- Home

- »

- Medical Devices

- »

-

Pharmaceutical Collaborative Robots Market Report, 2030GVR Report cover

![Pharmaceutical Collaborative Robots Market Size, Share & Trends Report]()

Pharmaceutical Collaborative Robots Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Picking & Packaging, Laboratory Applications), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-127-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

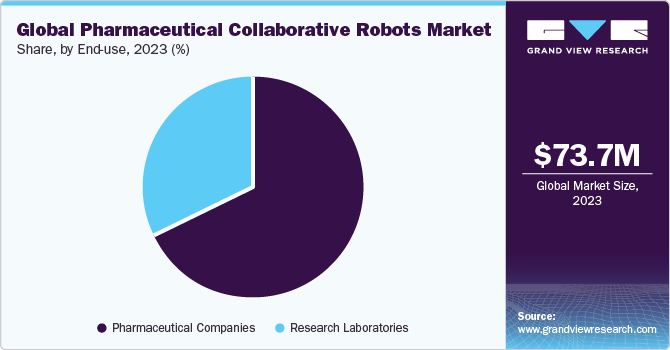

The global pharmaceutical collaborative robots market size was estimated at USD 73.73 million in 2023 and is projected to grow at a CAGR of 9.80% from 2024 to 2030. In the pharmaceutical industry, the imperative of regulatory compliance and quality assurance underscores the need for precision in manufacturing processes. Collaborative robots are pivotal in ensuring compliance by reducing errors and inconsistencies and concurrently elevating product quality through controlled and consistent operations.

In addition, the scarcity of skilled labor and the pursuit of enhanced workforce efficiency further propel the integration of pharmaceutical collaborative robots through automating repetitive tasks and enabling human workers to dedicate their skills to higher-value activities, thus augmenting overall productivity and operational effectiveness. For instance, several pharmaceutical companies such as Medtronic, AMGEN, and others are using collaborative robots (COBOTS) to help in different manufacturing plant processes.

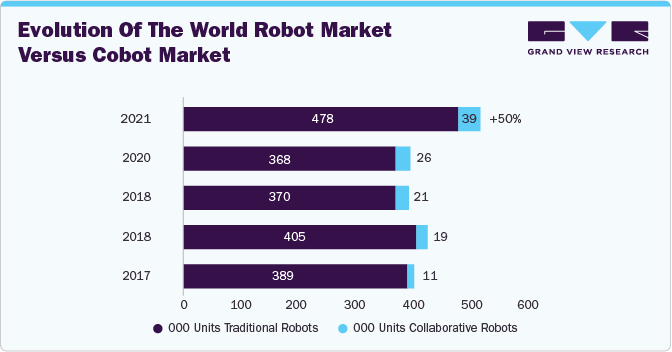

Collaborative robots, often referred to as cobots, are advanced robotic systems designed to work collaboratively with humans in shared workspaces. Unlike traditional industrial robots that operate in isolated environments, cobots are equipped with safety features, sensors, and user-friendly interfaces that enable efficient and safe interaction with human workers. In the healthcare industry, particularly in pharmaceutical settings, cobots are increasingly utilized for various tasks due to their adaptability, precision, and ability to work alongside human operators. For instance, according to the Association for Packaging and Processing Technologies (PMMI) study, robots were expected to handle 34% of primary pharmaceutical packaging operations in the U.S. in 2018.

Regarding pharmaceutical laboratories, collaborative robots, called cobots, represent advanced robotic systems engineered for seamless and cooperative interaction with human workers. Cobots have garnered popularity in the pharmaceutical sector due to their adaptability and aptitude for close collaboration with human operators. The primary benefit of cobots in the pharmaceutical industry is their capacity to augment human labor, resulting in heightened efficiency and productivity within production processes. For instance, Coty Cosmetics uses cobots such as UR5 and UR3 on mobile carts to assist its operatives in picking and packing products. The company expects this move to save them a significant amount of money, around USD 500,000 annually.

The primary benefit of cobots in the pharmaceutical industry is their capacity to augment human labor, resulting in heightened efficiency and productivity within production processes. By integrating cobots into operational frameworks, pharmaceutical enterprises can expedite production timelines and bolster output, all while upholding stringent benchmarks for product quality. Moreover, cobots possess the potential to elevate worker safety by undertaking hazardous and repetitive tasks that might otherwise jeopardize the well-being of human personnel.

Many pharmaceutical companies are replacing traditional robots with collaborative robots or cobots, a combination of humans and robots. The adoption of collaborative robots is significantly growing as they combine the repetitive tasks of robots and the individual skills of humans to bring efficiency to manufacturing processes. These robots are also cheaper and easier to operate & maintain as compared to traditional robots. For instance, in September 2022, GelSight introduced GelSight Mini, an AI-powered 3D tactile sensor offering superhuman touch resolution-in the commercial market. The device is designed to be used by both robots and humans and can generate sharable results in just 5 minutes, making it the fastest tactile device powered by AI available in the market. The device has a spatial resolution that exceeds human touch and quickly provides scientists and researchers with optimized images of material surfaces applicable in many industries.

Market Concentration & Characteristics

The market is characterized by a high degree of innovation owing to rising R&D activities, technological advancements in the robotics field, and the launch of novel and innovative cobots. These advancements, powered by AI, machine learning (ML), sensors, and advanced control algorithms, empower cobots to execute intricate tasks precisely. For instance, in August 2022, Yaskawa Electric Corporation launched a new lineup of MOTOMAN-HC30PL suitable for palletizing applications such as cardboard.

The market witnesses a moderate level of merger and acquisition (M&A) activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for cobots in the pharmaceutical industry and to maintain a competitive edge. For instance, in June 2022, in collaboration with Frazier Healthcare Partners, Becton, Dickinson, and Company finalized an official agreement for BD's acquisition of Parata Systems, a forward-thinking supplier of pharmacy automation solutions, for a total of USD 1.525 billion. Parata's assortment of inventive pharmacy automation solutions drives the expansion of a network of pharmacies, aiming to lower expenses, elevate patient safety, and enhance the overall patient journey.

Pharmaceutical collaborative robots must meet strict regulatory requirements to ensure high quality, safety, and effectiveness standards before being introduced to the market. In the U.S., the U.S. FDA regulates pharmaceutical collaborative robots. The regulations cover testing of material biocompatibility, strength, electrical system verification, testing of product software under hazardous & normal conditions, testing manual controls, and clinical testing, among others.

In collaboration with humans, manual packaging machines are used for packaging products in the pharmaceutical industry instead of collaborative robots. Furthermore, manual visual inspection in the parenteral pharmaceutical space largely depends on a well-trained and disciplined workforce.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in February 2021, ABB announced an expansion of its collaborative robot range with the addition of SWIFTI and GoFa cobot families. These are equipped with increased payloads and speeds, complementing YuMi and Single Arm YuMi in ABB’s cobot lineup. With enhanced strength, speed, and capabilities, these cobots are anticipated to drive the company’s growth in healthcare, electronics, logistics, consumer goods, and food & beverage sectors.

Application Insights

The picking & packaging segment dominated the market in 2023 with a revenue share of 54.8% and is anticipated to grow at the fastest CAGR over the forecast period. The growth can be attributed to this segment's critical role in the supply chain and manufacturing processes. Picking and packaging ensure products are efficiently sorted, prepared, and dispatched. With the increasing demand for streamlined logistics, rapid e-commerce growth, and the need for precision in delivering products to consumers, companies are prioritizing automation solutions in these areas. For instance, ESS Technologies' TaskMate Robotic Systems utilize Fanuc multi-axis robots for pick-and-place solutions in various applications. The company's new blister-loading system incorporates a Fanuc CRX-10iA cobot, which can handle up to 10kg and reach 1,418mm. This cobot has sensors and force controls to detect any solid object and immediately halt its motion to prevent accidents.

Moreover, the pharmaceutical industry increasingly leverages packaging robotics to enhance efficiency, precision, and compliance. These robotic systems are revolutionizing pharmaceutical packaging processes, offering advantages such as improved productivity, reduced error rates, and enhanced product quality. In addition, the pick-and-place approach offers these benefits and conserves floor space by operating within a confined work envelope, optimizing workspace utilization. This trend reflects the industry's commitment to maximizing operational efficiency while ensuring space optimization.

End-use Insights

The pharmaceutical companies segment dominated the market in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. A rise in the adoption of robotics in drug discovery and development contributes to this trend. Furthermore, the engagement in personalized medicine initiatives by pharmaceutical firms has fueled segment growth. Research laboratories are expected to experience notable expansion during the projected period due to the automation capacity to handle repetitive tasks, such as transferring test tubes and fluids, in drug discovery endeavors, enhancing precision and consistency.

Moreover, global and local pharmaceutical companies are driving the demand for robotic automation, utilizing robots for drug inspection, packing & packaging, and in-house laboratory applications. The widespread use of robotics in pharmaceutical manufacturing promotes consistency and reduces human errors. In addition, the need for new drugs has compelled pharmaceutical companies to adopt automated equipment, leading to increased productivity and streamlined operations. As the industry continues to evolve, the adoption of robotics is expected to play a pivotal role in meeting the increasing demand for innovative pharmaceutical products.

Regional Insights

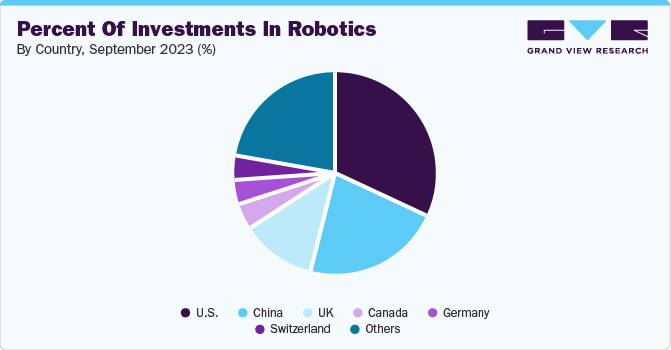

The North America pharmaceutical collaborative robots market is anticipated to register the fastest CAGR over the forecast period. Factors such as favorable government initiatives, highly developed healthcare infrastructure, rising disposable incomes, increasing adoption of robotic technologies, and product launches are some factors anticipated to support regional market growth. For instance, in May 2023, Elite Robots launched the C S620 cobot at the EASTEC trade show in West Springfield, Massachusetts. Moreover, a growing number of patients suffering from chronic diseases and the rising awareness about the advantages of advanced mobile robots in patient care are anticipated to propel the industry over the forecast period.

U.S. Pharmaceutical Collaborative Robots Market Trends

The pharmaceutical collaborative robots market in the U.S. held the largest share of 84.4% in 2023 in the North American region. The well-established healthcare infrastructure contributes to the increasing demand for collaborative robots in the pharmaceutical industry. Increased funding and awareness regarding the benefits of robots in healthcare are expected to impact market growth positively. For instance, in July 2023, a San Francisco-based startup, Collaborative Robotics, secured USD 30 million in Series A funding. The company aimed to utilize the funds raised to scale early field deployments and manufacture its innovative collaborative robots (cobots). This funding was expected to fuel the startup's growth in the collaborative robotic market.

Canada pharmaceutical collaborative robots market is anticipated to register the fastest CAGR in North America region over the forecast period. The factors contributing to market growth are the presence of key market players in the country, favorable government initiatives, and the increasing usage of robots in the pharmaceutical industry. For instance, in November 2022, the government of Canada (Minister of Innovation, Science and Industry) invested USD 30 million in Sanctuary Cognitive Systems Corporation, a Vancouver-based AI and robotics company, to develop human-like intelligence in robots to complete physical tasks in the healthcare industry. The above-mentioned factors are anticipated to fuel the market growth over the forecast period.

Asia Pacific Pharmaceutical Collaborative Robots Market Trends

The pharmaceutical collaborative robots market in Asia Pacific held the largest revenue share of 66.7% in 2023. Emerging robotics startups are expected to fuel this growth by developing innovative medical technologies that optimize patient care, enhance healthcare delivery, and reduce costs. For instance, in March 2023, according to an article in the Times of India, the number of such ventures in India has increased from 452 to nearly 90,000 since 2016, with over 8,000 health tech startups valued at around USD 2 billion and growing at a rapid rate of 40%.

The Japan pharmaceutical collaborative robots market shows a lucrative CAGR over the forecast period. Factors driving the market growth include a rapidly aging population and government initiatives to promote the use and adoption of robots in the pharmaceutical sector. Approximately 29.1% of the 125 million population is aged 65 or older. Thus, the rising geriatric population is expected to increase the demand for pharmaceutical collaborative robots.

Europe Pharmaceutical Collaborative Robots Market Trends

The pharmaceutical collaborative robots market in Europe is anticipated to register a significant CAGR over the forecast period, owing to favorable government initiatives and rising healthcare expenditure. The European robotics community’s Strategic Research Agenda focuses on achieving strategic goals, including the robotics market growth. Another initiative, the Public-Private Partnership (PPP), is aimed to encourage the development of disruptive robotic technology through research and innovation while raising awareness about robotics in less-developed countries of Europe. These strategic initiatives are expected to drive significant market growth during the forecast period.

The France pharmaceutical collaborative robots market is anticipated to register a lucrative CAGR over the forecast period. The healthcare industry in France has seen a significant boost due to the increasing adoption of cobots in the pharmaceutical sector and the introduction of advanced robotic equipment. The France government has been actively spending on healthcare, with a per capita spending of around USD 6,630 in 2022, which is 12.1% of its GDP. Such factors boost the market growth over the forecast period.

The pharmaceutical collaborative robots market in the UK is anticipated to register a considerable CAGR over the forecast period. The pharmaceutical industry is witnessing an increase in the adoption of robots due to their precision, cleanroom-grade operating capabilities, and ability to work around the clock. Moreover, western manufacturing faces a significant setback due to a severe labor shortage, which increases the demand for cobots, further driving market growth.

Key Pharmaceutical Collaborative Robots Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions. For instance, in April 2020, Realtime Robotics and Mitsubishi Electric partnered to develop the next generation of smart industrial robots. This partnership aims to streamline and expedite robotic automation, facilitating safe and efficient operation in dynamic, unstructured environments. The tailored solution integrates Realtime Robotics’ cutting-edge technology with Mitsubishi Electric’s industrial and collaborative robots portfolio.

Robotics in the pharmaceutical industry: Deals in Q3 2023

Announced Date

Deal Headline

Deal Type

Deal Value (USD Million)

Announced Date

September 2023

CMR Surgical Secures USD 165 Million in Venture Funding

Venture Financing

165

September 20, 2023

August 2023

Shanghai Ruilong Nuofu Medical Technology Raises Approximately USD 27.47 Million in Series Pre-B+ Financing

Venture Financing

27.47

August 30, 2023

August 2023

Mendaera Secures USD 24 Million in Series A Funding

Venture Financing

24

August 17, 2023

August 2023

Recursion Pharma Files Prospectus to Raise up to USD 300 Million in Public Offering of Shares

Equity Offerings

300

August 8, 2023

July 2023

Tampa General Hospital to Acquire Three Florida Hospitals from Community Health Systems

Asset Transaction

290

July 24, 2023

Key Pharmaceutical Collaborative Robots Companies:

The following are the leading companies in the pharmaceutical collaborative robots market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Universal Robots A/S (Teradyne)

- Mitsubishi Electric Corporation

- Kuka AG (Midea Group)

- Kawasaki Heavy Industries Ltd.

- Yaskawa Electric Corporation

- DENSO WAVE INCORPORATED

- FANUC America Corporation

- OMRON CORPORATION

- Seiko Epson Corporation

Recent Developments

-

In February 2024, Olis Robotics entered into a new partnership with Kawasaki Robotics Inc. This partnership is expected to enable customers to expedite production restarts, significantly reduce troubleshooting and downtime expenses by up to 90%, and swiftly access expert support. Olis users can directly connect to their robots through an on-premises device via a secure connection, eliminating the complexities and risks associated with cloud-based systems. In addition, Olis is engineered to consistently adhere to the safety restrictions set by the robot controller to ensure physical safety.

-

In December 2023, ABB Robotics and XtalPi formed a strategic partnership to manufacture automated laboratory workstations in China. These automated labs are expected to enhance R&D productivity in biopharmaceuticals, chemistry, chemical engineering, and new energy materials. XtalPi Intelligent Automation utilizes the GoFa cobots to create preparation, filtration, dilution, reaction, glovebox, UPLC testing, and sample warehousing workstations, along with Automated Guided Vehicles (AGV), streamlining lab research and development for improved efficiency.

Pharmaceutical Collaborative Robots Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 80.24 million

Revenue forecast in 2030

USD 140.58 million

Growth rate

CAGR of 9.80% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ABB; Universal Robots A/S (Teradyne); Mitsubishi Electric Corporation; Kuka AG (Midea Group); Kawasaki Heavy Industries Ltd.; Yaskawa Electric Corporation; DENSO WAVE INCORPORATED; FANUC America Corporation, OMRON CORPORATION, Seiko Epson Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Pharmaceutical Collaborative Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global pharmaceutical collaborative robots market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Picking and Packaging

-

Inspection of Pharmaceutical Drugs

-

Laboratory Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Research Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical collaborative robots market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 140.58 million by 2030.

b. The global pharmaceutical collaborative robots market size was estimated at USD 73.73 million in 2023 and is expected to reach USD 80.24 million in 2023.

b. The picking and packaging segment emerged as the dominant force in the market, capturing the largest share of 54.8% in 2023. The growth can be attributed to this segment's critical role in the supply chain and manufacturing processes. Picking and packaging ensure products are efficiently sorted, prepared, and dispatched. With the increasing demand for streamlined logistics, rapid e-commerce growth, and the need for precision in delivering products to consumers, companies are prioritizing automation solutions in these areas. As a result, investments in collaborative robots for picking and packaging have surged, bolstering the segment's market dominance in 2022.

b. Some of the key players in the market include ABB Ltd., Universal Robots A/S, Mitsubishi Electric Corporation, Kuka AG, Kawasaki Heavy Industries Ltd., Yaskawa Electric Corporation, Denso Wave, Inc., and FANUC America Corporation.

b. The pharmaceutical collaborative robots market is witnessing a surge in demand as the industry embraces automation to enhance efficiency and compliance. Rapid technological advancements have led to developing more versatile and user-friendly cobots that seamlessly integrate into pharmaceutical workflows. These robots are addressing challenges such as labor shortages, intricate regulatory requirements, and the need for flexible manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.