Pet Funeral Services Market Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Service Type (Burial, Cremation), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-096-6

- Number of Report Pages: 157

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Pet Funeral Services Market Size & Trends

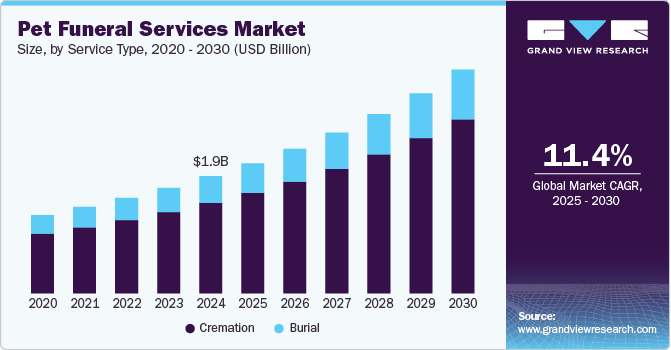

The global pet funeral services market size was estimated at USD 1.97 billion in 2024 and is projected to grow at a CAGR of 11.45% from 2025 to 2030. The market is mainly driven by rising pet companionship rates and pet humanization tendencies in emerging as well as developed countries. Significant factors driving market growth include expanding pet owner awareness of reasonably priced pet death care services, rising pet industry spending, and the growing popularity of pet cremation facilities. Pet humanization continues to grow as a result of shifting lifestyle patterns, such as the rise in nuclear families, single-person households, the aging population, and younger generations' growing understanding of pet ownership and care. According to the GITNUX Report 2024, nuclear families make up about 66% of all families globally.

Like other veterinary service industries, the pet funeral services market has been negatively impacted by the COVID-19 pandemic in 2020 as governments enforced strict regulations. These regulations included nationwide lockdowns, closure of pet service facilities, fewer funeral home appointments, and a highly executed interbusiness shift of cremation services to meet the demand for human funerals (as the number of human deaths in COVID-19 was increased). However, revenue normalized the next year due to higher global pet adoption and ownership rates. For example, the American Society for the Prevention of Cruelty to Animals (ASPCA) reported that during the COVID-19 pandemic, approximately 23 million American families got a new pet.

Pet humanization has drawn more focus in recent years from research studies and popular media outlets. Additionally, in recent decades, the relationship between humans and companion animals has been explored. Therefore, one of the main drivers of expansion is the global tendency of seeing dogs as members of the family rather than merely companion animals. The HealthforAnimals research states that between 2014 and 2019, pet ownership rose by 113%, and experts predict that China will have the most pets worldwide by 2024. This trend of pet humanization is likely to promote market growth throughout the forecast period.

Moreover, pet memorial services provide owners with a safe space to grieve openly and a sense of closure for their lost pets. Pet funeral services are becoming more and more necessary as a result of the growing emphasis on providing a dignified means of remembering the unique link between pet and owner. Some of the leading providers of pet funeral services worldwide are the CVS Group, Regency (Acq by Gateway Services) (IAOPCC recognized), Veternity (Acq. by IVC Evidensia), Vetspeed Ltd (CPC Cares), and Pets in Peace. The International Association of Pet Cemetery & Crematoriums has approved Pets in Peace as the first pet crematorium in Australia. Boxes, urns, lumber vessels, castings, plaques, memory jewelry, souvenirs, collectibles, and standard vessels are among the commemorative items it offers.

Market Concentration & Characteristics

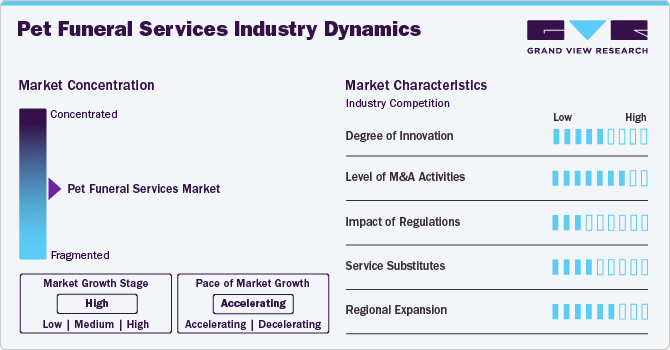

The market for pet funeral services shows a moderate level of concentration. The market is growing at a rapid rate and is currently in a high stage. The establishment of new pet crematoriums is one of the main factors driving market growth. The new pet crematoriums have created multiple opportunities for startup companies and veterinarian practices. For instance, GHMC finished constructing an innovative small animal cremation at its Animal Care Centre in Fathullaguda, according to a news published by THE HINDU BUREAU in December 2022.

Moreover, according to an article published by the Times of India in December 2023, the first animal cremation facility in Delhi, located in Dwarka Sector 29, will open up to customers very soon. It will run on CNG. With the rising demand for pet funeral services, there has been a notable trend toward customized pet memorialization solutions. Instead, they seek highly personalized memorialization options that resonate with owners’ unique relationship with their pets.

The market exhibits a moderate level of innovation, as demonstrated by supportive initiatives and continuous collaboration and partnership among market participants. For instance, in December 2023, Billy, the Whitehaven goose that unfortunately died on the port, was granted free crematorium by Pets at Peace. Pet owners can spend time with their animals at the family-run establishment, which offers a private, respectable service similar to a human funeral home.

There is a significant number of merger and acquisitions activities in the market, which indicates ongoing consolidation and strategic collaborations among industry leaders. For instance, in March 2022, Gateway Services Inc., a portfolio company of Imperial Capital, acquired Regency Pet, LLC, a company owned by Access Holdings, marking a significant expansion in the pet aftercare services sector.

The market experiences a low impact of regulations. Pet cremation regulations vary according to nation, state, and municipality. To obtain the license to operate a pet cemetery or crematorium, one must apply to the Secretary of State. The applicant must sign the application and attest to its truthfulness while facing possible perjury charges.

The risk of substitutes is expected to be low to moderate. The type of pet funerals varies in every region. Though globally these services are considered a standardized type of treatment for pet funeral use, several alternative forms of services do exist in some countries. Substitution services like resomation, and pet taxidermy, and others.

Moderate to high levels of regional growth operations in the market are caused by initiatives by major competitors in the market. For example, one of the top providers of veterinary services in the UK is CVS Group plc. It provides funeral services for pets. Its memorial services and pet cremation offer pet owners a kind opportunity to say goodbye to their cherished animals. These services are easily accessible due to CVS Group plc's wide network of veterinary clinics, which strengthens its position in the pet funeral industry.

Service Type Insights

The cremation segment held the highest revenue share in 2024 and is anticipated to grow at the fastest CAGR of 11.61% over the forecast period, due to the changing perspectives on pets as cherished family members and the increasing significance of giving them dignified and respectful funerals. In addition, global companies are increasingly involved in the pet funeral industry with innovative initiatives like SafePassages Pet Cremation (SPPC), which opened for business in January 2023 in Indiantown, Florida. Pet owners can have a peaceful ending with SPPC's eco-friendly and compassionate pet cremation service, which places a strong emphasis on traceability and openness throughout the procedure.

The burial segment is expected to grow at a significant CAGR from 2025 to 2030, driven by a combination of factors, including the growing trend of pet humanization, the desire for a more traditional & personalized farewell for pets, and the increasing willingness of pet owners to invest in meaningful & memorable pet funerals. This preference for burial over cremation often stems from the desire for a more tangible memorial, such as a grave marker or a burial plot, which can be visited and maintained by the pet's owner or family. The burial segment is also supported by the availability of a wide range of burial options, including traditional burial sites and more eco-friendly alternatives like pet cemeteries designed with environmental sustainability in mind.

A recent initiative by PetRest Carolina, a leading provider of pet funeral services, highlights the growing emphasis on personalized and meaningful burial options for pets. They offer a variety of burial options, including the choice of casket materials, personalized engraved markers, and even the option to have a pet's remains interred in a family plot. This focus on personalization and the inclusion of family members in the burial process reflects the evolving attitudes toward pet funerals, where pets are increasingly seen not just as pets but as cherished members of the family.

Pet Type Insights

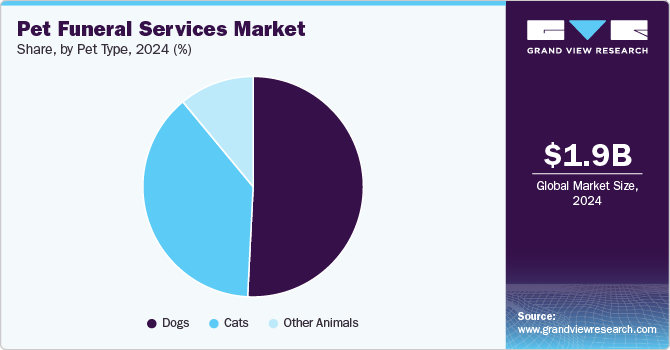

The dogs segment held the highest revenue share of 50.80% in 2024 due to an increasing popularity of dogs as companion animals worldwide and their sizeable population in wealthy countries. The growing trend of treating pets like family members is a result of the stronger emotional connection between humans and dogs. The increase in dog adoption rates reflects this viewpoint shift. In 2023, the American Pet Products Association (APPA) reported that 69 million households in the United States owned dogs, a number that is continuously increasing. The market is also impacted by the growing trend toward holistic and wellness lifestyles, which encourages pet owners to use services that deal with every aspect of their pets' lives, including their death.

The cat segment is poised for significant growth from 2025 to 2030, driven by several factors. The growing trend of pet adoption, especially for cats, is one of the primary factors driving the segment growth. Moreover, companies such as Veternity, CVS Group, and Regency are leading the way in the pet funeral services market, offering a comprehensive suite of services tailored to cat owners. The introduction of innovative products and services, including digital memorialization services & customizable memorial packages, is anticipated to stimulate market growth further.

Veternity, in particular, has distinguished itself through its innovative approach in providing comprehensive services for pets, including cats, positioning them as a frontrunner in the market. This trend of innovation and market expansion within the pet funeral services sector is expected to persist, fueling the growth of the cat market segment.

Regional Insights

North America dominated the pet funeral services market with the revenue share of 36.89% in 2024. North America pet funeral services market is dominated by high pet ownership rates, robust consumer spending, and the expanding pet humanization trend. Since pets are seen as members of the family in the region, there is a growing need for full-service pet funerals that include burial, cremation, and memorialization. According to the American Pet Products Association's (APPA) 2022 National Pet Owners Survey, more than 70% of households in the United States alone own a pet. Because pets are now seen as essential members of the family, there is a high demand for services relating to them.

U.S. Pet Funeral Services Market Trends

The pet funeral services market in the U.S. is experiencing substantial growth. Recent innovations in the U.S. pet funeral services market include the introduction of eco-friendly and sustainable options, such as biodegradable urns and green burial services, catering to environmentally conscious pet owners. Competitive players in the market, including Pet Passages, Pet Angel Memorial Center, and Resting Waters Aquamation, offer a wide range of services, from pet cremation and burial to memorialization products & grief support services, to meet the diverse needs of pet owners across the country. These companies are contributing to the market growth and competitive landscape, highlighting the dynamic nature of the pet funeral services industry in the U.S.

Europe Pet Funeral Services Market Trends

Europe pet funeral services market place is highly competitive, with a multitude of small to large pet funeral service providers continuously evolving their service offerings to meet the diverse needs and preferences of pet owners. Key players in Europe market include Pets at Peace Promise (UK), Pet Cremation Services Limited (UK), Deceased Pet Care Funeral Homes & Crematories (UK), Anubis Tierbestattungen (Germany), and Haustierbestattungen.de (Germany). These companies offer a range of services designed to cater to the unique needs and preferences of pet owners, contributing to the overall growth and development of the pet funeral services market in Europe.

The pet funeral services market in UK is witnessing notable growth, driven by the increasing humanization of pets and the growing demand for specialized aftercare services. According to PDSA Animal Wellbeing Report 2023, with approximately 51 million pets in the UK, including 12 million pet dogs and 10.9 million pet cats, there is a significant need for pet funeral services. The market is characterized by a range of offerings, including pet cremation and burial services, as well as memorial products & personalized ceremonies. Companies such as Dignity plc, CPC Cares, and Pet Cremation Services are among the key players in the UK's pet funeral services market, catering to the evolving needs of pet owners and ensuring dignified aftercare for beloved companions.

Asia Pacific Pet Funeral Services Market Trends

The Asia Pacific pet funeral services market is expanding rapidly, driven by increased pet ownership rates, particularly in China, Japan, and South Korea. China alone had 54.29 million dogs and 58.06 million cats, according to a recent industry report, suggesting a sizable market for pet-related services. Additionally, the trend of humanizing dogs has increased demand for respectful and customized funeral services, which is driving market growth.

The growth of pet funeral services market in China can be attributed to rising disposable income, increasing urbanization, and a cultural shift toward viewing pets as integral family members. Pet owners are increasingly opting for dignified farewells for their beloved companions, choosing services like cremation, burials in pet cemeteries, and memorial ceremonies over traditional abandonment or simple burials. Industry leaders such as Shanghai Meilin Pet Group are providing these services. Meilin, with its extensive network of over 20 pet cemeteries and funeral homes, offers elaborate ceremonies and personalized urns.

Latin America Pet Funeral Services Market Trends

The Latin America pet funeral services market is expanding due to a number of factors. The rising pet ownership rates in the area, where dogs are the most popular pets, followed by cats and birds, are one important factor. According to a June 2023 article by Pet Food Industry, the demand for cats and small dogs is rising as more people relocate to urban areas. Funerals and other pet-related services are becoming more in demand as a result of this trend. Pet owners want to give their cherished animals dignified farewells because pets are increasingly seen as members of the family.

The rise of specialized services and facilities is an important trend in pet funeral services market in Brazil. To meet the various demands of pet owners, these facilities provide a range of options, from straightforward cremations to ornate burial rites. To satisfy the growing demand, major competitors in this sector, such Pets in Peace and Pet Memorial, are increasing the range of products they offer. Companies are also investing in innovative solutions such as eco-friendly cremation choices and online memorial services to accommodate the changing demands of pet owners in the country.

Middle East & Africa Pet Funeral Services Market Trends

The Middle East and Africa pet funeral services market is experiencing growth due to increased pet companionship rates, a growing trend of pet humanization, and growing pet owner knowledge of reasonably priced pet death care services. Veternity, CVS Group, Regency, Vetspeed Ltd., and Pets in Peace are a few of the major companies in the global pet funeral services market, which covers the MEA region.

Growing rates of pet companionship are driving the pet funeral services market in South Africa. There are 21.7 million pets in the country. As pets are increasingly viewed as members of the family and owners look for respectful ways of saying final goodbye to their cherished companions, this trend is driving up demand for pet-related services, such as funerals.

Key Pet Funeral Services Company Insights

The majority of market participants collaborate closely with manufacturers and suppliers to maintain consistent global supply. As part of their worldwide strategy, some important companies engage in mergers and acquisitions as well as strategic collaborations. For instance, in November 2020, InvoCare Limited announced the acquisition of Family Pet Care Pty and Pets in Peace for USD 32.59 million in 2020, expanding its presence in the pet funeral services market.

Key Pet Funeral Services Companies:

The following are the leading companies in the pet funeral services market. These companies collectively hold the largest market share and dictate industry trends.

- Veternity (acquired by IVC Evidensia)

- CVS Group

- Regency (Acq by Gateway Services) (IAOPCC accredited)

- Vetspeed Ltd (CPC Cares)

- Pets in Peace

- PRECIOUS PETS CREMATORY

- Constant Companion Pet Crematorium

- Newhaven Funerals

- Paws to Heaven Pet Crematory

- Pet Cremation Services

- Midwest Cremation Service

- Sarasota Pet Crematory

- Okanagan Pet Cremation

- Precious Pet Cemetery

- Dignity Pet Crematorium

- High Peak Pet Funeral Services

- Anima Care

- Pets At Peace

View a comprehensive list of companies in the Pet Funeral Services Market

Recent Developments

-

In January 2023, Vedi and Evermore Pet Cremation have joined forces to create a streamlined service for handling a pet's passing, aiming to ease the burden on pet owners. By integrating with Vedi's universal health record platform, the partnership aims to eliminate the potential for mishaps in the often-manual process between veterinarians, owners, and crematoriums, which is typically managed using disparate methods like spreadsheets and labels.

-

In March 2021, VetPartners acquired Pet Cremation Services, a UK-based pet crematoria company, to expand its service offerings.

Pet Funeral Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.18 billion |

|

Revenue forecast in 2030 |

USD 3.75 billion |

|

Growth rate |

CAGR of 11.45% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Pet type, service type, region |

|

Regional scope |

North America; Europe;, Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia;, South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE;, Kuwait |

|

Key companies profiled |

Veternity (acquired by IVC Evidensia); CVS Group; Regency (Acq by Gateway Services) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pet Funeral Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet funeral services market report based on pet type, service type, and region.

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Burial

-

Cremation

-

Communal

-

Partitioned

-

Private

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet funeral services market size was estimated at USD 1.97 billion in 2024 and is expected to reach USD 2.18 billion in 2025.

b. The global pet funeral services market is expected to grow at a compound annual growth rate (CAGR) of 11.45% from 2025 to 2030 to reach USD 3.75 billion by 2030.

b. North American region dominated the global pet funeral services market and registered the largest revenue share of 36.89% in 2024. This substantial share is owing to the presence of a large pet population with respectively high expenditure on pet services, coupled with significant availability of pet funeral & cremation homes.

b. Some key players operating in the global pet funeral services market include Veternity; CVS Group; Regency.; Vetspeed Ltd.; Pets in Peace; PRECIOUS PETS CREMATORY.; Constant Companion; Newhaven Funerals; Paws to Heaven Pet Crematory; Pet Cremation Services; Midwest Cremation Service; SARASOTA PET CREMATORY; Okanagan Pet Cremation; Precious Pet Cemetery; Dignity Pet Crematorium; High Peak Pet Funeral Services; Anima Care; Pets At Peace, among others.

b. Increasing pet companionship rates & pet humanization trends in developed and developing countries, growing pet industry expenditures, rising awareness among pet owners about affordable pet death care services, and growing popularity of pet cremation centers are some of the factors that are majorly driving the growth of the pet funeral services market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."