Permanent Magnets Market Size, Share & Trends Analysis Report By Material (Ferrite, NdFeB), By Application (Consumer Goods & Electronics, Energy), By Region (Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-058-3

- Number of Report Pages: 117

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Permanent Magnets Market Size & Trends

The global permanent magnets market size was valued at USD 22.18 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2030. The rising prominence of renewable energy sources, such as wind and solar, is anticipated to positively aid the market growth over the forecast period. At present, permanent magnets are used in wind turbine generators for increasing their efficiency. Rare earth magnets, such as Neodymium Ferrite Boron (NdFeB), are being predominantly used in wind turbines owing to benefits, such as increased reliability and reduction in maintenance costs.

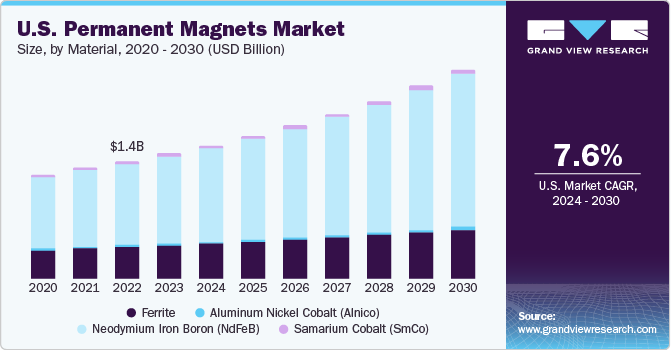

The permanent magnet market in U.S. is expected to grow at a higher rate than its ferrite counterpart over the forecast period owing to its wide usage in high-end applications like robotics, wearable devices, electric vehicles, and wind power. Since the economic meltdown of 2008-09, the automotive industry in the U.S. has grown steadily. The country has been witnessing a significant rise in the adoption of plug-in electric cars, primarily driven by the advanced products offered by key players, such as Tesla, Chevy, Nissan, Ford, Audi, and BMW, among others. In early 2018, Tesla became one of several electric carmakers to use motors with neodymium magnets.

However, due to fewer permanent motor magnet manufacturers in the country, it imported 4 million pounds of automotive parts from China, with the bulk of them being electric motors. The escalating trade war with China is likely to represent a significant challenge for the U.S., as it threatens to cut off its supply of rare earth and associated products to the U.S. To reduce its reliance on raw material sourcing of rare earth materials, the government has taken various steps including funding mining projects under the Defense Production Act. Such initiatives are likely to strengthen the raw material supply for the domestic industry in the U.S.

As per IMF, the GDP growth of North America for 2023 is anticipated to be 1.6%. The growth can be attributed to the U.S. economy, which witnessed growth in Q2 2023 despite high rates and inflation. The U.S. GDP grew by 2.4% (seasonally adjusted) for the April–June 2023 period due to government purchases, consumer spending, and investments in business & inventory. On account of the massive fiscal packages offered by the U.S. government to uphold industrial production, the domestic market for permanent magnets witnessed gradual growth in 2023.

Market Concentration & Characteristics

Market growth stage is high, and pace of the growth is accelerating. The industry is anticipated to witness growth owing to the increasing demand for sustainable energy sources such as wind power, and the exponential growth in the electric vehicle (EV) markets.

The permanent magnets market is fragmented and is characterized by regional concentration of players in certain parts of the world. On account of the presence of large-scale rare earth metal deposits in China, numerous small, medium, and large-scale manufacturers are located in its close vicinity.

The market is characterized by a high degree of innovation to optimize the production process in an environmentally sustainable manner, and to manage residue and waste. Manufacturers have been focusing on developing and innovating new products with higher efficiency to cater to high-end performance industries, such as defense, aerospace, and automation.

The market is expected to observe low level of merger and acquisition (M&A) activity owing to the stringent regulatory process and approvals required for mining licenses and residue management. Since the approval process is long, and the player concentration is high, M&A every year is observed to be lower than that of other industries.

The market is also subject to stringent regulatory scrutiny. Various regulatory authorities such as European Union restrict the production and use of permanent magnets in the region. End user concentration is a significant factor in the market, since there are several industries that consume permanent magnets, such as automotive, consumer goods, industrial and medical. The performance of each end use industry is influenced by macro-economic trends and seasonal variations in each industry.

Material Insights

The ferrite material segment dominated the market in 2023 and accounted for the largest revenue share of about 36.0%. Ferrite magnets are primarily used in motor applications. Over 65% of the total volume of ferrite magnets are utilized in motor applications, with consumption in automotive motors, appliance motors, HVAC motors, and industrial & commercial motors estimated roughly at 19%, 14%, 12%, and 11%, respectively, in 2022. Furthermore, they are also utilized in loudspeakers, separation equipment, Magnetic Resonance Imaging (MRI), relays & switches, and holding & lifting applications. Neodymium Iron Boron (NdFeB) is projected to emerge as the second-largest material segment with the fastest CAGR, in terms of volume as well as the revenue over the forecast period.

Over the past five years, the application scope of NdFeB magnets has broadened considerably. Apart from its traditional applications, the product is now witnessing significant penetration in the motors of electric and hybrid electric vehicles, wind power generators, air conditioning compressors & fans, and energy storage systems. Alnico is the name for an alloy composed of aluminum, nickel, and cobalt. Permanent magnets based on alnico were considered to be the strongest magnets before rare earth magnets, such as NdFeB, were discovered in the 1970s. According to Magnet Applications, Inc., the average Energy Density (BHmax) exhibited by the alnico magnet is 7 MGOe, which is higher than that of ferrite magnets but considerably lower than Neodymium-Iron-Boron (NdFeB) magnets.

Application Insights

Consumer goods & electronics accounted for the largest revenue share of about 26.0% and emerged as the leading application segment in 2023. In the electronics industry, the product is used in air conditioning compressors & fans, recorders, computer cables, DVDs, cameras, watches, earbuds, loudspeakers, microphones, mobile phones, voice coil motors, printers, fax stepper motors, printer machine rollers, hard disk drives (HDDs), and portable power tool motors among others. Growth in the production of the aforementioned product categories is estimated to directly support the market growth for permanent magnets.

The automotive segment is projected to observe a steady growth rate, in terms of revenue, over the forecast period. According to Arnold Magnetic Technologies, there are roughly 100 permanent magnet devices in a typical car. Although ferrite is favored by the majority of car manufacturers, the shifting paradigm of consumer demand for lightweight vehicles has fueled the need for small and high-performance magnetic products. Thus, advancement toward vehicle energy efficiency is projected to positively support the segment growth over the predicted timeline. The industrial application segment held the third-largest share, in terms of revenue, in 2023.

The need among oil & gas industry players to enhance the usage of energy-intensive technological processes like electronic submersible pumps and reduce power consumption represents a lucrative opportunity for the market vendors of the permanent magnet. As compared to asynchronous submersible electric motors, which are used for driving electrical submersible pumps, permanent magnet motors (PMM) have a number of characteristics that make them economically attractive for the oil & gas industry. Medical is projected to be among the fastest-growing application segments for the market over the predicted timeline. The product demand in the medical sector is primarily driven by its increasing use in devices, such as MRI, body scanners, and heart pacemakers.

Regional Insights

Asia Pacific accounted for the largest revenue share of nearly 75.0% in 2023. The region is a manufacturing hub of the world. Automotive and electronic productions are critical components of the region’s manufacturing activities. China, Japan, and South Korea have become hot centers for manufacturing computer hardware devices including hard disks, computer chips, and microprocessors. This has contributed to the rising demand for permanent magnets, which are being extensively consumed by electronics and hardware manufacturers. Europe is anticipated to emerge as the second-largest regional market by 2030, although the region witnessed a sharp decline in 2020. This is because industrial production in Europe has observed slower growth in the past few years due to the overall economic slowdown and due to political uncertainties, such as Brexit.

The economic growth in FY 2020 was further impacted by the lockdown caused by the COVID-19 pandemic. North America accounted for a significant revenue share in 2023. The COVID-19 pandemic drastically affected the market supply in the North America region. According to the International Monetary Fund, the GDP of North America declined by at least 7% in 2020. This indicates the decline in the manufacturing output of end-use industries, such as automotive & transportation, electrical & electronics, and aerospace & defense. Middle East & Africa witnessed a decline in terms of revenue, in 2023. The GDP of MEA contracted by roughly 4.2% in 2020. The key countries of the region, especially gulf countries, started to feel pressure as the deflation continue to rise.

Key Companies & Market Share Insights

Some of the key players operating in the market include Hitachi Metals Ltd., Shin-Etsu Chemical Co., Ltd. and Ningbo Yunsheng Co., Ltd.

-

Hitachi Metals Ltd. operates through three business segments, namely automotive related products, electronics-related products, and infrastructure related products. It offers a wide range of products including cutting tools, molding materials, chassis, exhaust components, magnets & motor related products, LCD displays & semiconductors, medical equipment, aircraft components, piping equipment, industrial equipment, and rubber.

-

Shin-Etsu Chemical Co., Ltd. operates through various business segments, namely PVC, silicones, specialty chemicals, semiconductor silicon, electronics & functional materials, and processing/trading businesses.

-

Ningbo Yunsheng Co., Ltd. develops and manufactures sintered and bonded NdFeB, AlNiCo, and SmCo magnets; magnetic assemblies; and electric motor products. The company is engaged in the research and management of servomotors, compact spinning devices, automobile motors, serinette, smart technology products & supplies, and neodymium magnets.

-

Earth-Panda Advance Magnetic Material Co., Ltd., and Ninggang Permanent Magnetic Materials Co., Ltd., are some of the emerging market participants.

-

Earth-Panda Advance Magnetic Material Co., Ltd. manufactures permanent and flexible magnets including ceramic and ferrite. Its product portfolio includes extruded magnet strips, rubber magnet sheets/rolls, magnetic products, electric motor seals, magnetic tapes, refrigerator seals, magnetic gifts, magnetic darts, bathroom seal, magnetic toys, magnetic belts, and office automation & stationary magnets.

- Ninggang Permanent Magnetic Materials Co., Ltd. was established in 2003 and is headquartered in Ningbo, China. It provides sintered SmCo materials, rubber magnets, plastic injection magnets, bonded NdFeB magnets, alnico, and ferrite magnets. The company has advanced producing technology, excellent test means, and strict quality guaranteed system to supply permanent magnets in various shapes.

Key Permanent Magnets Companies:

- Adams Magnetic Products Co.

- Earth-Panda Advance Magnetic Material Co., Ltd.

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Eclipse Magnetics Ltd.

- Electron Energy Corp.

- Goudsmit Magnetics Group

- Hangzhou Permanent Magnet Group

- Magnequench International, LLC

- Ningbo Yunsheng Co., Ltd.

- Ninggang Permanent Magnetic Materials Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- TDK Corporation

- Thomas & Skinner, Inc.

- Vacuumschmelze GMBH & Co. Kg

- Ugimag Korea Co., Ltd.

- SsangYong Materials Corp.

- Pacific Metals Co., Ltd.

Recent Developments

-

In October 2023, Ara Partners, a private equity firm acquired Vacuumschmelze (VAC), a German permanent magnets producer, from its equity investor Apollo. This will strengthen the duo’s rare earths value chain, and help the former to pursue its strategic growth opportunity of supplying permanent magnets to key industries such as electric vehicles (EV).

-

In January 2023, VAC signed an agreement with U.S. automaker General Motors to build a permanent magnets manufacturing plant in North America to manufacture, using locally sourced raw materials. The product would be used in the manufacture of electric motors supplied to GM automobiles.

Permanent Magnets Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 22.18 billion |

|

Revenue forecast in 2030 |

USD 39.71 billion |

|

Growth Rate |

CAGR of 8.7% from 2024 to 2030 |

|

Market size volume in 2023 |

1,177.6 kilotons |

|

Volume forecast in 2030 |

1,767.8 kilotons |

|

Growth Rate |

CAGR of 6.0% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; Russia; UK; France; Italy; China; India; South Korea; Indonesia; Japan; Brazil; Argentina |

|

Key companies profiled |

Adams Magnetic Products Co.; Earth-Panda Advance Magnetic Material Co., Ltd.; Arnold Magnetic Technologies; Daido Steel Co., Ltd.; and Eclipse Magnetics Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Permanent Magnets Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global permanent magnets market report on the basis of material, application, and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Ferrite

-

Neodymium Iron Boron (NdFeB)

-

Aluminum Nickel Cobalt (Alnico)

-

Samarium Cobalt (SmCo)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Automotive

-

Consumer goods & electronics

-

Industrial

-

Aerospace & Defense

-

Energy

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global permanent magnets market size was estimated at USD 20.58 billion in 2022 and is expected to reach USD 22.18 billion in 2023.

b. The global permanent magnets market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2033 to reach USD 39.71 billion by 2030.

b. Consumer goods & electronics segment dominated the permanent magnets market with a volume share of 27.0% in 2022, owing to its extensive use demand in manufacturing of speakers, headphones, and other electronic accessories.

b. Some of the key players operating in the permanent magnets market are Adams, Hitachi Group, Shin-Etsu, Daido Steel Co., Ltd., Eclipse Magnetsics Ltd, Goudsmit Magnetsics Group, Electron Energy Corporation, Magnequench International, LLC, and Hangzhou Permanent Magnets Group.

b. The key factors that are driving the permanent magnets market include rising demand for electronic accessories or gadgets and increasing focus towards wind energy generation.

Table of Contents

Chapter 1. Permanent Magnets Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Data Analysis Models

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Permanent Magnets Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Permanent Magnets Market: Variables, Trends, and Scope

3.1. Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.3. Manufacturing Trends & Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Opportunity Analysis

3.5.4. Market Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining Power of Suppliers

3.6.2. Bargaining Power of Buyers

3.6.3. Threat of Substitution

3.6.4. Threat of New Entrants

3.6.5. Competitive Rivalry

3.7. PESTLE Analysis

3.7.1. Political

3.7.2. Economic

3.7.3. Social Landscape

3.7.4. Technology

3.7.5. Environmental

3.7.6. Legal

Chapter 4. Permanent Magnets Market: Material Estimates & Trend Analysis

4.1. Permanent Magnets Market: Material Movement Analysis, 2023 & 2030

4.2. Ferrite

4.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.3. Neodymium Iron Boron (NdFeB)

4.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.4. Aluminum Nickel Cobalt (Alnico)

4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.5. Samarium Cobalt (SmCo)

4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Permanent Magnets Market: Application Estimates & Trend Analysis

5.1. Permanent Magnets Market: Application Movement Analysis, 2023 & 2030

5.2. Automotive

5.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.3. Consumer Goods and Electronics

5.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.4. Industrial

5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.5. Aerospace & Defense

5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.6. Energy

5.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.7. Medical

5.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.8. Others

5.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Permanent Magnets Market: Regional Estimates & Trend Analysis

6.1. Regional Analysis, 2023 & 2030

6.2. North America

6.2.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.2.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.2.4. U.S.

6.2.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.4.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.2.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.2.5. Canada

6.2.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.5.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.2.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.2.6. Mexico

6.2.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.2.6.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.2.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3. Europe

6.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.3.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.4. Germany

6.3.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.5. Russia

6.3.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.6. UK

6.3.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.7. France

6.3.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.7.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.3.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.8. Italy

6.3.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.8.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.3.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4. Asia Pacific

6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.4. China

6.4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.5. India

6.4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.6. Japan

6.4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.7. South Korea

6.4.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.8. Indonesia

6.4.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5. Central & South America

6.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.4. Brazil

6.5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.5. Argentina

6.5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6. Middle East & Africa

6.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.4. KSA

6.6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.2. Market estimates and forecasts, by material, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Ranking

7.4. Heat Map Analysis

7.5. Vendor Landscape

7.5.1. List of raw material supplier, key manufacturers, and distributors

7.5.2. List of prospective end-users

7.6. Strategy Mapping

7.7. Company Profiles/Listing

7.7.1. Adams Magnetic Products Co.

7.7.1.1. Company overview

7.7.1.2. Financial performance

7.7.1.3. Product benchmarking

7.7.2. Advance Magnetic Material Co., Ltd

7.7.2.1. Company overview

7.7.2.2. Financial performance

7.7.2.3. Product benchmarking

7.7.3. Arnold Magnetic Technologies

7.7.3.1. Company overview

7.7.3.2. Financial performance

7.7.3.3. Product benchmarking

7.7.4. Daido Steel Co., Ltd.

7.7.4.1. Company overview

7.7.4.2. Product benchmarking

7.7.5. Eclipse Magnetics Ltd.

7.7.5.1. Company overview

7.7.5.2. Product benchmarking

7.7.6. Electron Energy Corporation

7.7.6.1. Company overview

7.7.6.2. Product benchmarking

7.7.7. Goudsmit Magnetics Group

7.7.7.1. Company overview

7.7.7.2. Product benchmarking

7.7.8. Hangzhou Permanent Magnet Group

7.7.8.1. Company overview

7.7.8.2. Product benchmarking

7.7.9. Hitachi Metals Ltd.

7.7.9.1. Company overview

7.7.9.2. Product benchmarking

7.7.10. Magnequench International, LLC

7.7.10.1. Company overview

7.7.10.2. Financial performance

7.7.10.3. Product benchmarking

List of Tables

Table 1 Permanent magnets market estimates & forecasts, 2018–2030 (USD Million) (Kilotons)

Table 2 Ferrite permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 3 NdFeB permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 4 Alnico permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 5 SmCO permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 6 Permanent magnets market estimates & forecasts, by automotive, 2018 - 2030 (USD Million) (Kilotons)

Table 7 Permanent magnets market estimates & forecasts, by consumer good & electronics, 2018 - 2030 (USD Million) (Kilotons)

Table 8 Permanent magnets market estimates & forecasts, by industrial applications, 2018 - 2030 (USD Million) (Kilotons)

Table 9 Permanent magnets market estimates & forecasts, by aerospace & defense, 2018 - 2030 (USD Million) (Kilotons)

Table 10 Permanent magnets market estimates & forecasts, by energy, 2018 - 2030 (USD Million) (Kilotons)

Table 11 Permanent magnets market estimates & forecasts, by medical, 2018 - 2030 (USD Million) (Kilotons)

Table 12 Permanent magnets market estimates & forecasts, by others, 2018 - 2030 (USD Million) (Kilotons)

Table 13 North America permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 14 North America permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 15 North America permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 16 North America permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 17 North America permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 18 U.S. permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 19 U.S. permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 20 U.S. permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 21 U.S. permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 22 U.S. permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 23 Canada permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 24 Canada permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 25 Canada permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 26 Canada permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 27 Canada permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 28 Mexico permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 29 Mexico permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 30 Mexico permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 31 Mexico permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 32 Mexico permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 33 Europe permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 34 Europe permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 35 Europe permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 36 Europe permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 37 Europe permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 38 Germany permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 39 Germany permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 40 Germany permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 41 Germany permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 42 Germany permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 43 Russia permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 44 Russia permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 45 Russia permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 46 Russia permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 47 Russia permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 48 UK permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 49 UK permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 50 UK permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 51 UK permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 52 UK permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 53 France permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 54 France permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 55 France permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 56 France permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 57 France permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 58 Italy permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 59 Italy permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 60 Italy permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 61 Italy permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 62 Italy permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 63 Asia Pacific permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 64 Asia Pacific permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 65 Asia Pacific permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 66 Asia Pacific permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 67 Asia Pacific permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 68 China permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 69 China permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 70 China permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 71 China permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 72 China permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 73 India permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 74 India permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 75 India permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 76 India permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 77 India permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 78 Japan permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 79 Japan permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 80 Japan permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 81 Japan permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 82 Japan permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 83 South Korea permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 84 South Korea permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 85 South Korea permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 86 South Korea permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 87 South Korea permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 88 Indonesia permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 89 Indonesia permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 90 Indonesia permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 91 Indonesia permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 92 Indonesia permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 93 Central & South America permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 94 Central & South America permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 95 Central & South America permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 96 Central & South America permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 97 Central & South America permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 98 Brazil permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 99 Brazil permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 100 Brazil permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 101 Brazil permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 102 Brazil permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 103 Argentina permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 104 Argentina permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 105 Argentina permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 106 Argentina permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 107 Argentina permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 108 Middle East & Africa permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 109 Middle East & Africa permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 110 Middle East & Africa permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 111 Middle East & Africa permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 112 Middle East & Africa permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 113 KSA permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 114 KSA permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 115 KSA permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 116 KSA permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 117 KSA permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 118 UAE permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 119 UAE permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 120 UAE permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 121 UAE permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 122 UAE permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

Table 123 South Africa permanent magnets market estimates & forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 124 South Africa permanent magnets market estimates & forecasts, by material, 2018 - 2030 (USD Million)

Table 125 South Africa permanent magnets market estimates & forecasts, by material, 2018 - 2030 (Kilotons)

Table 126 South Africa permanent magnets market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 127 South Africa permanent magnets market estimates & forecasts, by application, 2018 - 2030 (Kilotons)

List of Fig.ures

Fig 1. Market segmentation

Fig 2. Information procurement

Fig 3. Data analysis models

Fig 4. Market formulation and validation

Fig 5. Market snapshot

Fig 6. Segmental outlook - Material & Application

Fig 7. Competitive outlook

Fig 8. Permanent magnets market outlook, 2018-2030 (USD Million) (Kilotons)

Fig 9. Value chain analysis

Fig 10. Market dynamics

Fig 11. Porter’s Analysis

Fig 12. PESTEL Analysis

Fig 13. Permanent magnets market, by material: Key takeaways

Fig 14. Permanent magnets market, by material: Market share, 2023 & 2030

Fig 15. Permanent magnets market, by application: Key takeaways

Fig 16. Permanent magnets market, by application: Market share, 2023 & 2030

Fig 17. Permanent magnets market: Regional analysis, 2023

Fig 18. Permanent magnets market, by region: Key takeaways

Market Segmentation

- Permanent Magnets Material Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Permanent Magnets Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Permanent Magnets Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- North America

- North America Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- North America Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- U.S.

- U.S. Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- U.S. Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- U.S. Permanent Magnets Market, By Material

- Canada

- Canada Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Canada Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Canada Permanent Magnets Market, By Material

- Mexico

- Mexico Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Mexico Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Mexico Permanent Magnets Market, By Material

- North America Permanent Magnets Market, By Material

- Europe

- Europe Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Europe Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Germany

- Germany Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Germany Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Germany Permanent Magnets Market, By Material

- Russia

- Russia Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Russia Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Russia Permanent Magnets Market, By Material

- UK

- UK Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- UK Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- UK Permanent Magnets Market, By Material

- France

- France Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- France Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- France Permanent Magnets Market, By Material

- Italy

- Italy Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Italy Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Italy Permanent Magnets Market, By Material

- Europe Permanent Magnets Market, By Material

- Asia Pacific

- Asia Pacific Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Asia Pacific Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- China

- China Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- China Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- China Permanent Magnets Market, By Material

- India

- India Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- India Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- India Permanent Magnets Market, By Material

- Japan

- Japan Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Japan Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Japan Permanent Magnets Market, By Material

- Indonesia

- Indonesia Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Indonesia Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Indonesia Permanent Magnets Market, By Material

- South Korea

- South Korea Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- South Korea Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- South Korea Permanent Magnets Market, By Material

- Asia Pacific Permanent Magnets Market, By Material

- Central & South America

- Central & South America Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Central & South America Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Brazil

- Brazil Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Brazil Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Brazil Permanent Magnets Market, By Material

- Argentina

- Argentina Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Argentina Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Argentina Permanent Magnets Market, By Material

- Central & South America Permanent Magnets Market, By Material

- Middle East & Africa

- Middle East & Africa Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Middle East Africa Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Saudi Arabia

- Saudi Arabia Permanent Magnets Market, By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

- Saudi Arabia Permanent Magnets Market, By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

- Saudi Arabia Permanent Magnets Market, By Material

- Middle East & Africa Permanent Magnets Market, By Material

- North America

Permanent Magnets Market Dynamics

Driver: Growing wind energy sector

Permanent magnets are used in wind turbine generators to improve their efficiency. Over the past few years, direct drive Permanent Magnet Generator (PMG) systems, which are directly connected to the generator have been increasingly used. PMG systems drastically reduce the downtime required for the maintenance of wind-generating units. This lowers the duration for which the system remains non-operational, thereby increasing the output. Moreover, mechanical losses associated with gearboxes are eliminated, which results in an improvement in the overall efficiency of the system. Furthermore, generators present with PMG systems increase the reliability of wind-generating units as a whole. NdFeB magnets are being widely employed in the wind generation industry owing to their superior performance over a wide range of temperatures. They are used in wind turbines on account of benefits such as increased reliability and low maintenance cost.

Regions other than Asia Pacific are also expected to witness an increase in the installed capacity of wind generators over the next few years on account of the increasing use of renewable energy sources for electricity generation. Technological developments within the wind generation sector, coupled with rising awareness regarding the long-term benefits of expensive Neo magnets, are expected to drive the demand for permanent magnets over the forecast period.

Driver: Growth in the electric vehicles market

A significant rise in the production of EVs is expected to propel the demand for permanent magnets over the forecast period. Despite the COVID-19 pandemic, the sales of plug-in vehicles increased by 43% from 2019 to 2020. With an increase of 137% in EV sales from 2019 to 2020, Europe surpassed China and became the largest EV market in 2020. With 1.4 million EVs sold, the region held a 45% share of global EV sales in 2020. As of September 2021, for the first time, plug-ins have held a 10% share of the global passenger car market.

On a year-over-year basis, the global passenger plug-in EV sales doubled in September 2021 to more than 685,000, which is higher by 98%. From January to September 2021, the global passenger plug-in EV sales were 4.3 million and total sales are expected to cross the 6 million mark by the end of 2021. Rising EV production is expected to contribute to the consumption of permanent magnets over the forecast period. The growing EV market in Europe has attracted foreign companies to invest in the region. For instance, in November 2020, Nidec announced plans to build an EV factory in Serbia at an investment worth USD 1.9 billion (JPY 200 billion) to strengthen its foothold in Europe and compete against Chinese players. The facility is expected to possess an annual production capacity of 300,000 EV motors by 2023.

Restraint: SSD as a substitute for HDD

Hard Disk Drives (HDD) is one of the largest markets for rare earth permanent magnets. Rare earth permanent magnets are used for driving the spindle motor. Even though the quantity of rare earth magnets used in HDD is small, the large-scale production of HDD requires large amounts of rare earth magnets. Although, SSD (Solid State Drives), which is a viable alternative to HDD, does not rely on permanent magnets. Instead, it relies on interconnected flash memory chips or an embedded processor. SSD has considerably improved in performance in the last five years. As per the figure given above, the operating cost (Packaging, power, cooling, maintenance, space, etc.) of SSD declined since 2015 due to rapid technological advancements in SSD technology.

Therefore, there is a growing demand for SSDs. The SSD’s lower operating cost and enhanced performance delivered by SSD have encouraged the manufacturers to stimulate the production of SSDs. As a result, SSD is expected to gradually snatch the market share of HDD over the coming years. As a result, the market growth for permanent magnets in HDD is expected to be restrained by the increasing demand for SSDs.

What Does This Report Include?

This section will provide insights into the contents included in this permanent magnets market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Permanent magnets market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Permanent magnets market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the permanent magnets market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for permanent magnets market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of permanent magnets market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Permanent Magnets Market Categorization:

The permanent magnets market was categorized into three segments, namely material (Ferrite, Neodymium Iron Boron, Aluminum Nickel Cobalt, Samarium Cobalt), application (Automotive, Consumer goods & electronics, Industrial, Aerospace & Defense, Energy, Medical), and region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa)

Segment Market Methodology:

The permanent magnets market was segmented into material, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The permanent magnets market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into sixteen countries, namely, the U.S.; Canada; Mexico; Germany; Russia; the UK; France; Italy; China; India; South Korea; Indonesia; Japan; Brazil; Argentina; KSA.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Permanent magnets market companies & financials:

The permanent magnets market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Adams Magnetic Products Co.: The company was founded in 1950 and is headquartered in Illinois, U.S. The company is a fabricator, custom manufacturer, and distributor of various permanent magnets and magnetic assemblies. It offers permanent magnets in ceramic, alnico, flexible, neodymium, and samarium cobalt materials. The company manufactures and provides a wide range of products including soft magnetic, industrial magnets, ferrite cores, neodymium magnets, magnetic assemblies, flexible magnets, and nanocrystalline cores & components. It has manufacturing facilities in Kentucky, California, Illinois, the U.S., and China.

-

Earth-Panda Advance Magnetic Material Co., Ltd.: The company was established in 2003 and is headquartered in Hefei Anhui, China. The company manufactures permanent and flexible magnets including ceramic and ferrite. Its product portfolio includes extruded magnet strips, rubber magnet sheets/rolls, magnetic products, electric motor seals, magnetic tapes, refrigerator seals, magnetic gifts, magnetic darts, bathroom seals, magnetic toys, magnetic belts, and office automation & stationary magnets. It supplies magnets to various companies including Thomson, GE, Samsung, Itochu, and Sanyo. The company exports around 70% of its products to the U.S., Japan, Korea, and European countries. Products offered by the company find applications in diverse fields including automobile, information technology, wind power, national defense, electric motors, medical, instrument, and magnetic machinery. It had 1,232 employees as of December 2020.

-

Arnold Magnetic Technologies: The company is a subsidiary of Compass Diversified Holdings, was founded in 1898, and is headquartered in New York, U.S. It is a global manufacturer of precision magnetic assemblies, high-performance magnets, and thin metals. The company caters to various sectors including industrial, consumer, medical, aerospace, military, and telecommunications. Magnets, metals, and systems manufactured by the company find application in motors, batteries, solar panels, and commercial aircraft. The company manufactures and distributes products, such as Flexmag flexible magnet materials, Wraptite carbon fiber sleeving, injection molded magnets, RECOMA samarium cobalt, electrical steel, ferrite, alnico, neodymium-iron-boron, and compression bonded magnets, which cater to clients from the U.S., Switzerland, Europe, and Asia. The company is downstream integrated and also produces electric motors. Its revenue was approximately USD 140 million and it had 720 employees as of 2020.

-

Daido Steel Co., Ltd.: Daido Steel was founded in 1916 and is headquartered in Nagoya, Japan. The company offers numerous products including tool steel, stainless steel, die forgings, welding wire, rare earth magnets, titanium products, titanium alloys, stainless steel, superalloy, alloyed powder, magnetic sensors, construction steel, advanced super tube, and LED. < Back to Table of Contents Permanent Magnet Market Analysis and Segment Forecasts to 2028 V1.1 ©Grand View Research, Inc., USA. All Rights Reserved 102 The company operates through numerous business segments, namely specialty steel, high-performance materials and magnetic materials, parts for automobile and industrial equipment, engineering, and trading & services. It caters its products to automotive, construction, aerospace, energy, chemical, and electronics sectors. It supplies steel parts to Honda Motor, Nissan Motor, and Mitsubishi Heavy Industries. It has production facilities located across Europe, Asia, and North America.

-

Eclipse Magnetics: The company was founded in 1889 and is headquartered in Atlas Way Sheffield, UK. The company has a presence across China, France, the UK, and the U.S. Its diversified product portfolio includes magnetic assemblies, magnetic filtration systems, magnetic separation systems, magnetic industrial equipment, and plumbing products. The company caters to various application segments including food processing, chemical processing, automotive, precision engineering, aerospace, robotics, and plumbing. It provides magnetic technology to numerous companies including Honda, Nestle, Ford, JCB, BMW, BAE Systems, and Bosch. The company’s revenue was approximately USD 11.1 million and it had 64 employees as of 2020.

-

Electron Energy Corporation: The company was founded in 1970 and is headquartered in Landisville, U.S. It is a vertically integrated supplier of rare earth magnets, magnet assemblies, neodymium-iron-boron (NdFeB) sintered permanent magnets, samarium cobalt (SmCo), and magnet systems for medical, military, aerospace, motion controls, and electronic sectors. Magnets and assemblies offered by the company are used in sophisticated and performance-critical components of advanced technology systems including magnetrons, traveling wave tubes (TWTs), and klystrons. It had approximately 130 employees as of 2020.

-

Goudsmit Magnetics Group: The company was founded in 1959 and is headquartered in Northern Ireland, UK. The company designs and manufactures magnetic systems for metal handling, metal separation, and recycling. It provides magnetic systems for industrial applications such as the de-ironing of mechanical conveying systems, the food industry, and recycling facilities. The company operates across numerous countries including China, the Netherlands, France, Germany, and the Czech Republic. Its revenue was approximately USD 32 million and had about 165 employees as of 2020.

-

Hangzhou Permanent Magnet Group., Ltd: The company was established in 1980 and is headquartered in Zhejiang, China. It is involved in the research & development, production, and sales of magnetic devices and materials. The company provides various permanent magnets, including SmCo, NdFeB, and AlNiCo, to electronics, medical, automotive, and engineering sectors. It produces a wide range of complex magnetic assemblies that find application in motors, sensors, and instruments. The company’s revenue was approximately USD 822 million and had approximately 4,130 employees as of 2020.

-

Hitachi Metals Ltd.: The company is a subsidiary of Hitachi Ltd. It was established in 1956 and is headquartered in Tokyo, Japan. The company operates through three business segments, namely automotive-related products, electronics-related products, and infrastructure-related products. It offers a wide range of products including cutting tools, molding materials, chassis, exhaust components, magnets & motor-related products, LCDs & semiconductors, medical equipment, aircraft components, piping equipment, industrial equipment, and rubber.

-

Magnequench International LLC: The company is a subsidiary of Molycorp was founded in 1986 and is headquartered in Greenwood Village, Colorado, U.S. The company offers a wide range of products including rare earth materials, rare metals, high-purity materials, and zirconium. It serves various applications including automotive and home appliances. The company has a presence in 25 locations across 10 countries including Japan, China, Singapore, Korea, the U.S., and some European countries. It had approximately 2,400 employees in 2020.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Permanent Magnets Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Permanent Magnets Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."