- Home

- »

- Animal Health

- »

-

Pet Grooming Services Market Size & Share Report, 2030GVR Report cover

![Pet Grooming Services Market Size, Share & Trends Report]()

Pet Grooming Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Service Type (Massage/Spa & Others, Shear & Trimming), By Delivery Channel (Commercial facilities, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-190-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Grooming Services Market Summary

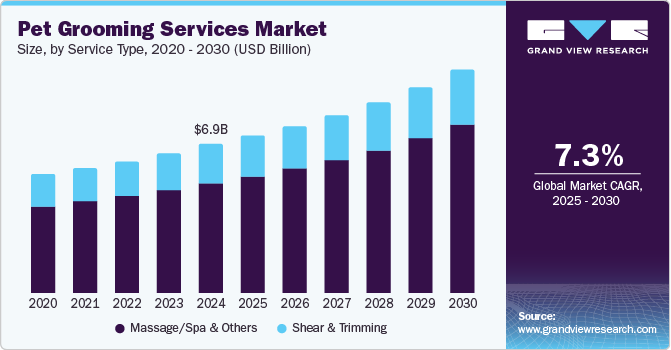

The global pet grooming services market size was estimated at USD 6.89 billion in 2024 and is projected to reach USD 10.35 billion by 2030, growing at a CAGR of 7.33% from 2025 to 2030. Rising expenditures, a growing number of companion groomers and firms, an increase in service offerings, and humanization are some of the major drivers driving the market growth.

Key Market Trends & Insights

- North America pet grooming services market held the largest share of more than 40% of the global market in 2024.

- The pet grooming services market in Asia Pacific is anticipated to grow at the fastest CAGR of 8.92% during the forecast period.

- Based on service type, the massage/spa & others segment dominated the global market in 2024 and is anticipated to grow at the fastest CAGR of 7.67% over the forecast period.

- Based on application, the indoor segment led the market with the largest revenue share of 67.75% in 2024.

- Based on pet type, the dog pet type segment led the market with the largest revenue share of 83% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.89 Billion

- 2030 Projected Market Size: USD 10.35 Billion

- CAGR (2025-2030): 7.33%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For example, Camp Bow Wow offers a variety of dog services, such as daycare, boarding, walking, sitting, and primping. As companions are increasingly viewed as family members, their care demands higher-quality primping services, including spa treatments, fur styling, and health-related primping. This increase in expenditure reflects a trend where consumers are willing to spend more frequently on personalized primping to ensure their companions’ comfort and well-being, thereby boosting market growth.

The COVID-19 pandemic negatively impacted the market. Many grooming facilities had to close temporarily or operate at limited capacity due to lockdowns and restrictions. This led to substantial revenue loss and forced some small businesses to shut down permanently. With limited access to professional primping services, companion owners turned to at-home primping solutions. This led to a shift in consumer behavior, with some companion owners continuing DIY grooming routines even after restrictions were lifted. Moreover, the pandemic disrupted the supply chain, causing delays and shortages in essential grooming products like shampoos, conditioners, and primping tools, impacting service quality and operating costs.

All over the world, companion owners spend approximately USD 300 billion each year on their animals, which covers everything from the initial purchase to ongoing pet insurance payments. According to Pangolia Pte. Ltd's July 2024 article, the statistic also includes massage service for companions. For example, 9% of dog owners use mobile primping services, and 30% of dog owners take their companions to a primping parlor in 2024 Additionally, 84% of companion owners give their dogs at least one annual primping.

The increasing number of pet groomer salons is indeed a driving factor in the market. For instance, according to Pangolia Pte. Ltd, in 2024, there are over 300,000 companion groomers in the US, with women making up 86% of this workforce. This growth is fueled by a rise in companion ownership and a heightened focus on pet health, hygiene, and appearance, which encourages companion owners to seek professional primping services more frequently. The convenience and accessibility of local primping salons also play a key role, catering to diverse primping needs ranging from basic hygiene to specialized services for various breeds.

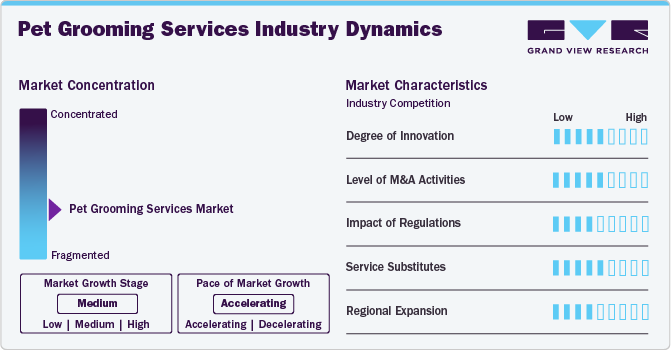

Market Concentration & Characteristics

The market is considered to be at a medium level in terms of growth stage, with significant expansion. The market is growing owing to the inclusion of massage, spa, and other primping services in pet insurance coverage, which goes beyond veterinary expenses. With insurance coverage, companion owners are more likely to invest in routine and preventative care, including primping services, as part of their pets' overall health regimen. Pet insurance policies often include wellness packages that cover primping-related care, such as nail trimming and coat maintenance, which encourages owners to use these services regularly. This increased frequency of grooming visits boosts revenue for primping businesses.

The market demonstrates a moderate degree of innovation, characterized by the usage of high-tech tools and mobile primping services. Mobile primping has grown in popularity, with vans equipped as fully functional salons. This service targets companion owners who prefer at-home grooming, especially for pets with mobility or anxiety issues. Moreover, technology-driven primping tools, like AI-powered primping machines, automatic nail trimmers, and advanced dryers, enhance efficiency and safety, reducing primping time and stress for pets.

The market experiences a moderate level of merger and acquisition activity, indicating ongoing consolidation and strategic collaborations among industry leaders. The need to reach a broader demographic, gain access to new technology or knowledge, and realize economies of scale are frequently the driving forces for these transactions. In November 2023, for instance, a definitive agreement was signed by Rover Group, Inc. to be acquired by Blackstone in a deal estimated to be worth USD 2.3 billion, exclusively in cash.

Regulations vary significantly depending on the country and region, but they often focus on ensuring animal welfare, setting industry standards, and protecting consumer rights. Many regions require grooming businesses to obtain licenses or permits, which confirm that they meet standards for facility conditions, hygiene, and staff training. Moreover, groomers may be required to follow guidelines on humane treatment, such as avoiding excessive restraint, maintaining appropriate handling practices, and recognizing signs of distress in animals.

Service substitutes for nail trimming and other companion care, such as at-home primping kits, self-service pet wash stations, and automated companion furnishing devices, can impact the market in several ways such as cost efficacy, flexibility, and convenience. Substitutes often appeal to budget-conscious companion owners as they provide a one-time or lower-cost alternative to routine professional grooming services. This could lead to a reduced frequency of salon visits, especially among companion owners with multiple companions or those seeking to save on recurring grooming costs.

In August 2023, Wag! Group Co announced the international expansion of pet insurance with Petted International in Canada.

Service Type Insights

The massage/spa & others segment dominated the global market in 2024 and is anticipated to grow at the fastest CAGR of 7.67% over the forecast period. These services are essential in maintaining primping skin health. The segment includes a range of services, such as bath, shampoo, brushing, blow dry, massage, conditioner, teeth cleaning, etc.

Massage and spa services are gaining popularity as companion owners increasingly view these services as essential to their pets' well-being. Many grooming salons now offer massage therapy, which can help alleviate stress, improve circulation, and ease muscle tension in pets. Spa treatments often include aromatherapy baths, deep-conditioning treatments. These luxury services cater to companion owners seeking to pamper their pets, making grooming a holistic experience that supports both physical and emotional health. The trend is also driven by the rise in pet humanization and a willingness among companion owners to invest in premium grooming services.

The shear and trimming segment is expected to grow significantly over the forecast period. Shearing and trimming are core services in companion furnishing, especially for breeds with long or thick coats that need regular maintenance. These services ensure pets stay comfortable and free from mats or tangles, which can lead to skin issues. Additionally, tailored trims for specific breeds enhance pets' appearance and align with breed standards, which is appealing to pet owners, particularly those participating in shows. As the demand for specialized grooming grows, shear and trimming services become pivotal in drawing in companion owners looking for quality grooming and personalized styling options.

Delivery Channel Insights

On the basis of delivery channel, the market is segmented into commercial facilities and others. These establishments offer a range of grooming services tailored to the needs of companion owners who seek professional grooming for their pets. With enhanced facilities, amenities, and dedicated spaces for pets, commercial grooming centers appeal to urban companion owners seeking convenience, quality, and variety in grooming options, helping to grow the market.

Other delivery channels include at-home and mobile services, which are anticipated to grow at the fastest CAGR over the forecast period. These services offer convenience for companion owners who prefer grooming at home or need mobile services due to time constraints or pet behavior challenges. Moreover, in December 2021, Pet Precious launched a mobile companion grooming service in Mumbai, India, in collaboration with Papa Pawsome, a company that specializes in natural grooming products. A grooming van that provides doorstep delivery is part of the mobile service.

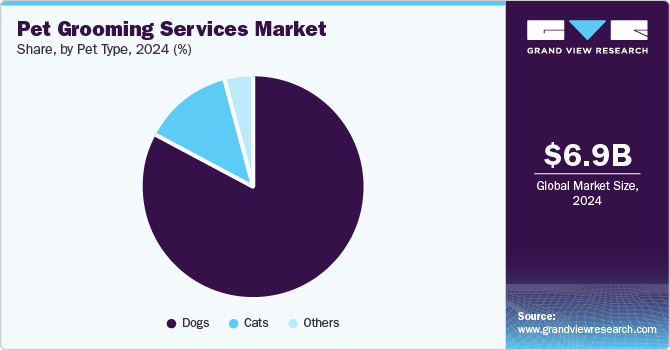

Pet Type Insights

On the basis of pet type, the market is categorized into cats, dogs, and others. The dog pet type segment dominated the global market in 2024 and accounted for the largest share of more than 83% of the overall revenue. The primary factor propelling the market is the rise in dog ownership across the globe. Additionally, rising dog expenses and the significance of dog health are anticipated to support further market growth. According to the World Population Review, the United States has the most pet dogs, with more than 90 million by 2024.

According to Madison Animal Care Hospital, the frequency with which professional dog grooming is performed is determined by many different factors. These include the breed, the weather, the length and type of the dog's coat, and the amount of time spent outside. Large breeds often have thick or double coats that shed significantly. Regular grooming helps control shedding, reducing loose hair around the home and preventing mats or tangles that can lead to skin irritation. Moreover, many large breeds, especially those with floppy ears, are prone to ear infections. Regular grooming includes ear cleaning, which prevents wax buildup and decreases the chance of ear infections.

On the other hand, the cat pet type segment is anticipated to register the fastest growth rate during the forecast years. Key factors contributing to the segment growth include the high population & humanization of pet cats in comparison to other pet types. Moreover, grooming of pets helps in preventative healthcare by early identification of changes to the skin or body of a pet and contributes to a hygienic home & helps reduce pet-related allergies.

Regional Insights

North America pet grooming services market held the largest share of more than 40% of the global market in 2024. Increased pet ownership, rising pet expenses, and growing concerns about the health and welfare of pets are some of the factors driving this growth. The 'True Cost of Pet Parenthood' research, published by Rover in March 2022, noted that companion owners are becoming more prepared to spend money on their animals. Pet parents are increasingly prioritizing pet care and favoring goods and services such as trimming, massage and other grooming services that align with their values, which is reflected in their purchasing habits.

U.S. Pet Grooming Services Market Trends

The U.S. pet grooming services market is driven by the rising expenditure on pets. As companion owners increasingly allocate more of their budgets to the health, comfort, and aesthetics of their animals, professional grooming services have become an essential part of pet care. In 2022, for example, companion owners in the United States spent USD 136.8 billion on their companion animals, according to the American Pet Products Association. This exceeded the USD 123.6 billion projected spending in 2021.

Europe Pet Grooming Services Market Trends

The Europe pet grooming services market accounted for the second-largest market share in 2024. The increase in the number of companion animals, combined with a high per capita income, is driving market growth. As more people adopt pets, demand rises for services that cater to their health and well-being, including grooming. In 2022, cats were the most common pet in Europe, with 127 million, or 26% of all homes, owning one, according to a September 2023 article by the Pet Food Industry.

The UK pet grooming services market is driven by the presence of key pet grooming facilities. Established grooming businesses offer a range of services, such as basic grooming, nail trimming, teeth cleaning, and specialized treatments like massages and spa services, which attract companion owners seeking premium care for their pets. For instance, Pets At Home, Inc., a leading pet care in the UK, offers grooming services, including pet food, toys and accessories.

Asia Pacific Pet Grooming Services Market Trends

The pet grooming services market in Asia Pacific is anticipated to grow at the fastest CAGR of 8.92% during the forecast period. The rising disposable income levels of customers in emerging countries, the rise in pet groomers, the existence of grooming start-ups, and the humanization of pets are all factors contributing to the APAC region's quickest development.

India pet grooming services market is growing rapidly, driven by increasing demand for pet grooming services, increasing pet ownership, urbanization, and a growing middle class. Pet grooming service providers' diversified service offerings and technological integration are key trends and drivers influencing the market growth. For instance, approximately 600,000 pets are adopted each year, with dogs being the most popular species.

Latin America Pet Grooming Services Market Trends

The pet grooming services market in Latin America is driven by the rising pet ownership rates in the region, where dogs are the most popular pets, followed by cats and birds. Ownership of pets has been changing throughout Latin America. According to a June 2023 article by the Pet Food Industry, the demand for cats and small dogs is rising as more people relocate to urban areas. To increase their market share, both domestic and international market participants are constantly putting novel strategies into practice, like regional growth.

Brazil pet grooming services market is influenced by pet insurance. As companion owners invest more in comprehensive pet health coverage, grooming services have become a routine part of pet care that insurance policies are beginning to cover or subsidize, especially when linked to health and hygiene benefits. With pet insurance reducing out-of-pocket costs, companion owners are more likely to opt for regular grooming, leading to increased demand for such services.

Middle East & Africa Pet Grooming Services Market Trends

The pet grooming services market in the Middle East & Africa is driven by the growing pet ownership and the growing need for pet insurance services and products. The region's high level of disposable income reflects a greater ability to spend on animal care. Due to the large cat population in the region, there are numerous potentials for cat insurance providers to expand.

South Africa pet grooming services market is seeing a rise in professional training and certification for groomers, leading to higher standards of service. As customers become more aware of the qualifications of groomers, they may choose services based on these standards. A growing awareness among companion owners about the importance of regular grooming for the health and well-being of pets. Grooming helps prevent health issues like skin infections and matting, leading owners to seek professional services.

Key Pet Grooming Services Company Insights

Due to the presence of many small-scale service providers in various countries that compete with established service providers, the market is fairly competitive. In order to increase their market share, players in this market are continuously engaged in a variety of strategic activities, including regional growth, mergers and acquisitions, and the introduction of new services. For instance, in November 2022, in order to assist in locating a pet care provider in the nearby region, Wag! Group Co. established a Neighborhood Network Platform.

Key Pet Grooming Services Companies:

The following are the leading companies in the pet grooming services market. These companies collectively hold the largest market share and dictate industry trends.

- Petsfolio

- Pets At Home, Inc.

- PetSmart LLC

- Wag Labs, Inc.

- Pooch Dog SPA

- Paradise 4 Paws

- PetBacker

- Dogtopia Enterprises

- Anvis Inc.

- Pawz & Company

Recent Developments

-

In November 2023, Dogtopia opened its 250th dog daycare center, surpassing 500 signed franchise agreements in the U.S.

-

In June 2023, Dogtopia signed a franchise agreement to open dog care centers in Passaic County, New Jersey, and Rockland County, New York.

Global Pet Grooming Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.27 billion

Revenue forecast in 2030

USD 10.35 billion

Growth rate

CAGR of 7.33% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, service type, delivery channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Petsfolio, Pets At Home, Inc., Wag Labs, Inc., PetSmart LLC, POOCH DOG SPA, PARADISE 4 PAWS, PetBacker, Dogtopia Enterprises, Anvis Inc., Pawz and Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Grooming Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet grooming services market report based on pet type, service type, delivery channel, and region:

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Large Breeds

-

Medium Breeds

-

Small Breeds

-

-

Cats

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Massage/Spa & Others

-

Shear & Trimming

-

-

Delivery Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet grooming services market size was estimated at USD 6.89 billion in 2024 and is expected to reach USD 7.26 billion in 2025.

b. The global pet grooming services market is expected to grow at a compound annual growth rate of 7.33% from 2025 to 2030 to reach USD 10.35 billion by 2030.

b. North America region dominated the pet grooming services market with a share of over 40% in 2024. This is attributable to the increasing awareness regarding the health and cleanliness of pets, along with high pet ownership in the region.

b. Some key players operating in the pet grooming services market include Petsfolio, Camp Bow Wow, Wag Labs, Inc., PetBacker, POOCH DOG SPA, PARADISE 4 PAWS, PetSmart LLC, Dogtopia Enterprises, Anvis Inc., Pawz and Company

b. Key factors driving the market growth include rising pet humanization nd pet expenditure, rising expansion of pet service offerings, and increasing adoption of subscription-based pet services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.