- Home

- »

- Healthcare IT

- »

-

Pharma 4.0 Market Size, Share And Growth Report, 2030GVR Report cover

![Pharma 4.0 Market Size, Share & Trends Report]()

Pharma 4.0 Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Software, Services), By Technology (AI/ML, Big Data Analytics, IoT, Blockchain Technology), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-385-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharma 4.0 Market Summary

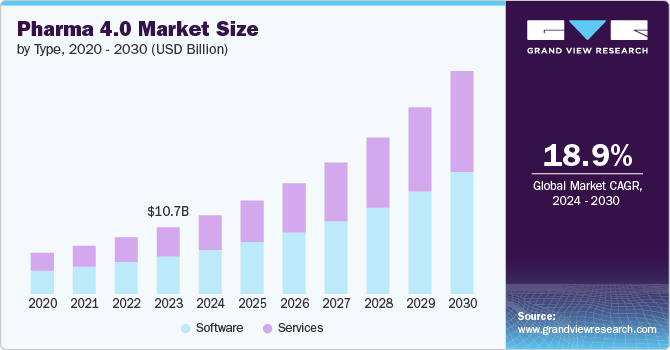

The global pharma 4.0 market size was estimated at USD 10.68 billion in 2023 and is projected to reach USD 35.79 billion by 2030, growing at a CAGR of 18.96% from 2024 to 2030. Pharma 4.0 represents a paradigm shift in pharmaceutical manufacturing through the integration of cutting-edge technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), Big Data Analytics, and Blockchain.

Key Market Trends & Insights

- North America dominated the pharma 4.0 market with a market share of 43.9% in 2023.

- The Pharma 4.0 Market in Europe is expected to grow at a substantial rate over the forecast period.

- The Pharma 4.0 Market in the Asia Pacific region is expected to grow at a rapid rate of 21.1% over the forecast period.

- Based on type, the software segment held the largest market share of 56.2% in 2023.

- In terms of technology, the AI/ML segment held the largest market share of 32.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.68 billion

- 2030 Projected Market Size: USD 35.79 billion

- CAGR (2024-2030): 18.96%

- North America: Largest market in 2023

These advancements are pivotal in enhancing and optimizing manufacturing processes within the industry. The market's expansion is propelled by several key drivers, including the rising demand for personalized medicine, the need for increased efficiency and productivity, and the pursuit of improved regulatory compliance. The growing prevalence of chronic conditions like cancer, diabetes, and genetic disorders has escalated the demand for personalized treatment approaches. AI, in particular, offers transformative potential by enabling more accurate diagnoses, optimized treatment selection, and advanced disease prediction. By tailoring treatment plans to individual patient profiles-encompassing genetic information, disease stage, and medical history, AI contributes to better patient outcomes and reduces healthcare costs by focusing on the most effective therapies for each individual.

In addition, the implementation of these advanced technologies significantly boosts operational efficiency. AI-driven systems automate numerous processes, minimize manual labor, and streamline workflows. In the pharmaceutical sector, AI is leveraged for tasks such as data analysis, documentation, and regulatory compliance, leading to cost savings and enhanced resource management. For instance, Starmind’s AI-powered expertise directory facilitates efficient knowledge sharing and collaboration by connecting employees with internal experts, thereby reducing the time spent searching for information, keeping projects on track, and avoiding duplication of efforts by providing immediate access to verified expertise.

Blockchain technology plays a pivotal role in enhancing pharmaceutical operations by preventing counterfeit drugs, ensuring data integrity, and simplifying regulatory compliance. Its tamper-proof and transparent nature makes it exceptionally difficult for counterfeiters to infiltrate the supply chain. By enabling consumers to verify the authenticity of their medications through blockchain tracing, it allows them to make well-informed decisions regarding the products they use.

Furthermore, blockchain brings unprecedented transparency to clinical trial data, safeguarding the authenticity and accuracy of results. Immutable blockchain records can verify patient consent, preserve data integrity, and ensure adherence to protocols, thereby fostering trust among stakeholders. In addition, Blockchain's automated verification capabilities streamline the regulatory compliance process. By creating a secure, tamper-proof repository for regulatory documents, it facilitates faster audits and ensures adherence to global standards.

Pharmaceutical companies are increasingly investing in digital transformation, which is driving market growth. For instance, Pfizer has partnered with IBM Watson to harness AI in drug discovery, with a focus on accelerating the identification of new drug targets in immuno-oncology. Technology providers such as IBM, Microsoft, and Amazon Web Services (AWS) are instrumental in supporting Pharma 4.0 initiatives by supplying critical infrastructure and tools. AWS, for example, provides cloud-based solutions to pharmaceutical companies, enabling the storage and analysis of vast amounts of data generated throughout the drug development process.

Case Study

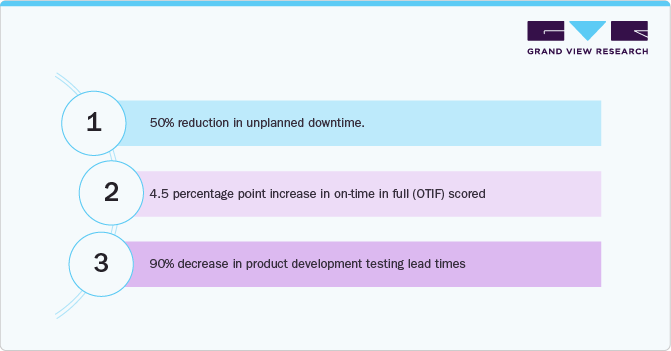

Johnson & Johnson's AI-Powered Manufacturing Optimization

Overview:

Johnson & Johnson has experienced substantial benefits from its Pharma 4.0 investments, which integrate AI and other advanced technologies into their manufacturing processes. These initiatives have led to notable improvements across various key performance indicators.

Results: These AI-powered Pharma 4.0 initiatives have significantly enhanced Johnson & Johnson's manufacturing efficiency, product quality, and supply chain performance. The integration of AI has led to:

-

Cost Reductions: Lower operational costs due to decreased downtime and optimized processes.

-

Increased Output: Higher production capacity through streamlined operations.

-

Accelerated Time-to-Market: Faster development and production cycles for new products, enhancing competitiveness in the market.

Conclusion: Johnson & Johnson’s investment in AI and advanced technologies has revolutionized their manufacturing processes, driving substantial improvements in efficiency, quality, and overall performance. These advancements demonstrate the transformative potential of AI in the pharmaceutical manufacturing sector.

Type Insights

The software segment held the largest market share of 56.2% in 2023. The demand for software solutions in the pharmaceutical industry is increasing as companies seek to harness advanced digital technologies to enhance efficiency, innovation, and compliance across their operations. The integration of Artificial Intelligence (AI), Machine Learning (ML), and big data analytics is transforming drug discovery, development, and personalized medicine efforts. These software solutions amalgamate various datasets-such as genomic, clinical, and behavioral information-to advance personalized medicine, ultimately improving treatment outcomes and patient satisfaction. In addition, the incorporation of Internet of Things (IoT) sensors and devices within these software solutions facilitates real-time monitoring of manufacturing processes, ensuring stringent quality control and enabling timely interventions. This technological integration is propelling sector growth, with prominent companies providing specialized software solutions. For example, Oracle Health Sciences offers cloud-based solutions equipped with AI and big data analytics specifically designed for pharmaceutical research, clinical trials, and regulatory compliance.

The services segment of Pharma 4.0 includes a broad array of offerings aimed at helping pharmaceutical companies adopt and integrate advanced technologies into their operations. These services are essential for leveraging IoT, AI, blockchain, and other digital innovations to enhance efficiency, productivity, quality, and compliance. Key players in this segment are driving its growth by offering specialized services. For instance, IBM Watson Health provides AI and data analytics consulting to improve drug discovery and development processes, while Siemens Healthineers offers IoT and predictive maintenance consulting for pharmaceutical manufacturing. As pharmaceutical companies continue to pursue digital transformation, the demand for these services is anticipated to grow significantly.

Technology Insights

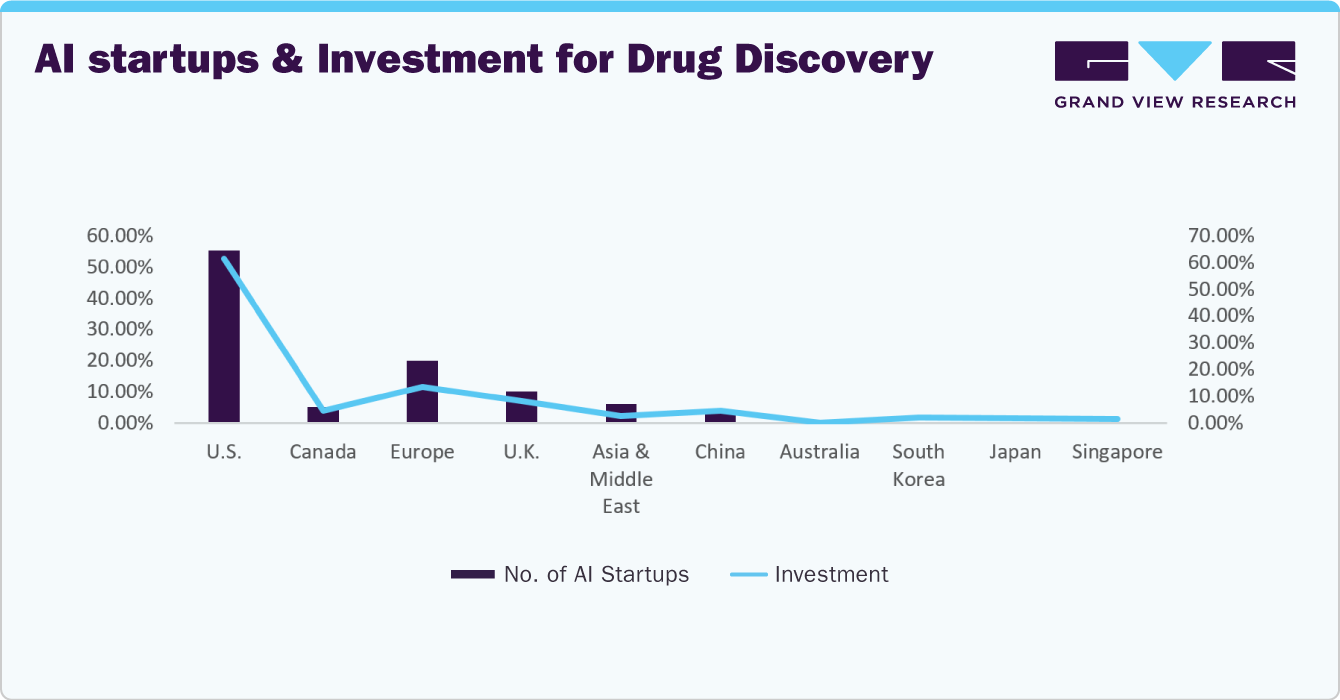

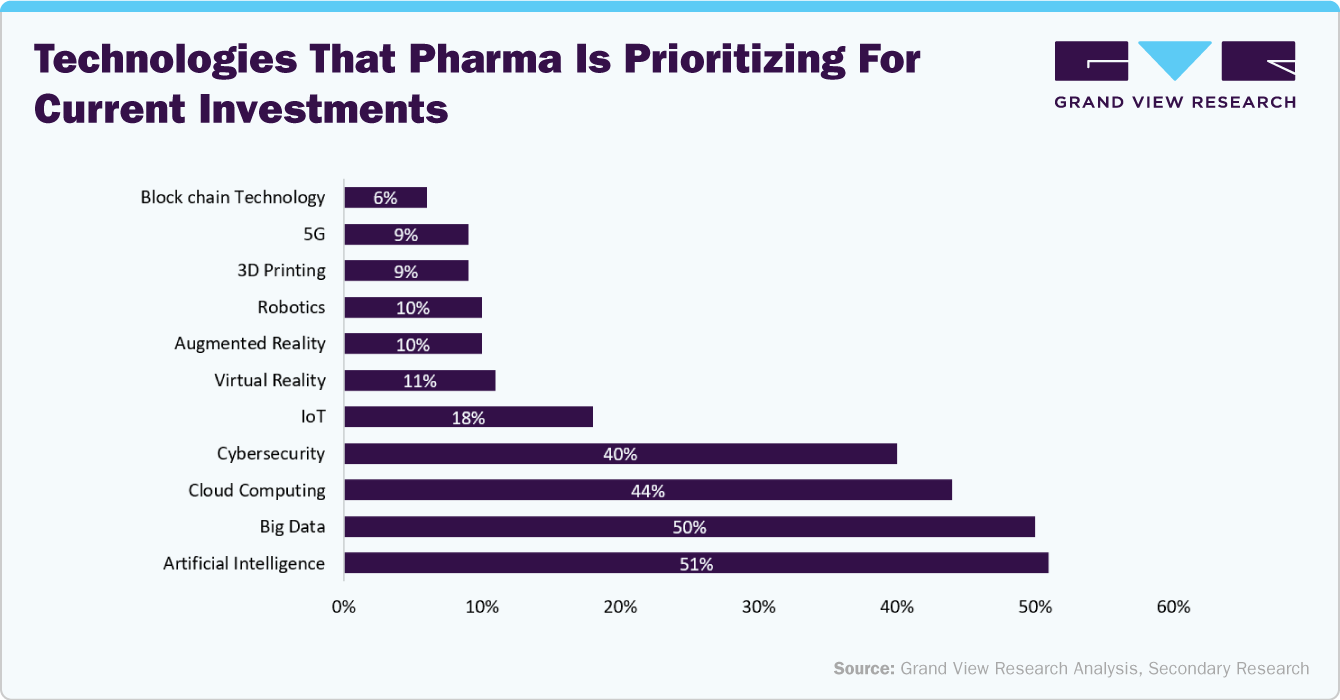

The AI/ML segment held the largest market share of 32.8% in 2023. Artificial Intelligence (AI) presents substantial opportunities for pharmaceutical manufacturers by improving process design, control, smart monitoring, and maintenance, ultimately driving continuous improvement. When combined with other cutting-edge technologies, AI has the potential to advance pharmaceutical quality, strengthen supply chains, and improve medicine availability for patients. The FDA is actively preparing for the integration of AI technologies into pharmaceutical manufacturing processes. To enhance production volume and optimize operational efficiency, pharmaceutical companies are making significant investments in generative AI solutions. Recent trends show a marked increase in drug and biologic applications incorporating AI and Machine Learning (ML) components. For instance, Pfizer extensively employs AI/ML technologies in its manufacturing operations, including automated visual inspection through image analysis, real-time anomaly detection, and AI-driven rapid root cause analysis.

Blockchain technology is also set for rapid expansion, particularly in improving drug safety, reducing counterfeiting and fraud, optimizing supply chain efficiency, and ensuring regulatory compliance. The adoption of blockchain by pharmaceutical companies is growing, driven by its ability to streamline supply chains. For example, Pfizer uses the MediLedger blockchain project to create a closed ecosystem for precise drug tracking, ensuring authenticity and preventing counterfeit products. This adoption is anticipated to drive growth in the blockchain segment throughout the forecast period.

Application Insights

The drug discovery and development segment accounted for the largest market share of 39.8% in 2023. The large and small pharmaceutical companies are increasingly integrating AI drug discovery platforms to streamline their research and development processes, shorten discovery timelines, reduce costs, and improve overall efficiency. The rising investment in AI for drug discovery is further accelerating growth in this segment. Notable examples include:

-

MegaRobo Technologies, based in Beijing, which raised USD 300 million in Series C funding.

-

ConcertAI, based in Massachusetts, securing USD 150 million in Series C funding.

-

Celsius Therapeutics, also based in Massachusetts, raising $83 million in Series A funding.

This trend signifies a substantial shift in the pharmaceutical industry towards leveraging advanced technologies to drive innovation and achieve competitive advantages.

The pharmaceutical supply chain is highly complex and heavily regulated, requiring stringent adherence to quality standards, traceability, and compliance with regulatory requirements. Pharma 4.0 technologies such as blockchain, IoT, and advanced analytics address these challenges by enhancing transparency, traceability, and regulatory compliance. These capabilities are crucial for pharmaceutical companies aiming to mitigate risks, ensure product safety, and maintain regulatory approvals.

In addition, these technologies are transforming supply chain management capabilities by enabling predictive maintenance, demand forecasting, intelligent inventory management, and automated decision-making. This optimization not only enhances supply chain operations but also improves overall supply chain resilience, ensuring a more robust and efficient system capable of withstanding various disruptions.

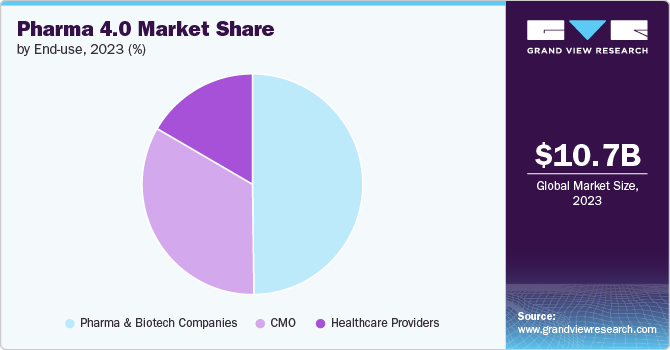

End-use Insights

Based on the end use, pharma & biotech segment held the largest market share of 49.8% in 2023. Pharmaceutical companies are increasingly adopting Pharma 4.0 technologies to enhance efficiency, productivity, and quality in their manufacturing processes. Globally, these companies are leveraging advanced machine learning algorithms and AI-powered tools to streamline the drug discovery process. These intelligent tools are designed to identify intricate patterns in large datasets, addressing challenges associated with complex biological networks.

Moreover, blockchain simplifies compliance with regulatory requirements by providing a clear and auditable trail of activities and transactions, facilitating faster and more efficient regulatory approvals. In addition, IoT and blockchain technologies improve supply chain transparency and efficiency, reducing logistics and inventory management costs. Leading pharmaceutical companies such as Johnson & Johnson, Pfizer, Bayer, and Eli Lilly are implementing these transformative technologies to improve efficiency, quality, and innovation in their manufacturing operations, thereby driving segment growth.

CRO & CDMO segment is anticipated to witness the fastest growth during the forecast period.

Contract Manufacturing Organizations (CMOs) are increasingly adopting Pharma 4.0 technologies to enhance their operational capabilities and meet the evolving demands of pharmaceutical manufacturing. By leveraging AI-driven predictive analytics, digital twins for simulation, and automated manufacturing processes, CMOs can accelerate time-to-market for new drug products, enhance product customization capabilities, and differentiate themselves in a competitive market.In addition, these technologies enable CMOs to achieve cost savings through operational efficiencies, reduced waste, and optimized resource allocation. Automation and robotics in manufacturing processes improve productivity and scalability, allowing CMOs to efficiently handle varying production volumes and meet fluctuating market demands without compromising quality.

Regional Insights

North America dominated the pharma 4.0 market with a market share of 43.9% in 2023. The market growth is driven by technological advancements and the need for increased efficiency and compliance within the pharmaceutical industry. In addition, the increasing need to manage and control overall costs and time associated with the discovery and development of drugs, growing cross-industry collaborations and partnerships, and impending patent expiries of blockbuster drugs are expected to further drive the market in North America.

For instance, VeChain, a blockchain-based supply chain solution, partnered with a major pharmaceutical company to enhance traceability in its supply chain. The partnership aims to prevent counterfeit drugs from entering the market by allowing consumers to verify a product’s authenticity. Furthermore, regulatory compliance requirements and the critical need to secure patient data are driving the adoption of blockchain technology. The U.S., in particular, has been actively investing in blockchain solutions to improve drug supply chain security and enhance the coordination of patient care, highlighting the significant potential and value of blockchain in the healthcare sector.

U.S. Pharma 4.0 Market Trends

U.S. is the leading country in the AI adoption within the pharmaceutical industry.Availability of developed infrastructure to facilitate the adoption of AI, coupled with the local presence of major players operating, is expected to contribute to market growth. In addition, growing awareness about AI and increasing number of manufacturers adopting it to lower costs of drug discovery is expected to further support market growth in the U.S.

Europe Pharma 4.0 Market Trends

The Pharma 4.0 Market in Europe is expected to grow at a substantial rate over the forecast period. Healthcare systems in Europe are overburdened due to increasing costs, the growing incidence of chronic conditions, a large elderly population, and increasing demand for healthcare facilities. In addition, increasing investments in AI in healthcare are expected to drive the market. For instance, in 2022, Sanofi secured significant AI partnerships. These included a USD 20 million upfront strategic research collaboration with Atomwise for up to five targets, a research collaboration with BioMed X aimed at leveraging AI to advance drug development efforts in chronic immune-mediated diseases such as atopic dermatitis (AD) and inflammatory bowel disease (IBD), and a collaboration agreement worth up to USD 1.2 billion with Insilico Medicine. In this latter deal, Sanofi will utilize Insilico’s comprehensive AI platform, Pharma.AI, to identify disease targets, generate new molecular data, and predict clinical trial outcomes to progress drug candidates for up to six new targets.

Furthermore, several major company initiatives in Europe are significantly driving the market growth of blockchain technology in the healthcare sector. Companies like IBM, Accenture, and Deloitte are actively involved in developing and implementing blockchain solutions in the pharmaceutical industry, demonstrating the technology's potential to enhance data security, streamline operations, and improve patient outcomes.

Asia Pacific Pharma 4.0 Market Trends

The Pharma 4.0 Market in the Asia Pacific region is expected to grow at a rapid rate of 21.1% over the forecast period. Several factors contribute to this growth, including an increasing patient pool, growing acceptance of cloud computing, and a rising number of government programs supporting AI. Moreover, an increasing number of biopharmaceutical firms are applying AI to modernize the drug discovery process, and AI applications are found in the field of diagnostics.

The Indian government is undertaking various initiatives to implement AI in its healthcare system. For instance, in July 2020, the Union Government of India launched the Drug Discovery Hackathon 2020 (DDH2020) to support the drug discovery process. This initiative encourages participation from faculty, researchers, professionals, and students from various fields, including chemistry, computer science, pharmacy, basic sciences, medical sciences, and biotechnology.

Furthermore, numerous companies are investing in adopting these technologies. For example, in September 2023, the Asian biotech startup Insilico raised USD 255 million to revolutionize the pharma industry using AI. By employing deep learning models and natural language processing technologies, Insilico aims to reduce the drug discovery process by up to 66%. Such initiatives are expected to drive market growth over the forecast period.

Key Pharma 4.0 Company Insights

Market players are utilizing innovative product development strategies, partnerships, and mergers and acquisitions to expand their presence in response to the increasing demand for early and accurate disease detection, cost containment, and providing value-based care.

Key Pharma 4.0 Companies:

The following are the leading companies in the pharma 4.0 market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- IBM

- Amazon Web Service (AWS)

- SAP

- Oracle

- GE Healthcare

- Siemens Healthineers

- Cisco

- Cinntra

- Dassault Systems

- Nexocode

Recent Developments

-

In May 2024, Sanofi has collaborated with Formation Bio and OpenAI to harness AI to expedite drug development. To streamline the process of bringing new medicines to patients, the companies will combine their data, software and tuned models to create purpose-built solutions across the development lifecycle of the drugs.

-

In April 2024, Avery Dennison has partnered with Controlant, one of the leaders in digital transformation of pharma supply chains, to drive real-time, end-to-end visibility and support sustainability initiatives in the pharma industry.

-

In April August 2023, Solve. carelaunched a novel Care.Trials Network. This cutting-edge network, backed by blockchain and Zero-knowledge (ZK) technology, offered novel solutions to conduct clinical trials.

Pharma 4.0 Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 12.62 billion

The revenue forecast in 2030

USD 35.79 billion

Growth rate

CAGR of 18.96% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use , application

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Norway; Sweden; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Microsoft Corporation; IBM; Amazon Web Service (AWS); SAP; Oracle; GE Healthcare; Siemens Healthineers; Cisco; Cinntra; Dassault Systems; Nexocode

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharma 4.0 Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the Pharma 4.0 market on the basis of type, technology, application, end-use and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

AI &ML

-

Big Data Analytics

-

IoT

-

Blockchain Technology

-

Others (Digital twin, Advanced robotics, AR &VR)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery & Development

-

Manufacturing

-

Supply Chain Management

-

Others (Product Lifecycle Management, Personalized Medicine, Regulatory Compliance)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharma & Biotech companies

-

Healthcare Providers

-

CRO & CDMO

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharma 4.0 market was estimated at USD 10.68 billion in 2023 and is expected to reach USD 12.62 billion in 2024.

b. The global pharma 4.0 market is expected to grow at a compound annual growth rate of 18.96% form 2024 to 2030 to reach USD 35.79 billion by 2030.

b. North America dominated the pharma 4.0 market with a market share of 43.9% in 2023. The market growth is driven by technological advancements and the need for increased efficiency and compliance within the pharmaceutical industry. In addition, availability of developed infrastructure to facilitate the adoption of AI, coupled with the local presence of major players operating, is expected to contribute to market growth.

b. Some key players operating in the pharma 4.0 market include Microsoft Corporation, IBM, Amazon Web Service (AWS), SAP, Oracle, GE Healthcare, Siemens Healthineers, Cisco, Cinntra, Dassault Systems, and Nexocode

b. Key factors that are driving the market growth include the rising demand for personalized medicine, the need for increased efficiency and productivity, and the pursuit of improved regulatory compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.