- Home

- »

- Pharmaceuticals

- »

-

Periodontal Therapeutics Market Size & Share Report, 2030GVR Report cover

![Periodontal Therapeutics Market Size, Share & Trends Report]()

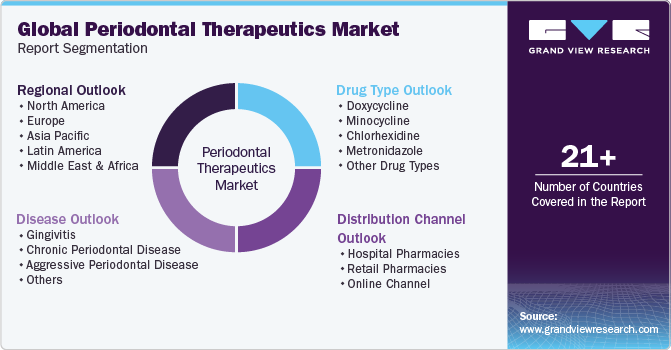

Periodontal Therapeutics Market Size, Share & Trends Analysis Report By Disease (Chronic Periodontal Disease, Aggressive Periodontal Disease), By Drug Type (Doxycycline, Minocycline), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-295-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Periodontal Therapeutics Market Trends

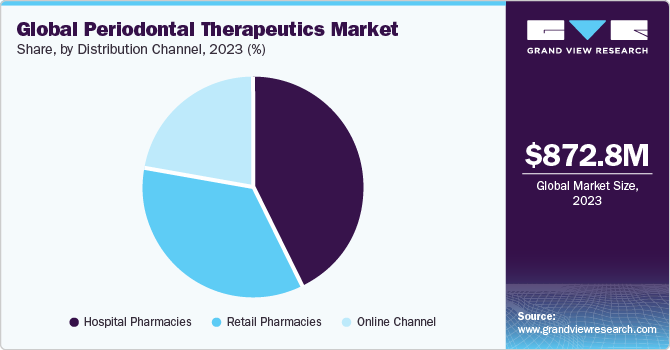

The global periodontal therapeutics market size was estimated at USD 872.8 million in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The growth of the market is attributed to the growing prevalence of periodontal diseases. According to the WHO article published in March 2023, severe periodontal diseases have been estimated to impact approximately 19% of the adult population worldwide, which accounts for over 1 billion cases. These conditions encompass ailments like gingivitis and periodontitis, which pose significant challenges to oral health globally.Increasing awareness about oral health, rising geriatric population, and technological advancements in dentistry are further propelling the growth of the market.

Increasing awareness about oral health fuels the growth of the periodontal therapeutics market. The WHO has been actively promoting awareness about oral health globally. In 2021, they passed a resolution focusing on preventive measures rather than just treatment, encouraging oral health promotion in families, schools, and workplaces. They stressed the importance of integrating oral health into broader healthcare agendas. In 2022, WHO adopted a global strategy to ensure everyone gets proper oral healthcare by 2030. This strategy involves detailed plans and monitoring to track progress towards the goal. Their Global Oral Health Status Report for 2022 highlighted the need for a public health approach to tackle common risk factors like sugary diets, tobacco use, and excessive alcohol consumption. It also emphasized integrating oral health services into primary healthcare systems and improving access to essential products like fluoride toothpaste.

Strengthening data collection and analysis systems was also recommended to understand oral health needs better worldwide. Despite challenges like the COVID-19 pandemic impacting dental care, WHO's efforts underscore the importance of prioritizing oral health globally and ensuring everyone can access quality oral healthcare services. According to the American Dental Association article published in November 2022, the report highlights the serious state of global oral health and the requirement for immediate action. It offers a comprehensive overview of oral diseases in 194 countries, including the U.S. This data serves as a crucial reference for policymakers and stakeholders to advocate for better prioritization of oral health on a global, regional, and national scale. It emphasizes the significant impact of oral diseases on vulnerable populations and the need for a global action plan to address these inequalities and ensure necessary care reaches those in need.

Rising geriatric population is boosting the growth of the market. For instance in November 2023, the global population aged 65 and above is projected to undergo a significant increase, doubling from approximately 800 million in 2022 to an estimated 1.6 billion by the year 2050. Moreover, according to the NCBI article published in August 2022, an examination of periodontal health and the detection rate of periodontitis in middle-aged and elderly populations revealed a notably high prevalence within these demographics. Specifically, among individuals aged 65 to 74, the periodontitis detection rate was 47.06%. This finding underlines the considerable proportion of individuals within this age group afflicted by severe periodontal disease, highlighting the importance of targeted interventions and comprehensive oral health strategies for middle-aged and elderly populations.

Technological advancements in dentistry, specifically for periodontal disease, have significantly improved this condition's diagnosis, treatment, and management. For instance, in July 2023,digital dentistry, including advanced imaging techniques, has transformed treatment by allowing periodontists to generate precise 3D models of patients' mouths. These models facilitate the planning of procedures such as dental implants, enhancing treatment accuracy and communication among dental professionals. As a result, patient outcomes improve and dental care becomes more streamlined and effective.

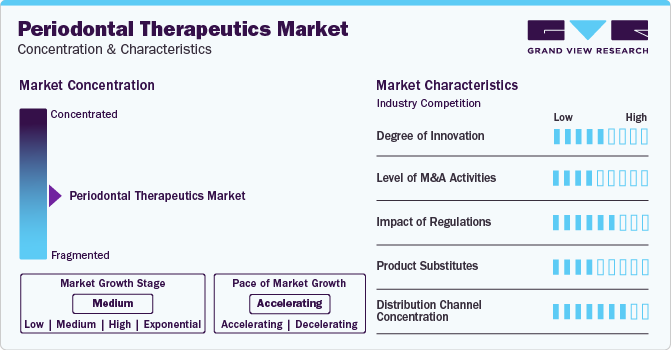

Market Characteristics & Concentration

The degree of innovation is significant in the market. For instance, an alternative therapeutic approach involves modulating the body's immune response to reduce undesired reactions. This can be achieved through systemic or local administration of pharmacological drugs. Commonly used drugs include non-antimicrobial doses of antibiotics, like tetracyclines, which inhibit collagenolytic activities and the function of immune cells. Additionally, anti-inflammatory drugs such as NSAIDs are utilized to block pathways involved in inflammation. These approaches aim to slow down disease progression and improve periodontal health by targeting specific aspects of the immune response and inflammatory processes.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their portfolios, and improve competency. For instance, in May 2023, OraPharma entered in a strategic partnership with Alex Rodriguez, a well-known figure in sports and health advocacy, to promote awareness about the importance of managing gum diseases.

Regulations in periodontal therapeutics, particularly concerning pharmaceuticals, ensures the safety, efficacy, and quality of drugs. For instance, stringent regulatory oversight by agencies like the FDA (Food and Drug Administration) mandates rigorous testing before a periodontal drug can be approved for market release. This ensures that patients receive effective treatments while minimizing potential risks and adverse effects. However, navigating these regulations can lead to prolonged drug development timelines and increased costs for manufacturers.

The level of substitution is generally high. Substitutes can include alternative treatments such as non-pharmacological interventions like improved oral hygiene practices, lifestyle modifications, and surgical procedures like scaling and root planning. Additionally, patients may opt for over-the-counter oral care products such as mouthwashes and toothpaste formulated for gum health.

The distribution channel concentration refers to the level of focus among channels through which drugs reach consumers. Typically, this industry sees a concentration in channels such as pharmacies, dental clinics, and online platforms. For instance, pharmaceutical companies often prioritize partnerships with pharmacies and dental clinics for direct distribution to healthcare professionals while also utilizing online platforms for direct-to-consumer sales. This concentration ensures efficient access to drugs for healthcare providers and patients, optimizing market reach and convenience.

Disease Insights

The chronic periodontal disease segment dominated the market and accounted for a share of 34.7% in 2023. Chronic periodontitis (CP) is a serious gum disease characterized by inflammation, tissue damage, and bone loss around teeth. It typically starts as gingivitis and can progress to severe periodontitis. According to the article published in March 2023, research suggests that CP is linked to various systemic diseases like diabetes, cardiovascular issues, respiratory infections, and chronic kidney disease (CKD). Interestingly, there's a bidirectional relationship between CKD and CP: as CKD worsens, patients become more susceptible to CP, and those with poor kidney function often exhibit poorer oral hygiene and a higher prevalence of moderate to severe CP. From a business perspective, this underscores the importance of holistic oral health care and the potential for dental businesses to develop comprehensive solutions addressing both the disease and its systemic impacts, potentially expanding their market reach and improving patient outcomes.

The gingivitis segment is expected to grow at a fast pace during the forecast period. Gingivitis is a common gum disease caused by bacteria in the mouth infecting the gums near a tooth, resulting in inflammation. This happens when plaque, a film of bacteria, builds up on teeth. While regular brushing and flossing help reduce plaque, gingivitis can still occur if an infection develops. Despite available dental treatments, many people don't seek care, allowing the condition to worsen. This presents an opportunity for businesses in the dental industry to educate people about prevention and treatment options for gingivitis, potentially leading to increased demand for dental products and services. For instance, gingivitis, the initial stage of gum disease, impacts over 90% of the global population to varying extents, regardless of age. This widespread prevalence indicates a significant market potential for businesses in the dental industry.

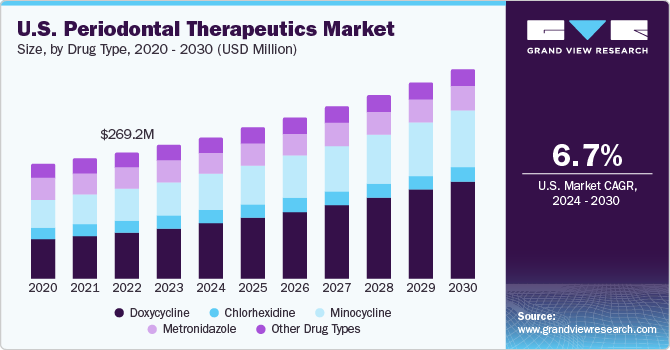

Drug Type Insights

Doxycycline dominated the market with a share of 37.7% in 2023. Doxycycline, even at lower concentrations, has been found to inhibit matrix metalloproteinase-8 (MMP-8), an enzyme abundant in periodontitis. According to the BioMed Central Ltd article published in November 2022, a preliminary study investigated a modified form of tetracycline-3 in periodontal patients undergoing scaling and root planning. Administering this antimicrobial at a low dose (10 mg/day) showed moderate reductions in interleukin-1-beta and MMP-8 levels in gingival crevicular fluid. Other research studies have indicated that sub-antimicrobial doses of doxycycline can lead to reduced pocket depth (PD) and improvements in clinical attachment level (CAL) in patients with periodontal disease. Additionally, these studies have reported better clinical parameters and reduced gingival inflammation in patients. Moreover, these findings suggest the potential for developing innovative therapies using sub-antimicrobial doses of doxycycline, which could address unmet needs in the market and improve patient outcomes.

Minocycline segment is anticipated to grow rapidly over the forecast period. Minocycline is a type of antibiotic that belongs to the tetracycline class. It is commonly used in the treatment of various bacterial infections, including acne, and periodontal diseases. According to the MDPI article published in April 2022 , the study revealed that delivering minocycline directly to the periodontal site caused notable alterations in the types of bacteria present below the gumline. This indicates that administering minocycline directly to the affected area can impact the bacterial composition, which might play a role in the positive therapeutic outcomes seen in patients with periodontitis.

Distribution Channel Insights

The hospital pharmacies segment held the largest share of 42.6% in 2023. Hospital pharmacies play a crucial role in patient care, providing medications and treatments directly to patients within the hospital setting. As the diseases are increasingly recognized for their systemic implications, hospitals are integrating comprehensive oral care into their treatment protocols, including the use of periodontal therapeutics. Many hospitals are expanding their dental departments or establishing specialized oral health clinics to address the growing prevalence of the diseases. This trend drives the demand for periodontal therapeutics within hospital pharmacies, as they become key providers of these medications for inpatient and outpatient dental procedures. Hospital pharmacies often collaborate closely with dental professionals, including periodontists and oral surgeons, to ensure optimal medication management for patients undergoing periodontal treatments.

Retail pharmacies held the second largest share of the market in 2023. Retail pharmacies play a significant role in the market by providing access to a wide range of oral care products, including medications used to treat periodontal diseases. These pharmacies offer convenience and accessibility to patients seeking over-the-counter oral hygiene products and prescription medications prescribed by dentists or healthcare providers. Stocking a variety of periodontal therapeutics such as antimicrobial mouth rinses, toothpaste, and locally administered antibiotics, retail pharmacies offer to the needs of individuals seeking to maintain or improve their oral health. Moreover, retail pharmacies often serve as a point of education, where pharmacists can offer advice and recommendations on proper oral hygiene practices and using medications.

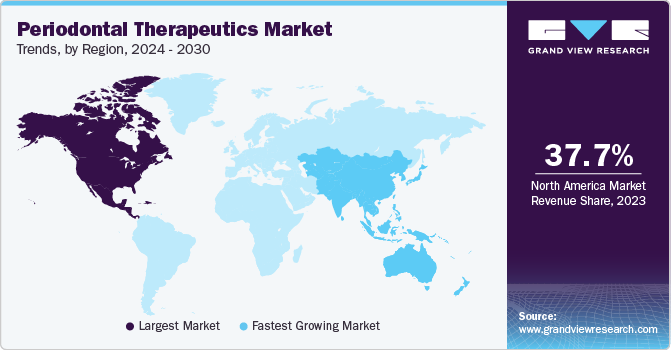

Regional Insights

North America market accounted for 37.7% share in 2023 owing to factors such as high prevalence of periodontal diseases and increasing number of favorable government initiatives. Periodontal disease (PD) is a widespread oral health issue affecting a significant portion of the population in the U.S. Research indicates that approximately 42% of adults in the U.S. are afflicted with this condition. Moreover, the market is experiencing growth due to the positive measures undertaken by market players to offer increasing demand for dental disease in the region. For instance, in August 2021, the University of Pennsylvania and the ADA Science & Research Institute received USD 2 million from the NIH to study oral mucosa. They're particularly interested in understanding how the mouth's protective barrier works when dealing with gum disease.

U.S. Periodontal Therapeutics Market Trends

The in the U.S. is expected to grow rapidly over the forecast period due to these include advancements in dental research and technology, leading to the development of more effective and innovative treatment options for periodontal diseases. Additionally, an increasing awareness of oral health and the importance of preventative dental care among the population is driving demand for periodontal therapeutics.

Europe Periodontal Therapeutics Market Trends

Europe is identified as a lucrative region in this industry. The region claims a significant population base, including an aging demographic, which is more prone to periodontal diseases. This demographic trend has increased the demand for therapeutics in Europe. Additionally, Europe has a strong healthcare infrastructure with well-established dental care facilities and professionals.

The UK periodontal therapeutics market is projected to expand in the future due to the growing awareness among the population regarding the importance of oral health and hygiene. This heightened awareness is often accompanied by a greater willingness to seek professional dental care, including treatment for periodontal diseases.

The periodontal therapeutics market in France is influenced by changes in lifestyle factors such as diet, smoking habits, and stress levels that can impact oral health and increase the risk of periodontal diseases. As awareness of these risk factors grows, individuals may seek out therapeutics to address and manage their oral health concerns.

The Germany periodontal therapeutics market is expected to grow over the forecast period due to a strong healthcare system with comprehensive coverage for dental care. Favorable healthcare policies and reimbursement schemes may incentivize individuals to seek treatment for periodontal diseases, driving demand for therapeutics.

Asia Pacific Periodontal Therapeutics Market Trends

Asia Pacific market is anticipated to witness the fastest growth over the forecast period. The presence of a large target population, high unmet clinical needs, and developing healthcare is anticipated to provide high growth potential for the region. Major players operating in the region are constantly focusing on the development of periodontal therapeutics solutions owing to the rising prevalence of the aging population and the increasing cases of chronic diseases.

The periodontal therapeutics market in China is driven by a large population with a rising prevalence of periodontal diseases, attributed to factors such as changing dietary habits, lifestyle factors, and an aging population.

The Japan periodontal therapeutics market is expected to grow over the forecast period due to the presence of the world's most rapidly aging population, with a significant proportion of elderly individuals. Aging is associated with an increased risk of the diseases, as well as other oral health issues.

Latin America Periodontal Therapeutics Market Trends

Latin America market is expected to grow at a rapid rate. The region has a rapidly growing population, along with increasing urbanization rates. Urbanization often leads to lifestyle changes such as dietary habits, tobacco use, and stress, which contribute to the prevalence of periodontal diseases.

The Brazil periodontal therapeutics market is expected to grow over the forecast period due to the growing awareness of the importance of oral health and hygiene among the population in Brazil. As a result, individuals are becoming more proactive in seeking preventive dental care and treatment for periodontal diseases, thereby driving the demand for periodontal therapeutics.

MEA Periodontal Therapeutics Market Trends

The MEA market is identified as a lucrative region in this industry. The market in this region is driven by the high prevalence of periodontal diseases due to various factors such as poor oral hygiene practices, tobacco use, and inadequate access to dental care.

The periodontal therapeutics market in Saudi Arabia is growing owing to rising awareness of the importance of oral health and hygiene in Saudi Arabia, driven by educational initiatives and public health campaigns. As a result, individuals are becoming more proactive in seeking preventive dental care and treatment, leading to an increased demand for therapeutics.

Key Periodontal Therapeutics Company Insights

Some of the leading players operating in the market include Pfizer Inc., Teva Pharmaceuticals USA, Inc., and Bausch Health Companies Inc. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their presence.

Melinta Therapeutics LLC, Cipla, Inc., and Chartwell Pharmaceuticals LLC are some of the emerging participants in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel launches to capitalize on untapped avenues.

Key Periodontal Therapeutics Companies:

The following are the leading companies in the periodontal therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Lupin Ltd

- Teva Pharmaceuticals USA, Inc.

- Sun Pharmaceutical Industries Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Bausch Health Companies Inc.

- USAntibiotics

- Melinta Therapeutics LLC

- Cipla, Inc.

- Chartwell Pharmaceuticals LLC.

Recent Developments

-

In September 2023, Bausch Health Companies Inc. and its oral health care division, OraPharma announced plans to team up with the League of United Latin American Citizens (LULAC), the biggest Hispanic group in the U.S. Their goal is to spread awareness about gum disease among Hispanic communities. This collaboration aims to help Hispanics better understand how to detect and treat gum disease.

-

In June 2023, Eli Lilly and Company finalized an agreement to acquire DICE Therapeutics, Inc., a renowned biopharmaceutical firm recognized for its groundbreaking DELSCAPE technology platform. This platform is instrumental in creating novel oral therapeutic candidates, such as oral IL-17 inhibitors, which are presently in clinical development. These treatments are designed to target chronic immune-related diseases.

-

In March 2023, Haleon initiated the #BetterOralCareNation campaign in Malaysia to enhance oral health practices across the country. The campaign seeks to raise awareness about the importance of oral hygiene and promote better oral care habits among Malaysians.

Periodontal Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 932.07 million

Revenue forecast in 2030

USD 1.41 billion

Growth Rate

CAGR of 7.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, drug type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil Mexico; Argentina; South Africa; UAE; Kuwait; and Saudi Arabia

Key companies profiled

Pfizer Inc.; Lupin Ltd; Teva Pharmaceuticals USA; Inc.; Sun Pharmaceutical Industries Ltd.; Tokyo Chemical Industry Co.; Ltd.; Bausch Health Companies Inc.; USAntibiotics; Melinta Therapeutics LLC; Cipla, Inc.; Chartwell Pharmaceuticals LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Periodontal Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global periodontal therapeutics market report based on disease, drug type, distribution channel, and region.

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Gingivitis

-

Chronic Periodontal Disease

-

Aggressive Periodontal Disease

-

Others

-

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Doxycycline

-

Minocycline

-

Chlorhexidine

-

Metronidazole

-

Other drug types

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Channel

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global periodontal therapeutics market size was estimated at USD 872.80 million in 2023 and is expected to reach USD 932.07 million in 2024.

b. The global periodontal therapeutics market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 1.41 billion by 2030.

b. North America dominated the periodontal therapeutics market with a share of 37.65% in 2023. Factors such as high prevalence of periodontal diseases and increasing number of favorable government initiatives are responsible for market growth.

b. Key factors that are driving the periodontal therapeutics market growth include a growing prevalence of periodontal diseases, increasing awareness about oral health, rising geriatric population, and technological advancements in dentistry.

b. Some key players operating in the periodontal therapeutics market include Pfizer Inc., Lupin Ltd, Teva Pharmaceuticals USA, Inc., Sun Pharmaceutical Industries Ltd., Tokyo Chemical Industry Co., Ltd., Bausch Health Companies Inc., USAntibiotics, Melinta Therapeutics LLC, Cipla, Inc. and Chartwell Pharmaceuticals LLC.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."