billion in 2025.

b. The global pharmaceutical impurity synthesis and isolation services outsourcing market is expected to grow at a compound annual growth rate of 8.10% from 2025 to 2030 to reach USD 1.94 billion by 2030.

b. North America dominated the pharmaceutical impurity synthesis and isolation services market with a share of 38.07% in 2024. This is attributable to the increasing complexity of drug formulations, stringent regulatory requirements for impurity profiling, growing focus on drug safety and efficacy, and the rising demand for specialized drug development and manufacturing services. Moreover, strong presence of biopharmaceutical organizations and availability of skilled professionals driving market demand in the North America.

b. Some key players operating in the pharmaceutical impurity synthesis and isolation services market include Eurofins Scientific, Charles River Laboratories, Wuxi AppTec, SGS Société Générale de Surveillance SA., Intertek Group Plc, Almac Group, Cambrex Corporation, Pharmaron, Laboratory Corporation of America Holdings, Syngene International Limited, PCI Pharma Services, Catalent Inc, Symeres, Piramal Pharma Solutions, Frontage Labs, Veeda Clinical Research.

b. Key factors that are driving the market growth include a growing focus on development of innovative therapeutics, growing demand for innovative therapeutics such as personalized medicine, continuous reforms in regulatory framework, increasing outsourcing trends, and growing R&D spending among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.