Consumer Electronics Market Size, Share, & Trends Analysis Report By Sales Channel (Online, Offline), By Product (Smartphones, Tablets, Desktops, Laptops/Notebooks, Digital Cameras), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-510-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Consumer Electronics Market Size & Trends

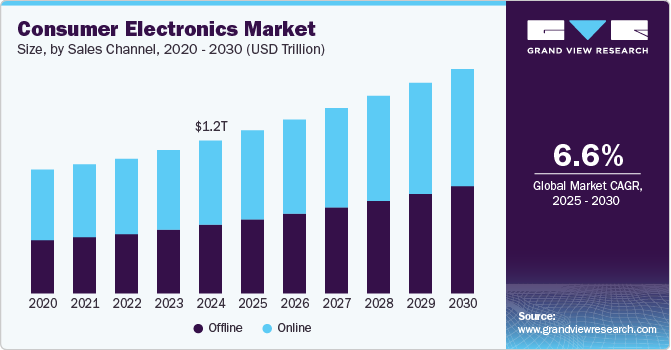

The global consumer electronics market size was valued at USD 1,214.11 billion in 2024 and is anticipated to grow at a CAGR of 6.6% from 2025 to 2030. The consumer electronics industry is driven by several key factors, including rapid technological advancements, rising disposable incomes, and increasing consumer demand for convenience and connectivity. Innovations in smart technologies, such as artificial intelligence (AI), Internet of Things (IoT), and 5G connectivity, are enabling the development of more sophisticated and interconnected devices, enhancing user experiences. In addition, growing digitalization across sectors and the proliferation of smart homes are fueling demand for smart devices such as smartphones, wearables, and smart home appliances.

E-commerce growth has also played a pivotal role, providing consumers with easy access to a wide range of electronic products. Furthermore, the shift towards sustainable and energy-efficient solutions, coupled with rising awareness of environmental concerns, has spurred the development of eco-friendly and energy-efficient devices, further bolstering market growth.

Technological advancements are a primary driver for market growth, with innovations such as artificial intelligence (AI), Internet of Things (IoT), and 5G connectivity transforming the capabilities of consumer devices. These technologies enable smarter, faster, and more interconnected products, enhance user experiences, and provide seamless integration across multiple devices. These advancements, from AI-powered virtual assistants to IoT-enabled smart home systems, are redefining convenience and efficiency in everyday life.

Rising disposable incomes have also significantly influenced the market, particularly in emerging economies. Consumers are increasingly willing to invest in premium and cutting-edge electronic products as they achieve higher earning potential. This trend has expanded the demand for high-quality smartphones, smartwatches, laptops, and other lifestyle-enhancing gadgets, driving growth across various product categories.

Growing consumer demand for connectivity and convenience has further accelerated the market. The proliferation of smart homes and connected ecosystems underscores the need for devices that offer seamless interoperability. Consumers are gravitating towards integrated solutions that simplify their lives, such as voice-activated home systems, wearable health trackers, and smart appliances that can be controlled remotely.

E-commerce growth has revolutionized consumer electronics access, offering unparalleled convenience and choice. Online platforms have made it easier for consumers to compare products, read reviews, and make informed purchasing decisions. This has opened up new avenues for manufacturers and retailers, enabling them to reach wider audiences and penetrate untapped markets.

The increasing focus on sustainability and energy efficiency has introduced a new dimension to the market. Consumers and manufacturers prioritize eco-friendly solutions, driving innovation in energy-efficient devices and materials. This shift aligns with broader environmental goals and reflects a growing awareness of consumer sustainability issues. This trend has reshaped product development and provided a competitive edge to companies investing in green technologies.

Sales Channel Insights

The offline segment held the largest market share of 55% in 2024. The offline segment dominates the market due to its ability to provide tangible experiences and personalized service. Physical stores allow consumers to directly interact with products, assess their quality, and seek immediate assistance from sales staff, which is especially important for high-value or complex items. In addition, brick-and-mortar outlets often cater to customers who prefer instant gratification, as they can purchase and take home products immediately. Many consumers also trust physical stores for after-sales services, such as repairs and returns, which enhances their shopping experience and builds loyalty.

The online segment is expected to grow at a significant rate during the forecast period, driven by the convenience and accessibility it offers. E-commerce platforms offer consumers a vast selection of products, competitive pricing, and the ability to compare options effortlessly. Integrating advanced technologies, such as AI-driven recommendations and augmented reality for virtual product trials, further enriches the online shopping experience. Moreover, the increasing penetration of smartphones, digital payment solutions, and internet connectivity, particularly in emerging markets, has expanded the reach of online platforms. Seasonal discounts, flash sales, and the option for doorstep delivery further enhance the appeal of online shopping, making it a rapidly growing segment in the consumer electronics industry.

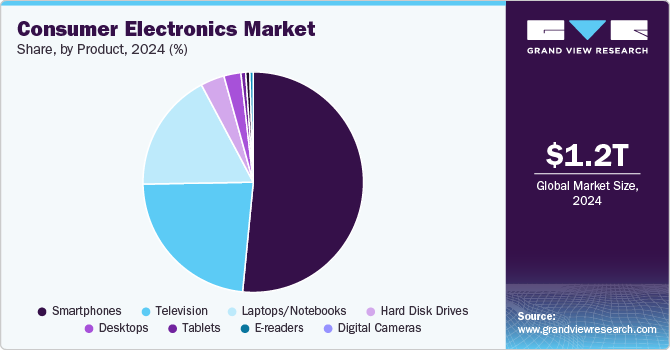

Product Insights

The smartphone segment held the largest market share in 2024. Smartphones dominate the market due to their indispensable role in modern life as multifunctional devices. They combine communication, entertainment, productivity, and connectivity, making them essential for personal and professional use. Continuous technological advancements, such as faster processors, improved camera systems, and enhanced battery life, have driven demand across all demographics. Moreover, the rise of mobile applications and services, including social media, mobile banking, and streaming platforms, further cements smartphones as a cornerstone of daily activities. The affordability of entry-level smartphones in emerging markets, coupled with frequent product launches by manufacturers, has also contributed to their widespread adoption.

The laptops/notebooks segment is expected to grow at a significant rate during the forecast period due to evolving work, education, and entertainment needs. The shift towards remote and hybrid work models and the increasing prevalence of online education have boosted demand for portable yet powerful computing devices. Technological innovations, such as lightweight designs, enhanced processing capabilities, and improved battery performance, have made laptops more versatile and appealing to a wider audience. The growing demand for gaming laptops and creative workstations has also opened new avenues for market growth. Rising consumer preferences for high-performance and multifunctional laptops further contribute to the segment's expanding market share.

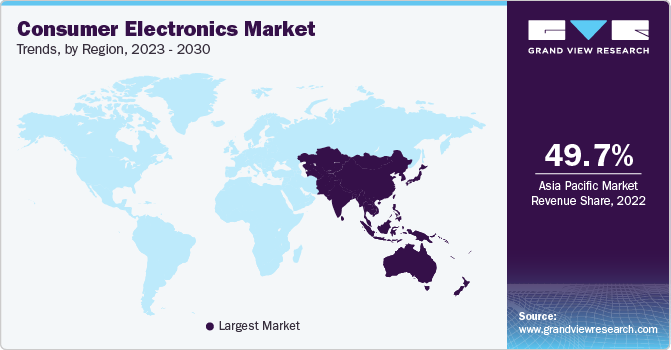

Regional Insights

North America consumer electronics market held the major global revenue share of over 20% in 2024. The consumer electronics industry in North America is shaped by strong demand for smart devices and advanced technologies. In the U.S., the proliferation of smart homes and connected ecosystems has driven the adoption of IoT-enabled products like smart thermostats, security systems, and appliances. The market also benefits from high disposable incomes and a tech-savvy population willing to invest in premium electronics, such as wearables and 4K televisions.

U.S. Consumer Electronics Market Trends

The consumer electronics industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. leads the North American market, focusing on innovation and early adoption of new technologies. The increasing penetration of 5G networks has bolstered demand for smartphones and other connected devices. In addition, the rise of e-commerce platforms and subscription-based streaming services has influenced purchasing behaviors, particularly for home entertainment and audio systems.

Europe Consumer Electronics Market Trends

The consumer electronics industry in Europe is growing significantly at a CAGR of over 3% from 2025 to 2030. In Europe, sustainability is a significant trend driving the consumer electronics industry. Consumers increasingly seek energy-efficient and eco-friendly products, aligning with stringent environmental regulations. Smart home devices and wearable technology are in high demand, fueled by an aging population and a growing focus on health and wellness.

The UK consumer electronics industry is expected to grow rapidly in the coming years. The UK market is characterized by rising demand for smart home products and portable electronics. Consumer preferences for high-quality audio-visual systems and gaming equipment have also surged. Adopting e-commerce and digital payment methods further supports growth in online sales channels.

The Germany consumer electronics industry held a substantial market share in 2024. As a leading technology hub in Europe, Germany emphasizes precision engineering and quality in consumer electronics. The market is witnessing significant growth in smart appliances and energy-efficient devices, driven by government incentives and consumer awareness. Demand for laptops and tablets has also grown, particularly for remote work and education.

Asia Pacific Consumer Electronics Market Trends

The consumer electronics industry in the Asia Pacific is growing significantly at a CAGR of over 8% from 2025 to 2030. The Asia Pacific region is a major growth driver for the global consumer electronics industry, driven by rapid urbanization, rising disposable incomes, and technological advancements. Increasing smartphone penetration, coupled with the expansion of e-commerce platforms, has transformed consumer behavior. The demand for affordable electronics and high-performance devices is particularly strong in emerging economies.

The China consumer electronics industry held a substantial share in 2024. As the largest consumer electronics market globally, China is driven by advancements in 5G technology and AI integration. Domestic manufacturers dominate, offering a wide range of products at competitive prices. Smart home devices, smartphones, and gaming equipment are particularly popular, reflecting a tech-savvy and digitally connected population.

The Japan consumer electronics industry held a substantial share in 2024. Japan's consumer electronics industry is characterized by high demand for innovative and compact devices. Consumers prioritize quality, reliability, and technological sophistication, driving the adoption of advanced robotics, wearables, and home appliances. Japan's aging population also contributes to the demand for health monitoring devices and assistive technologies.

India's consumer electronics industry is expanding rapidly. India is one of the fastest-growing consumer electronics markets, fueled by a young population, increasing internet penetration, and the rising adoption of smartphones. The demand for affordable yet feature-rich devices is strong, with significant growth in smart TVs, laptops, and wearables. The rapid expansion of e-commerce platforms and government initiatives promoting digitalization further bolster the market.

Competitive Insights

Key players operating in the global consumer electronics industry include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Canon Inc., Dell Technologies, among others. The key companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, Samsung Electronics America unveiled its latest innovation, Samsung Vision AI1, at the CES First Look 2025 event. This advanced AI technology showcases groundbreaking applications designed to deliver exceptional picture quality and serve as adaptive, intelligent companions that simplify and enhance daily life. Samsung Vision AI1 is seamlessly integrated across the company's new AI-powered screens and devices, including flagship models such as the Neo QLED 4K, Neo QLED 8K, OLED, and The Frame. Furthermore, Samsung announced the expansion of its Art Store to additional models and introduced several visionary display technologies, further cementing its leadership in the consumer electronics space.

-

In December 2024, at the TechDay 2024 event in Bengaluru, India, Lenovo unveiled the AMD ThinkPad T14s Gen 6, a groundbreaking laptop offering 50 TOPS (tera operations per second) AI processing power. As the first laptop to feature such capabilities on the x86 architecture, it is specifically designed to excel in AI-driven tasks. Powered by an NPU, the AMD Ryzen AI 7 Pro 360 processor, and an integrated AMD Radeon 880M GPU, the device is ideally suited for graphic design, intensive content creation, and other demanding computational workloads.

Key Consumer Electronics Companies:

The following are the leading companies in the consumer electronics market. These companies collectively hold the largest market share and dictate industry trends.

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Canon Inc.

- Dell Technologies

- Google LLC

- Hewlett Packard Enterprise Development LP

- HTC Corporation

- Huawei Technologies Co., Ltd.

- Lenovo

- LG Electronics

- Micromax

- Motorola Mobility LLC

- Nikon

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Seagate Technology LLC

- Sony Corporation

- Toshiba Corporation

- ZTE Corporation

Consumer Electronics Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 1,294.37 billion |

|

Revenue forecast in 2030 |

USD 1,782.60 billion |

|

Growth Rate |

CAGR of 6.6% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, sales channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa |

|

Key companies profiled |

Acer Inc., Apple Inc., ASUSTeK Computer Inc., Canon Inc., Dell Technologies, Google LLC, Hewlett Packard Enterprise Development LP, HTC Corporation, Huawei Technologies Co., Ltd., Lenovo, LG Electronics, Micromax, Motorola Mobility LLC, Nikon, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Seagate Technology LLC, Sony Corporation, Toshiba Corporation, and ZTE Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Consumer Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global consumer electronics market report based on product, sales channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smartphones

-

Tablets

-

Desktops

-

Laptops/Notebooks

-

Digital Cameras

-

Hard Disk Drives

-

Television

-

E-readers

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global consumer electronics market size was estimated at USD 1,214.11 billion in 2024 and is expected to reach USD 1,294.37 billion in 2025.

b. The global consumer electronics market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 1,782.60 billion by 2030.

b. Smartphones dominated the consumer electronics market with a share of 51.6% in 2024. This is attributed to the high degree of digital convergence and product innovation initiatives by key manufacturers. The smartphone market is dominated by three major operating platforms: Android, iOS, and Windows.

b. Some key players operating in the consumer electronics market include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Canon Inc., Dell Technologies, Google LLC, Hewlett Packard Enterprise Development LP, HTC Corporation, Huawei Technologies Co., Ltd., Lenovo, LG Electronics, Micromax, Motorola Mobility LLC, Nikon, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Seagate Technology LLC, Sony Corporation, Toshiba Corporation, and ZTE Corporation.

b. The consumer electronics market is driven by several key factors, including rapid technological advancements, rising disposable incomes, and increasing consumer demand for convenience and connectivity. Innovations in smart technologies, such as artificial intelligence (AI), Internet of Things (IoT), and 5G connectivity, are enabling the development of more sophisticated and interconnected devices, enhancing user experiences.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."