- Home

- »

- Medical Devices

- »

-

Personal Care CMO And CDMO Market Size Report, 2030GVR Report cover

![Personal Care CMO And CDMO Market Size, Share & Trends Report]()

Personal Care CMO And CDMO Market (2024 - 2030) Size, Share & Trends Analysis Report By Services, By Product Category, By Form (Creams & Lotions, Gels, Liquids & Suspensions), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-265-6

- Number of Report Pages: 172

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Care CMO And CDMO Market Trends

The global personal care CMO and CDMO market size was estimated at USD 26.70 billion in 2023 and is expected to grow at a CAGR of 4.81% from 2024 to 2030. The increasing demand for cosmetics and personal care is one of the major factors supporting the growth of the personal care contract research organizations (CRO) and contract development & manufacturing organizations (CDMO) industry. This increased demand is likely to drive the need for contract manufacturing, which allows brands to expand their product range & develop products better suited to customer demands. Moreover, cosmetic brands opting for contract manufacturing models to offer products to more consumers is another significant factor supporting the market's growth. In addition, advancements in cosmetics manufacturing with new technology and various formulations fuel the market's growth.

The demand for personal care CMO & CDMO services is growing due to various benefits such as an increased consumer base for cosmetics and personal care, the presence of the GenZ and millennial population, specialized expertise, and high-quality manufacturing. Moreover, the market is competitive, with established and emerging players offering various cosmetics and skincare products. Companies are leveraging technologies and innovative methodologies to gain a competitive edge. Such factors strengthen market growth.

Market Concentration & Characteristics

The market growth stage is medium and it is expected to accelerate over the forecast period. The personal care CMO & CDMO market is characterized by technologies, regulatory considerations, and globalization & outsourcing of services processes to influence advantages and specialized capabilities.

The cosmetic and skincare product categories have observed advancements due to enormous pressure to create innovative new products that help consumers feel beautiful and refreshed.

Regulatory bodies and other authorities can influence the Personal Care CMO & CDMO market. Cosmetic contract manufacturing companies follow an iterative methodology to maintain quality experience/interface & constantly changing requirements.

Outsourcing has proved to facilitate the firms to gain or retain leadership or help in international expansion. In addition, the competitive landscape has helped businesses position themselves effectively and differentiate their offerings.

Rising expansions, increasing R&D activities, and growing adoption of skincare can positively influence market dynamics. Besides, some of the key factors for market growth are increasing awareness among consumers regarding natural ingredients and the potential to address a range of skin-related problems, which is expected to influence market dynamics positively.

The increase in R&D expenditure, the existence of technologically advanced service providers, and increasing spending on Personal Care CMO & CDMO fuels the market growth.

Services Insights

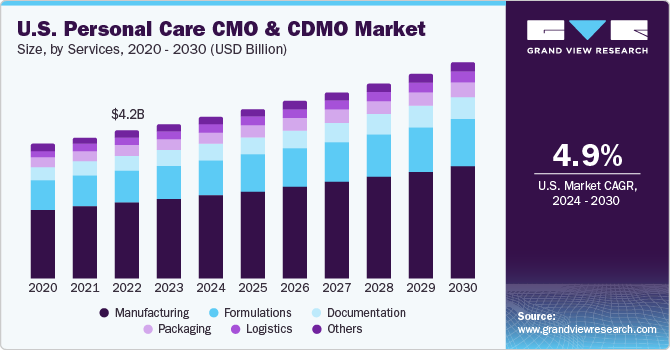

The manufacturing segment held the largest market share in 2023. Key factors contributing to the growth are improved cosmetic formulations, growing requirements for a streamlined manufacturing process, increasing R&D of cosmetic products to overall efficiency, and expanding product portfolio.

Changing customer requirements seeking new products has led to technological advancements in manufacturing new cosmetics for various skin types. Adoption of natural ingredients and growing product approval & launches can bode well for the segment’s growth. The rising cosmetic brands founded by celebrities and entrepreneurs have led to rising demand for outsourcing, fueling the market growth.

On the other hand, the documentation segment is anticipated to grow at a CAGR of 5.10% over the forecast period. The segment is expected to grow significantly due to the increasing regulatory compliance, product safety, and quality control throughout the product lifecycle.

Product Category Insights

The skincare segment held a revenue share of 49.94% in 2023. The global skincare market is highly competitive. The demand for skincare is expected to surge due to the increasing interest in health-promoting and self-care products and the significant potential to address a range of acne, pimple, and other skin-related problems. Hence, skincare products are currently in the spotlight as the cosmetic industry players are widely emphasizing the development of various formulation-based skincare products to meet growing consumer needs.

The makeup & color cosmetics segment is anticipated to grow at a CAGR of 4.86% over the forecast period. The segment growth is due to a rise in product innovations and continuous upgradation of makeup and color cosmetics products. Rising emphasis on high technology-oriented, price-sensitive, and quality competitive makeup & color cosmetics accelerates the demand for the segment. Moreover, consumers' growing preference for makeup & color cosmetics is expected to drive segment growth.

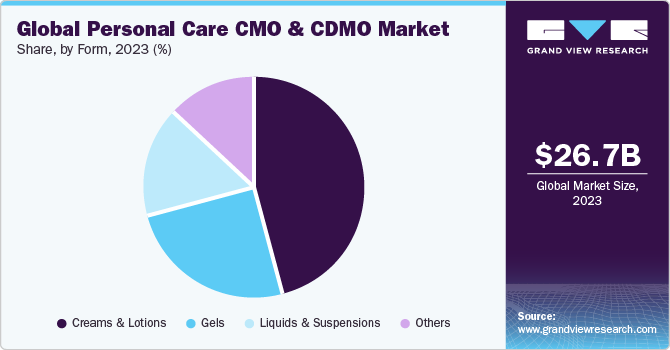

Form Insights

The creams & lotions segment dominated the market in 2023, accounting for a revenue share of 45.86%. The growth of this segment can be attributed to the increasing demand for cost-effective products and a rising focus on skin hydration and appearance. In addition, cosmetics companies are launching products that hydrate and replenish the skin using various formulations that deliver exemplary results. Besides, creams & lotions have become a millennial skincare regimen, with a strong preference for targeted and potent formulations. In addition, the adoption of the latest technology trends toward advanced manufacturing is anticipated to drive market growth.

The liquids & suspensions segment is expected to grow at a CAGR of 5.07% over the forecast period. Recently, liquids & suspensions trends have shown a vast migration in product category with significant advancements in formulation. Besides, cosmetics liquids & suspensions hold significant promise for emerging brands, particularly those that emphasize innovation. With the rich product category and increased sales, the segment is expected to grow significantly.

Regional Insights

In North America, the market is expected to grow at a CAGR of 4.85% over the forecast period. This can be attributed to the presence of established manufacturing companies and growing innovation for personal care & beauty products. In addition, many cosmetics companies have shifted their focus to outsourcing service providers to efficiently handle the increasing volume of product categories. Besides, rising skincare routine practices among populations are the major factor for the market growth. Furthermore, the presence of retail chains for cosmetics products is another factor driving the market across the region. This has led to rising demand for the personal care CMO & CDMO market.

U.S. Personal Care CMO And CDMO Market Trends

The personal care CMO & CDMO market in the U.S. is driven by the well-established cosmetics industry, expanding personal care & beauty products, and rising R&D investments.

Europe Personal Care CMO And CDMO Market Trends

The personal care CMO & CDMO market in Europe is expected to grow significantly due to the increasing adoption of skin care products to enhance the lifestyle. For instance, according to the European Consumer Perception Study 2022, 72% of European consumers seek cosmetics and personal care products as important parts of their lives.

The personal care CMO & CDMO market in Germany is anticipated to grow over the forecast period owing to growing interest in new and innovative natural ingredients-based cosmetics and personal care products, which is expected to boost the market demand further.

UK personal care CMO & CDMO market is anticipated to grow over the forecast period. The rapidly evolving demand for cosmetics product category contributes to the growing personal care CMO & CDMO in this region.

Asia Pacific Personal Care CMO And CDMO Market Trends

Asia Pacific dominated the personal care CMO & CDMO market, accounting for the largest revenue share of 49.75% in 2023. The region's high share is due to growing cosmetic innovation and production; strong cost-efficiency offered by companies in countries such as China, India, and South Korea are contributing to its prominence in this field. Moreover, growing demand for various product categories and fostering innovation & technological expertise within the region fuels the market growth.

The personal care CMO & CDMO market in China is expected to grow over the forecast period due to technological advancements, growing demand for cost-effective product categories, and high cosmetic manufacturing expenditure.

Japan Personal Care CMO & CDMO Market is expected to grow over the forecast period due to the growing product category industry and increasing adoption of skincare products.

The personal care CMO & CDMO market in India is anticipated to grow over the forecast period owing to new product development, and destinations for manufacturing services drive the market.

Key Personal Care CMO And CDMO Company Insights:

The major players operating in the market are focused on adopting inorganic strategic initiatives such as mergers, partnerships, acquisitions, etc. The prominent strategies companies adopt are launches, mergers & acquisitions, partnerships & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge in driving market growth. Hence, increasing adoption of strategic initiatives is highly anticipated to boost the market share of prominent players operating across the market.

Key Personal Care CMO And CDMO Companies:

The following are the leading companies in the personal care CMO and CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Nutrix International LLC

- Swiss American CDMO

- Universal Packaging Systems, Inc. Dba PakLab

- Suzhou Ante Cosmetics Co., Ltd

- Arizona Natural Resources Inc.

- Opal Cosmetics

- Concentrated Aloe Corporation (CAC)

- Ausmetics

- Intercos S.P.A

- BPI Labs

- Cosmetic Solutions

- SBLC Cosmetics

- Akums Drugs and Pharmaceuticals Ltd.

- Maxima Solutions

- New Look Cosmetics

- Radical Cosmetics

- Dermatech Labs

Recent Developments

-

In September 2023, Crafted launched YourCrafted for personal care brand. The company’s YourCrafted is the new hub for personal care products that are off-the-shelf stuff.

-

In March 2023, Pelham Group launched turnkey creation platform with low MOQs. The new tool offers formulations that supports brands to stay agile in their product launches.

Personal Care CMO & CDMO Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.91 billion

Revenue forecast in 2030

USD 36.99 billion

Growth rate

CAGR of 4.81% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, product category, form, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Nutrix International LLC; Swiss American CDMO; Universal Packaging Systems, Inc. Dba PakLab; Suzhou Ante Cosmetics Co., Ltd; Arizona Natural Resources Inc.; Opal Cosmetics; Concentrated Aloe Corporation (CAC); Ausmetics; Intercos S.P.A.; BPI Labs; Cosmetic Solutions; SBLC Cosmetics; Akums Drugs and Pharmaceuticals Ltd.; Maxima Solutions; New Look Cosmetics; Radical Cosmetics; Dermatech Labs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Care CMO And CDMO Market Report Segmentation

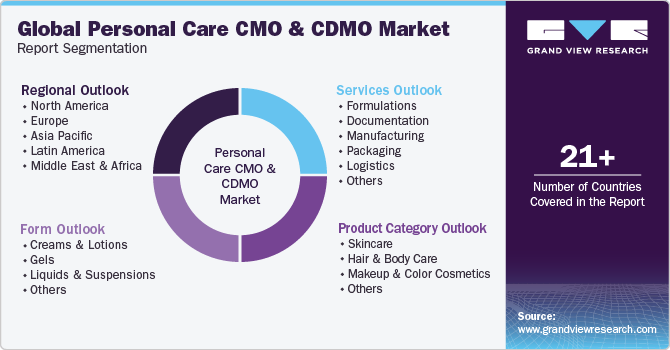

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personal care CMO & CDMO market report based on services, product category, form, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Formulations

-

Documentation

-

Manufacturing

-

Packaging

-

Logistics

-

Others

-

-

Product Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Hair & Body Care

-

Makeup & Color Cosmetics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Creams & Lotions

-

Gels

-

Liquids & Suspensions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personal care CMO and CDMO market size was estimated at USD 26.70 billion in 2023 and is expected to reach USD 27.91 billion in 2024.

b. The global personal care CMO and CDMO market is expected to grow at a compound annual growth rate (CAGR) of 4.81% from 2024 to 2030 to reach USD 4.81 billion by 2030.

b. The skincare segment dominated the market in 2023 with a market share of 49.94%. Growth in the segment can be attributed to the increasing interest in health-promoting and self-care products and the significant potential to address a range of acne, pimples, and other skin-related problems

b. Nutrix International LLC, Suzhou Ante Cosmetics Co., Ltd, Arizona Natural Resources Inc., Opal Cosmetics, Concentrated Aloe Corporation (CAC), Ausmetics, Intercos, BPI Labs, Cosmetic Solutions, SBLC Cosmetics, Akums Drugs and Pharmaceuticals Ltd., Maxima Solutions, New Look Cosmetics, RADICAL COSMETICS, Dermatech Labs

b. The increasing demand for cosmetics and personal care, rising GenZ and millennial population, specialized expertise, and high-quality manufacturing are key growth drivers for this market. Moreover, the market is competitive, with established and emerging players offering various cosmetics and skincare products, further supporting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.