Pharma HUB And Patient Access Support Service Market Size, Share & Trends Analysis Report By Service Type (Program Enrollment, Treatment Navigators), By Service Delivery Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

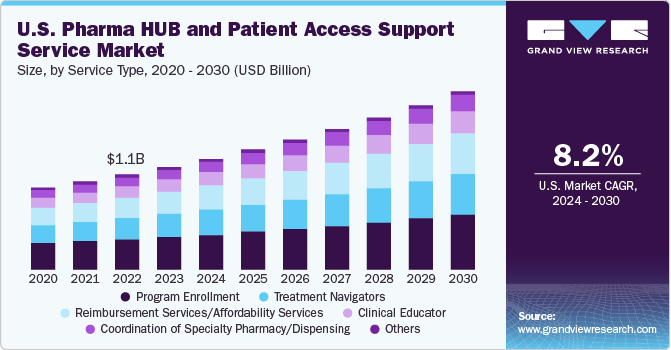

The global pharma HUB and patient access support service market size was estimated at USD 3.0 billion in 2023 and is expected to grow at a CAGR of 9.9% from 2024 to 2030. The growth is attributed to the increasing need to administer new medicines for various specialties and rare & orphan diseases, prioritizing creating a patient-centric ecosystem to support patients throughout their therapy, and the growing demand for customized solutions to enhance patient outcomes.

The market is further driven by players undertaking several strategic initiatives. For instance, in November 2023, Docquity announced the expansion of its digitized patient access program, DocquityCare PAP, to Thailand. It launched five PAPs in Thailand, supporting 250 authorized HCPs and around 100 enrolled hospitals to enhance patient care for individuals with cancer and additional life-threatening conditions.

The prevalence of genetic and rare diseases worldwide serves as a significant driver for the growth of the market. For instance, according to Global Genes, over 10,000 genetic and rare diseases impact an estimated 400.0 million individuals globally. These diseases often pose unique challenges, including limited treatment options, complex diagnoses, and specialized care requirements. As a result, pharmaceutical companies and healthcare providers are increasingly focusing on developing targeted therapies and personalized medicine solutions to address these medical needs.

The demand for innovative treatments and specialized care for genetic and rare diseases has led to the emergence of dedicated pharma HUB and patient access support services. These services play a crucial role in facilitating access to life-changing therapies, providing patient education and support, navigating reimbursement processes, and ensuring continuity of care for individuals affected by these conditions.

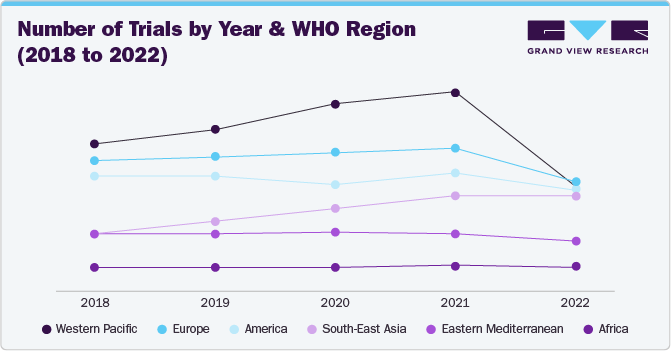

Furthermore, increasing government support in the form of funding aimed at drug development to cure chronic diseases is also contributing to the market growth. Hence, many prominent pharmaceutical and biotechnological companies are conducting numerous clinical trials due to the clinical urgency of developing high-potency drugs, contributing to market growth. These drugs are further made available to patients as per their needs. The following is the number of clinical trials conducted in various WHO regions.

Case Study Insights

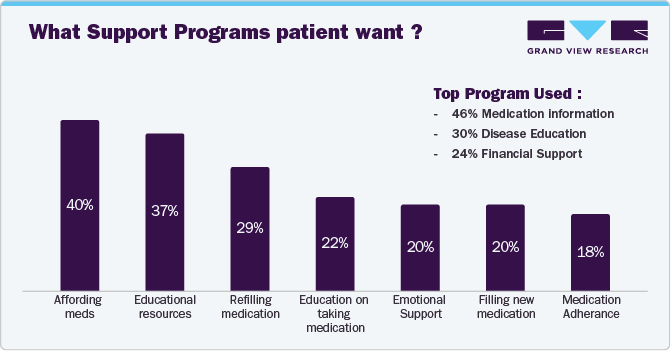

Phreesia, a healthcare technology company, conducted a survey of patients who checked in for their doctor's visits on the Phreesia Platform between February 17 and March 2, 2021. The survey aimed to gain insights into patient support programs for medications and understand patients' opinions and experiences with such programs.

Result shows: According to a survey conducted on the Phreesia platform, 53% of patients expressed a strong intention to use the copay card, indicating that the content they saw on the platform had a significant impact on their decision-making.

Phreesia's technology solutions help healthcare providers engage with patients in a personalized and effective way by delivering clinically relevant content at every stage of their care journey.

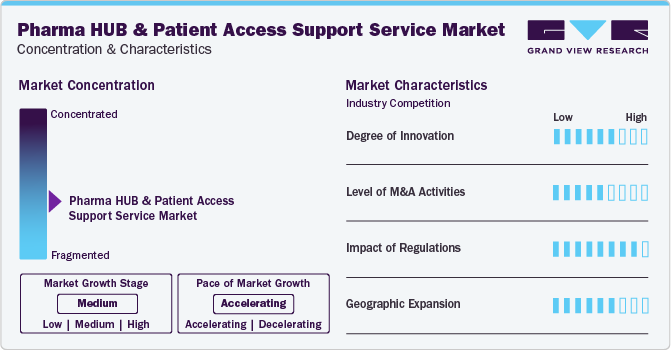

Market Concentration & Characteristics

The degree of innovation in the industry is medium. Technology plays a vital role in patient access services, as it automates appointment scheduling, facilitates telemedicine, enhances patient portals, improves data collection and analysis, enables patient engagement, and more. It offers convenience for patients to access care and offers healthcare providers tools and data to help them improve the efficiency and quality of care.

The M&A activities enable companies to expand geographically, financially, and technologically. Furthermore, strategic partnerships and acquisitions with patient access support providers offer companies a competitive edge across various sectors, contributing to pharma HUB and patient access support market growth. For instance, with Inizio Engage's strategic roadmap, in February 2022, the company Group acquired the remaining 80% membership interest in Propensity4 Smart Data LLC, following a 20% acquisition in 2021. Propensity4, a notable player in healthcare insights and analytics, joined Inizio Engage, enhancing the company's analytical capabilities. This acquisition enabled Inizio Engage to leverage analytical expertise for program redesign, improving return on investment in patient engagement, commercial, and medical affairs services, ultimately enhancing patient outcomes.

The impact of regulations is high in the industry. The U.S. FDA and other relevant regulatory authorities primarily govern the U.S. regulatory framework for pharma HUB and patient access support services. These regulations aim to ensure the safety, efficacy, and quality of pharma HUB and patient access support services used in clinical trials and healthcare settings.

Companies in the industry undergo geographic expansion strategies to maintain their position in emerging markets and customer base from these regions. For instance, in April 2023, PharmaCord LLC expanded its operations by opening a new facility in Jeffersonville, Indiana. This facility is strategically designed to enhance capacity, specifically catering to the sustained growth in patient support programs that PharmaCord manages for its life sciences clients.

Service Type Insights

The program enrollment segment dominated the market with the largest share of 31.3% in 2023. Program enrollment refers to the procedure of registering patients in specific programs that aim to provide them access to healthcare services, medications, or support required to manage their health conditions. The growing demand for customized solutions and the need to enable better patient outcomes drive the need for patient enrollment services. Several companies are launching new program enrollment solutions contributing to the market growth. For instance, in December 2022, Pfizer Inc. launched ‘Pfizer PAP India,’ a mobile application designed to enable and accelerate enrolment in Pfizer’s Patient Access Programmes (PAP). Pfizer operated over 10 programs backing patients undergoing treatments.

The reimbursement services/affordability services segment is expected to grow at the fastest CAGR during the forecast period. Reimbursement services refer to specialized offerings that assist healthcare providers, pharmaceutical companies, and patients in navigating the complex landscape of healthcare reimbursement. These services aim to optimize revenue capture, streamline reimbursement processes, and ensure timely payment for healthcare services and medications. For instance, McKesson RxO's PAP Reimbursement and Revenue Recovery Management solutions are designed to pinpoint revenue-generating opportunities, streamline the review and validation processes of pharmacy revenue cycle data through automation, enhance the collection of revenue for medications administered in clinics, and establish seamless communication between pharmacies and finance departments.

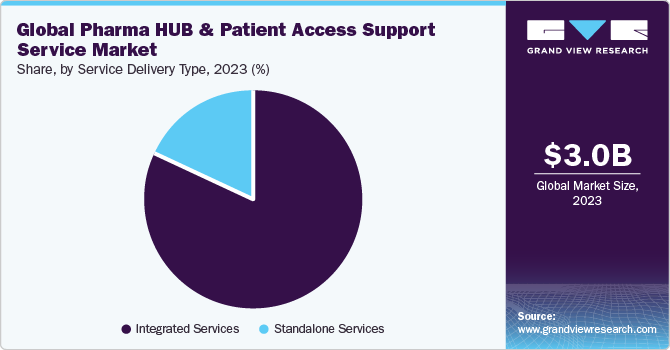

Service Delivery Type Insights

The integrated services segment dominated the market with the largest share in 2023. With the launch of complex pharmaceutical products and the need for effective market access, manufacturers are looking for a comprehensive approach to streamline their services. Integrated solutions offer a unified platform to manage various functions such as patient access support, reimbursement assistance, and pharmacy coordination. To overcome the complexity of the product lifecycle, key manufacturers are focusing on expanding their services. In March 2023, Terebellum (AscellaHealth) expanded its HUB/patient support services for life sciences manufacturers. These services help ensure access to medication, compliance, and improved outcomes for patients. Terebellum's outsourced solutions are known as the best-in-class in the industry.

The standalone services segment is expected to grow at a significant CAGR during the forecast period. As the pharmaceutical industry becomes more complex and regulations keep changing, companies are looking for specialized services that go beyond traditional offerings. Patient access support and pharmaceutical HUB services are customized solutions that address challenges such as market access, reimbursement, and patient engagement. In addition, there is an increasing demand for services that improve patient access, adherence, and overall experience as the pharmaceutical industry is shifting toward patient-centric approaches.

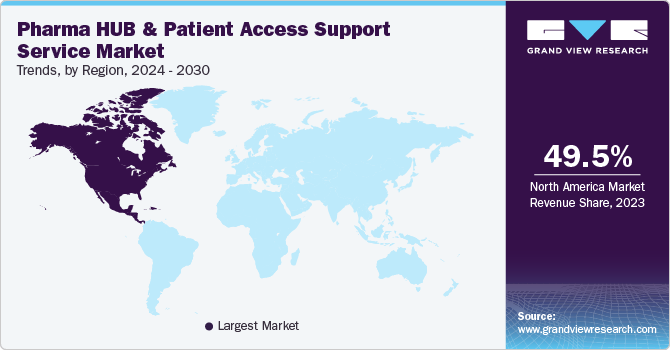

Regional Insights

North America dominated the pharma HUB and patient access support service market with a revenue share of 49.5% in 2023. The increasing target population, coupled with the rising prevalence of lifestyle-associated diseases, such as diabetes & cardiovascular disorders, are factors contributing to the market growth. The National Institute of Mental Health’s re-release of funding opportunity announcements for clinical trial-based research is expected to fuel market growth further. Moreover, the presence of major market players and the availability of sophisticated infrastructure are projected to boost growth in this region.

U.S. Pharma HUB And Patient Access Support Service Market Trends

The pharma HUB and patient access support service market in the U.S. dominated the North American region in 2023. Key players in the market are investing to enhance patient access to clinical trials, which is anticipated to fuel market growth over the forecast period. For instance, in June 2022, Parexel, a global clinical research organization, launched the Community Alliance Network. The initiative aimed to enhance the integration of clinical research into community healthcare settings to better serve patients and increase diversity in clinical trials.

Europe Pharma HUB And Patient Access Support Service Market Trends

The pharma HUB and patient access support service market of Europe had a significant revenue share in 2023. As a developed region, Europe has a greater healthcare spending capability, which boosts the demand for pharma HUB and patient access support services.In addition, the growing geriatric population in Europe is leading to an increase in the prevalence of target diseases, which is expected to increase the demand for patient access support services in the region.

Germany pharma HUB and patient access support service market dominated the European region in 2023. There has been a growing focus on patient-centric approaches in healthcare and clinical research in the country. According to an article published by Cardinal Health in 2022, it was found that more than 90% of physicians are facing patient care delays due to the prior authorization process. The complexities involved have led to about 37% of these physicians abandoning the requests. To ensure patients can access and stay on therapies, it is necessary to adopt technology solutions such as eBV & ePA to compress onboarding time for both prior authorizations and electronic benefit investigations.

The pharma HUB and patient access support service market in the UK is expected to grow significantly during the forecast period. As the UK continues to prioritize digital health and invest in research & innovation, pharma HUB and patient access support services are expected to play an increasingly critical role in advancing clinical research and improving patient outcomes. Furthermore, the UK has been emphasizing patient-centric approaches in healthcare. Patient access support services with patient engagement features, such as patient portals and ePRO tools, are being adopted to involve actively patients in clinical research. This is anticipated to propel the market growth over the forecast period.

Asia Pacific Pharma HUB And Patient Access Support Service Market Trends

The pharma HUB and patient access support service market in Asia Pacific is growing as high unmet medical needs and the rising prevalence of target chronic diseases such as cancer, cardiovascular conditions, and infectious diseases are stoking the demand for software solutions in the region. As an emerging economy, the growth of the APAC market is largely driven by government funding related to research and drug discovery, which is estimated to enhance its growth over the forecast period.

China pharma HUB and patient access support service market had a significant market share in 2023. The country has immense growth opportunities owing to improved healthcare facilities and untargeted medical needs. According to the Clarivate April 2023 insights, the Chinese government significantly focuses on enhancing access to treatment for rare diseases, driving the adoption of patient HUB & patient access support services. Furthermore, China's regulatory environment is evolving rapidly to accommodate the growing adoption of digital health solutions, including patient access support services, positively impacting market growth.

The pharma HUB and patient access support service market in Japan is expected to grow significantly during the forecast period. Japan is a significant player in the global pharmaceutical and clinical research industry. The country's pharmaceutical companies and research institutions conduct numerous clinical trials. Therefore, the adoption of eClinical solutions along with pharma HUB and patient access support services has become essential for efficient data collection, management, & analysis during these trials. In addition, the Japanese government supports digital health initiatives and technology adoption in healthcare.

Key Pharma HUB And Patient Access Support Service Company Insights

The pharma HUB and patient access support service market is fairly competitive, and some of the most notable participants in the market are PharmaCord, McKesson, Inizio Engage, and others. These players are involved in new product launches, partnerships, and acquisitions to gain a competitive edge over each other.

Key Pharma HUB And Patient Access Support Service Companies:

The following are the leading companies in the pharma hub and patient access support service market. These companies collectively hold the largest market share and dictate industry trends.

- PharmaCord

- Fortrea

- AssistRx

- CareMetx

- ConnectiveRx

- Lash Group

- McKesson

- Inizio Engage

- NS Pharma, Inc. (a wholly owned subsidiary of Nippon Shinyaku Co., Ltd.)

- Sonexus Health (acquired by Cardinal Health)

- Envoy Health Management, LLC (independently operated subsidiary of Diplomat Pharmacy, Inc.)

- EVERSANA

- United BioSource LLC (UBC)

- Mercalis

Recent Developments

-

In July 2023, Inizio Engage launched the Patient Access Services, a tailored and integrated suite of patient support services designed to enhance the overall patient experience. Specifically crafted to promote adherence and enhance health outcomes in specialty, rare, or orphan diseases, this service is aimed at assisting patients, care partners, HCPs, and their staff. It addresses the complexities faced during the lengthy journey to diagnosis.

-

In June 2023, AssistRx introduced Advanced Gateway, a single API integration solution. This innovative solution enables the implementation of tech-first, self-service access solutions for patients and healthcare providers. With the single integration, life sciences organizations can access standardized and actionable program data, eliminating the need for multiple vendor partnerships to support the patient journey.

-

In June 2023, Labcorp announced the spin-off of Fortrea. Fortrea is now an independent CRO that offers patient access, Phase I-IV clinical trial management, and technology solutions to biotechnology & pharmaceutical organizations globally. This strategic move is anticipated to enhance the company’s ability to meet customer needs, unlock shareholder value, and facilitate targeted value-creating investments.

-

In January 2022, CareMetx, LLC acquired Human Care Systems, Inc., a company assisting patients in adhering to and benefiting from pharmaceutical & biotechnology products. Its offerings include Resilix, a proprietary technology platform designed to provide patients with a personalized treatment experience. Through this acquisition, CareMetx aims to enhance its capability to support the entire patient journey, spanning from initiation to adherence.

-

In June 2021, United BioSource LLC partnered with Surescripts, the country’s leading health information network. This partnership integrates Surescripts Specialty Patient Enrollment service into UBC’s biopharma support services. This enhanced service enables healthcare providers to seamlessly initiate Risk Evaluation And Mitigation Strategies (REMS) enrollment, clinical studies, registries, and patient support services directly from their EMR workflow, eliminating the need to switch platforms.

Pharma HUB And Patient Access Support Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.2 billion |

|

Revenue forecast in 2030 |

USD 5.7 billion |

|

Growth rate |

CAGR of 9.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service Type, service delivery type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

PharmaCord; Fortrea; AssistRx; CareMetx; ConnectiveRx; Lash Group; McKesson; Inizio Engage; NS Pharma, Inc. (a wholly owned subsidiary of Nippon Shinyaku Co., Ltd.); Sonexus Health (acquired by Cardinal Health); Envoy Health Management, LLC (independently operated subsidiary of Diplomat Pharmacy, Inc.); EVERSANA; United BioSource LLC (UBC); Mercalis |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

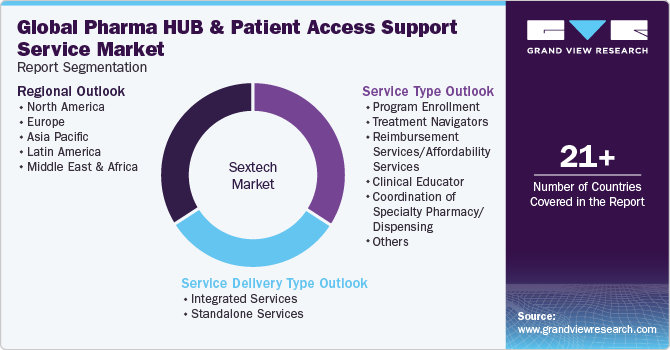

Global Pharma HUB And Patient Access Support Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global pharma HUB and patient access support service market report based on service type, service delivery type, and region:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Program Enrollment

-

Order processing

-

Application processing

-

Ease of enrollment (through phone, face, portal, or app)

-

Program data

-

-

Treatment Navigators

-

Process flows and standard operating procedures

-

Program literature and scripts

-

Care team training

-

Systems testing and optimization

-

-

Reimbursement Services/Affordability Services

-

Clinical Educator

-

Coordination of Specialty Pharmacy/Dispensing

-

Others

-

-

Service Delivery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated Services

-

Standalone Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharma HUB and patient access support service market was valued at USD 3.0 billion in 2023 and is expected to reach 3.2 billion in 2024.

b. The global pharma HUB and patient access support service market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 5.7 billion by 2030.

b. North America dominated the pharma HUB and patient access support service market with a revenue share of 49.5% in 2023. The increasing target population, coupled with the rising prevalence of lifestyle-associated diseases, such as diabetes & cardiovascular disorders, are factors contributing to the market growth.

b. Some key players operating in pharma HUB and patient access support service market include PharmaCord, Fortrea, AssistRx, CareMetx, ConnectiveRx, Lash Group, McKesson, Inizio Engage, Mercalis, United BioSource LLC, EVERSANA, etc.

b. Key factors driving the market are increasing need to administer new medicines for various specialties and rare & orphan diseases, prioritizing creating a patient-centric ecosystem to support patients throughout their therapy, and the growing demand for customized solutions to enhance patient outcomes.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."