- Home

- »

- Animal Health

- »

-

Pet Dental Health Market Size, Share & Growth Report, 2030GVR Report cover

![Pet Dental Health Market Size, Share & Trends Report]()

Pet Dental Health Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Type (Products, Services), By Indication (Gum Diseases, Endodontic Disease), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-982-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pet Dental Health Market Size & Trends

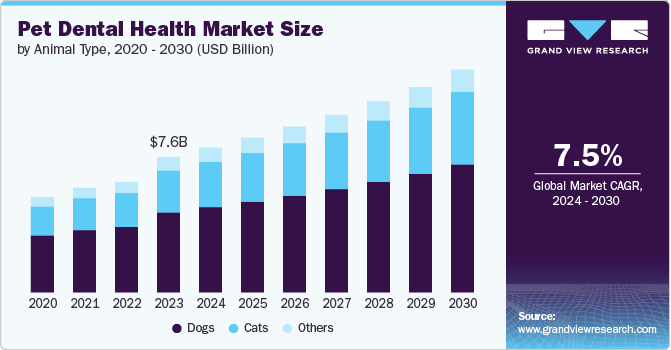

The global pet dental health market size was estimated at USD 7.59 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. The market is driven by increasing pet humanization, focus on preventive care, growing awareness about pet dental health, and adoption of pet insurance. Every February, the American Veterinary Medical Association (AVMA) sponsors National Pet Dental Health Month to raise awareness about pet dental health. Such initiatives are expected to boost market growth.

Pet owners concerned about their pet's health are more likely to prioritize dental health and be willing to invest in products & services that support it. They need products that are effective in maintaining their pet's dental health. They are likely to be more willing to purchase products with proven effectiveness, such as those endorsed by veterinarians. Safety is a key concern for pet owners, especially when it comes to oral care products that their pets will ingest. Hence, pet owners have an increasing preference for products with natural ingredients, which has prompted market players to launch several natural ingredients-based products.

Dental diseases are common in companion animals such as dogs and cats, affecting almost 78% to 80% of dogs and around 70% of cats over 3 years of age. According to VCA Animal Hospitals, periodontal diseases, also referred to as gum diseases, are the most common dental conditions reported in dogs. They are majorly associated with the inflammation of tissues (periodontium) surrounding tooth of animals. As per an article published by American Kennel Club (AKC) in January 2021, periodontitis is considered to be the number 1 cause of tooth loss in companion animals. As per data presented by AKC and Cornell University, the top dental diseases in dogs are periodontitis, oral trauma, benign tumors, gingivitis, and deciduous teeth. In cats are gum disease, gingivitis, tooth resorption, oral trauma, and ulcerative stomatitis.

Similarly, dental conditions such as periodontitis are the leading causes of tooth loss in equine species, with disease prevalence ranging from 35% to 85% of the horse population. Furthermore, proactive animals such as dogs, horses, and cats are commonly prone to a variety of traumatic dental injuries leading to fractured teeth (prevalence 10%-27%) and tooth loss. As most of these dental indications are reversible at early stages with timely treatments, requirement for dental care products and dental treatment services is growing. These factors are driving the growth of the market.

The pet population has been significantly rising over the years in various regions. Most common pet animals, such as dogs and cats, are valued for providing companionship to humans. Pets have become a part of each household due to their various benefits, such as psychological comfort, stress reduction & depression among adults, and helping overcome anxiety in humans. Such factors have increased pet ownership and pet humanization in various countries. A 2023-2024 survey report published by American Pet Products Association estimated that 65.1 million households in the U.S. own dogs and 46.5 million households own cats. The FEDIAF 2022 report suggested that the region had 113.6 million cats and 92.9 million dogs as of 2021. Thus, the constantly rising pet population and growing adoption of dogs & cats are among the key drivers of market growth.

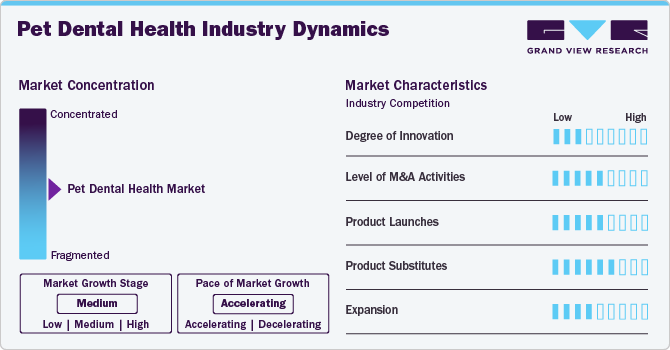

Market Concentration & Characteristics

The pet dental health market is highly concentrated. The market is in a moderate growth stage, and the rate of expansion is rapidly increasing. Industry leaders like Colgate- Palmolive Company, Dechra Pharmaceuticals plc, Nestlé Purina Pet Care, Vetoquinol SA, Ceva Sante Animale, Heska Corporation (Mars Inc.), Merrick Pet Care, BarkBox, etc. are undertaking strategies, such as launch of new products, partnerships, and mergers and cquisitions in order to gain a greater share of the market. For instance, in March 2024, Purina DentaLife launched its new Puppy Teething Chews by hosting the Puppy Smiles Gallery in New York City. The event highlighted the importance of early dental care for puppies, with DentaLife offering free samples of its teething chews designed to support healthy brain, tooth, and bone development. This initiative emphasizes the growing focus on pet dental health within the pet care market.

The pet dental health market is experiencing a high degree of innovation, with brands continuously developing advanced products to address common oral health issues in pets. Innovations include dental chews with unique textures and shapes designed to effectively clean teeth and gums, natural ingredients that target plaque and tartar, and enhanced formulations incorporating herbs and postbiotics for improved breath and oral microbiome balance. This focus on innovation is driven by the increasing awareness of pet oral health's importance and the demand for convenient, effective solutions. For instance, In March 2024, NPIC launched Flossta by N-Bone, a dental chew for dogs designed with a floss-like structure to clean teeth and gums in difficult-to-reach areas. It is formulated with natural herbs like parsley and fennel and is available in chicken, beef liver, and mint flavors. This product reflects NPIC's commitment to innovative pet care solutions, enhancing oral health with a unique design and natural ingredients, contributing to the growing pet dental health market.

The market is also characterized by a strategy to acquire resources such as facilities, capabilities, labor, equipment, or product/service portfolios to boost their market position & revenue. These initiatives may be implemented to expand regionally or widen global network to reach more customers. For instance, in February 2024, Targeted PetCare (TPC) acquired Pet Brands, enhancing its pet treat portfolio with new sourcing, design, and packaging capabilities. This acquisition strengthens TPC's position in the pet consumables market, particularly in natural dog and cat treats, including dental chews, reflecting the growing focus on pet dental health within the industry.

The market is price-sensitive, and companies are involved in offering customers the right balance of quality and affordability to increase sales. Although established manufacturers such as Virbac, Dechra Pharmaceuticals, Colgate, and Nestlé Purina have a strong customer base and portfolio, the emergence of new and niche players poses significant competition. The availability of cheaper alternatives from manufacturers and traders in countries including China & India increases the competition with existing market players.

Product launches in the pet dental health market significantly drive growth by introducing innovative solutions that cater to rising consumer demand for effective and convenient dental care products. New products, such as dental chews, powders, and treats, help in preventing common issues like plaque, tartar buildup, and periodontal disease, which are prevalent concerns among pet owners. These launches also enhance market competition, leading to further advancements in product formulations, ingredients, and delivery methods, ultimately expanding the market's scope and reach. For instance, in February 2024, Stella & Chewy's introduced Dental Delights, a new line of dental treats designed to help control plaque and tartar while providing an engaging and fun experience for dogs. Similarly, in February 2024 Blue Buffalo introduced a new dental chew for dogs, featuring a patented design with 50 ridges and grooves that help clean teeth, support gum health, and freshen breath. Made with natural ingredients, including real chicken and spearmint flavor, these chews are designed to prevent periodontal disease, reflecting the growing demand for effective pet dental health solutions.

The increase in product expansions within the pet dental health market significantly drives market growth. New product launches, such as size-specific dental treats and innovative formulations, address diverse consumer needs and enhance oral care for pets of various sizes. This expansion broadens product offerings and caters to rising consumer awareness about the importance of dental health in pets, leading to increased adoption and market penetration. For instance, in March 2024, PetIQ, Inc. expanded its Minties dental treats line with the introduction of a new option specifically for large-sized dogs. These veterinarian-recommended treats are designed to freshen breath and promote oral health with natural ingredients like alfalfa and peppermint. The expansion reflects the growing demand in the pet dental health market for effective, affordable solutions designed to different dog sizes.

Animal Type Insights

Dogs segment held the highest market share of 59.13% in 2023, this is attributed to the growing preference for dogs as companion animals. According to the 2024 APPA National Pet Owners Survey, 82 million U.S. households own a pet. Among them 58 households owns at least one dog, making dogs the most popular pet in the U.S. By 2030, this number is projected to exceed 100 million. Thus, the increasing population of pet dogs in several key countries is expected to contribute to the demand for pet dental health products and services.

As pet owners become more aware of the importance of dental care for their dogs, the demand for products and services that support oral hygiene continues to increase. For instance, there has been an increase in demand for professional dental cleaning services. Veterinary clinics and pet dental specialists are offering more dental services, including cleanings, X-rays, and oral surgery. Pet owners are also becoming more aware of the link between good dental health and overall health in dogs, which is estimated to propel the market in the coming years.

Type Insights

Services segment held the highest market share in 2023. This is due to the wide-scale availability of multiple dental care, diagnosis, and treatment alternatives offered by veterinary clinics. Since oral health greatly impacts a pet's overall health and behavior, routine annual dental exams for pets are crucial. The key to controlling dental issues is prevention, and therefore, it is important to consistently brush and clean the pet’s teeth to prevent plaque development. The American Animal Hospital Association advises routine oral checkups and dental cleanings to reduce tartar & prevent gum diseases.

The increasing frequency of veterinary dental check-ups and procedures performed in response to increased dental illness in companion animals is predicted to fuel this segment. Root canal therapy typically preserves the dog's tooth for life and is less invasive than extraction. A tooth with strong periodontal support can also be extracted as a different alternative. In addition, surgery is the recommended course of action for pet dental care to remove growths, fix jaw fractures, and remove oral tumors.

The need for canine tooth extractions is rather common and may arise for a variety of reasons. Sometimes a fractured tooth suffers permanent damage. In other situations, it could be necessary to extract a tooth with severe decay to prevent infections and further dental decay. Once an affected tooth is extracted and surrounding area is cleaned of infectious debris, dog should be free of infection.

Indication Insights

Gum diseases segment held the highest market share in 2023. The most common condition in cats and dogs is gum disease. It is a progressive, cyclical inflammatory disorder of dental structural supports that causes dental disease & premature tooth loss. Furthermore, these disorders may result in major health problems if left untreated, such as organ failure. As per AVMA, approximately 70% of cats and 80% of dogs suffer from some type of periodontal disease by the age of 3 years. The rising incidence of various oral health-related illnesses has been identified as the major factor promoting market growth

Dental calculus segment has the fastest growth rate among the indications. Calculus and gingivitis are the most common dental problems in pets. According to the DSM pet owner study, only 16% of dog owners brush their pets' teeth daily. As a result, pet products that give a comprehensive approach to oral care, such as breath fresheners, water additives, dental treats, and dental wipes, are in high demand. A pet's oral health can also be improved by regular veterinary examinations and preventative treatment given at home. As a result, the key driver of market growth has been identified as the rising prevalence of various conditions associated with oral health.

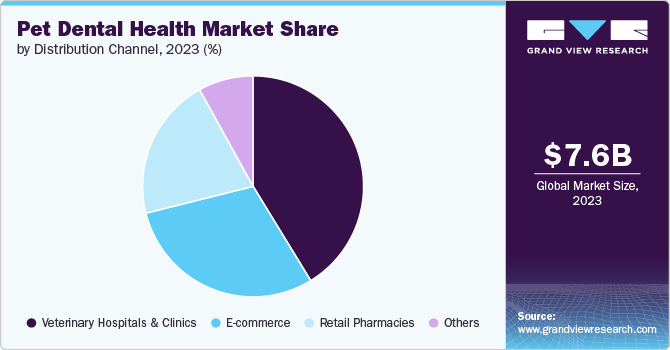

Distribution Channel Insights

Veterinary hospitals segment led the market in 2023. This is attributed to the increase in veterinary hospitals and clinics with innovative infrastructures worldwide. Veterinary clinics and hospitals are crucial for the appropriate care of a pet's teeth since they provide expert dental services to qualified veterinary dentists. The increasing number of veterinary experts is another factor driving the segment. The AVMA estimated that 127,131 veterinarians operated in the U.S. in 2023. Furthermore, according to Canadian Veterinary Medical Association, there were approximately 15,459 veterinarians in Canada in 2023, with approximately 3,825 of them working in clinical practice. Resulting in an increase in demand for veterinary services, like preventative care, medical treatment, surgery, etc.

Changing customer shopping behaviors, specifically the shifting trend toward online shopping due to the COVID-19 pandemic & digitalization, have altered nearly all products, including pet dental health services & products. It is accepted and commonly discussed that retail stores undertake fewer retail transactions for goods and pharmaceuticals than they previously did. For instance, for dogs, cats, and other pets, specialty foods & other dental foods, in general, were purchased by a high percentage of animal owners at a physical store. Several E-commerce websites are widely contributing to the growth of the market. With an increasing number of families having companion animals, there is a greater demand for easy access to pet oral care supplies. There are numerous brands of dental care diets, toothbrushes, chews, wipes, snacks, rinses, oral care water additives, pastes, and other products available for use in pet dental care.

Regional Insights

North America pet dental health market held the largest share of 38.2% of the global market in 2023, The increased prevalence of a variety of oral health-related disorders has been highlighted as a significant driver of market growth. The American Pet Product Association (APPA) estimates that in 2023-24, the number of households that owned a pet was 65.1 million in the U.S. Furthermore, pet owners' increased knowledge of pet health and an increase in the number of dental operations are driving the growth of the pet dental health market in North America. In addition, the COVID-19 pandemic led to a surge in pet adoptions and ownerships, which further boosted the pet dental health market. With more people spending time at home and seeking companionship, the demand for pets increased.

U.S. Pet Dental Health Market Trends

The U.S. pet dental health market is expected to grow at a significant pace over the forecast period due to the growing need to mitigate unexpected veterinary costs, the penetration of pet insurance, and the increasing medicalization rate. For instance, as per the North American Pet Health Insurance Association, about 5,676,776 million pets were insured in the U.S. in 2023. Leading insurance companies, such as Trupanion, in February 2023 announced that pet insurance enrollments in their organization reached 1.54 million as of December 31, 2022. This represented a growth of 31% over the previous year. Pet owners are adopting insurance facilities to reduce their out-of-pocket expenditure for various dental diseases and their respective medications. For instance, in the case of pet dental insurance, companies such as ASPCA, Trupanion, Nationwide, Lemonade, Healthy Paws, Embrace, Petplan, and Fetch by the Dodo are covering both dental illnesses & dental accidents for companion animals.

Europe Pet Dental Health Market Trends

The Europe pet dental health market is experiencing significant growth driven by increasing awareness among pet owners about the importance of oral hygiene for pets. Key trends include the rising demand for specialized dental products, such as toothbrushes, dental chews, and water additives. Opportunities are emerging in the development of innovative, vet-approved dental care solutions and the expansion of services like professional dental cleanings at veterinary clinics. Additionally, there is growing interest in natural and eco-friendly dental products, reflecting broader consumer preferences.

In Europe, pet dental disease is highly prevalent, with studies revealing significant concerns across various countries. In the UK, 12.5% of dogs suffer from dental disease, with breeds like Greyhounds and King Charles Spaniels being most affected. In the Czech Republic, 85.3% of dogs at a private veterinary hospital exhibited dental issues, including periodontitis and missing teeth. In Spain, 30.9% of cats at a veterinary teaching hospital were diagnosed with periodontal disease. This widespread prevalence underscores the urgent need for effective pet dental health products and services across Europe.

Germany pet dental health market held the largest share in the European Pet Dental Health Market in 2023. Germany has a vast number of companion animals in Europe. A recent report by the Central Association of Zoological Specialist Companies (ZZF) stated that in 2023, 45% of German households owns at least one pet. Cats remained the most popular pets, residing in 25% of homes, Dogs followed closely, with 21% of households. Based on a survey of 5,000 households conducted by Skopos for the Pet Supplies Industry Association (IVH) eV and ZZF, the report indicated that pets are a significant part of German life. Additionally, prevalence of pet dental diseases in Germany is a significant concern. According to various studies, around 70% to 85% of dogs and 60% to 70% of cats above the age of 3 years have active gum diseases. This indicates the country's potential need for pet dental health products.

Pet dental health market in the UK is expected to grow rapidly due to increased awareness among pet owners about pet dental health and a growing number of veterinary experts in the country. According to new claims data from Co-op Insurance, untreated pet dental diseases can cost UK pet owners up to £962 (USD 1,261.6) in vet expenses, demonstrating the financial effect of poor canine dental hygiene. Over 42% of dog and cat owners list dental difficulties as one of the most common causes for vet appointments, while roughly 19% have postponed care due to growing prices. Popular breeds, such as Cocker Spaniels and Labradors, are the most susceptible to dental claims. Thus, increasing awareness of costly dental problems is driving the growth of the UK pet dental health market, with a focus on preventive care and products like dental chews.

Furthermore, due to the rising incidence of dental disease, veterinary clinics have started offering comprehensive dental care services such as regular check-ups and professional cleanings. For example, The London Cat Clinic uses modern diagnostic and treatment strategies to address the rising prevalence of feline dental diseases in the UK. This increase in initiatives by veterinary care providers in the UK is likely to drive market growth.

Asia Pacific Pet Dental Health Market Trends

Asia Pacific is anticipated to witness significant growth in the pet dental health market. The growing demand for pet care in developed and emerging countries in the Asia Pacific is expected to drive the overall market during the forecast period. Market players are adopting various strategic initiatives such as new product launches, partnerships, acquisitions, mergers, and collaboration to improve their market positions. For instance, the new Pedigree Dentastix chewy chunk from Mars Petcare was introduced in to stop plaque buildup throughout the day. The company also plans to provide the same product in beef and chicken tastes with a maxi or mini choice for bigger & smaller dogs. Pet dental health market in the Asia Pacific region is growing due to various factors.

Pet dental health market in India is witnessing notable growth due to increasing awareness among pet owners to preserve their pets’ oral health. This increased knowledge is driving demand for pet dental care products in India. Companies are introducing creative and advanced goods, like dental chews, sprays, and wipes, to cater to pet owners who are concerned about their pets’ oral health. As an example of the growing demand for pet dental care products in the region, Virbac Animal Health India recently launched a new range of dental chews and oral hygiene products for dogs and cats. This launch indicates the increasing efforts of companies to cater to the growing demand for pet dental care products in the country.

Latin America Pet Dental Health Market Trends

Pet dental health market in Latin America is growing steadily, driven by increasing pet ownership and rising awareness of pet health and wellness. More pet owners are recognizing the importance of dental care, leading to higher demand for dental products like toothbrushes, dental chews, and oral rinses. Veterinary clinics are also expanding their dental care services, further contributing to market growth. The market is poised for continued expansion as education on the impact of dental health on overall pet well-being spreads throughout the region.

Middle East & Africa Pet Dental Health Market Trends

Pet dental health market in The Middle East & Africa is witnessing gradual growth, driven by increasing pet ownership and a growing focus on pet health. Key trends include rising demand for pet dental care products, such as dental chews and specialized toothpaste, particularly among urban pet owners. Veterinary clinics are expanding their services to include dental care, reflecting a broader awareness of the importance of oral hygiene in pets. However, the market is still in the early stages of development, with opportunities for growth in education and the availability of advanced dental care products.

Saudi Arabia pet dental health market is witnessing a rise due to the increased pet population in the country. The market growth is driven by factors such as increasing pet humanization, rising disposable income, and growing awareness about animal health. Pet owners in Saudi Arabia are becoming more aware of the importance of dental health in their pets, leading to an increase in demand for pet dental care products and services.

Key Pet Dental Health Company Insights

Key players in the pet dental health market are actively engaged in highly competitive market dynamics. Companies are focusing on innovation, introducing advanced dental products like enzymatic toothpastes, dental wipes, and chew toys with dual-action cleaning features.

Key Pet Dental Health Companies:

The following are the leading companies in the pet dental health market. These companies collectively hold the largest market share and dictate industry trends.

- Virbac

- Colgate- Palmolive Company

- Dechra Pharmaceuticals plc

- Petzlife Products

- imrex

- Nestlé Purina Pet Care

- Vetoquinol SA

- Ceva Sane Animale

- TropiClean Pet Products

- Basepaws, Inc (Zoetis)

- Dentalaire, International.

- Midmark Corporation.

- Heska Corporation (Mars Inc.)

- Merial (Boehringer sub)

- BarkBox

View a comprehensive list of companies in the Pet Dental Health Market

Recent Developments

-

In July 2024, Pet Honesty launched Fresh Breath Dental Powder, a meal-time supplement designed to improve dogs' oral health by freshening breath, reducing plaque, and supporting gum health. This innovative product, featuring natural ingredients and postbiotics, reflects growing demand for effective and convenient dental care solutions in pet dental health market.

-

In May 2023, Virbac, a global animal health company, acquired a distributor in the Czech Republic and Slovakia. This acquisition will allow Virbac to expand its presence and strengthen its position in the Central European market.

Pet Dental Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.11 billion

Revenue forecast in 2030

USD 12.49 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, type, Indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

US; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Petzlife Products; imrex; Nestlé Purina Pet Care; Vetoquinol SA; Ceva Sane Animale; TropiClean Pet Products; Basepaws Inc (Zoetis); Dentalaire; International; Midmark Corporation; Heska Corporation (Mars Inc.); Merial (Boehringer sub); BarkBox

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Dental Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet dental health market report based on animal type, type, indication, distribution channel, and region:

-

Animal type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Oral Care Products

-

Tooth pastes & brushes

-

Oral care solutions

-

Dental Treats

-

Dental Chews

-

Dental Powder

-

Others

-

-

Medicines

-

Equipments

-

-

Services

-

Diagnosis

-

Treatment

-

Dental Cleaning

-

Surgery

-

Root Canal Therapy

-

Others

-

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Gum Diseases

-

Endodontic Diseases

-

Dental Calculus

-

Oral Tumor

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Retail Pharmacies

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet dental health market size was estimated at USD 7.59 billion in 2023 and is expected to reach USD 8.11 billion in 2024.

b. The global pet dental health market is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030 to reach USD 12.49 billion by 2030.

b. North America dominated the pet dental health market with a share of over 38% in 2023. This is attributable to the increasing pet healthcare expenditure and the large number of veterinary practice establishments in the region.

b. Some key players operating in the pet dental health market include Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Nestlé Purina Pet Care; Vetoquinol SA; Nylabone (Central Garden & Pet Company); Barkbox; imRex Inc.; Basepaws, Inc.; Animal Microbiome Analytics, Inc.; Dentalaire, International.; Pedigree (Mars Incorporate); PetIQ, LLC.; Animal Dental Clinic; Petzlife UK.

b. Key factors that are driving the pet dental health market growth include the growing prevalence of numerous pet dental diseases, such as periodontitis, and rising awareness among pet parents coupled with the increasing number of routine veterinary dental check-ups and treatments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."