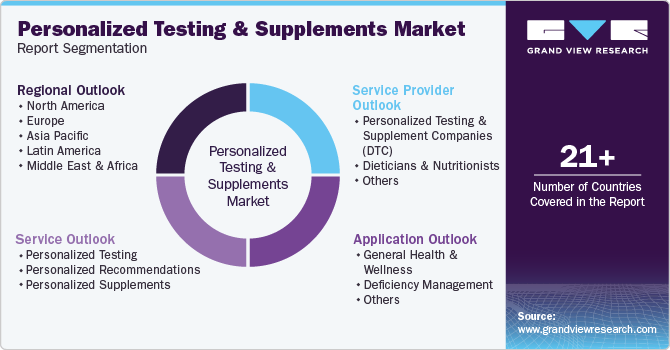

Personalized Testing & Supplements Market Size, Share & Trends Analysis Report By Service (Personalized Testing, Personalized Supplements), By Application, By Service Provider, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-481-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

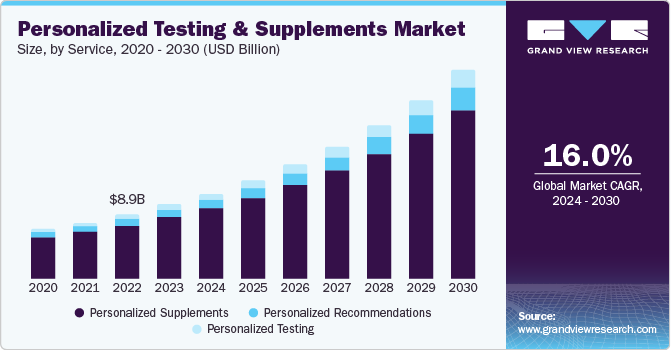

The global personalized testing & supplements market size was estimated at USD 11.77 billion in 2024 and is projected to witness a CAGR of 16.18% from 2025 to 2030. The market has experienced significant growth due to the increasing consumer demand for tailored health solutions. As people become more health-conscious, they seek products that align with their specific nutritional needs, genetics, and health conditions. This shift towards personalization has led companies to innovate and develop customized supplements, resulting in a more engaging consumer experience. Personalized health tests, such as DNA analysis and microbiome assessments, provide insights that enable individuals to make informed decisions about their health and wellness.

The COVID-19 pandemic has further accelerated this trend, highlighting the importance of preventive healthcare and immunity support. Consumers have become more aware of their health and are increasingly investing in supplements to boost their immune systems and overall well-being. The pandemic also prompted a surge in online health consultations and testing services, making personalized health solutions more accessible. As telehealth gained popularity during lockdowns, many companies pivoted to offer virtual consultations and personalized supplement plans, catering to the growing demand for home-based health management.

In addition, the rise of e-commerce has played a crucial role in expanding the market. With more consumers shopping online, companies have seized the opportunity to enhance their digital presence, offering tailored products and services directly to consumers. This shift not only provides convenience but also allows for more effective customer engagement through targeted marketing and personalized recommendations. As the online health marketplace evolves, companies leverage data analytics to refine their product offerings and improve customer experience.

Furthermore, the increasing focus on mental health and wellness has driven demand for personalized supplements that support cognitive function and emotional well-being. Consumers are looking for holistic solutions that address both physical and mental health, leading to specialized formulations targeting stress, anxiety, and overall mental clarity. The interplay between physical health, nutrition, and mental wellness is becoming increasingly recognized, prompting the industry to adapt and innovate in response to consumer needs, ultimately driving market growth.

AI Integration in Personalized Testing & Supplements Market

Artificial Intelligence (AI) is being increasingly used to create highly tailored dietary plans, using a wide array of data sources, such as genetic information, lifestyle choices, health metrics, and real-time data from wearables. This personalized approach significantly improves health outcomes and supports long-term wellness goals.

Key Areas of AI Integration:

-

Data Collection and Analysis: AI leverages diverse data sources, including genomics, microbiome profiles, and activity data from wearables. This data is processed and analyzed to offer customized dietary plans that align with an individual’s specific health needs, preferences, and goals. For instance, AI systems can collect information about a person's daily activity level, sleep patterns, and even their genetic makeup to provide more accurate nutrition advice.

-

Predictive Analytics and Dynamic Adjustments: AI models can predict potential health issues based on individual data and adjust dietary recommendations dynamically. This helps individuals manage chronic conditions like diabetes, cardiovascular diseases, or obesity. With continuous user feedback, machine learning algorithms refine recommendations, providing more effective solutions over time.

-

Integration with Wearable Devices: AI systems integrate with wearable devices like Fitbit, Apple Watch, and other smart health trackers. These devices monitor real-time data such as steps taken, sleep patterns, and heart rate, which AI uses to offer personalized nutritional advice tailored to the user’s daily activity levels.

-

Genomics and Nutrigenomics: AI can analyze genomic data to understand how genes affect nutrient metabolism, which allows for even more precise dietary recommendations. Nutrigenomics helps optimize nutritional plans based on individual genetic predispositions, maximizing the benefits of supplements and foods consumed.

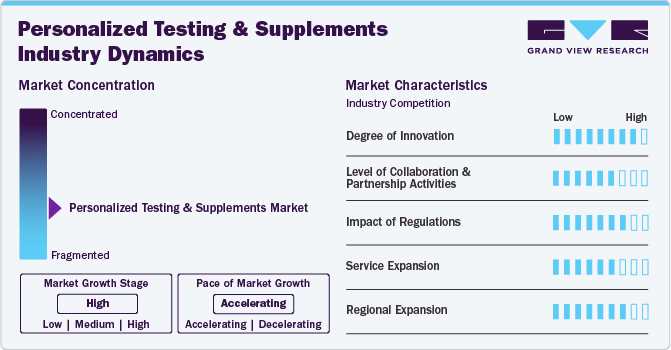

Market Concentration & Characteristics

The personalized testing and supplements industry is experiencing vibrant innovation driven by progress in ingredient formulations, delivery methods, and technology integration. Businesses consistently invest in research and development to enhance efficacy, safety, and consumer satisfaction in this dynamic industry. In addition, breakthroughs in genomics, AI-driven analysis, and precision nutrition allow companies to incorporate technologies related to DNA, microbiome, and metabolic testing, allowing them to provide tailored solutions.

The level of collaboration and partnership in the personalized testing and supplements industry remains moderate as companies form strategic partnerships to strengthen their market presence and capitalize on emerging trends in health and wellness.

Regulation significantly impacts the North American personalized testing & supplements industry by ensuring product safety, efficacy, and accurate labeling. Stringent regulations, such as those from the FDA and FTC, shape product development, marketing strategies, and consumer trust, driving industry compliance and safeguarding public health.

Service expansion in the personalized testing & supplements industry is evident through the introduction of innovative formulations targeting diverse consumer needs, including fat reduction, metabolism support, and appetite control.

The personalized testing and supplements industry is experiencing substantial regional growth. Companies strategically focus on different geographic regions to leverage diverse consumer preferences, health trends, and regulatory frameworks. This approach enhances market penetration and fosters overall growth.

Consumer Behavior Analysis

Consumers are increasingly looking for products tailored to their unique genetic makeup, lifestyle, and health goals. Technological advancements, the rise of health consciousness, and the increasing desire for preventative healthcare drive this shift.

Personalization and Health Data:

Consumers are becoming more informed about their bodies and are eager to use data to make decisions about their health. They want personalized insights and expect their health products, including supplements, to align with their specific needs. Key players are capitalizing on the opportunity to cater to this behavior. For instance, Persona Nutrition offers personalized supplement plans based on a comprehensive health questionnaire. The company uses data on factors like age, diet, lifestyle, and health conditions to create a tailored daily supplement regimen.

Convenience and Accessibility:

Consumers value convenience, and the availability of at-home testing kits and online platforms has made it easier for individuals to engage with personalized health solutions. Everlywell offers a variety of at-home tests, including vitamin D, thyroid, and cholesterol tests, that allow consumers to gather health data without visiting a healthcare provider. After testing, Everlywell offers tailored supplement recommendations based on the results, which consumers can conveniently order through the company’s platform.

Trust and Scientific Backing:

Consumers in the personalized supplement market are increasingly prioritizing trust and scientific validation. They prefer companies that provide clear, research-backed explanations for how their products work. For instance, Viome uses microbiome and RNA testing to provide personalized nutrition advice and supplement recommendations. They use a combination of advanced scientific testing and artificial intelligence to deliver highly personalized recommendations that are grounded in clinical research on gut health, metabolism, and overall wellness.

Health Goals:

The market is also being driven by consumers' desire to meet specific health goals, whether it's increasing energy, managing weight, improving gut health, or enhancing fitness recovery. Thorne, a company known for its premium supplements, offers tailored wellness solutions by conducting blood tests first and providing customers with personalized health insights. Thorne then recommends supplements that target specific needs like immune health, joint support, and cardiovascular wellness. This approach speaks directly to consumers' desire to optimize their physical health and performance.

Service Insights

Based on service, the personalized supplements segment dominated the overall market with a revenue share of 82.32% in 2024. The growing consumer demand for tailored health solutions that cater to individual nutritional needs, genetic makeup, and lifestyle is a reason for the segment’s growth. As awareness about the benefits of preventive health rises, consumers are increasingly turning to personalized supplements to optimize their well-being. Technological advancements in DNA analysis, microbiome testing, and AI-driven assessments have made it easier for companies to offer customized products, enhancing user engagement and effectiveness and thereby propelling market growth.

The personalized testing segment is expected to grow at the highest CAGR from 2025 to 2030. With growing awareness of the impact of genetics and lifestyle on health, consumers seek personalized insights to make informed dietary and supplement choices. Furthermore, the increasing availability of affordable genetic testing kits and AI-based analysis have made personalized testing more accessible, encouraging more individuals to adopt these solutions and thereby driving market growth.

Key Personalized Testing Techniques

As the personalized health and wellness industry grows, personalized supplement regimens are increasingly tailored to individual needs through various testing techniques. The three primary types of testing that are leading the market include Blood Tests, DNA Tests, and Wearable Device & App-based Tests. In addition to these, other techniques, such as Urine Tests or Gut Microbiome Tests, also contribute to the growing trend of personalized supplementation. Below is a comparative analysis of these testing methods, highlighting their key players, advantages, challenges, and how they fit into the personalized supplements market.

|

Testing Technique |

Key Players |

Metrics Tested |

Advantages |

Challenges |

|

Blood Tests |

Thorne, Everlywell |

Vitamins, minerals, cholesterol, hormones, inflammation |

Highly accurate, actionable data; comprehensive biomarkers |

Requires lab access or home kits; expensive |

|

DNA Tests |

DNAfit, 23andMe, Everlywell |

Genetic variants, nutrient absorption, metabolism |

Long-term insights into genetics; non-invasive |

Expensive; needs expert interpretation; not immediate |

|

Wearable Device & App-based |

Oura Ring, Levels Health |

Activity, sleep, heart rate, glucose levels |

Real-time data; continuous monitoring; non-invasive |

Data overload; limited scope; battery and device maintenance |

|

Other Tests |

Viome |

Gut microbiome, hydration, vitamin levels, metabolic markers |

Unique insights into gut health and hydration; non-invasive |

Requires expert interpretation; more specialized data |

Service Provider Insights

Based on service providers, the personalized testing & supplement companies (DTC) segment dominated the market with a share of 64.89% in 2024 and is expected to grow at the highest CAGR from 2025 to 2030. The rising consumer preference for direct-to-consumer (DTC) models that offer convenience, accessibility, and customization fuels the segment. Consumers increasingly want tailored health insights and products delivered to their doorstep, fueled by advancements in at-home testing kits, data analytics, and online platforms. This DTC approach allows companies to gather valuable data, offer more personalized recommendations, and maintain a closer connection with customers, which enhances brand loyalty and drives market growth.

The dieticians & nutritionists segment is expected to grow significantly over the forecast period—the growing consumer demand for expert guidance on individualized health and nutrition plans. As more people seek customized solutions based on genetic, lifestyle, and health data, dieticians and nutritionists increasingly leverage personalized testing to offer tailored recommendations. This trend boosts the adoption of personalized supplements, as clients are more likely to follow precise guidance, enhancing the efficacy of these health solutions and driving growth in this sector.

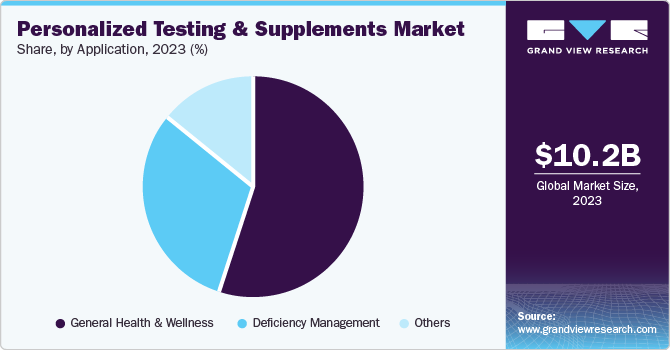

Application Insights

Based on application, the general health and wellness segment dominated the market with a revenue share of 55.18% in 2024 and is expected to grow at the highest CAGR from 2025 to 2030. As individuals seek to maintain long-term health, they turn to personalized solutions catering to their unique genetic makeup, lifestyle, and health goals. This has led to a surge in demand for tailored supplements and health testing, allowing consumers to address specific deficiencies, optimize their nutrition, and manage potential health risks more effectively.

The deficiency management segment is expected to grow significantly over the forecast period. The key market driver for deficiency management is the growing awareness of nutrient deficiencies and their impact on overall health. Advances in diagnostic technologies make it easier for individuals to detect nutrient gaps, enabling targeted supplementation, which drives demand and growth in this segment.

Regional Insights

North America personalized testing & supplements market accounted for the largest market share of 56.93% in 2024 for the personalized testing and supplements market, driven by various factors including increasing health consciousness, rising disposable incomes, and the prevalence of sedentary lifestyles. Furthermore, the increasing consumer awareness of preventive health and wellness, combined with the region's advanced healthcare infrastructure, is driving the market in this region. Moreover, the expansion of direct-to-consumer (DTC) platforms and e-commerce channels makes personalized testing and supplements more accessible, further fueling market growth in the region.

U.S. Personalized Testing & Supplements Market Trends

The personalized testing & supplements market in the U.S. is expected to grow over the forecast period. With rising health awareness, consumers are increasingly adopting personalized solutions for nutrition and fitness, driven by advancements in genetic testing, AI-based health assessments, and the popularity of personalized nutrition. The widespread availability of direct-to-consumer testing kits and online platforms, along with the high prevalence of chronic diseases, also accelerates the adoption of tailored health solutions in the U.S. market.

Europe Personalized Testing & Supplements Market Trends

The personalized testing & supplements market in Europe is projected to grow significantly due to rising health concerns, increasing awareness, and consumer preference for natural products. Key growth factors include a higher demand for personalized nutrition, technological advancements, and the prevalence of obesity in the region. For instance, in 2019, the European health interview survey revealed significant variations in the proportion of overweight and obese adults across different countries in the European Union (EU).

The UK personalized testing & supplements market held a significant share in 2024. The UK market is witnessing significant growth, aligning with the increasing prevalence of obesity. This highlights the public's need for effective solutions to combat this health issue. For instance, in the Health Survey for England 2021, it was found that 25.9% of adults in England are obese, while 37.9% are overweight, indicating a growing concern for public health and the need for effective weight management solutions.

The personalized testing & supplements market in France is growing, mirroring the rise in obesity rates. In 2020, overweight and obesity affected nearly half of the adult population in France. Among them, 47% were classified as overweight, with 17% specifically struggling with obesity. This highlights the growing concern for public health in the country.

Germany personalized testing & supplements market is growing due to a combination of factors such as a health-conscious population, advanced healthcare infrastructure, and the availability of high-quality products. A 2022 report by NIH revealed that over 53% of adult Germans grapple with overweight issues, with men experiencing them more frequently than women. Both sexes faced an obesity prevalence of 19%. Notably, the occurrence of overweight and obesity tends to rise with age in both genders.

Asia Pacific Personalized Testing & Supplements Market Trends

The personalized testing & supplements market in Asia Pacific is projected to grow at a significant CAGR over the forecast period largely driven by factors such as increasing health consciousness, rising obesity rates, and a growing preference for natural and herbal products. With a population that is becoming more health-aware and proactive in managing their weight, the demand for an effective market has surged. Several factors contribute to the market's expansion in this region. Firstly, the rising prevalence of obesity and lifestyle-related diseases has led consumers to seek alternative solutions to maintain a healthy weight. Moreover, the growing middle class with disposable income is more inclined to invest in self-care and wellness products.

China personalized testing & supplements market is experiencing significant growth, driven by factors such as increasing health consciousness, a rising middle class, and the growing prevalence of obesity and lifestyle-related diseases. As more Chinese citizens become aware of the importance of maintaining a healthy weight and adopting healthier lifestyles, the demand for an effective market has risen. In a study conducted in August 2023, it was found that among the participants, 34.8% were classified as overweight, while 14.1% were identified as obese in China. Notably, the prevalence of overweight and obesity was higher in males than in females across the overall study population.

The personalized testing & supplements market in Japan is witnessing notable growth. Manufacturers and retailers in Japan are responding to these trends by introducing new, high-quality markets that cater to the diverse preferences of Japanese consumers. As the market continues to evolve, it is expected that the growth of the weight loss supplement industry in Japan will remain robust, offering ample opportunities for businesses and investors in this sector.

MEA Personalized Testing & Supplements Market Trends

The personalized testing & supplements market in MEA has experienced considerable growth in recent years, driven by several factors. Rising health consciousness among consumers, increasing obesity rates, and growing disposable incomes have contributed to the expansion of this market. Furthermore, the influence of Western lifestyles and dietary habits has fueled the demand for weight loss products in the region. Moreover, advancements in product formulations, marketing strategies, and distribution channels have further propelled market growth. With consumers increasingly prioritizing health and wellness, the market in the Middle East and Africa is poised for continued expansion in the coming years.

Saudi Arabia personalized testing & supplements market has experienced steady growth in recent years, paralleling the rising prevalence of obesity in the country. The demand for weight management solutions has increased significantly with lifestyle changes and dietary habits shifting. A recent study published by the National Institutes of Health in March 2023 reported a significant finding from a comprehensive survey conducted across all regions of Saudi Arabia (KSA). The survey revealed that obesity prevalence in the country stands at 24.7%.

The personalized testing & supplements market in Kuwait is experiencing notable growth, driven by factors such as increasing health consciousness, rising obesity rates, and a growing preference for natural and herbal products. As the population in Kuwait becomes more health-aware and proactive in managing their weight, the growing demand for an effective market is on the rise.

Key Personalized Testing & Supplements Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve their availability, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Personalized Testing & Supplements Companies:

The following are the leading companies in the personalized testing & supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Viome

- DSM Nutritional Products AG

- Thorne

- Pharmavite

- Baze

- GNC Holding

- The Vitamin Shoppe

- Nestlé Health Science

- Vitaminpacks, Inc.

- myDNA

- LifeNome

Recent Development

-

In September 2024, Bioniq, announced a new partnership with Truemed. This collaboration allows Bioniq's pharmaceutical-grade nutritional supplements to be recognized as medically necessary, enabling eligible consumers to use HSA and FSA funds for their preventative healthcare routines. Typically, qualified consumers utilizing HSA/FSA funds can enjoy savings of approximately 30%

-

In April 2024, Hexis, a UK-based personalized sports nutrition company, announced a strategic integration with "TrainingPeaks," a platform for coaches and athletes. This makes Hexis the first app that dynamically estimates an athlete’s nutritional needs, tailoring them to precise workout requirements.

-

In March 2024, reports emerged about the upcoming Samsung Galaxy Ring, which is expected to transform personalized nutrition by providing meal plans based on caloric intake and BMI. It will integrate with Samsung Food to offer tailored recipes.

-

In February 2024, Herbalife unveiled its latest innovation, the Herbalife GLP-1 Nutrition Companion, introducing a new series of food and supplement product combinations. These offerings, available in both Classic and Vegan options, are now accessible in the U.S. and Puerto Rico, offering consumers a diverse array of flavors to choose from.

Personalized Testing & Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.58 billion |

|

Revenue forecast in 2030 |

USD 28.73 billion |

|

Growth rate |

CAGR of 16.18% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

February 2025 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, service provider, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Viome, DSM Nutritional Products AG, Thorne, Pharmavite, Baze, NC Holding, The Vitamin Shoppe, Nestlé Health Science, Vitaminpacks, Inc., myDNA, LifeNome. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Personalized Testing & Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global personalized testing & supplements market based on service, service provider, application, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Personalized Testing

-

Blood Tests

-

DNA Tests

-

Wearable Device & App-based Tests

-

Others

-

-

Personalized Recommendations

-

Fixed

-

Repeat

-

Continuous

-

-

Personalized Supplements

-

Proteins & Amino Acid

-

Vitamins

-

Minerals

-

Probiotics

-

Herbal/Botanic

-

Others

-

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Personalized Testing & Supplement Companies (DTC)

-

Dieticians & Nutritionists

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Health & Wellness

-

Deficiency Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized testing and supplements market size was estimated at USD 11.77 billion in 2024 and is expected to reach USD 13.58 billion in 2025.

b. The global personalized testing and supplements market is expected to grow at a compound annual growth rate of 16.18% from 2025 to 2030 to reach USD 28.73 billion by 2030.

b. North America dominated the personalized testing and supplements market with a share of 56.93% in 2024. This is attributable to the rising demand for effective supplement products and growth in healthcare awareness.

b. Some key players operating in the personalized testing & supplements market include Viome, DSM Nutritional Products AG, Thorne, Pharmavite, Baze, GNC Holding, The Vitamin Shoppe, Nestlé Health Science, Vitaminpacks, Inc., myDNA, LifeNome

b. Key factors that are driving the market growth include increasing awareness about health and wellness, rising demand for personalized supplement options, and technological innovation in supplement products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."