- Home

- »

- Medical Devices

- »

-

Pharmaceutical Contract Development And Manufacturing Organization Market 2033GVR Report cover

![Pharmaceutical Contract Development And Manufacturing Organization Market Size, Share & Trends Report]()

Pharmaceutical Contract Development And Manufacturing Organization Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Small Molecule, Large Molecule), By Product (API, Drug), By Services, By Workflow, By Therapeutic Area, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-064-1

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Contract Development And Manufacturing Organization Market Summary

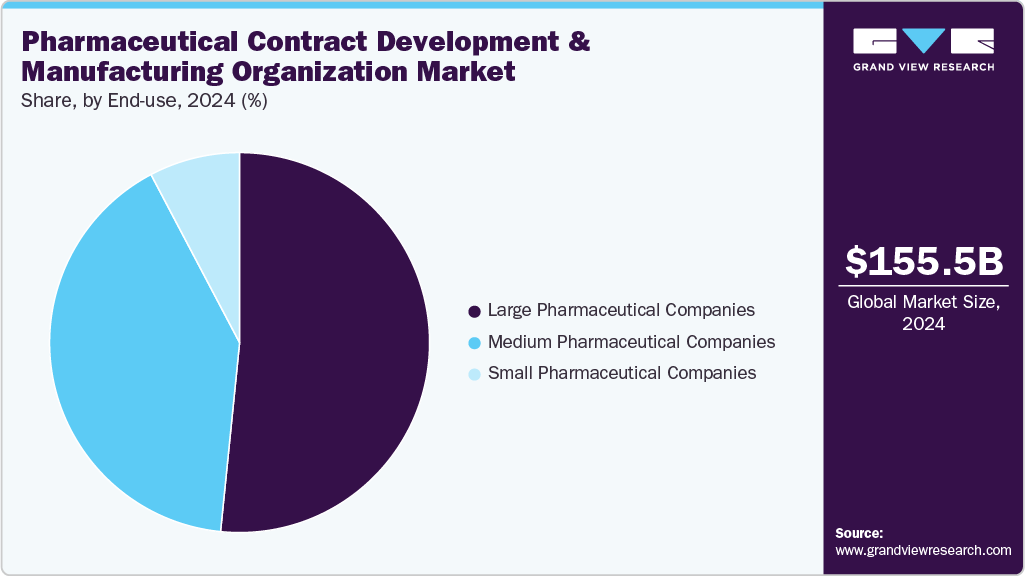

The global pharmaceutical contract development and manufacturing organization market size was estimated at USD 155.5 billion in 2024 and is projected to reach USD 293.6 billion by 2033, growing at a CAGR of 7.38% from 2025 to 2033. Growth in the market can be attributed to the rising investments by CDMOs to expand new drug development and the increasing demand for novel therapies.

Key Market Trends & Insights

- Asia Pacific pharmaceutical contract development and manufacturing organization market held the largest share of 37.90% of the global market in 2024.

- The pharmaceutical contract development and manufacturing organization in the U.S. is expected to grow significantly over the forecast period.

- By type, the small molecule segment led the market with the largest revenue share of 65.63% in 2024.

- By product, the API segment led the market with the largest revenue share in 2024.

- By service, the contract manufacturing segment led the market with the largest revenue share in 2024.

- By workflow, the commercial segment held the highest market share in 2024.

- By therapeutic area, the oncology segment held the highest market share in 2024.

- By end-use, the large pharmaceutical companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 155.5 Billion

- 2033 Projected Market Size: USD 293.6 Billion

- CAGR (2025-2033): 7.38%

- Asia Pacific: Largest market in 2024

In addition, growing investments in pharmaceutical R&D, rising demand for genetic drugs, and growing prevalence of cancer & age-related disorders, coupled with increasing need for advanced therapeutics, are some of the key factors driving market growth.The pharmaceutical industry is experiencing a significant shift from traditional small molecules to biopharmaceuticals. This includes monoclonal antibodies, vaccines, recombinant proteins, and other therapies such as mRNA treatments. In addition, this shift is driven by the growing prevalence of chronic diseases, an aging global population, and the increasing access to targeted therapies that tend to provide better efficacy and fewer side effects than conventional treatments.

According to the data published by IQVIA in January 2024, the global medicine spending at list prices is anticipated to rise by 38% between 2024 and 2028, with biologics accounting for more than 40% of that growth, reflecting the central role in the treatments. Regulators such as the U.S. FDA continue to clear record numbers of innovative biologics, approving 50 novel drugs in 2024, of which a significant proportion were advanced biologics and specialty medicines, supported by a 74% first-cycle approval rate that accelerates patient access. Also, biopharmaceuticals represent over half of the late-stage pipeline, and categories such as GLP-1 agonists for diabetes and obesity, cell and gene therapies for rare diseases, and monoclonal antibody–based cancer therapies are shaping demand trajectories. Therefore, CDMOs play an essential role in this environment as biologics production requires complex infrastructure, such as single-use bioreactors, continuous bioprocessing systems, and high-level cold chain logistics, all of which demand expertise and heavy capital investment.

Opportunity Analysis

The pharmaceutical CDMO market is experiencing new growth opportunities driven by rising demand for outsourcing across drug development and production stages. Besides, expanding pipelines of innovative small molecules, biologics, and advanced therapies creates new opportunities for CDMOs to offer integrated end-to-end services. Moreover, companies in the healthcare industry increasingly rely on CDMOs to provide expertise in formulation, analytical testing, scale-up, and commercial manufacturing while optimizing cost and accelerating time-to-market. Besides, the market has more opportunities, particularly for small molecules, biologics manufacturing, sterile injectables, and highly potent active pharmaceutical ingredients (HPAPIs), where specialized infrastructure and regulatory expertise are required for production processes. Further, emerging markets present new growth avenues as pharmaceutical companies seek to establish efficient supply chains and expand access to affordable medicines. In addition, the trend of personalized and orphan drugs is boosting the need for flexible manufacturing models that CDMOs can provide. Furthermore, growing strategic partnerships, capacity expansion, and compliance with evolving regulatory frameworks are expected to drive the market growth. Thus, the market is expected to witness potential growth opportunities demonstrating technological competence and global reach, as well as further support for both large pharmaceutical companies and emerging biopharma innovators.

Impact of U.S. Tariffs on the Global Pharmaceutical Contract Development And Manufacturing Organization Market

U.S. tariffs on pharmaceutical products have affected the global CDMO market due to increasing raw materials and intermediate product costs. Besides, the tariffs have increased the production expenses for CDMOs that depend on imported ingredients, particularly APIs and excipients from countries like China and India. Besides, cost pressure on CDMOs to increase their fees, compromising their competitiveness in the market, further creates new challenges. In addition, due to supply chain disruption, the pharmaceutical industry explores alternative sourcing strategies and diversifies suppliers across various regions to mitigate risks. However, these tariffs have provided an opportunity for domestic CDMOs in the U.S., as established pharmaceutical companies are increasingly inclined to collaborate with local manufacturers that can offer them compliance, quality, and supply chain services. Moreover, CDMOs are expanding their regional presence by forming strategic partnerships to navigate these cost-related challenges. Thus, U.S. tariffs have changed the pharmaceutical CDMO market dynamics, emphasizing the need for greater supply chain resilience and underscoring the significance of geographic flexibility and operational efficiency.

Technological advancements in pharmaceutical CDMO are expected to drive the market with continuous manufacturing as it is increasingly preferred over traditional batch processes for quality, scalability, and cost reductions. Further, analytical techniques enable the precise characterization of the pharmaceutical products. In addition, the adoption of single-use bioprocessing systems is rising due to their potential to lower contamination risks, minimize cleaning requirements, and support the production of small-batch or personalized medicines. Moreover, automation & robotics drive productivity by reducing human error, increasing throughput, and streamlining tasks such as packaging, inspection, and sample handling. In addition, digitalization & integrated data platforms offer real-time monitoring, predictive maintenance, and enhanced transparency throughout the development and manufacturing lifecycle. Hence, these innovations are expected to provide high-quality, flexible, and cost-effective solutions, further supporting the pharmaceutical companies to accelerate drug development and commercial supply.

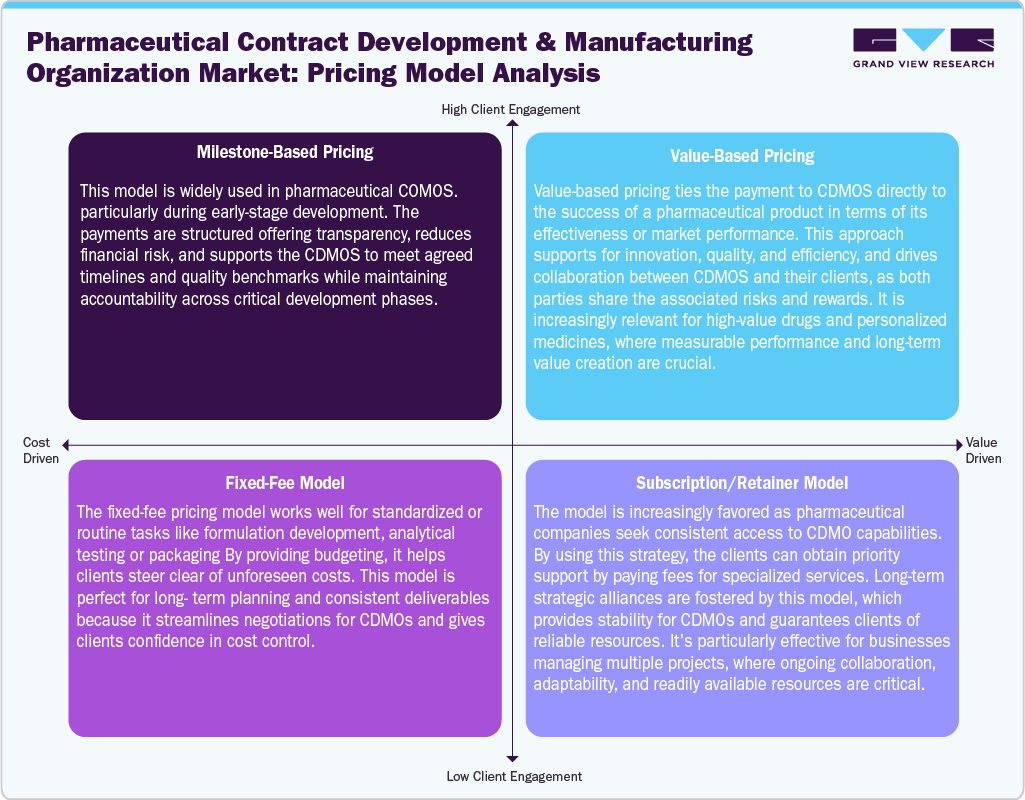

Market pricing models are crucial for client expectations. For instance, milestone-based pricing ties payments to deliverables for transparency and aligns with the development progress. In addition, the value-based pricing links fees to therapeutic or commercial success, promoting efficiency outcomes. The fixed-fee model offers predetermined costs by supporting reliable budgeting and long-term planning. Moreover, subscription models are becoming popular, allowing clients to continuously access CDMO expertise, capacity, and priority services through recurring fees. Thus, these models highlight the demand for flexible agreements, enabling CDMOs to cater to varying drug development and manufacturing needs while encouraging stronger, long-term partnerships.

Market Concentration & Characteristics

The industry growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Continuous improvements in process development, biologics manufacturing, and advanced formulations fuel innovation in pharmaceutical CDMOs. Besides, companies are investing in technologies, flexible manufacturing systems, and specialized capabilities to meet the rising demand for complex therapies. In addition, integrated service models and customized solutions drive the innovations. These efforts strengthen client trust, minimize timelines, and enhance competitiveness, positioning CDMOs as vital partners in the evolving pharmaceutical landscape.

Mergers and acquisitions are transforming the pharmaceutical CDMO market. It allows CDMOs to provide comprehensive, integrated services and enhances their ability to compete with larger industry players. Such activities highlight the rising demand, competitive landscape, and the critical need for scaling and enhancing capabilities.

Regulatory frameworks impact the CDMO operations by ensuring compliance with testing, manufacturing, and supply chain practices. The stringent requirements and compliance demands can lead to increased costs for CDMOs that are well-prepared to stand out from the competition, attract multinational clients, and build long-term partnerships rooted in reliability and trust.

Pharmaceutical CDMOs are broadening their portfolios to meet client needs across the drug lifecycle. This includes formulation, clinical trial material production, packaging, and commercial-scale manufacturing. Besides, demand for biologics, sterile injectables, and high-potency APIs drives the market expansion. Comprehensive, end-to-end solutions allow CDMOs to strengthen partnerships, capture larger market share, and position themselves as one-stop providers.

Regional expansion is a key growth strategy for pharmaceutical CDMOs seeking proximity to clients and new markets. Companies are establishing facilities in Asia-Pacific, Latin America, and the Middle East to leverage cost advantages and growing demand. This approach supports supply chains, enhances regulatory compliance, and provides access to emerging opportunities while diversifying revenue sources and strengthening global competitiveness.

Type Insights

On the basis of type, the small molecule segment held the largest market share in 2024, accounting for a revenue share of 65.63%. Small molecule drug development remains crucial for pharmaceutical CDMOs. CDMOs offer services such as process chemistry, formulation, scale-up, and commercial manufacturing for drug production. Besides, with the growing demand for generics, therapies, and cost-effective production, CDMOs significantly optimize the processes, ensuring compliance with regulatory standards. Their capability to provide comprehensive solutions allows pharmaceutical companies to accelerate their time-to-market and effectively manage complex global supply chains. In addition, CDMOs are investing in continuous manufacturing and high-potency capabilities to establish themselves as strategic partners in the competitive and cost-sensitive landscape of small molecule development and commercialization.

The large molecule segment is expected to grow significantly during the forecast period. Large molecules include biologics, monoclonal antibodies, and cell and gene therapies. With the growing demand for biologics, CDMOs increasingly focus on providing specialized expertise to support clinical and commercial supply. The range of services offered by the market players includes advanced facilities for fermentation, purification, and operations, enabling clients to manage complex production. Moreover, growing investments and modular facilities enhance pharmaceutical scalability and production capacity. Thus, CDMOs are preferred as critical partners due to the growing demand for biology and the advanced therapy market.

Product Insights

On the basis of product, the API segment dominated the market with the largest revenue share in 2024. The segment growth can be attributed to the highly competitive drug development and growing demand for end-to-end contract development & manufacturing organization (CDMO) services. In addition, growing advances in API manufacturing, and growth of the biopharmaceutical sector are some of the key factors propelling segment growth. Moreover, an increasing prevalence of chronic diseases, such as cardiovascular diseases and cancer, is anticipated to boost the market over the forecast period.

The drug product segment is expected to grow significantly during the forecast period. The robust demand for drug products, such as oral solid dose, semisolid dose, liquid dose, and others, is expected to drive the segment over the forecast period. Among drug products, oral solid doses (capsules, tablets, powders, solid & liquid sachets, granules, orally dispersible films, & others) are largely divided into solid & liquid oral dosage forms. Liquid oral dosage forms and semisolids are present as suspensions, syrups, solutions, dispersions, semisolids, softgels, etc. Furthermore, the growing R&D pipeline and burden of chronic and infectious diseases are expected to impact the market positively. The growing burden of diseases is expected to increase the interest of pharmaceutical companies in developing new drugs, fueling CDMO requirements.

Service Insights

On the basis of service, the contract manufacturing segment accounted for the largest share in 2024.The manufacturing supports pharmaceutical companies to enhance their production capacity, cost savings, & operational flexibility. These services cover small- and large-scale manufacturing of APIs, intermediates, and finished dosage forms. By outsourcing manufacturing, pharmaceutical companies reduce capital investments in facilities and gain access to advanced technologies maintained by CDMOs. In addition, CDMOs help manage supply chain complexity while meeting global regulatory standards. Besides, the ability to deliver high-quality, scalable, and compliant manufacturing solutions positions CDMOs as key partners, particularly as demand grows for biologics, sterile injectables, and other specialized therapies worldwide.

The contract development segment is expected to grow significantly during the forecast period. The services offered by CDMOs support early-stage drug formulation, process development, analytical method validation, and scale-up. Besides, it supports reducing development timelines and provides pharmaceutical companies with specialized expertise that may not exist in-house. In addition, CDMOs add value by optimizing processes, ensuring regulatory readiness, and enabling smooth transition into manufacturing stages. Moreover, their integrated approach, which combines development with downstream production capabilities, strengthens client partnerships and creates efficiencies, making them vital contributors to successful drug development programs.

Workflow Insights

On the basis of workflow, the commercial segment dominated the market with the largest revenue share in 2024. The segment is driven by robust demand for pharmaceutical products, including biologics, sterile injectables, and highly potent active pharmaceutical ingredients (APIs). Some other factors contributing to segment growth are rising global trends toward outsourcing and an expanding product pipeline. Besides, currently, most pharmaceutical companies increasingly rely on the expertise and infrastructure of Contract Development and Manufacturing Organizations (CDMOs), allowing them to save time and reduce costs, while focusing on launching new products and navigating complex formulations and strict regulatory standards. Such factors are expected to drive segment growth.

On the other hand, the clinical segment is projected to grow at a significant CAGR duringthe forecast period. The segment growth is primarily attributed to a highly competitive drug development landscape, an increasing demand for end-to-end global services, rising clinical trial volumes, and the growing complexity of therapies. Most companies face surging costs for drug development along with stringent timelines, which has led increased need for partnerships to mitigate operational costs while ensuring compliance across diverse regulatory environments. Moreover, the necessity for risk mitigation, especially related to patient recruitment delays and supply chain continuity, has increased the reliance on CDMOs that provide comprehensive clinical workflow solutions. This has led rising demand for flexible outsourcing models that can effectively support global research and development (R&D) pipelines is expected to drive segment growth.

Therapeutic Area Insights

On the basis of therapeutic area, the oncology segment accounted for the largest share in 2024. The segment's market is likely to expand with the rising development of oncology drugs, growing preclinical research to clinical trial material supply & commercial manufacturing, and increasing cancer cases globally. For instance, the Cancer Atlas mentioned that the number of cancer cases is expected to reach 29 million globally by 2040. This is expected to drive the need for new oncology drugs across the globe, further contributing to market growth. In addition, for oncology drug development, most pharmaceutical CDMO companies offer a range of expertise, including high-potency active pharmaceutical ingredient (HPAPI) synthesis, production of biologics & cell therapies, and advanced formulation techniques for targeted treatment delivery. By ensuring regulatory compliance, CDMOs support oncology companies to achieve faster market entry with increased cost efficiency, further contributing to market growth.

The autoimmune diseases segment is expected to grow significantly during the forecast period.In autoimmune/inflammation, the immune system erroneously targets its healthy cells & tissues; these diseases affect approximately one in 10 individuals. Among autoimmune conditions like Rheumatoid Arthritis (RA), Multiple Sclerosis (MS), lupus, and type 1 diabetes, a shared aspect is the immune system’s malfunction. The misdirected immune response caused by autoimmune conditions leads to persistent inflammation and harm to various organs & systems. Hence, CDMO represents a key milestone for innovating new devices and drug developments for autoimmune diseases. Moreover, the ongoing innovative approaches for autoimmune disease drug development are expected to drive the segment growth. For instance, in January 2025, ImmuPharma PLC mentioned innovative advancements in its preclinical research program focused on P140 and the pathogenesis of autoimmune diseases. This discovery is conducted by the company’s R&D subsidiary ImmuPharma Biotech, which has yielded compelling data that provides novel insights into autoimmune disease mechanisms. Such factors are expected to drive the market.

End Use Insights

On the basis of end-use, the large pharmaceutical companies segment accounted for the largest share in 2024.Large pharmaceutical companies partner with CDMOs to enhance flexibility, reduce costs, and expand manufacturing capacity. While these companies often have in-house resources, outsourcing supports access to specialized capabilities such as biologics production or high-potency drug handling. Besides, CDMOs add value by ensuring regulatory compliance, shortening timelines, and supporting complex supply chains. This collaboration strengthens efficiency and allows large companies to focus resources on innovation and commercialization strategies.

The medium pharmaceutical companies segment is expected to grow at a significant CAGR during the forecast period. These companies depend on CDMOs to bridge gaps between limited in-house resources and market demands. The CDMOs provide access to expertise, advanced technologies, and scalable manufacturing capacity without heavy capital investment. Moreover, CDMOs support formulation, clinical trial material production, and regulatory compliance, supporting medium-sized companies to accelerate product pipelines. By offering end-to-end solutions, CDMOs enable companies to compete effectively and expand market reach, further supporting evolving therapeutic and regulatory needs in the market. Such factors are expected to drive the market.

Regional Insights

North America pharmaceutical contract development and manufacturing organization market is expected to grow at a significant CAGR over the forecast period.The growth is attributed to growing investments in R&D of new drugs by pharmaceutical companies, which boosts the demand for pharmaceutical contract development and manufacturing services. In addition, pharmaceutical companies across the U.S. and Canada are creating a constant stream of novel projects that require external expertise in formulation, scale-up, and advanced manufacturing. Instead of managing every stage internally, many sponsors are collaborating with CDMOs that provide flexible capacity, specialized technologies, and faster development timelines. This trend is showing how outsourcing is becoming a strategic enabler rather than remaining a cost-saving measure. Such factors are expected to drive the market.

U.S. Pharmaceutical Contract Development And Manufacturing Organization Market Trends

The pharmaceutical contract development and manufacturing organization market in the U.S.accounted for the highest market share in the North America market. The U.S. pharmaceutical CDMO market is driven by a robust pipeline in biopharmaceuticals, a high prevalence of chronic diseases, and increasing outsourcing trends among major drug developers. Companies in the U.S. leverage advanced technologies and regulatory know-how while providing extensive capabilities in formulation, clinical trial supply, and commercial manufacturing. In addition, rising demand for biologics, cell and gene therapies, and high-potency drugs further enhances the importance of CDMOs in the industry. In addition, strategic partnerships, capacity expansion, and investments are expected to support the market the growth.

Canada pharmaceutical contract development and manufacturing organization market is expected to grow at a significant CAGR during the forecast period. Canada’s pharmaceutical CDMO market is experiencing steady growth, driven by government backing for life sciences, an expansion in clinical research, and increasing demand for biopharmaceuticals. In addition, Canadian CDMOs are recognized for their quality manufacturing, adherence to regulatory standards, and specialization in sterile injectables and biologics. Moreover, rising investments in R&D are expected to drive cost-effective and high-quality drug production for global pharmaceutical and biotechnology companies. Such factors are expected to drive the market.

Europe Pharmaceutical Contract Development And Manufacturing Organization Market Trends:

The pharmaceutical contract development and manufacturing organization market in Europe is evolving due to regulatory framework, proximity to major pharma headquarters, and a skilled scientific workforce. Growing complexity of drug molecules, particularly biologics, cell and gene therapies, and high-potency APIs, is encouraging pharmaceutical companies to rely on CDMOs with specialized capabilities rather than expanding in-house infrastructure. In addition, emphasis on sterile injectables, parenteral drugs, and advanced formulation technologies has led to expansions across European countries. Besides, this trend is also supported by government policies encouraging domestic manufacturing of critical medicines, particularly in the EU, where supply security has become a key healthcare priority.

Furthermore, established companies such as Lonza, Recipharm, Siegfried, and Eurofins are expanding their service portfolios through acquisitions of niche technology providers, while mid-sized CDMOs are scaling capacity to attract biologics and advanced therapy projects. In turn, this outsourcing approach has strengthened long-term partnerships between European CDMOs and global pharmaceutical innovators, positioning as the developing region across the globe for contract development and manufacturing landscape.

Germany pharmaceutical contract development and manufacturing organization market held the highest share in Europe in 2024. Germany is a leading European hub for pharmaceutical CDMOs driven by presence of advanced technology infrastructure, and highly skilled workforce. Besides, CDMOs in the country are specializing high-quality manufacturing of APIs, biologics, and advanced formulations, meeting strict EU regulatory standards. In addition, with growing focus on complex therapies and personalized medicines, CDMOs in Germany are investing in innovation and flexible capacity. Collaborations with global pharmaceutical companies and proximity to major European markets strengthen their role. The country’s emphasis on quality, efficiency, and compliance positions German CDMOs as reliable partners in global drug development and manufacturing.

The pharmaceutical contract development and manufacturing organization market in the UK is expected to grow significantly over the forecast period. The market is driven by increased R&D activities, expanding biomanufacturing capabilities, and regulatory environments. Besides, CDMOs offer specialized knowledge in small molecules, biologics, and innovative formulations, excelling particularly in early-stage development and the supply of clinical trial materials. In addition, the market is fueled by collaborations & government backing for life sciences. Thus, as the demand for personalized medicines increases, UK-based CDMOs are broadening their service offerings, reinforcing their roles as essential partners for domestic and international pharmaceutical companies needing high-quality, compliant solutions.

Asia Pacific Pharmaceutical Contract Development And Manufacturing Organization Market Trends

The pharmaceutical contract development and manufacturing organization market in Asia Pacificdominatedthe global industry in 2024, holding a revenue share of 37.90%.The market has become a critical hub for global drug development and manufacturing driven by its cost-efficient production capabilities, growing scientific expertise, and rising local demand for innovative medicines. Besides, the region benefits from a favorable cost structure for raw materials, labor, and large-scale facilities, attracting multinational pharmaceutical companies to shift portions of their supply chain to APAC. Increasing investments in biologics and biosimilars, coupled with government initiatives to strengthen domestic manufacturing, are also fueling expansion in high-value CDMO services. Local biotech innovation, particularly in China and South Korea, has further created opportunities for CDMOs to provide integrated services spanning preclinical development to commercial supply.

China pharmaceutical contract development and manufacturing organization market is rapidly growing due to cost benefits, increasing domestic needs, and global outsourcing trends. These organizations offer various services, including small molecule APIs, biologics, and large-scale production, backed by significant investments in technology. Supported by the government, China is becoming a key player in global outsourcing, but compliance with regulatory and quality standards is essential for international collaborations. Chinese CDMOs are enhancing their role in global drug manufacturing by leveraging competitive pricing and improving advanced therapy expertise.

The pharmaceutical contract development and manufacturing organization market in Japan is driven by presence of established pharmaceutical industry, robust regulatory standards, and a rising demand for biologics and specialty drugs. Japanese CDMOs emphasize high-quality production, formulation, and the provision of clinical trial supplies, supported by advanced infrastructure and expertise. Moreover, strategic partnerships with multinational companies and collaborations with research institutes drive innovations.

India pharmaceutical contract development and manufacturing organization market is experiencing rapid expansion attributed to low costs, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities. Furthermore, some of the key players in India's pharmaceutical contract development and manufacturing services are Wuxi AppTec, Charles River Laboratories International, Inc., IQVIA, Recipharm AB; and Catalent, Inc. Local players include Dr. Reddy's Laboratories, Cadila Healthcare Limited, and Cipla Ltd. Several CMOs & CROs operating in India have expanded their facilities to meet the growing demand for pharmaceuticals.

Latin America Pharmaceutical Contract Development And Manufacturing Organization Market Trends

The pharmaceutical contract development and manufacturing organization market in the Latin America region is expected to significant witness growth over the estimated time period. The market in the region is fueled by rising demand for cost-effective drug development and manufacturing solutions, coupled with the growing presence of multinational pharmaceutical companies. Besides, countries such as Brazil are emerging as attractive outsourcing destinations due to their large patient populations, expanding healthcare infrastructure, and competitive operating costs compared to North America and Europe. In addition, the growing demand for generic drugs & biosimilars is accelerating the reliance on CDMOs, as regional governments encourage affordable treatment access through local production. In parallel, the rise in chronic diseases such as diabetes, cancer, and cardiovascular conditions is driving drug innovation pipelines, creating opportunities for CDMOs to provide formulation development, scale-up, and commercial manufacturing support.

Brazil pharmaceutical contract development and manufacturing organization market is driven by robust growth and development in biologics, and the rising pharmaceutical market are expected to boost pharmaceutical CDMO in the country. Moreover, the demand for pharmaceutical CDMO in the country is growing as consumers increasingly seek effective pharmaceutical formulations due to the growing burden of diseases. The rising competition for drug development and approval is anticipated to increase the requirement for pharmaceutical CDMO.

Middle East & Africa Pharmaceutical Contract Development And Manufacturing Organization Market Trends

The pharmaceutical CDMO market in the Middle East & Africa region is gaining traction due to growing demand for new therapies and affordable generics, which is encouraging partnerships between multinational drug makers and regional CDMOs. Cost efficiency, coupled with improving regulatory frameworks, enables global sponsors to outsource formulation development, packaging, and manufacturing activities to the region. In addition, growing investment in sterile injectables and biosimilars production, alongside expanding clinical trial activities, further reinforces CDMO demand across MEA. Such factors are expected to drive the market over the estimated time period.

The UAE pharmaceutical contract development and manufacturing organization market is experiencing growth driven by rising prevalence of several chronic diseases, increasing investments in complex biologic molecules development, a supportive regulatory environment, entry of new market players, and growing year-on-year investments of foreign pharmaceutical companies & CDMOs. Moreover, the market is fueled by domestic players who expand their pharmaceutical production capacities & geographical presence through various strategies. Such factors support the country's production of pharmaceutical products.

Key Pharmaceutical Contract Development And Manufacturing Company Insights

Key players operating in the pharmaceutical contract development and manufacturing organization market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Pharmaceutical Contract Development And Manufacturing Companies:

The following are the leading companies in the pharmaceutical contract development and manufacturing organization market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- Lonza

- Recipharm AB

- Catalent, Inc

- WuXi AppTec, Inc

- Samsung Biologics

- Piramal Pharma Solutions

- Siegfried Holding AG

- Corden Pharma International

- Cambrex Corporation

- Vetter Pharma

- Delpharm

- Jubilant Pharmova / HollisterStier

- Eurofins CDMO

- Almac Pharma Services

Recent Developments

-

In April 2025, Thermo Fisher launched an enhanced CHO K-1 cell line, reducing IND timelines from 13 to nine months, boosting protein expression, and accelerating biologics development with integrated CDMO, CRO, and bioprocessing solutions.

-

In August 2025,Polpharma Biologics and Fresenius Kabi launched a global licensing deal for PB016, a proposed vedolizumab biosimilar, with Polpharma leading development/manufacturing and Fresenius Kabi handling global commercialization, excluding MENA.

-

In December 2024, Altaris announced the acquisition of WuXi AppTec’s U.S. and U.K. Advanced Therapies unit, expanding its cell therapy portfolio with viral vector, process development, and biosafety testing capabilities.

Pharmaceutical Contract Development And Manufacturing Organization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 166.0 billion

Revenue forecast in 2033

USD 293.6 billion

Growth rate

CAGR of 7.38% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, service, workflow, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Thermo Fisher Scientific, Inc; Lonza; Recipharm AB; Catalent, Inc; WuXi AppTec, Inc; Samsung Biologics; Piramal Pharma Solutions; Siegfried Holding AG; Corden Pharma International; Cambrex Corporation; Vetter Pharma; Delpharm; Jubilant Pharmova / HollisterStier; Eurofins CDMO; Almac Pharma Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Contract Development And Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmaceutical contract development and manufacturing organization market report based on type, product, service, workflow, therapeutic area, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecule

-

Branded

-

Generic

-

-

Large Molecule

-

Biologics

-

Biosimilar

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

API

-

Traditional Active Pharmaceutical Ingredient (Traditional API)

-

Highly Potent Active Pharmaceutical Ingredient (HP-API)

-

Biologics

-

Others

-

-

Drug Product

-

Oral solid dose

-

Semi-solid dose

-

Liquid dose

-

Others

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Development

-

Pre-formulation & Formulation Development Services

-

Process Development & Optimization

-

Analytical Testing & Method Validation

-

Scale-up & Tech Transfer

-

-

Contract Manufacturing

-

API Manufacturing

-

Finished Drug Products Manufacturing

-

-

Packaging and Labelling

-

Regulatory Affairs

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Commercial

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Infectious Diseases

-

Neurological Disorders

-

Cardiovascular Disease

-

Metabolic Disorders

-

Autoimmune Diseases

-

Respiratory Diseases

-

Ophthalmology

-

Gastrointestinal Disorders

-

Orthopedic Diseases

-

Dental Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Pharmaceutical Companies

-

Medium Pharmaceutical Companies

-

Large Pharmaceutical Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical contract development and manufacturing organization market size was estimated at USD 155.5 billion in 2024 and is expected to reach USD 166.0 billion in 2025.

b. The global pharmaceutical contract development and manufacturing organization market is expected to grow at a compound annual growth rate of 7.38% from 2025 to 2033 to reach USD 293.6 billion by 2033.

b. Asia Pacific dominated the pharmaceutical CDMO market, with a share of 37.90% in 2024. The market is driven by its cost-efficient production capabilities, growing scientific expertise, and rising local demand for innovative medicines. In addition, rapid advancements in drug delivery technology and growing partnership agreements between CDMOs and pharmaceutical companies are anticipated to drive the market.

b. Some key players operating in the pharmaceutical CDMO include Thermo Fisher Scientific, Inc, Lonza, Recipharm AB, Catalent, Inc, WuXi AppTec, Inc, Samsung Biologics, Piramal Pharma Solutions, Siegfried Holding AG, Corden Pharma International, Cambrex Corporation, Vetter Pharma, Delpharm, Jubilant Pharmova / HollisterStier, Eurofins CDMO, and Almac Pharma Services, among others.

b. Growth in the market can be attributed to the rising investments by CDMOs to expand new drug development and increasing demand for novel therapies. In addition, growing investments in pharmaceutical R&D, rising demand for genetic drugs, and growing prevalence of cancer & age-related disorders, coupled with increasing need for advanced therapeutics, are some of the key factors driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.