- Home

- »

- Homecare & Decor

- »

-

Pet Insect Repellent Market Size, Share, Growth Report 2030GVR Report cover

![Pet Insect Repellent Market Size, Share & Trends Report]()

Pet Insect Repellent Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sprays, Spot-on Treatments), By Pet Type (Dogs, Cats), By Application (Households, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-270-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Insect Repellent Market Size & Trends

The global pet insect repellent market size was estimated at USD 3.20 billion in 2023 and is expected to grow at a CAGR of 4.2% from 2024 to 2030. This is attributed to the increased awareness among pet owners regarding the health risks posed by insect-borne diseases and the rising prevalence of vector-borne diseases transmitted by insects, such as heartworm disease and Lyme disease. The expansion of the pet care industry, coupled with the growing pet humanization trend, is encouraging pet owners to invest in premium insect repellent products to ensure the well-being and comfort of their pets.

The Companion Animal Parasite Council (CAPC) 2021 data revealed significant disparities in the screening rates and positive cases of vector-borne diseases among pets, emphasizing the urgency for effective insect repellent solutions. While 17,680,518 dogs were tested for heartworm infection, resulting in 215,392 positive cases (1.22%), only 10,323,420 dogs underwent Lyme disease screening, with 434,737 positive cases (4.21%). These figures underscore the higher prevalence of Lyme disease compared to heartworm infection, yet the screening rates for Lyme disease remain comparatively lower. This data highlights the critical need for enhanced awareness and proactive measures, including the use of pet insect repellents, to combat the rising incidence of vector-borne diseases and safeguard pet health and well-being.

According to the HealthforAnimals.org, a surge in pet adoptions was observed during pandemic lockdowns across the UK and Australia. The UK witnessed a significant surge in pet adoptions during pandemic lockdowns, with more than two million people choosing to adopt pets.Similarly, Australia experienced a notable increase in pet adoptions, with over a million pets being adopted during the peak of the pandemic.

Additionally, rising disposable incomes in key markets like China are enabling individuals to invest more in acquiring and caring for pets. China saw a remarkable 113% increase in its pet population from 2014 to 2019. These trends reflect a growing emphasis on pet health and well-being, indicating a heightened demand for pet care products, including insect repellents, to ensure the protection and comfort of pets against pests and vector-borne diseases.

Market Concentration & Characteristics

The market growth stage is low and the pace of the market is accelerating. The pet insect repellent industry is fragmented, featuring several global and regional players. The market players are investing in research & development to develop innovative products and gain a competitive edge in the market.

The high degree of innovation in the pet insect repellent market is driven by advancements in technology and biotechnology have enabled the development of more effective and safer repellent formulations. Additionally, heightened awareness among pet owners regarding the importance of protecting their pets from insect-borne diseases has spurred demand for innovative solutions.

The impact of regulations on the market is moderately high due to stringent guidelines governing the safety and efficacy of these products. Regulatory bodies, such as the EPA in the U.S., impose rigorous testing requirements to ensure that pet insect repellents are safe for use on animals and do not pose harm to the environment.

Traditional methods such as homemade repellents, insect killer machines, and insect killer rackets are the only substitutes in the market. Traditional homemade repellents are not as efficient and long-lasting as compared to the insect repellents available in the market. Moreover, insect killer rackets have low durability, which drives consumers to opt for insect repellents available in the market.

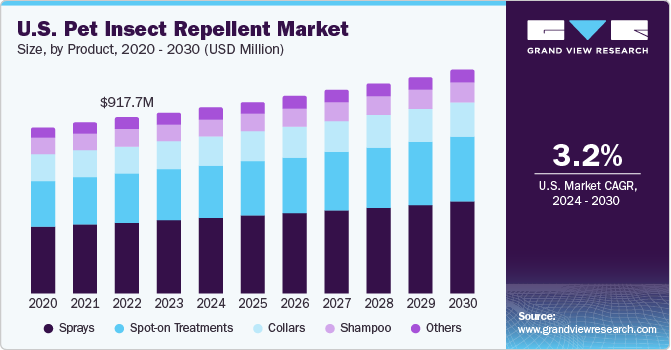

Product Insights

Pet insect repellent sprays accounted for a revenue share of 40.9% in 2023.Pet owners are increasingly opting for convenient and easy-to-use solutions to protect their pets from insects and pests, making sprays a preferred choice due to their simplicity and effectiveness in application. Moreover, the versatility of sprays allows for direct application to pets' fur or surroundings, offering comprehensive protection against various insects, including fleas, ticks, mosquitoes, and flies.

Pet insect repellent spot-on treatment is projected to grow at a significant CAGR from 2024 to 2030.Spot-on treatments offer targeted and long-lasting protection against a wide range of insects, including fleas, ticks, mosquitoes, and other pests, making them highly effective in preventing infestations and vector-borne diseases in pets.Moreover, advancements in formulation technologies have led to the development of spot-on treatments with improved safety profiles and reduced environmental impact, addressing concerns about potential adverse effects on pets and surroundings.

Pet Type Insights

Insect repellents for dogs accounted for a revenue share of 54.9% in 2023. Dogs are among the most common pets globally, with a large population of pet owners prioritizing their health and well-being. As a result, there is a growing awareness of the need to protect dogs from various insect-borne pests, including fleas, ticks, mosquitoes, and other parasites, which can pose significant health risks to dogs and their owners. According to the American Veterinary Medical Association, there was a notable increase in dog-owning households in the U.S., rising from 38% to approximately 45% from 2016 to 2022.

Sales of insect repellents for cats is projected to grow at a significant CAGR from 2024 to 2030. As more households adopt cats as pets, particularly in urban areas where the population of indoor cats is rising, the need for preventative measures against pests becomes more prominent, driving demand for pet insect repellents.

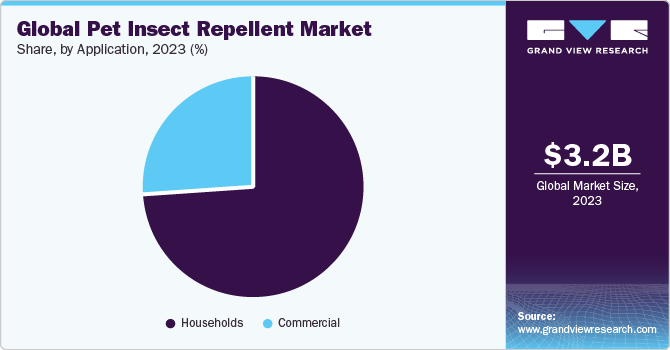

Application Insights

Households held a revenue share of 74.4% in 2023. Households with pets, particularly dogs and cats, are increasingly concerned about protecting their furry companions from pests such as fleas, ticks, and mosquitoes, which can transmit diseases and cause discomfort. As a result, pet owners are more likely to invest in insect repellent products to safeguard the health and well-being of their pets, driving the market growth.

Pet insect repellent sales in commercial applications are projected to grow at a significant CAGR from 2024 to 2030. Commercial establishments such as pet clinics and pet shops are increasingly recognizing the importance of insect repellent solutions for pets. The emphasis on preventive healthcare for petsis driving the uptake of these products in commercial settings.

Regional Insights

The market in North America held a market share of 40.1% of the global revenue in 2023. North America boasts a large population of pet owners, with a substantial portion considering their pets as integral family members. Additionally, the region exhibits a strong culture of pet care, reflected in higher spending on pet health and wellness products, including insect repellents. According to the American Pet Products Association, pet ownership statistics in the U.S. in 2024 reveal a notable trend wherein millennials constitute the largest segment of pet owners, comprising 33% of the total, followed by Gen X at 25% and baby boomers at 24%.

U.S. Pet Insect Repellent Market Trends

The market in the U.S. is expected to grow at a CAGR of 3.2% from 2024 to 2030. As of 2024, over 66% or 86.9 million of U.S. households own a pet, indicating a substantial increase from 56% in 1988, according to Forbes. As pet owners increasingly view their pets as integral members of their families, there is a growing awareness of the importance of safeguarding pet health and well-being. This trend fuels the demand for innovative and effective solutions such as insect repellents tailored to the specific needs of pets.

Asia Pacific Pet Insect Repellent Market Trends

Asia Pacific market held a share of 20.2% of the global revenue in 2023. This is primarily attributed to the region's increasing pet ownership trends and increasing awareness of pet health and well-being. Rising urbanization and disposable incomes across countries in the region have led to a surge in pet ownership, driving the demand for insect repellents to safeguard pets from vector-borne diseases and parasites. Key countries contributing to the market growth in Asia Pacific include China, Japan, South Korea, India, and Australia.

Key Pet Insect Repellent Company Insights

The market for pet insect repellent is largely fragmented. Key companies are actively innovating and undergoing partnerships to gain a competitive advantage. Companies are investing in research and development to introduce advanced formulations and delivery methods that cater to the evolving needs of pet owners. Additionally, collaborations with distributors and retailers enable them to expand their reach and enhance product accessibility, driving market growth and ensuring sustained competitiveness in the industry.

Key Pet Insect Repellent Companies:

The following are the leading companies in the pet insect repellent market. These companies collectively hold the largest market share and dictate industry trends.

- Tick Killz

- First Saturday Lime

- Mad About Organics

- Compana Pet Brands LLC

- Zoetis Inc.

- Wondercide

- Pet Naturals

- Adams Pet Care

- PetIQ

- WildWash

Recent Developments

-

In 2021, Mori Vietnam Investment, Production, and Trading LLC unveiled its latest innovation: Multipurpose Insect Repellent, boasting advanced Nano biotechnology for comprehensive insect treatment. This product promises efficacy against flies, mosquitoes, cockroaches, ants, fleas, and more, without compromising safety for users, pets, or the environment. With its versatile application and non-discoloring formula, it addresses a growing need in the market, offering pet owners a reliable solution to keep pests at bay while ensuring the well-being of their pets.

Pet Insect Repellent Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.33 billion

Revenue forecast in 2030

USD 4.26 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pet type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

Tick Killz; First Saturday Lime; Mad About Organics; Compana Pet Brands LLC; Zoetis Inc.; Wondercide; Pet Naturals; Adams Pet Care; PetIQ; WildWash

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

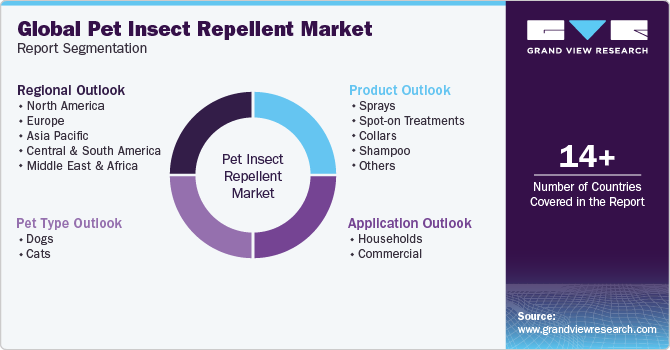

Global Pet Insect Repellent Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet insect repellent market report based on product, pet type, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sprays

-

Spot-on Treatments

-

Collars

-

Shampoo

-

Others

-

-

Pet Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dogs

-

Cats

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Households

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global pet insect repellent market size was estimated at USD 3.20 billion in 2023 and is expected to reach USD 3.33 billion in 2024.

b. The global pet insect repellent market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 4.26 billion by 2030.

b. In 2023, the pet insect repellent market in North America held 40.1% of the global revenue. This is attributed to North America's substantial population of pet owners, who often view their pets as indispensable family members. Furthermore, the region's robust culture of pet care is evidenced by higher expenditures on pet health and wellness products, including pet insect repellents.

b. Some of the key market players include Tick Killz, First Saturday Lime, Mad About Organics, Compana Pet Brands LLC, Zoetis Inc., Wondercide, Pet Naturals, Adams Pet Care, PetIQ, and WildWash.

b. Key factors that are driving the pet insect repellent market growth include growing pet humanization, growth in pet ownership across the regions, and growing awareness among pet owners about the health hazards associated with insect-borne illnesses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.