Pharmaceutical Cleaning Validation Market Size, Share & Trends Analysis Report By Product (Small Molecule, Cleaning Detergent, Peptides, Proteins), By Validation Test, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-507-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

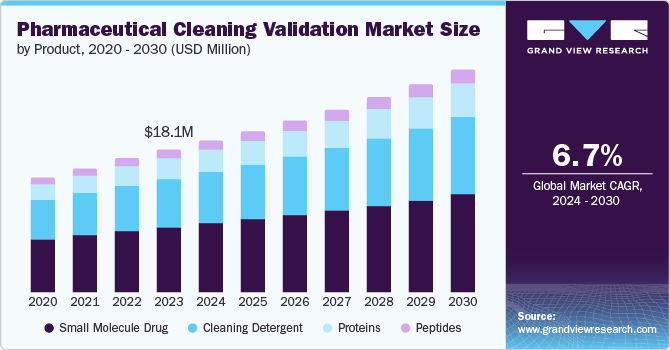

The global pharmaceuticals cleaning validation market size was valued at USD 18.13 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. The growing focus on patient health and safety is a major driver for market expansion. This has resulted in strict regulations by health authorities globally, requiring thorough cleaning validation processes in the pharmaceutical industry. Furthermore, the expanding pharmaceutical industry, especially in developing countries, is increasing the need for efficient cleaning validation procedures.

Regulation significantly impacts the global pharmaceuticals cleaning validation market by ensuring that cleaning processes meet stringent standards, thereby safeguarding public health. Key regulations, such as the U.S. Food and Drug Administration (FDA) guidelines, the European Medicines Agency (EMA) regulations, and the World Health Organization (WHO) guidelines, mandate rigorous validation procedures to prevent cross-contamination and ensure product purity. The FDA’s Current Good Manufacturing Practice (CGMP) regulations require pharmaceutical companies to validate cleaning methods to demonstrate their effectiveness. Similarly, the EMA's EudraLex Volume 4 outlines the necessity for thorough cleaning validation protocols. These regulations drive the demand for advanced cleaning validation technologies and services, fostering innovation and maintaining high safety and quality standards across the industry.

Product Insights

The small molecule drug segment held the largest revenue share of 46.1% in 2023. This dominance can be attributed to the widespread use of small-molecule drugs. The production process of small molecule drugs typically involves intricate chemical reactions, resulting in the generation of various residues. Thorough cleaning validation processes are essential to eliminate these residues, effectively preventing cross-contamination. The growing demand for small molecule drugs, along with the necessity for strict cleaning validation, contributes to the significant revenue share of this segment.

The peptides segment is projected to register the fastest CAGR of 8.1% from 2024 to 2030. As peptides are typically produced using solid-phase synthesis, the cleaning validation process for peptide manufacturing equipment is complex and requires specialized procedures. This complexity drives the demand for advanced cleaning validation solutions. As investment in peptide therapeutics research and development increases, the growth of this segment is expected to accelerate, leading to significant expansion in the global pharmaceutical cleaning validation market.

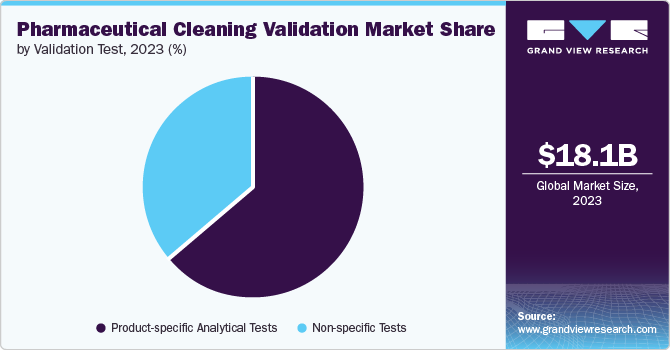

Validation Test Insight

The product-specific analytical tests segment captured 64.5% revenue share in 2023. This dominance is driven by the growing preference for state-of-the-art High-Performance Liquid Chromatography (HPLC) and UV spectroscopy among pharmaceutical companies. HPLC, in particular, has played a pivotal role in this success, as it is widely employed for the detection of small drug molecules and detergents in swab & rinse samples. The demand for reliable testing methods for cleaning validation samples, alongside the effectiveness of product-specific analytical testing methods such as Enzyme-Linked Immunosorbent Assay (ELISA) or HPLC, has significantly bolstered the revenue share of this segment.

The non-specific tests segment is projected to grow at a CAGR of 7.5% from 2024 to 2030. The increasing demand for Total Organic Carbon (TOC) testing, which accounted for 45.8% of the revenue share among non-specific tests segment, is a major factor contributing to the growth of this segment. The U.S. FDA rising acceptance of TOC test for cleaning validation has further propelled the growth of this segment. For instance, TOC is used as a replacement of oxidizable substances test for USP Purified Water. Due to limitations of product-specific testing causing equipment downtime, the cleaning validation field has seen a rise in non-specific methods such as TOC analysis. This shift allows for efficient process evaluation by focusing on broader residue indicators rather than individual product residues.

Regional Insights

North America accounted for 41.9% of revenue share in 2023. Stringent regulations by the US FDA and Health Canada ensure adherence to high cleaning standards, fostering a strong regional manufacturing base. In addition, factors such as the growing presence of pharmaceutical companies, rising healthcare spending, and an increasing disease burden contribute to North America's market leadership.

U.S. Pharmaceutical Cleaning Validation Market Trends

The U.S. market for pharmaceutical cleaning validation is projected to grow at steady pace. The growth is driven by the rapid expansion of pharmaceutical manufacturing facilities, increasing prevalence of diseases, growing geriatric population, increased healthcare expenditure, and rising investments to comply with regulatory standards set by international governing bodies such as the U.S. FDA.

Europe Pharmaceutical Cleaning Validation Market Trends

The European market for pharmaceutical cleaning validation is experiencing growth due to several key factors. European healthcare systems are grappling with rising costs, a growing burden of chronic disease, a rapidly aging demographic, and pressure to deliver high-value care. The European Medicines Agency (EMA) is a pioneer in setting regulatory standards for risk-based cleaning validation standards to avoid cross-contamination in manufacturing facilities. These factors have boosted demand for cleaning validation among pharmaceutical manufacturers, resulting in healthy market growth.

Asia Pacific Pharmaceutical Cleaning Validation Market Trends

The Asia Pacific market is expected to grow significantly during the forecast period mainly due to increasing awareness of the requirement for cleaning validation processes in the Pharmaceutical Industry, especially in China. The growth in this region is also driven by the rapid expansion of pharmaceutical manufacturing facilities, increasing prevalence of diseases, growing geriatric population, increased healthcare expenditure, and rising investments to comply with regulatory standards set by international governing bodies.

Key Pharmaceutical Cleaning Validation Company Insights

Key players are primarily focused on developing pharmaceutical cleaning validation products and services to meet regulatory standards, improve product performance, and avoid cross-contamination, whichis expected to positively impact market growth in the coming years.

Key Pharmaceutical Cleaning Validation Companies:

The following are the leading companies in the pharmaceutical cleaning validation market. These companies collectively hold the largest market share and dictate industry trends.

- Lucideon

- Element Materials Technology

- Hach

- SCION Instruments

- Intertek Group Plc

- Merck KGaA

- SGS SA

- Waters corporation

- KYMOS Group

- Shimadzu corporation

- QPharma, Inc

- ProPharma Group

Recent developments

-

In November 2023, Savillex acquired ONFAB, expanding its reach to global pharmaceutical and biopharma companies, offering solutions that improve user safety, reduce manufacturing costs, and streamline cleaning validation processes.

-

In May 2023, Valgenesis launched a cleaning validation software, which eliminates the commonly cited mistakes observed by the regulatory agencies in cleaning validation programs. It does it by digitizing, automating, and controlling the end-to-end cleaning validating lifecycle according to regulations of the U.S. FDA.

Pharmaceutical Cleaning Validation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 19.30 billion |

|

Revenue forecast in 2030 |

USD 28.40 billion |

|

Growth rate |

CAGR of 6.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, validation test, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Russia; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Singapore; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Luchideon; Elements Material technology; Hach; SCION Instruments; SGS SA; QPharma,inc; ProPharma Group; Merck kGaA; Intertek Group Plc; KYMOS Group; Shimadzu Corporation; Waters Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pharmaceutical Cleaning Validation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical cleaning validation market report based on product, validation test, and region:

-

Products Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule Drug

-

Peptides

-

Proteins

-

Cleaning Detergent

-

-

Validation Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-specific Tests

-

Total Carbon Analysis (TC)

-

Total Organic Carbon Testing (TOC)

-

Non-purgeable Organic Carbon (NPOC)

-

Conductivity

-

Others

-

-

Product-specific Analytical Tests

-

Ultraviolet-Visible Spectroscopy (UV/VIS)

-

High-Performance Liquid Chromatography (HPLC)

-

Liquid Chromatography/ Mass Spectrometry (LC/MS)

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."