Pet Furniture Market Size, Share & Trends Analysis Report By Product, By Application, By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-092-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Pet Furniture Market Size & Trends

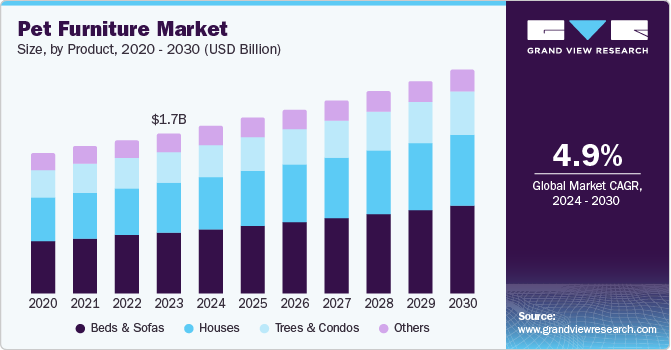

The global pet furniture market size was estimated at USD 1.74 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. As consumers treat their pets as integral family members, they are willing to invest significantly in their comfort and well-being, leading to a surge in demand for premium pet furniture. Consumers in developed regions such as North America and Europe prioritize high-quality, aesthetically pleasing pet furniture that harmonizes with their home décor, justifying premium pricing.

The pet population is experiencing significant growth, driven by relaxed pet ownership regulations and demographic trends. According to the Health for Animals Association, a falling birth rate in China has contributed to the increased pet ownership in the country. This surge in pet ownership drives demand for pet furniture, particularly for dogs and cats, and fuels innovation in eco-friendly and multifunctional products.

The humanization of pets has increased expenditures on specialized furniture that enhances their living conditions. Pet owners seek innovative products that cater to their pet’s needs, such as orthopedic and temperature-controlled beds designed to provide support and comfort. This focus on health and wellness has prompted manufacturers to innovate and expand their product lines, catering to the growing demand for specialized pet furniture.

The expansion of e-commerce has also played a crucial role in driving the growth of the pet furniture market. Online platforms have made it easier for consumers to access a wide range of pet furniture options, contributing to market growth. Manufacturers are now focusing on customization and online sales channels to cater to the diverse needs of pet owners worldwide. As the market evolves, manufacturers must adapt to changing consumer preferences and trends, such as smart furniture and urban living solutions, to remain competitive and drive expansion.

Product Insights

The beds & sofas segment held the largest revenue share of 38.1% in 2023. Pet owners invest in the comfort of their pets, mirroring how they care for family members. As a result, there is a growing demand for orthopedic and temperature-controlled beds, which offer health benefits for pets’ joints and overall well-being. Multifunctional designs that blend with home decor are also gaining popularity, allowing pet owners to prioritize aesthetics and their pets’ comfort.

The houses segment is projected to experience significant growth over the forecast period. Integrating pet houses with home decor is gaining traction as consumers seek to balance aesthetics and functionality. Multifunctional designs, such as cat trees that double as bookshelves, are particularly popular in urban areas with limited space. Moreover, pet owners prioritize the health of their pets, driving demand for houses with advanced temperature control and orthopedic support.

Application Insights

The cat segment led the market and accounted for a share of 35.2% in 2023, owing to the growing popularity of cat ownership, particularly among millennials. Pet owners’ increased sentimentality towards their cats drives demand for stylish and functional furniture that balances pet comfort and home decor. Eco-friendly and innovative designs also meet consumers’ preferences for sustainable products, further boosting the market.

The dogs segment is anticipated to register the fastest CAGR of 4.9% over the forecast period. The global dog population is experiencing significant growth, driven by high adoption rates in the U.S., China, and the UK. With approximately 30% of households globally owning a dog, as stated by the World Population Review, there is a rising demand for customized dog beds and furniture. The humanization of pets drives owners to invest in comfort and well-being, fueling demand for innovative, multifunctional products with features such as orthopedic support and temperature control.

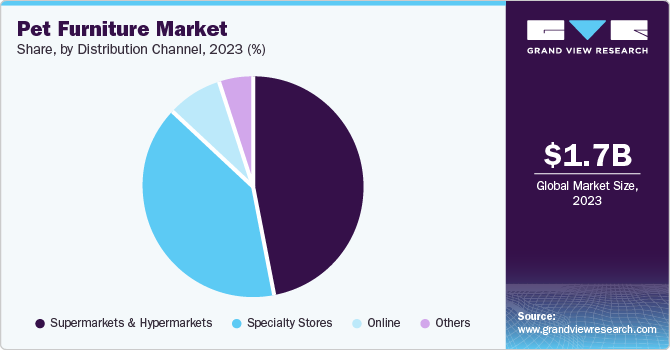

Distribution Channel Insights

Supermarkets & hypermarkets dominated the market with a revenue share of 46.9% in 2023. The coexistence of brick-and-mortar retail formats, including supermarkets and hypermarkets, offers consumers a convenient one-stop shopping experience for pet furniture products. Established brands and competitive pricing through special discounts attract budget-conscious shoppers. The organized layout of these stores enhances product visibility, facilitating the discovery of niche pet items, and meets the growing demand for accessible shopping options as pet ownership increases.

Online distribution channels are expected to register the fastest CAGR of 6.3% over the forecast period. The rise of e-commerce has revolutionized the pet furniture market, offering consumers a vast array of products from multiple brands. Online platforms provide competitive pricing, promotions, and customer reviews, enabling informed purchasing decisions. The growing trend of pet humanization and increased internet penetration drive demand for innovative, customizable products, fueling the shift toward online shopping.

Regional Insights

North America pet furniture market dominated the global market with a revenue share of 40.5% in 2023. The region’s high pet ownership rates, particularly for dogs and cats, drive demand for innovative and high-quality furniture. Established brands and retailers, combined with a growing focus on health-oriented products such as orthopedic beds, fuel market expansion as consumers prioritize their pets’ health and lifestyle needs.

U.S. Pet Furniture Market Trends

The pet furniture market in the U.S. dominated North America in 2023, driven by the increase in pet ownership in the country. According to the 2024 APPA National Pet Owners Survey, pet ownership has risen from 67% to 70% of households between 2021 and 2024. The trend of pet humanization, with 35% of households in the country having multiple pets, fuels demand for pet furniture. Innovative products and health-oriented furniture, such as orthopedic beds, enhance consumer interest and contribute to market growth.

Europe Pet Furniture Market Trends

Europe pet furniture market held a substantial market share in 2023. European consumers’ growing trend of treating pets as family members drives demand for premium, stylish, and functional furniture. The pet humanization phenomenon demands high-quality materials and innovative designs that balance aesthetics and comfort. Multi-pet households require specialized solutions, increasing market appeal as owners seek to provide individual spaces for their pets.

The pet furniture market in Germany is expected to grow lucratively between 2024 and 2030, driven by the country’s growing pet population. German consumers seek stylish and functional furniture that meets aesthetic and comfort needs. The emphasis on sustainability and wellness also shapes consumer preferences, leading to increased demand for eco-friendly products.

Asia Pacific Pet Furniture Market Trends

Asia Pacific pet furniture market is expected to register the fastest CAGR of 6.1% in the forecast period. The region is experiencing a surge in pet ownership and disposable incomes, driving demand for premium pet products. Consumers in China, India, and Japan are increasingly aware of their pets’ needs, leading to a shift towards multifunctional furniture and eco-friendly materials. Stringent pet safety regulations also fuel innovation and market growth.

The pet furniture market in China dominated the Asia Pacific pet furniture market with a revenue share of 21.5% in 2023, driven by urbanization and rising disposable incomes. With 53 million cats and 27 million dogs, the market demands high-quality, multifunctional pet furniture that balances pets’ comfort and owners’ lifestyles. E-commerce and premium products drive growth.

Key Pet Furniture Company Insights

Some key companies operating in the market include Go Pet Club, Ware Pet Products, Inter IKEA Systems B.V., and PetPals Group, Inc., among others. Companies prioritize strategic initiatives, including eco-friendly materials, e-commerce expansion, and partnerships, to capitalize on emerging market opportunities. Multifunctional designs that cater to the needs of both pets and owners are intensifying competition in the sector.

-

Go Pet Club, LLC offers a diverse range of products, including cat trees, condos, and pet strollers, designed for functionality, aesthetics, and durability. The company leverages e-commerce platforms to reach a wider audience.

Key Pet Furniture Companies:

The following are the leading companies in the pet furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Go Pet Club

- Ware Pet Products

- Inter IKEA Systems B.V.

- PetPals Group, Inc.

- MidWest Homes for Pets

- North American Pet, and North American Product

- Aosom LLC

- MiaCara

- Fable Pets, Inc.

- Critter Couch Company

Recent Developments

-

In May 2024, IKEA launched its Utsådd pet collection, which focused on eating, sleeping, playing, and hiding. The collection, which featured 29 pieces, was showcased in two catalogues.

Pet Furniture Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.83 billion |

|

Revenue forecast in 2030 |

USD 2.44 billion |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, application, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, Australia, South Korea, Brazil, Saudi Arabia |

|

Key companies profiled |

Go Pet Club; Ware Pet Products; Inter IKEA Systems B.V.; PetPals Group, Inc.; MidWest Homes for Pets; North American Pet; Aosom LLC; MiaCara; Fable Pets, Inc.; Critter Couch Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pet Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet furniture market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Beds & Sofas

-

Houses

-

Trees & Condos

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cats

-

Dogs

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."