- Home

- »

- Animal Health

- »

-

Pet Boarding Services Market Size & Share Report, 2030GVR Report cover

![Pet Boarding Services Market Size, Share & Trends Report]()

Pet Boarding Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats, Others), By Service Type (Long term, Short Term), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-102-2

- Number of Report Pages: 148

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Boarding Services Market Summary

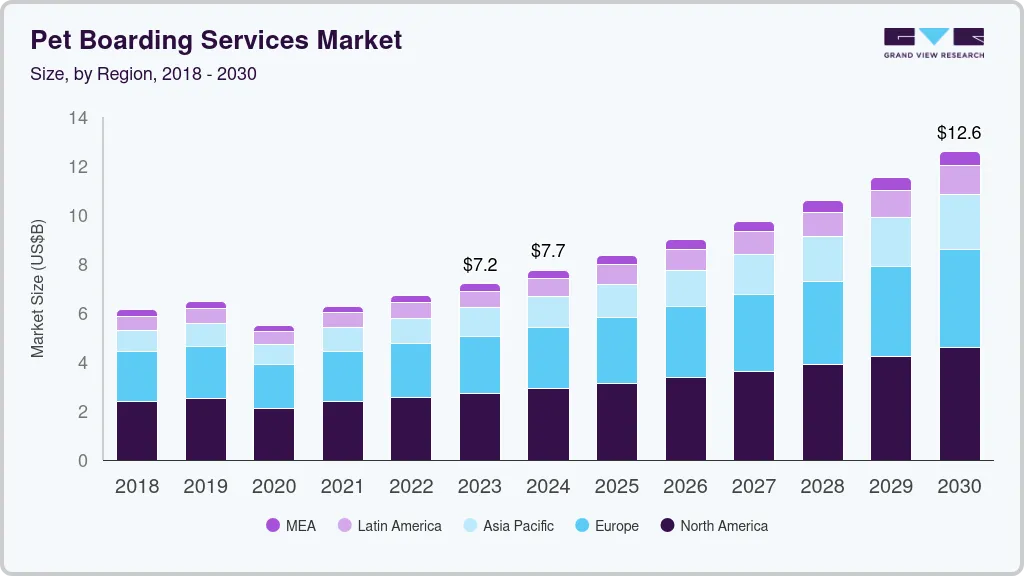

The global pet boarding services market size was estimated at USD 8.62 billion in 2024 and is anticipated to reach USD 14.02 billion by 2030, growing at a CAGR of 8.59% from 2025 to 2030. The market growth can be attributed to the rising pet ownership rates, increasing disposable income, and growing demand for premium pet care services.

Key Market Trends & Insights

- The North America pet boarding services market held the largest revenue share of 41.88% of the global market in 2024.

- The pet boarding services market in the U.S. is driven by new collaborations among pet care service providers.

- By service type, the short term segment dominated the market in 2024 and is expected to grow at a CAGR of 8.83% over the forecast period.

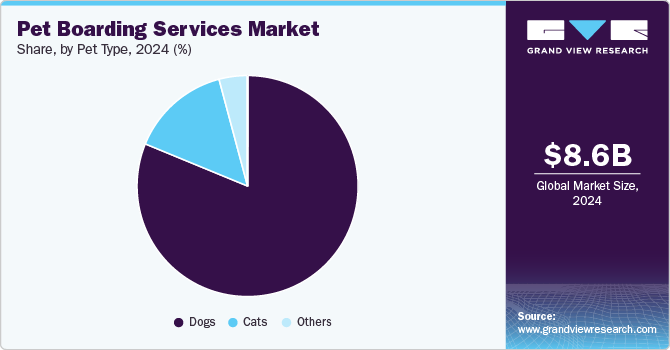

- By pet type, the dogs segment dominated the market in 2024 with the highest revenue share of 81.22%.

Market Size & Forecast

- 2024 Market Size: USD 8.62 Billion

- 2030 Projected Market Size: USD 14.02 Billion

- CAGR (2025-2030): 8.59%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the expansion of e-commerce platforms offering pet boarding bookings and the development of specialized, luxury boarding facilities contribute to market growth. For instance, in April 2024, Hounds Town USA opened a new dog daycare and boarding facility in Florida. The center offers interactive daycare, all-day play, and spa services, with a focus on dog health & community engagement. Hounds Town’s expansion underscores its commitment to high-quality, inclusive pet care, strengthening its status as a leader in the industry.

The market suffered heavily owing to the commencement of COVID-19, as a result of the temporary cessation of all nonessential activities, such as pet boarding, care, grooming, and travel, and constraints on care service providers due to social distancing conventions. Furthermore, work-from-home arrangements and travel restrictions allowed owners to spend more time at home with their pets, reducing the need for boarding services in some parts of the country. According to Pet Camp, San Francisco's most unique and award-winning dog daycare, and boarding facility, initially the pandemic caused a steep decline in demand as owners, confined to their homes, managed their dogs' needs themselves. This led to significant financial strain on dog care businesses, resulting in some closures and staff layoffs.

The rising cost of pet ownership is indicative of a larger cultural trend where pets are now seen as essential family members as opposed to mere pets. People are more likely to prioritize spending on their pets' well-being as they become wealthier and more urbanized, which includes buying them upscale food, high-quality medical care, grooming, and accessories. According to data published by Hepper in January 2024, ownership increased during the pandemic, with 59% of UK households now owning at least one pet and many owning two or more. As a result, an estimated USD 10.1 billion is spent annually on food and treats for pets, in addition to USD 1.3 billion on insurance and USD 5.1 billion on veterinary care & other services.

Owing to the younger demographic's increasing ownership and the trend of pet humanization, the adoption rate has been steadily rising, further promoting market growth. Moreover, many facilities adopt eco-friendly practices. These advancements have driven significant growth by meeting the evolving demands of owners who seek high-quality care for their pets while away. For instance, in June 2023, The Happy Cat Hotel & Spa, a new luxury cat boarding facility in Greenburgh, launched themed suites, climbing equipment, and grooming services for felines.

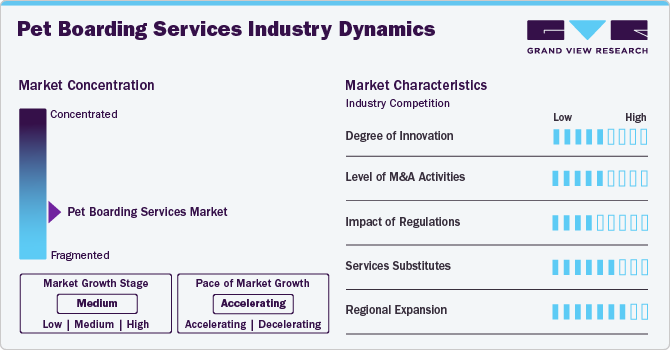

Market Concentration & Characteristics

In terms of the growth stage, the market is positioned at a medium level, characterized by significant growth. The expansion of pet insurance coverage beyond veterinary costs to include boarding is significantly supporting the market growth. By incorporating boarding expenses into insurance policies, providers enhance the value proposition for owners, making boarding more accessible and financially manageable. For example, insurance providers in the Nordics offer policies that cover not only veterinary bills but also grooming, boarding, and training. This comprehensive coverage encourages more owners to utilize boarding services, contributing to higher demand and market growth. In addition, some insurers use data enrichment and advanced analytics to tailor policies to specific pet characteristics such as age, breed, or health history, which helps increase adoption rates.

The market demonstrates a moderate degree of innovation, characterized by ongoing collaboration between market players and supportive initiatives. For instance, in November 2023, Fetch! Pet Care entered into a partnership agreement with the Best Friends Animal Society, a national animal welfare organization. Under the partnership, the company would provide significant donations to Best Friends for its operations and the resources for its partners.

Within the market, there exists a moderate level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic partnerships among industry players. These transactions are often driven by the desire to expand market reach, access new technologies or expertise, and achieve economies of scale. In April 2024, for instance, Swifto announced the acquisition of Wagz 'n Whiskerz, a dog walking company. This initiative further expanded the company's presence in the U.S. market.

The market experiences a low to moderate impact of regulations. Although there are no federal regulations specifically governing pet boarding services, the Animal Welfare Act (AWA) administered by the USDA sets standards for animal care in research facilities, which can influence best practices in boarding facilities. Pet boarding facilities must obtain licenses from relevant state or local authorities. For instance, California requires boarding facilities to be licensed under the California Department of Food and Agriculture's (CDFA) Pet Store and Boarding Kennel regulations.

The risk of substitutes is expected to be moderate. Alternatives such as in-home pet sitting, daycare centers, and pet-friendly accommodations provide viable options for owners seeking different care solutions. In-home pet sitters offer personalized care, while daycare centers cater to pets' social and exercise needs. In addition, some hotels and rental properties accommodate pets, adding to the range of choices. These substitutes can influence market demand by offering convenience, flexibility, and potentially lower costs, compelling traditional boarding services to enhance their offerings and customer value.

In May 2024, Camp Bow Wow announced its plan to open 12 new camps by the end of 2024, with agreements in place for 50 more locations. The brand continues to expand its services globally.

Service Type Insights

The short term segment dominated the market in 2024 and is expected to grow at a CAGR of 8.83% over the forecast period. Short-term boarding services are frequently the most popular option as they allow owners to leave their pets in expert care throughout the day. As a significant number of pet parents are millennials and Gen Z, who returned to work after the pandemic, the need for short-term facilities is expected to grow over the coming decade. Short-term boarding facilities are typically chosen by owners with additional responsibilities, such as personal or professional commitments, health issues, or brief visits to locations where pets might not be permitted. The developments in this market and the rise in access to pet care services are anticipated to fuel market growth over the forecast period.

The long term segment is expected to grow at a significant CAGR from 2025 to 2030. This growth can be attributed to the growing demand for travel and vacation services. As travel (both for leisure & business) becomes more frequent, owners increasingly seek reliable long-term boarding services. In addition, the rise in pet-friendly hotels and destinations encourages owners to travel with pets; however, they may still need boarding services for part of the journey. According to an article published by Condor Limited in 2024, around 2 million domesticated pets board commercial flights annually, and over half of the owners intend to travel with their animals. Pet travel is a significant component of the travel business. Making travel as accessible as possible would benefit tourists & companies, as over one-third of owners claim they will not travel without their animals.

Pet Type Insights

The dogs segment dominated the market in 2024 with the highest revenue share of 81.22%. The segmental growth can be attributed to the increasing number of dog owners compared to other pets and the specific needs dogs have for care, exercise, & social interaction when their owners are away. In addition, several boarding facilities cater specifically to dogs, offering services like grooming, training, and socialization. Moreover, the popularity of specific dog breeds, the rapid growth of the pet care business sector, and the growing humanization of dogs are expected to improve the demand for dog boarding services. According to an article published by Pangolia Pte. Ltd. in 2024, there are around 80.0 million pet dogs in the U.S., with nearly 50.0 million homes.

Furthermore, an increasing number of dog boarding facilities in the U.S. is one of the major factors expected to drive the market. The U.S. has a wide range of boarding facilities that offer various services, from basic care to luxury accommodations, and cater to different customer needs & budgets, which is anticipated to boost the market. According to an article published by Pangolia Pte. Ltd. in June 2024, there are over 20,000 pet care establishments in the U.S. and over 9,000 boarding kennels across the U.S. and Canada.

The cat segment is expected to grow at the highest CAGR from 2025 to 2030, due to the rising popularity of cats as pets, evolving lifestyles, socioeconomic constructs, and increasing disposable income across the globe. Moreover, the rising awareness of healthy lifestyles and the health benefits of having pets is expected to propel market growth over the forecast period. According to an article published in the Pet Food Industry, in the U.S., about 5,39,015 cats were adopted from shelters in 2022 compared to 5,28,526 cats in 2021. This shows an increase of 2% in the cat adoption rate compared to a 1.2% increase in the adoption of dogs. Cat ownership statistics are witnessing a significant uptick as an increasing number of families worldwide are adopting cats. According to Pangolia Pte. Ltd. report, in 2024, the U.S., China, and Russia have the world’s highest cat ownership rates. Vermont is one of the few states where households own more cats than dogs as pets.

Regional Insights

The North America pet boarding services market held the largest revenue share of 41.88% of the global market in 2024. The region is expected to continue its steady expansion, maintaining its dominant position over the forecast period. This growth is driven by factors such as increased ownership, higher spending, and growing concerns for health and wellbeing. A report from Rover in March 2022, titled the 'True Cost of Pet Parenthood', highlighted a rising willingness among owners to invest in their pets. This shift is reflected in purchasing behaviors, with parents increasingly prioritizing care and preferring products and services that resonate with their values.

U.S. Pet Boarding Services Market Trends

The pet boarding services market in the U.S. is driven by new collaborations among pet care service providers. Such initiatives can help improve service offerings, enhance owners’ convenience, expand customer base, improve quality, and gain a competitive edge in the market. For instance, according to the American Pet Products Association, U.S. pet owners spent USD 136.8 billion on their companion animals in 2022. This was greater than the 2021 expenditure estimate of USD 123.6 billion.

Europe Pet Boarding Services Market Trends

Europe pet boarding services market held the second-largest revenue share of the global market in 2024. Several factors, including a surge in ownership, the trend of humanizing pets, and the emergence of specialized & personalized services, are likely to propel the market. Furthermore, technological advancements, such as the incorporation of technology into boarding services, improved safety protocols, and the availability of insurance coverage, can contribute to market growth.

The pet boarding services market in Germany has experienced a steady increase in pet ownership over the years. According to FEDIAF estimates, 25% of German households owned at least one dog in 2023, while 26% owned at least one cat. This rise in ownership directly correlates with the demand for boarding services, as owners seek reliable care for their animals while away. Furthermore, the presence of prominent boarding service providers, such as PetBacker, is expected to fuel market growth in the country.

Asia Pacific Pet Boarding Services Market Trends

The Asia Pacific pet boarding services market is projected to grow at the fastest CAGR of over 10.95% during the forecast period. Changing consumer preferences, greater interest in adopting companion animals, and growing disposable income are increasing the pet industry expenditure in the region. Rising disposable income in many Asia Pacific countries allows owners to spend more on their pets’ care. This includes paying for premium boarding services that offer high-quality accommodations and additional amenities.

The pet boarding market in China is growing rapidly, driven by increasing demand for boarding services, increasing ownership, urbanization, and a growing middle class. Key trends and factors shaping the market include technology integration and diverse service offerings by boarding service providers. For instance, according to Petdata.cn, in 2023, the number of pet dogs in China reached 51.75 million, up 1.1% from the previous year, while the number of pet cats increased by 6.8% to 69.8 million.

Latin America Pet Boarding Services Market Trends

The Latin America pet boarding services market is driven by the humanization of pets and rising pet populations. With a market capitalization of more than USD 2 billion, Brazil is the largest pet care industry in the region. In Latin America, dogs are the most popular pets; Brazil has the second-highest dog population.

The pet boarding services market in Brazil includes urbanization and lifestyle changes and rising tourism and travel. Brazil’s domestic and international travel industry is growing, leading to a need for boarding options as more people travel for work or leisure and cannot take their pets with them. Moreover, as urbanization continues, many owners live in smaller spaces or work longer hours, making it difficult to care for full-time. This has boosted the demand for boarding facilities where pets can be cared for in a safe environment while their owners are busy or traveling.

Middle East & Africa Pet Boarding Services Market Trends

The Middle East and Africa pet boarding services market have a thriving pet boarding industry. Rising ownership, evolving lifestyles, more travel and tourism, the humanization of pets, the emergence of internet platforms, and growing awareness of welfare issues are the main factors propelling the market. In the MEA region, there is a growing trend toward humanization, wherein animals are viewed as part of the family. The need for high-quality care services is being driven by owners' willingness to spend money on upscale services, such as pet boarding, in order to guarantee the comfort and well-being of their animals.

The pet boarding services market in South Africa is growing at a very quick pace. Due to the spike in ownership during the pandemic, owners are in more need of dependable animal care, particularly once they resume their regular routines and return to their offices.

Key Pet Boarding Services Company Insights

The market is fairly competitive owing to the presence of a large number of small-scale service providers in various countries competing with established service providers. Players in this market are constantly involved in various strategic initiatives, such as regional expansion, mergers & acquisitions, and new service launches, to gain a higher market share. For instance, in March 2024, Dogtopia launched its latest store design, which includes more playroom space and a smaller footprint than the company's previous store layout.

Key Pet Boarding Services Companies:

The following are the leading companies in the pet boarding services market. These companies collectively hold the largest market share and dictate industry trends.

- A Place for Rover, Inc.

- Holidog.com

- Fetch! Pet Care

- Swifto Inc.

- Camp Bow Wow

- PetSmart LLC

- PARADISE 4 PAWS.

- PetBacker

- We Love Pets

- Dogtopia Enterprises

Recent Developments

-

In May 2023, We Love Pets Ltd entered into a partnership agreement with Husse, a pet food brand. This partnership was focused on improving product offerings and promote a happier, healthier life for pets.

-

In January 2023, Wag! Group Co. finalized the acquisition of Dog Food Advisor, which was aimed at expanding the company’s presence in the pet food and treats market.

-

In March 2023, A Place for Rover, Inc. launched a line of branded merchandise, Rover Gear. The collection includes a variety of walking gear designed to make walking dogs more comfortable and enjoyable. Some examples include a no-pull harness, a leash with a built-in poop bag dispenser, and a hands-free poop carrier. The collection is available on the company’s website and Amazon.

Pet Boarding Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.29 billion

Revenue forecast in 2030

USD 14.02 billion

Growth rate

CAGR of 8.59% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, service type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain, Denmark; Netherlands; Poland; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

A Place for Rover, Inc.; Holidog.com; Fetch! Pet Care; Swifto Inc.; Camp Bow Wow; PetSmart LLC; PARADISE 4 PAWS.; PetBacker; We Love Pets; Dogtopia Enterprises.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Boarding Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet boarding services market report based on pet type, service type, and region.

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Long term

-

Short term

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Poland

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pet boarding services market size was estimated at USD 8.62 billion in 2024 and is expected to reach USD 9.28 billion in 2025.

b. The global pet boarding services market is expected to grow at a compound annual growth rate (CAGR) of 8.59% from 2025 to reach USD 14.02 billion by 2030.

b. North American region dominated the global pet boarding services market and registered the largest revenue share of over 41% in 2024. This substantial share is owing to the presence of a large pet population with respectively high expenditure on pet services.

b. Some key players operating in the global pet boarding services market include A Place for Rover, Inc.; Holidog.com; Fetch! Pet Care; Swifto Inc.; Camp Bow Wow; PetSmart LLC; PARADISE 4 PAWS.; PetBacker; We Love Pets; Anvis Inc.; Dogtopia Enterprises., among others.

b. The market growth is largely propelled by factors such as the rising popularity & awareness of pet boarding or day-care services, growing pet ownership & animal humanization trends, increasing pet care expenditure in developed and developing countries, and growing strategic initiatives by key market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.