- Home

- »

- Consumer F&B

- »

-

Pet Snacks And Treats Market Size, Industry Report, 2030GVR Report cover

![Pet Snacks And Treats Market Size, Share & Trends Report]()

Pet Snacks And Treats Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Eatable, Chewable), By Pet Type (Dogs, Cats), By Distribution Channel (Supermarkets & Hypermarket, Specialty Pet Store, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-948-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Snacks And Treats Market Summary

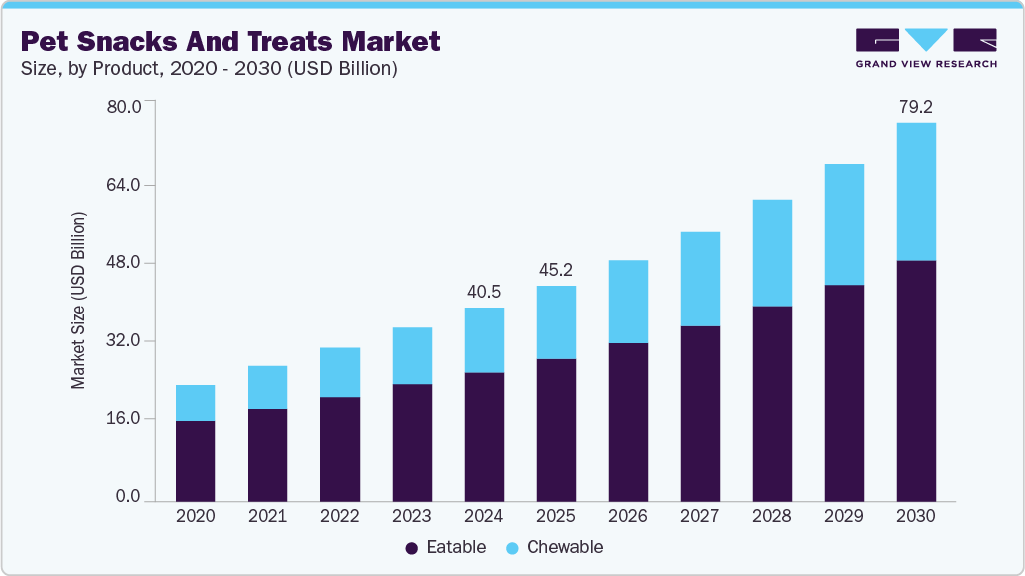

The global pet snacks and treats market size was estimated at USD 40.52 billion in 2024 and is projected to reach USD 79.23 billion by 2030, growing at a CAGR of 11.9% from 2025 to 2030. The high pet adoption rate over the years and the growing tendency to consider pets an integral part of the family have propelled the demand for natural, nutritious, tasty, and healthy pet snacks & treats essential for companion animals' overall growth and well-being.

Key Market Trends & Insights

- North America dominated the pet snacks and treats market with a revenue share of 52.5% in 2024.

- The pet snacks and treats market in the U.S. is expected to grow at a CAGR of 12.0% from 2025 to 2030.

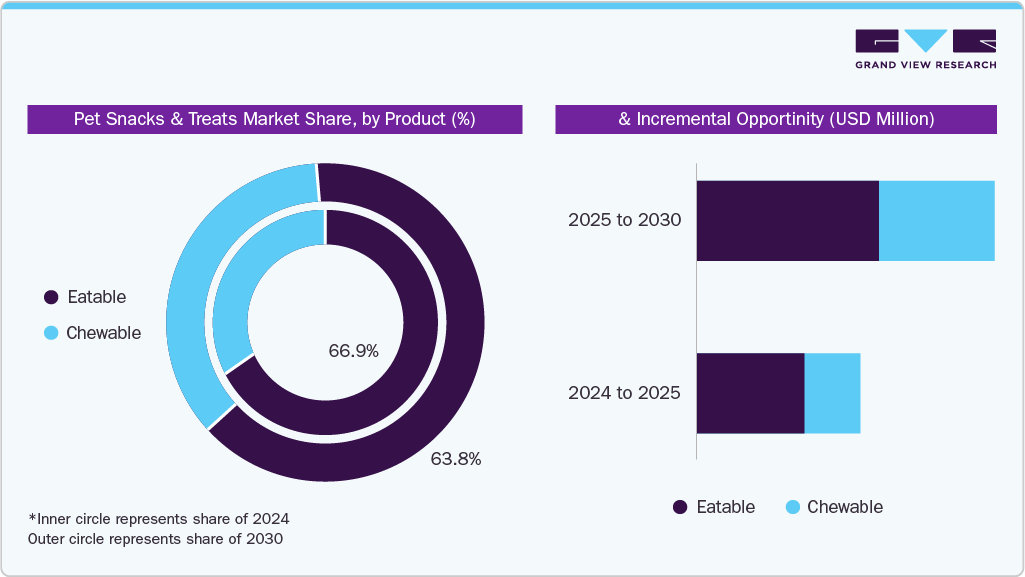

- Based on product, the eatable segment contributed to the largest revenue share of 66.9% in 2024.

- Based on pet types, the dogs segment contributed to the largest revenue share of over 66.9% in 2024.

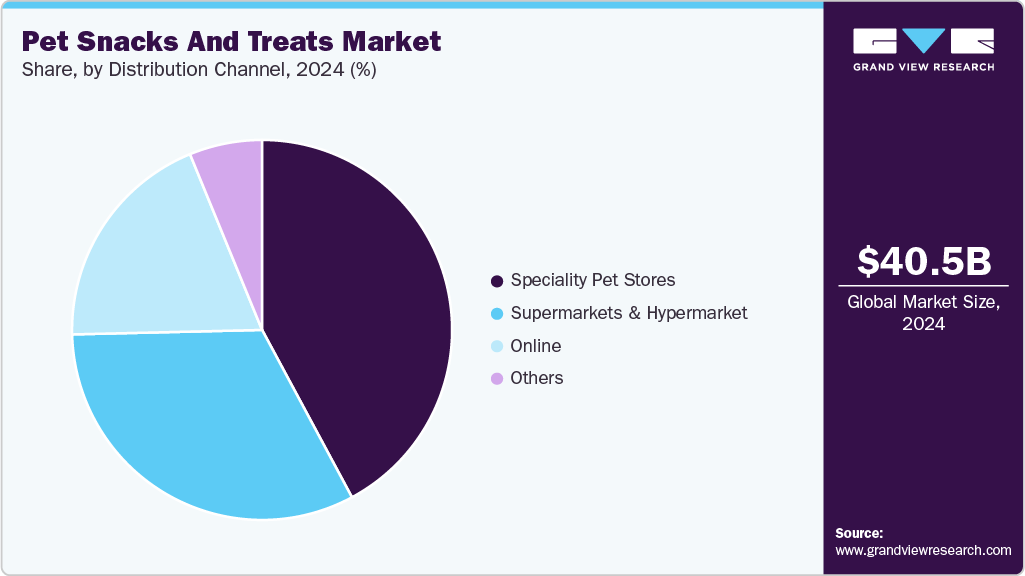

- By distribution channel, the specialty pet store segment dominated the global pet snacks & treats market, with a share of 42.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 40.52 Billion

- 2030 Projected Market Size: USD 79.23 Billion

- CAGR (2025-2030): 11.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growth is especially visible in countries where the middle-income group is expanding, such as China and South Korea. This can also be attributed to changing attitudes toward pets, a new pet culture centered on the increased humanization of pets, and a rise in the number of pets kept just for companionship. According to the American Pet Products Association (APPA), a total of USD 151.9 billion was spent on pets in the U.S. in 2024; the majority sales breakdown for the spending is as follows: pet food & treats; supplies, live animals, and OTC medicines; vet care and product sales; and other services such as boarding, grooming, insurance, training, pet sitting, and walking. Overall, increased spending on pet care, especially pet food, reflects changing consumer attitudes towards pets and a greater emphasis on their health, happiness, and overall well-being. As a result, the market is experiencing steady growth, with opportunities for innovation, expansion, and market penetration.

Pet owners' most common dietary preferences suggest a movement toward moderation and higher-quality ingredients. Consumers in the global market seek pet snacks and treats that are organic, natural, sugar-free, low-calorie, low-carb, and contain plant-based ingredients. Furthermore, there is a growing demand for Chewable pet food and an increasing interest in natural pet snacks and treats with limited ingredients and health claims, such as grain-free.

The rising importance of sustainability in consumer decision-making has spurred initiatives within the pet snacks and treats industry to adopt eco-friendly practices. Companies are exploring alternative and renewable ingredients and eco-conscious packaging solutions to align with pet owners' environmentally conscious preferences. This commitment to sustainability is a response to market trends and reflects a broader societal shift towards responsible and ethical business practices.

In recent years, the market has witnessed a surge in innovations and mergers and acquisitions (M&A) activities as companies seek to capitalize on the growing demand for premium and functional pet food products. These developments are driven by evolving consumer preferences, increased pet health and wellness awareness, and a desire for convenient and nutritious options for furry companions.

One notable trend in pet snacks is the emphasis on natural and organic ingredients. Pet owners are increasingly looking for products for their pets’ dietary choices, leading to a rise in the availability of treats made from high-quality, human-grade ingredients. Companies are investing in research and development to create innovative formulations that not only cater to the taste preferences of pets but also address specific health concerns such as allergies, digestive issues, and weight management.

Product Insights

The eatables segment led the market with the largest revenue share of 66.9% in 2024, based on product, driven by rising demand for functional, clean-label, and plant-based products. Increasing awareness regarding pet food and treats that offer functional benefits, such as supporting joint, skin, and coat health, is driving the demand for eatable pet snacks & treats. In October 2025, Fredun Pharmaceuticals launched Snacky Jain pet food, India’s first Jain pet food under the Freossi brand. The product is completely free from meat, animal ingredients, and root vegetables, aligning with Jain dietary principles while providing essential nutrients to support immunity, energy, and overall well-being in pets. In May 2022, Wellness Pet Company launched Good Dog by Wellness, a brand that offers treats crafted with high-quality, natural ingredients. The treats, which provide functional benefits and encourage positive behavior in dogs, come in three types: Happy Puppy, Training Rewards, and Tender Toppers.

The chewable segment is expected to grow at the fastest CAGR over the forecast period as it's easier for pets to chew, digest, and enjoy than dry kibble or pills. Many chewables are enriched with minerals, vitamins, probiotics, or joint-health ingredients such as glucosamine or omega-3, which is expected to drive market growth. In August 2025, Woof launched HonestChew. According to the brand, it is a long-lasting and durable chew designed to be tougher than nylon synthetic chews. It is made of plant-based food-grade materials, vegetable broth, and powdered antler bone to provide an alternative to plastic, nylon, and rawhide.

Pet Type Insights

The dogs segment led the market with the largest revenue share of 66.9% in 2024 based on pet type. The increasing adoption of pet companions, such as dogs, is anticipated to present favorable opportunities for key players in the market over the forecast period. As per the findings of the 2023-2024 APPA National Pet Owners Survey, approximately 66% of households in the U.S., totaling 86.9 million households, are pet owners. Among these households, approximately 65.1 million own at least one dog.

The cats segment is expected to grow at the fastest CAGR of 13.0% from 2025 to 2030. The pet humanization trend has led to an increased focus on cats' health and well-being. Many cat owners seek snacks and treats made with high-quality, natural ingredients that offer nutritional benefits and support their cat's overall health. Market players are capitalizing on the rising awareness about the health of pet animals, including cats, and are launching new snacks and treats to support the rising demand.

Distribution Channel Insights

The specialty pet stores segment led the market based on distribution channel, accounting for the largest revenue share of 42.2% in 2024. Growing initiatives by specialty pet stores, such as partnerships with prominent pet snacks and treats manufacturers, will likely boost segment growth and give players a competitive advantage. In September 2023, Pet Supermarket, a well-known specialty retailer of pet supplies with over 225 stores in the Southeast U.S., announced its new partnership with Fromm Family Foods. This collaboration highlighted Pet Supermarket's dedication to improving pet health and well-being by introducing Fromm Family Foods' dry and wet treats and complete-and-balanced foods to its stores and online platform.

The online sales channel segment is expected to grow at the fastest CAGR of 13.1% from 2025 to 2030. E-commerce has significantly altered consumer shopping behavior, offering several advantages, such as doorstep delivery, attractive discounts, and the convenience of finding various items on a single platform. Moreover, the availability of a diverse array of pet snacks and treats, and growing customer loyalty facilitated by 'Subscribe & Save' programs are anticipated to strengthen the online channel. Chewy, an online retailer specializing in pet snacks and treats, boasts a selection of over 2,000 pet brands and offers round-the-clock customer service.

Regional Insights

North America dominated the pet snacks and treats market with a revenue share of 52.5% in 2024. The ascendance of e-commerce and a notable rise in pet ownership among high-revenue households in North America have paved the way for innovations in pet snacks and treats. Development in the market underscores the continuation and affirmation of prevailing trends within the pet care industry. Notably, premiumization is emphasized, wherein pet owners increasingly seek and invest in high-quality, Chewable products for their furry companions. Simultaneously, a growing demand for preventive care solutions is evident, indicating a proactive approach among pet owners to address their pets' health and well-being.

U.S. Pet Snacks And Treats Market Trends

The pet snacks and treats market in the U.S. is expected to grow at a CAGR of 12.0% from 2025 to 2030. The pet snacks and treats market in the U.S. continues to benefit from widespread pet ownership. As of 2024, 66% of U.S. households own a pet, totaling 86.9 million homes. Dogs remain the most popular, present in 58% of households, while 36% have cats. Other pets, including freshwater fish, account for the others.

Asia Pacific Pet Snacks And Treats Market Trends

The pet snacks and treats market in Asia-Pacific is expected to grow at the fastest CAGR over the forecast period. Growth is driven by rising disposable incomes, urbanization, and increasing pet adoption. This surge in pet ownership has resulted in the substantial growth of the pet snacks and treats market in Asia Pacific, supported by changing consumer lifestyles and a growing emphasis on pet health and wellness. As pet ownership becomes more prevalent across countries, pet owners increasingly seek specialized and premium snacks and treats for their companion animals.

Europe Pet Snacks And Treats Market Trends

The growing pet population across the continent supports the surge in European pet snack and treat sales. The rise in pet snack and treat sales in Europe can be attributed to the increasing pet population across the continent. In 2022, the European Pet Food Industry Federation reported a significant presence of pets in European households, reaching a total of 91 million, which is approximately 46% of all households. Among the various pets, cats emerged as the most favored, with a population of 127 million and a presence in 26% of households. Following closely, dogs secured the second position, residing in around 25% of European households and boasting a population of 104 million. This data underscores the substantial impact of pets on European households, highlighting the need for high-quality and diverse pet food options to cater to the preferences and nutritional requirements of this growing and diverse pet population.

Key Pet Snacks And Treats Companies Insights

Key players operating in the pet snacks & treats market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

-

Colgate-Palmolive Company is a multinational consumer goods corporation. While its primary focus lies in oral and personal care products, the company has diversified its portfolio to include the pet care sector. Its subsidiary, Hill's Pet Nutrition, is a key player in this domain, specializing in premium pet food. Hill's Pet Nutrition is renowned for offerings like Hill's Science Diet and Hill's Prescription Diet, which address the specific nutritional requirements of both dogs and cats. With a global footprint, Colgate-Palmolive's products are widely distributed across North America, Latin America, Europe, Asia, and Africa, solidifying its reputation as a trusted and recognized brand in diverse markets.

Key Pet Snacks And Treats Companies:

The following are the leading companies in the pet snacks and treats market. These companies collectively hold the largest market share and dictate industry trends.

- Mars, Incorporated

- Nestlé

- J.M. Smucker Co.

- General Mills Inc.

- Colgate-Palmolive Company

- Off Leash Pet Treats

- Wellness Pet, LLC

- Merrick Pet Care

- Spectrum Brands, Inc.

Recent Developments

-

In October 2025, Avanti Pet Care introduced the Avant Furst dog food brand at an event in New Delhi, India, that was attended by more than 100 veterinarians, retailers, and dealers.

-

In October 2025, Blue Buffalo launched Love Made Fresh. This line of fresh pet food allows dog parents to mix dry and fresh food for feeding flexibility with a scoop & serve resealable tub.

-

In April 2025, Godrej Pet Care launched Godrej Ninja, its pet food in Tamil Nadu, India. It is a scientifically formulated dog food for improving immunity and gut health.

-

In February 2024, VAFO Group, a European producer of super premium pet foods, acquired Finnish company Dagsmark Pet food, making VAFO the leading player in the Nordic pet food market. Dagsmark specializes in wet pet food production and will complement VAFO's product range in Finland. The acquisition allows for expansion into other Nordic markets and provides resources for further development. The Finnish company's products will continue unchanged, utilizing local ingredients and aligning with VAFO's sustainability strategy

-

In August 2023, Spectrum Brands, Inc. introduced Meowee! cat treats. Exclusively accessible at Chewy.com, Meowee! Products aim to enhance treat time for both cats and pet owners, offering a diverse range of textures and delightful flavors. Crafted by veterinarians, Meowee! treats prioritize natural ingredients and are devoid of artificial colors, flavors, or animal by-products

-

In August 2022, in a strategic move to support the expansion of its Hill's Pet Nutrition business, Colgate-Palmolive Company agreed to acquire three pet food manufacturing plants from Red Collar Pet Foods. The acquisition, valued at USD 700 million, is aimed at fortifying Colgate-Palmolive's commitment to the global growth of its pet food business under Hill's Pet Nutrition.

Pet Snacks And Treats Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.18 billion

Revenue forecast in 2030

USD 79.23 billion

Growth rate

CAGR 11.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segment covered

Product, pet type, distributional channel, region

Regional scope

North America; Europe; Asia Pacific; Middle East Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Mars; Incorporated; Nestlé; J.M. Smucker Co.; General Mills Inc.; Colgate-Palmolive Company; Off Leash Pet Treats; Wellness Pet, LLC; Merrick Pet Care; Spectrum Brands, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Snacks And Treats Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet snacks and trends market report on the basis of product, pet type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Eatable

-

Chewable

-

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarket

-

Specialty Pet Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet snacks and treats market size was estimated at USD 40.52 billion in 2024 and is expected to reach USD 45.18 billion in 2025.

b. The global pet snacks and treats market is expected to grow at a compounded growth rate of 11.9% from 2025 to 2030 to reach USD 79.23 billion by 2030.

b. In 2024, North America captured a revenue share of over 52.5% in the pet snacks and treats market. North America market is witnessing an inclination toward natural and clean-label diets for pets. This trend aligns with the broader consumer movement of healthier and more transparent nutritional choices, reflecting a desire among pet owners to provide their animals with nutritionally superior and wholesome options.

b. Some key players operating in the market include Mars, Incorporated; Nestlé S.A.; The J.M. Smucker Company; General Mills Inc.; Colgate Palmolive Company; Off-Leash Pet Treats; Wellness Pet, LLC; Merrick Pet Care; Spectrum Brands, Inc.; VAFO Group a.s.

b. The high pet adoption rate over the years and the growing tendency to consider pets an integral part of the family have propelled the demand for natural, nutritious, tasty, and healthy pet snacks & treats essential for the overall growth and well-being of companion animals

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.