- Home

- »

- Consumer F&B

- »

-

Pet Food Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Pet Food Market Size, Share & Trends Report]()

Pet Food Market Size, Share & Trends Analysis Report By Pet Type (Dog [Wet Food, Dry Food, Snacks/Treats], Cat [Wet Food, Dry Food, Snacks/Treats], Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-559-5

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Pet Food Market Size & Trends

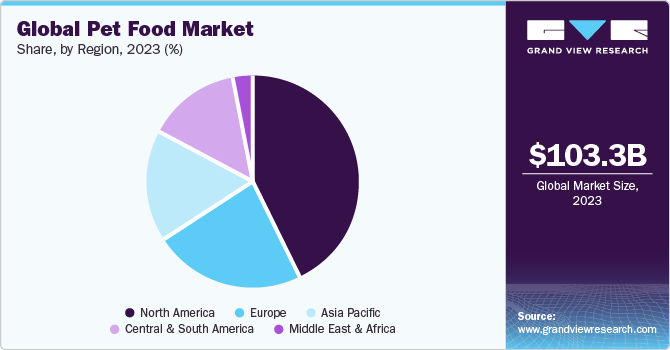

The global pet food market size was estimated at USD 103.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. The demand for products is anticipated to be driven by growing consumer inclination toward the adoption of pets along with rising concerns regarding their health. Improvement in overall digestion and performance of pet animals owing to consumption of nutritious food is also likely to boost market growth in the forecast period. The pet food products that are available in the global market rarely vary. This, in turn, has prompted manufacturers to include multi-functional and innovative ingredients in their products to curb such similarity bias. Convenience is likely to play a vital role in driving this industry, given the increased popularity of prepared pet food. The other segment is organic pet food, a recent and growing trend in the market.

Increasing availability of organic products in a variety of flavors and the inclusion of essential ingredients such as probiotics and antioxidants are factors that are likely to induce a positive impact on global market growth. On the other hand, low product penetration owing to its slightly high price may restrain organic segment growth in the coming years as every household would not be able to purchase high-priced products.

The market value chain is characterized by the presence of raw material suppliers, manufacturers, distributors, and end-users. The raw materials which are used for production include meat, meat byproducts, cereals, grains, and specialty proteins derived from animals, palatants, flavors & sweeteners, vitamins, minerals, and enzymes among others.

Manufacturers formulate these products in accordance with the standard nutritional requirements of domesticated animals. Meat-based raw materials are processed/rendered to separate protein components, water, and fat. The manufacturing process also entails grinding, cooking, and mixing the aforementioned raw materials with other ingredients.

The raw materials utilized in each pet food product segment are primarily commodities and agricultural-based products. Grains, fruits, and animal protein meals, among other ingredients, are procured from various suppliers. The cost, quality, and availability of these key ingredients have fluctuated in the past and are expected to fluctuate in the future as well. For instance, in March 2023, pet food prices in America rose by 15.1% YoY. Due to this, residents are considering giving away their pets. Such sudden and sharp increases in the prices of pet food can adversely affect market growth.

Regional Insights

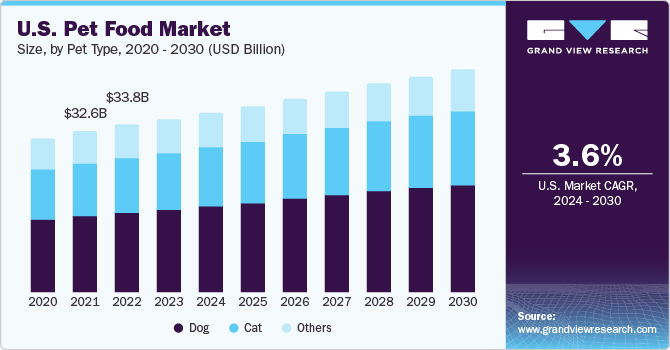

North America dominated the market with a revenue share of 42.87% in 2023. This is attributed to the rising consumer awareness regarding the beneficial impact of products on health along with the increasing trend of humanization of pets. The U.S. dominated the North American market in 2023 owing to a high percentage of pet ownership along with the presence of a well-developed pet food industry.

The outbreak of COVID-19 in the region has affected the supply of raw materials and ingredients and disrupted supply chains, especially in the U.S. Key factors, such as the affected supply chain and logistics in the region and economic crisis, have hampered product demand in North America in the first half of 2020. However, the strong position held by North American manufacturers and availability of pet food and treat options domestically are estimated to trigger market growth in the near future.

Europe held the second-largest revenue share globally. This is because of the humanization of pets and increasing demand for premium food products, mainly organic, raw, and natural, depending upon the choice of the customer. According to the European Pet Food Industry Federation (FEDIAF), Europe is one of the largest markets for the pet food industry, accounting for approximately 30% of total pet care and pet food sales across the globe.

Pet Type Insights

Dog pet type dominated the market with a revenue share of more than 42.1% in 2023. This is attributed to the growing adoption of dogs as household pet and rising household expenditure towards healthy dog food due to an increase in concerns of owners about their dog health. Dogs are a carnivorous species, and therefore, their meals are largely meat-based. For dogs, the requirement of carbohydrate content is relatively low, which has driven demand for products with higher meat and lower starch content.

Dry dog food is preferred by owners globally. It has its advantages in supporting the healthy oral system of the dog. More importantly, it is relatively more convenient and cost-effective as compared to that of available wet food products. Another advantage of these products is their longer shelf-life, and it does not require refrigeration or a special storage facility. Free feeding is the other advantage, and these factors are collectively expected to boost segment growth in the coming years.

Cat food type held the second largest revenue contributor globally. This is due to the increased concerns about health and a balanced diet requirement for cats. Cats are strict carnivores and need high protein (derived from other animals) in their daily meals. Animal-based proteins are more popular when compared to plant-based proteins because they are reported to be better in quality and biological value. Therefore, poultry (turkey and chicken) and rabbit-derived protein intake are preferred for cat diets in their daily meal.

Market Dynamics

According to the American Pet Products Association (APPA), in 2021, USD 123.6 billion was spent on pets including pet food & treats, supplies, vet care, and others in the U.S. In 2021, the highest sales in the country, amounting to USD 50.0 billion, were attributed to pet food and treats. Rising concerns among pet owners have been observed considering various health issues among their pets. Joint disease due to lack of exercise and overfeeding was one of the main reasons behind pets being overweight.

Pets also suffer from high blood pressure and diabetes. Pet owners are now increasingly shifting toward adopting nutritious foods manufactured by various companies owing to rising awareness among them to maintain the health of their pets. This shift in consumer preference is expected to have a positive impact on the pet food industry over the forecast period.

Diseases, such as osteoarthritis, among dogs and cats, have considerably increased with over 50% of cats and dogs reportedly suffering from it globally. The demand for pet food has grown significantly over the past few years. Large companies manufacture high-quality products while others are attempting to market less expensive imitations. This is expected to act as a restraining factor for the growth of the market in coming years.

Key Companies & Market Share Insights

The competitive landscape of this market is moderately consolidated with the presence of multinationals striving to fulfill high demand from large customers and end-user base. Key industry participants are inclined toward adopting new marketing strategies and using advanced technologies to strengthen their customer base and generate more revenue in near future. In addition, companies are undertaking expansion, mergers, and acquisitions as a part of their strategic initiatives. For example, in January 2022, Manna Pro acquired Oxbow Animal Health, a small animal pet brand that offers premium food, and supplements for rabbits, pigs, hamsters, and other pets. In addition, in September 2023, Superlatus, Inc., a key food distribution and technology firm, merged with TRxADE HEALTH, Inc., and announced its expansion in the pet food industry with plant-based or vegan pet food treats.

Industry participants are inclined toward investing heavily in research and technology to advance processes and create new recipes, which are manufactured with varied and special ingredients. Key manufacturers are also focused on developing innovative formulas to offer diverse and high-quality food for pets and farm animals. Industry players also utilize raw materials with criteria to meet demands, as well as regulations, in both domestic and international markets.

Key Pet Food Companies:

- The J.M. Smucker Company

- Nestle Purina

- Mars, Incorporated

- LUPUS Alimentos

- Total Alimentos

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- WellPet LLC

- The Hartz Mountain Corporation

Pet Food Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 103.3 billion

Revenue forecast in 2030

USD 139.29 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; Poland; Ukraine; Russia; Turkey; China; India; Japan; South Korea; Indonesia; Malaysia; Vietnam; Thailand; Australia; Brazil; Argentina; Middle East; South Africa.

Key companies profiled

The J.M. Smucker Company; The Hartz Mountain Corporation; Mars; Incorporated; Hill’s Pet Nutrition; Inc.; Nestle Purina; LUPUS Alimentos; Total Alimentos; General Mills Inc.; WellPet LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Food Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet food market report based on pet type and region:

-

Pet Type Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Dog

-

Wet Food

-

Dry Food

-

Snacks/Treats

-

-

Cat

-

Wet Food

-

Dry Food

-

Snacks/Treats

-

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Poland

-

Ukraine

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Malaysia

-

Vietnam

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Middle East

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet food market size was estimated at USD 103.3 billion in 2023 and is expected to reach USD 108 billion in 2024.

b. The global pet food market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 139.29 billion by 2030.

b. North America dominated the market and accounted for a 42.87% share of global revenue in 2023. The regional demand for pet food is primarily driven by rising consumer awareness regarding the beneficial impact on pet health along with the increasing trend of humanization of pets.

b. Some key players operating in the pet food market include The J.M. Smucker Company; The Hartz Mountain Corporation; Mars Incorporated; Hill’s Pet Nutrition, Inc; Nestlé Purina; Lupus Alimentos; Total Alimentos SA; Blue Buffalo Pet Products, Inc.; WellPet LLC; and Diamond Pet Foods.

b. Key factors that are driving the pet food market growth include the rising trend of pet adoption as a companion for families and consumer awareness regarding the beneficial impact on pet health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."