- Home

- »

- Homecare & Decor

- »

-

Pet Carriers Market Size, Share And Trends Report, 2030GVR Report cover

![Pet Carriers Market Size, Share & Trends Report]()

Pet Carriers Market Size, Share & Trends Analysis Report By Product (Soft Sided Carriers, Hard Shell Carriers, Backpack Carriers), By Pet Type, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-255-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Pet Carriers Market Size & Trends

The global pet carriers market size was estimated at USD 764.5 million in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. In recent years, the global market has demonstrated favorable growth, propelled by factors, such as the growing number of pet owners worldwide, increased pet humanization trends, and notable advancements in product design & materials. With rising pet ownership globally, particularly in urban areas, there is a growing need for safe and convenient transportation solutions for pets. According to the 2023 - 2024 APPA National Pet Owners Survey, 66% of U.S. households own a pet, which equates to 86.9 million households.

Although there is a considerable number of different animals as pets, such as fish, birds, hamsters, and rabbits; dogs and cats remain the most common pets in the U.S. The rise in pet ownership globally has contributed to the market expansion. With more households adopting pets, there is a corresponding need for suitable carriers to transport them safely and conveniently. This trend is particularly evident in urban areas with pet-friendly policies and a growing number of pet-friendly establishments, which encourage pet ownership and, consequently, boost the demand for pet-related products. The implementation of pet-friendly policies in various public spaces, workplaces, and accommodations has encouraged pet owners to take their pets along more frequently, necessitating the use of carriers for transport.

Also, the growing trend of pet-friendly travel and leisure activities, such as hiking, camping, and outdoor adventures, has spurred demand for durable, versatile pet carriers suitable for various environments and activities. Increased awareness of pet safety and well-being, particularly during travel, has prompted pet owners to invest in high-quality carriers that provide adequate ventilation, security, and protection. In addition, comprehensive regulations cover every facet of the pet products industry, encompassing ingredient choice, manufacturing procedures, and the promotion and distribution of pet items. For instance, as per the Health of Animals Regulations (Sections 146-153) under broader guidelines issued by the Canadian Food Inspection Agency (CFIA), animals must be transported in a humane manner that prevents distress, injury, and illness.

The carrier must be appropriate for the size, species, and temperament of the animal. This means it should be large enough for the animal to stand upright, turn around, and lie down comfortably. It should also be secure to prevent escape and injury and provide adequate ventilation. Such regulations established by government bodies and other authorities have attracted pet owners seeking both functionality and style in their pet accessories consequently bolstering the market demand. Also, the International Air Transport Association (IATA) sets detailed regulations for the transport of live animals, including those regarding pet carriers. IATA specifies detailed requirements regarding carrier dimensions, ventilation, labeling, and material durability

Such rules and regulations set by authorities highlight the importance of offering carriers that align with the lifestyle choices of pet owners, emphasizing the necessity for products that seamlessly complement their daily activities. This perception fuels a strong preference for pet carriers that prioritize both safety and comfort during travel and outdoor activities, while also embodying a combination of practicality and visual appeal. To comply with industry regulations, leading manufacturers offer products that adhere to IATA standards. For example, Stefanplast provides the Gullivar pet carrier product line, designed for medium-sized dogs, equipped with a plastic hood, and manufactured as per IATA regulations. The carrier weighs 6.857 kg / 15.12 lbs.

In addition, the growth of e-commerce channels and digital marketing has expanded the market reach for pet grooming products for consumers. Online retailing has provided consumers with greater accessibility to a diverse range of pet products, including carriers, allowing them to compare prices, read reviews, and make informed purchasing decisions. This shift has also allowed niche and specialty grooming brands to enter the market, offering unique and customized products to meet specific needs. This evolution has provided opportunities for companies to leverage e-commerce and digital marketing to drive sales, build brand loyalty, and expand their market presence.

Market Concentration & Characteristics

The pet carrier industry is witnessing a notable degree of innovation driven by evolving consumer preferences and technological advancements. Manufacturers are continually introducing innovative features and designs to enhance pet comfort, safety, and convenience during travel. Advanced materials, such as lightweight yet durable polymers, are being incorporated to improve portability without compromising on strength.

Product designs are also evolving to cater to various modes of transportation, including air travel, public transit, and car journeys. Features, such as collapsible structures, ergonomic handles, and adjustable straps, are being integrated to provide versatility and ease of use for pet owners. Furthermore, digital integration is becoming increasingly prevalent, with smart pet carriers equipped with GPS tracking, temperature monitoring, and even automated feeding systems.

Regulatory standards, particularly those set by organizations like the IATA, play a significant role in shaping the industry. Compliance with these regulations is essential for manufacturers to ensure the safety and well-being of pets during travel.

IATA regulations, for example, dictate specific requirements regarding carrier dimensions, ventilation, labeling, and material durability to ensure that pets are transported securely and humanely. Manufacturers must adhere to these standards to obtain certification and ensure market acceptance of their products. While regulatory compliance imposes certain constraints on product design and manufacturing processes, it also fosters innovation by providing clear guidelines and benchmarks for safety and quality standards. Moreover, adherence to regulations enhances consumer trust and confidence in the industry, driving the demand for compliant products.

Product launches in the industry are characterized by a focus on innovation, safety, and user experience. Manufacturers are introducing a diverse range of products tailored to meet the needs of different pet sizes, breeds, and travel preferences. Recent trends include the launch of multi-functional carriers that can seamlessly transition between various modes of transportation, such as backpack carriers with detachable wheels for easy maneuverability in airports and urban settings.

There is also a growing demand for eco-friendly and sustainable pet carriers made from recycled materials or biodegradable polymers, reflecting broader consumer preferences for environmentally conscious products. Collaborations between pet carrier manufacturers and pet care brands are becoming increasingly common, resulting in product lines that integrate features, such as built-in hydration systems, odor control technology, and washable fabrics for enhanced hygiene and convenience.

Product Insights

The soft-sided pet carriers segment captured the largest revenue share of 59% in 2023. Soft-sided pet carriers offer enhanced comfort for pets during travel compared to traditional hard-shell carriers. The flexible and padded construction provides a more cushioned and cozy environment, reducing stress and anxiety for pets. In addition, these products also feature collapsible or foldable designs, allowing for easy storage when not in use. In addition, their flexible construction enables them to conform to tight spaces, such as under-seat or overhead compartments during air travel, maximizing available space. For instance, Mr. Peanut's Pet Carriers company offers frameless soft-sided pet carriers. These carriers meet IATA requirements easily due to their flexible construction and lightweight materials, making them a preferred choice for pet owners.

The demand for backpack carriers is anticipated to grow at a CAGR of 8.3% from 2024 to 2030. Backpack pet carriers offer pet owners the convenience of hands-free transportation, allowing them to carry their pets comfortably on their backs while keeping their hands free for other tasks. This portability is particularly appealing for pet owners who enjoy outdoor activities, such as hiking, biking, and sightseeing. Many backpack pet carriers are designed with versatility in mind, offering additional features, such as convertible designs, that can be used as traditional carriers, car seats, or pet beds. This multi-functionality adds value for pet owners seeking versatile travel solutions for their pets.

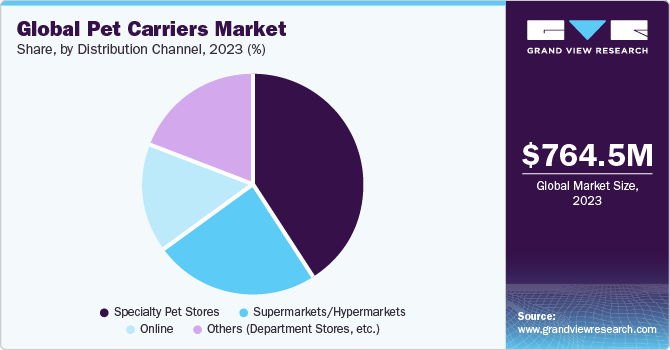

Distribution Channel Insights

The specialty pet stores segment captured the largest revenue share of 40.8% in 2023. Unlike many other consumer goods, pet carriers are often selected by physically examining the product rather than solely relying on online evaluations. The ability to physically interact with and assess the quality of these products instills confidence and assurance, which can be challenging to achieve through online shopping. In addition, the market encompasses products with specific features tailored to different breeds and coat types based on their sizes. As a result, many pet owners prefer to seek guidance from in-store experts or trained staff at brick-and-mortar stores to ensure they select the most suitable carriers for their pets.

The online distribution channel segment is anticipated to grow at a CAGR of 7.7% from 2024 to 2030. The growth of online distribution channels is driven by the expansion of digital offerings by brick-and-mortar pet product specialists worldwide. Established retail giants, such as PetSmart and Petco, capitalize on their market presence to deliver a wide range of services to customers. Pet care retailers employ innovative strategies to enhance their competitive position, including personalized shopping experiences, comprehensive product information, educational content, omnichannel fulfillment, social media engagement, and mobile applications. The allure of retail incentives, competitive pricing, extensive product assortments, access to detailed product information and reviews, and overall convenience increasingly attract pet owners to shop for products through online platforms.

Pet Type Insights

The dog carriers segment held a market share of 57.6% in 2023. The growing number of pet owners worldwide, particularly in urban areas, is fueling demand for pet carriers for dogs. As more people welcome dogs into their homes and lives, the need for safe and convenient transportation solutions becomes essential for pet owners to travel with their furry companions. According to Forbes Advisor, as of 2023, close to 70% of households in the U.S. own a pet, with dogs emerging as the most common choice (44.5% as of 2022), followed by cats (29%). Dogs are increasingly viewed as valued members of the family, leading pet owners to prioritize their comfort and well-being in all aspects of life, including travel. Pet carriers offer a way for owners to ensure their dogs’ safety, security, and comfort while accompanying them on various outings and excursions.

The demand for cat carriers is anticipated to grow at a CAGR of 7.5% from 2024 to 2030. Similar to dogs, regulations and guidelines set by transportation authorities and airlines regarding pet travel safety drive demand for compliant pet carriers for cats. Cat owners seek carriers that meet size, weight, and safety requirements for use in different modes of transportation, including air travel, to ensure a stress-free journey for themselves and their cats. The European Pet Food Industry Federation (FEDIAF) released its Facts and Figures 2022 report, offering comprehensive insights into pet ownership trends across Europe. According to the report, approximately 127 million cats were kept as pets, representing 26% of households in the region. Notably, Russia emerged as the leader in cat ownership, with a significant total of 23,150,000 feline companions. This promising trend presents favorable opportunities for growth in the cat carriers market.

Regional Insights

The North America pet carriers market held the largest share of 37.7% of the global revenue in 2023. Pet owners in the region are emotionally invested in their pets, viewing them as members of the family. This has led to a growing willingness to invest more in pet care, including carriers, to ensure the overall well-being and comfort of their pets.

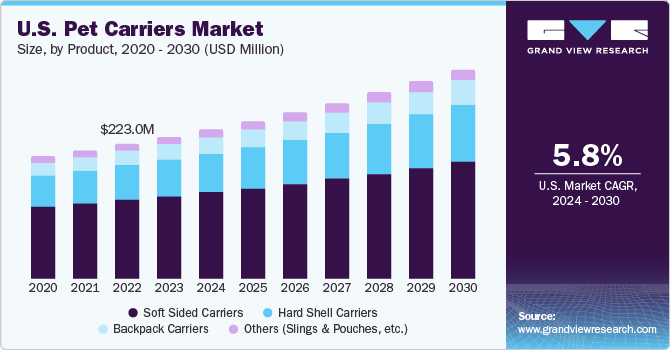

U.S. Pet Carriers Market Trends

The pet carriers market in the U.S. is expected to grow at a CAGR of 5.8% from 2024 to 2030. According to data published by the APPA in 2022, expenditures on pets in the U.S. reached USD 136.8 billion in 2022. Furthermore, it was estimated that in 2023, total spending on pets in the U.S. would increase to USD 143.6 billion, reflecting a year-on-year growth of 5.0%. Consequently, the substantial increase in pet adoption rates in the U.S. will continue to propel market growth.

Asia Pacific Pet Carriers Market Trends

The Asia Pacific pet carriers market is anticipated to grow at a CAGR of 8.0% from 2024 to 2030. In recent years, China has undergone notable influence from Western culture, particularly in terms of pet ownership. As indicated by a white paper published by the China Pet Industry Association, the collective population of dogs and cats, the predominant pets in Chinese urban areas, surpassed 100.8 million in 2020. Moreover, the region features a substantial youth demographic, many of whom express keen interest in owning dogs as pets. Consequently, there has been an increase in the consumption of pet products in the region, including carriers. This trend is especially pronounced among nuclear families and single working-class individuals. These dog owners demonstrate a willingness to allocate higher budgets for premium products, thereby driving growth within this segment.

Key Pet Carriers Company Insights

The competitive landscape in the pet carriers industry is characterized by a diverse array of players, ranging from large multinational corporations to small-scale manufacturers and boutique brands. Leading companies, such as Petmate, Sherpa, Bergan, and Gen7Pets, dominate the global market with their extensive product offerings, brand recognition, and widespread distribution networks. These established brands often leverage economies of scale, research and development capabilities, and strategic partnerships to maintain their competitive edge.

Compliance with regulatory standards and industry certifications, such as those set by the IATA and relevant government agencies, is essential for manufacturers and brands to ensure product safety, quality, and market acceptance. Adherence to regulations can serve as a competitive advantage and differentiate reputable brands from competitors.

Some of the key developments and strategic initiatives carried out by leading manufacturers are listed below:

-

In March 2023, Diggs Inc., one of the prominent players in the industry, launched Enventur, an inflatable travel kennel designed to elevate the experience for pet owners and their dogs. Enventur represents a premium solution, offering enhanced comfort, safety, and security for pets during travel. Lightweight and exceptionally durable, this innovative product provides pets with optimal comfort and convenience, during short- as well as long-distance travels

-

In December 2022, Paravel, the luxury luggage company, collaborated with Rescue City to unveil the Cabana Pet Carrier. This handcrafted carrier offers a blend of fashion and functionality, featuring four striped color options (Marlin, Shandy, Domino Black, and Paloma) and crafted by third-generation artisans in Florence, Italy

Key Pet Carriers Companies:

The following are the leading companies in the pet carriers market. These companies collectively hold the largest market share and dictate industry trends.

- PAWS AND PALS, INC.

- Petmate

- PetWise, Inc.

- Ferplast S.p.A.

- EliteField LLC

- Pet-Tom

- Diggs Inc.

- Sleepypod

- Kurgo (A Radio Systems Corporation brand)

- Coastal Pet Products Inc.

Pet Carriers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 809.8 million

Revenue forecast in 2030

USD 1,178.7 million

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pet type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain, China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Paws And Pals, Inc.; Petmate; PetWise, Inc.; Ferplast S.p.A.; EliteField LLC.; Pet-Tom; Diggs Inc.; Sleepypod; Kurgo (A Radio Systems Corporation brand); and Coastal Pet Products Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

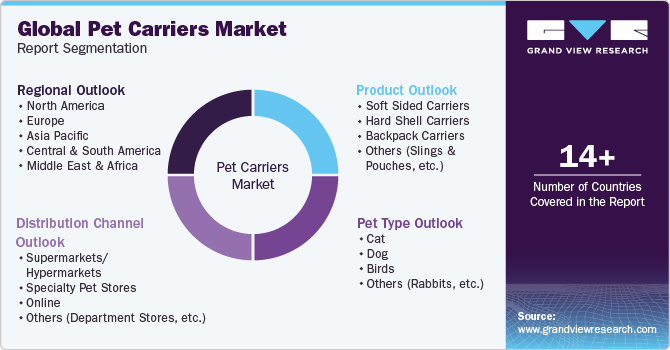

Global Pet Carriers Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pet carriers market report based on product, pet type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Soft Sided Carriers

-

Hard Shell Carriers

-

Backpack Carriers

-

Others (Slings and Pouches, etc.)

-

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cat

-

Dog

-

Birds

-

Others (Rabbits, etc.)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Pet Stores

-

Online

-

Others (Department Stores, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet carriers market was estimated at USD 764.5 million in 2023 and is expected to reach USD 809.8 million in 2024.

b. The global pet carriers market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 1,178.7 billion by 2030.

b. North America dominated the pet carriers market with a share of around 37.7% in 2023. Pet owners in the region are increasingly emotionally invested in their pets, viewing them as essential members of the family resulting in increased spending on pet carriers, to ensure comfortable travel for their pets.

b. Some of the key players operating in the pet carriers market include PAWS AND PALS, INC., Petmate, PetWise, Inc., Ferplast S.p.A., EliteField LLC., Pet-Tom, Diggs Inc., Sleepypod, Kurgo (A Radio Systems Corporation brand), and Coastal Pet Products Inc.

b. Key factors that are driving the pet carriers market growth include an expanding base of pet owners worldwide, heightened pet humanization trends, and notable advancements in product design and materials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."