- Home

- »

- Animal Health

- »

-

Pet Diabetes Care Market Size, Share, Industry Report, 2030GVR Report cover

![Pet Diabetes Care Market Size, Share & Trends Report]()

Pet Diabetes Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Solution (Treatment, Glucose Monitoring Devices), By Distribution Channel (E-Commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-953-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Diabetes Care Market Summary

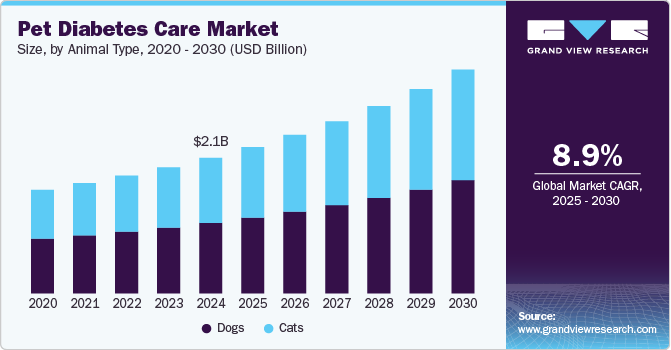

The global pet diabetes care market size was estimated at USD 2.10 billion in 2024 and is projected to reach USD 3.47 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. The availability of companion diabetic care devices, the increasing incidence of various diseases, the growing companion population, the rising adoption of companion, the rising acceptance of companion insurance, and the increasing risk of illness are all factors that continue to be key drivers.

Key Market Trends & Insights

- North America pet diabetes care market held more than 40% of the revenue share of the market in 2024.

- The U.S. dominated the North America Pet Diabetes Care market in 2024.

- By animal type, the dog segment dominated the market by animal type in 2024.

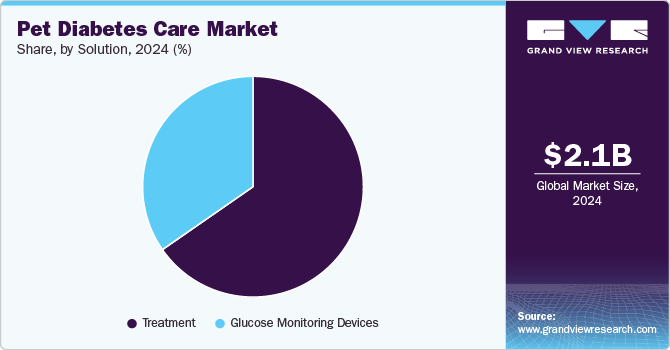

- By solution, the treatment segment held the largest market share in 2024.

- By distribution channel, the veterinary hospitals & clinics segment held the largest market share of over 41% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.10 Billion

- 2030 Projected Market Size: USD 3.47 Billion

- CAGR (2025-2030): 8.9%

- North America: Largest market in 2024

Furthermore, the rise in prevalence of chronic diseases such as diabetes and cancer in dogs, as well as supportive awareness campaigns and strategies developed by significant companies, are contributing to the industry growth. In November 2023, Patterson Vet Supply, Inc. published an article estimating that 1 in 230 cats and 1 in 300 dogs would get diabetes at some point in their lives.

The COVID-19 pandemic dropped sales and slowed the growth of the companion diabetic treatment, particularly in 2020. The proclamation of lockdown in several countries, along with restricted access to or closure of veterinary facilities, were the main causes of this consequence. However, the industry gradually rebounded as the fundamental causes for consumer demand remained unchanged. Additionally, the pandemic raised companion parents' knowledge of companion health and encouraged them to purchase companion insurance, which is anticipated to fuel industry growth in the coming years.

The global companion population has gradually increased, owing to several factors, including shifting demographics, urbanization, and lifestyle changes. The total companion population is expected to grow during the projected period as more people adopt dogs and cats. The demand for companion-related goods and services, such as veterinary care and pet insurance, is rising in direct proportion to the rise in companion ownership. Increased companion ownership expands the pool of possible clients for pet insurance providers, propelling industry growth.

The rising uptake of companion insurance is one of the key factors contributing to the industry's growth. For instance, The North American Pet Health Insurance Association, Inc. reports that Canada's overall insured companion sector expanded by 17.6%. Since 2018, the average annual growth rate for insured pets has been 17.1%. Dogs make up 76.9% of all insured companion, but cats make up a larger percentage (23.1%) than in the U.S.

Animal Type Insights

The dog segment dominated the market by animal type in 2024. The segment is primarily driven by a rise in dog ownership around the world. Additionally, rising veterinary healthcare expenses and the significance of companion health are anticipated to support additional market growth. In 2024, there were approximately 92 million dogs in the United States, according to the World Population Review. In addition, the growing number of obese dogs is another driver responsible for market growth. There is a growing need for efficient solutions as pet owners become more conscious of the health hazards that come with overweight companion.

The cat segment is anticipated to register a CAGR of over 9% during the forecast period because companion owners are becoming more conscious of the signs of diabetes in their felines. Another element driving the growth is the rising incidence of diabetes in the feline population. Boehringer Ingelheim International GmbH, for example, claims that cats are three times more likely than dogs to develop diabetes. Additionally, almost 50% of the cats are obese, which increases their risk of diabetes. In diabetic cats, visual indicators such excessive urination, thirst, appetite, and abrupt weight loss are warning companion parents to get a diagnosis as soon as possible and to stick with treatment.

Solution Insights

The treatment segment held the largest market share in 2024. Since insulin therapy helps move glucose from food into other areas of the body, veterinarians view it as the gold standard for treating diabetes in companion. Due to the inability to reuse needles, veterinary clinics and homes continue to have a strong demand for insulin delivery equipment such syringes, needles, and delivery pens. Moreover, insulin therapy is often a primary treatment option. Insulin injections help regulate blood sugar levels in diabetic companion, making it essential for managing the condition effectively. This therapy, along with other associated products like syringes, glucose meters, and test strips, forms the basis of the growing market.

The glucose monitoring devices segment is expected to hold a significant market share over the forecast period, due to manufacturers introducing diabetes care equipment for companion and the rising number of companion receiving a diabetes diagnosis. The major players have introduced specialized companion glucose monitoring devices since human glucometers are inaccurate for animal glucose readings.

For example, the Zoetis' AlphaTRAK blood glucose monitoring device is a user-friendly veterinary kit that assists companion owners in managing their pet's diabetes. Furthermore, companies are offering online application software that may be used with these gadgets to access trustworthy, important data on tablets or smartphones. For example, the PetDialog App was introduced by Zoetis and is utilized in conjunction with the AlphaTRAK monitoring gadget. These factors contribute to the segment growth.

Distribution Channel Insights

The veterinary hospitals & clinics segment held the largest market share of over 41% in 2024. This is due to the increasing number of veterinary hospitals and clinics with updated facilities. Veterinary clinics and hospitals are additionally primary care facilities for companion owners and a major supplier of medication for sick dogs. For example, Scarborough Vet-Pine Point Animal Hospital offers the guidance and direction needed to properly manage a companion diabetes. To support a companion health, the hospital provides routine examinations, blood glucose testing, and nutritional advice. Another aspect propelling market segment growth is the increasing number of veterinarians.

The e-commerce segment is anticipated to grow at a fastest CAGR over the forecast period. The rise of online shopping has made it easier for companion owners to access diabetes management products, including insulin, syringes, glucose meters, and related supplies. E-commerce platforms, such as Amazon, Chewy, and pet-specific online pharmacies, often offer a broader selection of diabetes care products compared to traditional companion stores. This variety allows companion owners to compare different brands, prices, and delivery options.

Regional Insights

North America pet diabetes care market held more than 40% of the revenue share of the market in 2024. Obesity is the most frequent preventable condition among dogs in North America. According to VCA Animal Hospitals, over 50% of dogs are overweight, as reported by the Association for Pet Obesity Prevention. Dogs who are overweight may also be at higher risk of having diabetes. Lack of exercise and overfeeding are the main causes of this. In the area, a lot of public-private partnerships are forming with the goal of developing and carrying out programs to enhance the health of companion animals. Numerous awareness programs are being launched to educate companionowners about the importance of promptly managing diabetes.

U.S. Pet Diabetes Care Market Trends

The U.S. dominated the North America Pet Diabetes Care market in 2024. This is attributed to a rise in the popularity of companioninsurance. Petinsurance is becoming more and more popular due to a number of variables, including a growing number of companion animals and high per capita income. For example, at year-end 2023, NAPHIA members reported that the overall premium volume in the United States was around $3.9 billion. As a result, the US market is still growing by double digits. Trupanion, Nationwide Pet Insurance, Healthy Paws Pet Insurance Foundation, ASPCA Pet Health Insurance, Crum, Petplan Pet Insurance, and Forster Pet Insurance Group are a few of the major pet insurance providers in the country.

Europe Pet Diabetes Care Market Trends

The Europe region held the second-largest revenue share of the market in 2024. This is due to the presence of significant important players like as Boehringer Ingelheim International GmbH, Zoetis, Merck, and others in European countries. Furthermore, the market is expanding due to the rising need for accurate and prompt diabetes detection in companion as well as companion humanization in countries like the UK and Germany.

UK Pet Diabetes Care Market is growing due tofactors such as increasing pet diabetes prevalence, improved veterinary care, awareness campaigns, e-commerce growth, and pet insurance coverage are all contributing to the market growth in the UK. For instance, In the UK, 1 in 175 pets are considered to have pet diabetes, according to the Orchard House Vets. Moreover, veterinary organizations and some UK government bodies are providing support for better pet healthcare through public awareness campaigns and initiatives aimed at improving pet welfare. This includes more focus on chronic conditions like diabetes and its management.

Asia Pacific Pet Diabetes Care Market Trends

The Asia Pacific market is growing rapidly, and this trend is expected to continue throughout the forecast period. This is a result of the growing pet adoption trend and the growth of the regional economy. Other factors propelling market growth include improved veterinary healthcare infrastructure and heightened awareness of veterinary health. Additional reasons driving the market growth include rising per capita income, rising animal health costs, growing veterinarian health awareness, and an increase in the number of companion animals.

India pet diabetes care market is anticipated to grow significantly over the forecast period. According to an article published by Hindustan Times in December 2024, 1.5% of dogs and 0.5-1% of cats have diabetes, making it a frequent condition in pets. For management, early diagnosis and therapy are essential. Furthermore, because of the negative effects on the pets' health as well as the lifestyle and financial situation of their owners, 20% of diabetic dogs and cats are put down within a year after diagnosis.

Latin America Pet Diabetes Care Market Trends

Latin America's market is growing swiftly in the coming years. The region suffers a common challenge such as a lack of understanding among pet owners about the need to manage pet obesity. For instance, in countries like Argentina, the industry is driven by substantial pet health awareness initiatives, like Zoetis Inc.'s yearly DogRun, which helps people realize how important regular veterinary care is for pets. To properly address and manage pet obesity, there is a need for increased awareness, educational programs, and professional assistance throughout the region.

Brazil pet diabetes care market is growing due to several factors, including the increasing number of pet diabetes diagnoses. As pets live longer, they are more prone to developing chronic diseases, including diabetes. This trend is reflected in the growing number of diabetic pets in Brazil, especially in urban areas. Additionally, obesity, a common risk factor for diabetes, is rising among pets due to poor diet and lifestyle, further contributing to the increasing prevalence of the condition.

Middle East & Africa Pet Diabetes Care Market Trends

South Africa, Saudi Arabia, the United Arab Emirates, and Kuwait together make up the Middle East and Africa market. Due to growing disease prevalence and disposable income, the market is expected to grow at a compound annual growth rate (CAGR) of more than 9% throughout the forecast period. Furthermore, rising pet care needs and improved understanding of pet illnesses are expected to fuel market growth.

South Africa pet diabetes care market is driven by increasing obesity, which is considered the leading health issue for pets in the country. Pets that are overweight are more prone to get diseased and may only live for two and a half years. Obesity in pets has been linked to more than 20 disorders, including diabetes, cancer, heart disease, rheumatoid arthritis, skin conditions, and urinary tract disorders. In South Africa, October is designated as Pet Obesity Month to promote proper obesity management.

Key Pet Diabetes Care Company Insights

The market is competitive, and the top companies are implementing a range of strategic efforts, including partnerships and collaboration, competitive pricing, sales and marketing campaigns, and mergers and acquisitions. For example, Boehringer Ingelheim International GmbH introduced the 20 ml formulation of prozinc (protamine zinc recombinant human insulin) as a daily single-dose medication for diabetic dogs in August 2020.

Key Pet Diabetes Care Companies:

The following are the leading companies in the pet diabetes care market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Zoetis

- BD

- Boehringer Ingelheim International GmbH

- Nova Biomedical

- Allison Medical, Inc.

- AccuBioTech Co., Ltd

- i-SENS, Inc.

- TaiDoc Technology Corporation

Recent Developments

-

In August 2023, The U.S. Food and Drug Administration has authorized SENVELGO, a revolutionary new medication for cats with diabetes developed by Boehringer Ingelheim.

-

In September 2022, NewMetrica, a company based in the UK that produces diabetic care devices for pets, was purchased by Zoetis, a US-based producer of pet medication immunizations.

Pet Diabetes Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.27 billion

Revenue forecast in 2030

USD 3.47 billion

Growth rate

CAGR of 8.9% from 2025 to 2030

Historical Data

2018 - 2023

Actual data

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, solution, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD; Boehringer Ingelheim International GmbH; Merck Animal Health; Nova Biomedical; Zoetis; Allison Medical, Inc.; UltiMed, Inc.; AccuBioTech Co., Ltd; i-SENS, Inc.; TaiDoc Technology Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Diabetes Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet diabetes care market report based on animal type, Solution, distribution channel, and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Treatment

-

Insulin Therapy

-

Insulin Delivery Devices

-

Other Treatments

-

-

Glucose Monitoring Devices

-

-

Distribution channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Retail Pharmacies

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet diabetes care market size was estimated at USD 2.10 billion in 2024 and is expected to reach USD 2.27 billion in 2025

b. The global pet diabetes care market is expected to grow at a compound annual growth rate (CAGR) of over 8.87% from 2025 to 2030 to reach USD 3.47 billion by 2030

b. North America dominated the pet diabetes care market with a share of over 40% in 2024. This is attributable to the increasing pet healthcare expenditure and the constant research & development initiatives in the region

b. Some key players operating in the pet diabetes care market include Merck Animal Health, Zoetis, BD, Boehringer Ingelheim International GmbH, Trividia Health, Inc., Allison Medical, Inc., UltiMed, Inc., ACON Laboratories, Inc., i-SENS, Inc., and TaiDoc Technology Corporation.

b. Key factors that are driving the pet diabetes care market growth include the increasing companion animal population and pet adoption, availability of pet diabetes care devices, the prevalence and rising risk factors of the disease, supportive awareness programs, and strategies implemented by key companies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.