- Home

- »

- Food Additives & Nutricosmetics

- »

-

Personal Care Specialty Ingredients Market Size Report, 2030GVR Report cover

![Personal Care Specialty Ingredients Market Size, Share, & Trends Report]()

Personal Care Specialty Ingredients Market (2023 - 2030) Size, Share, & Trends Analysis Report By Product (Active, Inactive), By Application (Skin Care, Hair Care, Oral Care, Color Cosmetics, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-107-8

- Number of Report Pages: 96

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Care Specialty Ingredients Market Summary

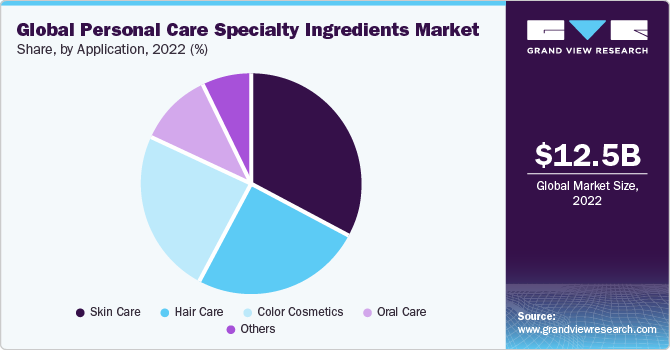

The global personal care specialty ingredients market size was estimated at USD 12.54 billion in 2022 and is projected to reach USD 19.07 billion by 2030, growing at a CAGR of 5.4% from 2023 to 2030. Growing consumer awareness regarding the toxicity of synthetic chemicals used in personal care products and toiletries is expected to propel the market for organic ingredients over the next eight years.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

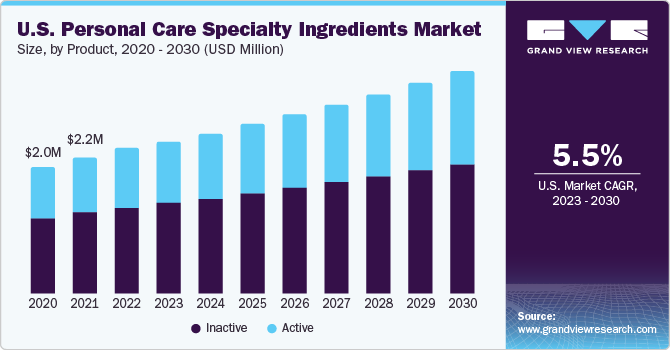

- North America is expected to grow at a CAGR of 5.6% during the forecast period.

- Based on application, the skin care segment accounted for the largest revenue share of 33.3% in 2022.

- Based on product, the inactive segment accounted for the largest revenue share of 58.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 12.54 Billion

- 2030 Projected Market Size: USD 19.07 Billion

- CAGR (2023-2030): 5.4%

- Asia Pacific: Largest market in 2022

Personal care products with negligible skin irritation have gained significance among various consumer age groups. This trend can be attributed to the increasing access to health forums via internet sources. In the hair care segment, the shifting preference toward water-based products over solvent-based alternatives is attributed to the ease of use and minimal damage caused to hair by prolonged usage.

The above trend has urged manufacturers to shift toward the use of mild ingredients such as sulfate-free anionic surfactants, which are preferred over conventional products such as sodium lauryl ether sulfates. A similar trend was also witnessed in the other product segments such as the anti-microbial and anti-aging product categories.

Major sources of the active ingredients comprise raw materials such as soybean, neem, fish oil, xanthan gum, and guar gum. While xanthan gum is majorly used in skincare, haircare, makeup, and bath products, soy-based ingredients find significance in anti-aging products. Specialty ingredients demand is primarily influenced by the price and availability of these raw materials for the further production of cosmetic chemicals.

While climatic conditions influence raw material production and supply, regulatory norms govern the extraction and processing of ingredients from these sources. Certification bodies such as EcoCert, BDIH, Certech, and Soil Association have established stringent guidelines for cosmetics based on food standards. These guidelines influence the trading of products that are not produced according to the guidelines. These strategies are anticipated to impact the false labeling of products and steer the natural and organic personal care specialty ingredients market over the next eight years.

Application Insights

The skin care segment accounted for the largest revenue share of 33.3% in 2022. Growing awareness among consumers regarding the significance of skincare and its role in maintaining healthy skin has led to an increased demand for skin care products. Factors such as urbanization, pollution, exposure to harmful UV rays, and changing lifestyles have adversely affected skin health. Consequently, consumers are seeking skin care products that can counter these negative effects.

The hair care segment is expected to grow at a CAGR of 5.6% over the forecast period. Increasing consumer awareness regarding hair health and the desire for personalized and effective hair care products have fueled the demand for hair care products. Hair-related issues such as hair loss, dandruff, dryness, and frizz continue to be significant concerns for consumers. As a result, there is a strong demand for ingredients that address these specific hair concerns and provide effective solutions.

Product Insights

The inactive segment accounted for the largest revenue share of 58.9% in 2022. The high penetration of this segment can be attributed to its efficiency in enhancing the benefits of individual components of cosmetic formulations. In addition, its enhanced compatibility with various formulations has led to increased adoption across hair and skin care products over the past few years.

The active segment is expected to grow at the fastest CAGR of 5.7% during the forecast period. The high growth of this segment can be attributed to the growing conditioning polymers and emollients demand in beauty products such as body washes, lotions, gels, and creams.

Conditioning polymers are expected to witness the highest growth within the active elements over the forecast period at an estimated CAGR of 5.9% from 2023 to 2030. Shifting consumer preference toward multi-functional products has urged the formulators to develop products with both conditioning and other functionalities such as coloring and anti-dandruff treatment. Ongoing research activities in polyquaternium and protein-based ingredients to develop effective hair conditioning products are expected to offer ample opportunities for industry participants over the long term.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 33.8% in 2022. The shifting consumer trend towards at-home beauty treatment has contributed to the significant demand for skin care and hair care products in the region. In addition, ongoing research projects adopted by various start-ups in countries such as China, India, and Vietnam for formulating innovative products from local ingredients are expected to further drive R&D investments over the long term.

North America is expected to grow at a CAGR of 5.6% during the forecast period. Shifting consumer trends toward UV protection and moisturizing products in the region, especially in the U.S. and Mexico is expected to drive related personal care product demand over the next eight years.

Key Companies & Market Share Insights

The global market for personal care specialty ingredients is highly fragmented owing to the presence of a large number of independent small & medium scale manufacturers, particularly in Asia Pacific and the Middle East.

Key Personal Care Specialty Ingredients Companies:

- Inolex, Inc.

- Vantage Specialty Chemicals

- Naturex

- Adina Cosmetic Ingredients Ltd.

- Avenir Ingredients Pty Ltd.

- Cosmetic Ingredients

- Lotioncrafter

- Treatt Plc

- Akott Evolution S.r.l.

- Symrise

- CLARIANT

- BASF Personal Care and Nutrition GmbH

- Evonik Industries AG

- Dow

Recent Developments

-

In July 2023, Evonik Industries AG acquired Novachem, an Argentinian manufacturer of cosmetic active ingredients. This strategic move involves the integration of Novachem into Evonik's Care Solutions business line, which operates within the company's life sciences division.

-

The primary objective of this acquisition is to enhance its existing portfolio of active ingredients, specifically catering to the beauty industry. Evonik aims to strengthen its position in serving the evolving needs of the cosmetics sector by incorporating Novachem's capabilities and expertise.

-

In May 2023, Evonik Industries AG collaborated with Safic-Alcan, a distinguished specialty chemicals distributor, to expand the reach of its nutraceutical offerings to a wider customer base. Through this partnership, Evonik is able to distribute its comprehensive range of nutraceutical products, including AvailOm, Healthberry, and IN VIVO BIOTICS, to customers across Europe, Turkey, and Egypt. By leveraging the distribution capabilities of Safic-Alcan, Evonik will be able to serve broader clients through an extensive network of local sales offices. This collaboration strengthens Evonik's portfolio and enables the company to cater to a diverse array of consumer needs, particularly in areas such as brain health, eye health, and heart health.

-

In March 2022, Vantage Specialty Chemicals, a prominent and vertically integrated supplier of naturally derived ingredients, successfully completed the acquisition of JEEN International Corporation. This strategic move enables Vantage Personal Care to further enhance its comprehensive range of naturally derived ingredients, encompassing active ingredients, natural oils, and bio-based chassis ingredients. The acquisition of JEEN International Corporation aligns seamlessly with Vantage Personal Care's existing portfolio, offering complementary products and expertise.

-

In August 2022, Inolex, a reputable specialty ingredients company, introduced ProCondition Sativa (INCI: Cannabisamidopropyl Dimethylamine), an innovative emulsifying and conditioning ingredient derivative of Cannabis sativa (hemp) seed oil. This new product is both sustainable and biodegradable.

-

ProCondition Sativa offers similar performance to Cetrimonium Chloride (CTAC) as a conditioning agent, while providing enhanced safety for the skin and eyes. Moreover, it is environmentally friendly, poses no harm to aquatic life. Functioning as a primary emulsifier, this ingredient contributes to the stability of formulations through the creation of lamellar liquid crystals.

Personal Care Specialty Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.20 billion

Revenue forecast in 2030

USD 19.07 billion

Growth Rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Inolex, Inc.; Vantage Specialty Chemicals; Naturex; Adina Cosmetic Ingredients Ltd.; Avenir Ingredients Pty Ltd.; Cosmetic Ingredients; Lotioncrafter, Treatt Plc; Akott Evolution S.r.l.; Symrise; CLARIANT; BASF Personal Care and Nutrition GmbH; Evonik Industries AG; Dow

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Care Specialty Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personal care specialty ingredients market based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Active

-

Surfactant

-

Amphoterics

-

Anionics

-

Cationics

-

Non-ionics

-

Others

-

-

Emollient

-

Emollient ester

-

Natural oil

-

Other

-

-

UV Absorber

-

Organic

-

Inorganic

-

-

Conditioning polymer

-

Silicone

-

Polyquaternium

-

Conditioning protein

-

-

Antimicrobial

-

Preservative

-

Bacteriostats

-

Antidandruff agent

-

-

Others

-

-

Inactive

-

- Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

Oral Care

-

Color Cosmetics

-

Others

-

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global personal care specialty ingredients market size was estimated at USD 12.5 billion in 2022 and is expected to reach USD 13.2 billion in 2023.

b. The global personal care specialty ingredients market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 19.1 billion by 2030.

b. Asia Pacific dominated the personal care specialty ingredients market with a share of 33.8% in 2022. This is attributable to the shifting consumer trend towards at-home beauty treatment, which has led to a significant demand for skin care and hair care products in the region.

b. Some key players operating in the personal care specialty ingredients market include BASF SE, Evonik Industries, Dow Chemicals, Clariant International Limited, Symrise Group, Akott, Ashland, Inc., Vantage Specialty Ingredients, Naturex. and others.

b. Key factors that are driving the market growth include the growing consumer awareness regarding the toxicity of synthetic chemicals used in personal care products and toiletries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.