- Home

- »

- Clothing, Footwear & Accessories

- »

-

Period Panties Market Size, Share & Trends Report, 2030GVR Report cover

![Period Panties Market Size, Share & Trends Report]()

Period Panties Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Brief, Bikini, Boyshort, Hi-waist), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-027-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Period Panties Market Summary

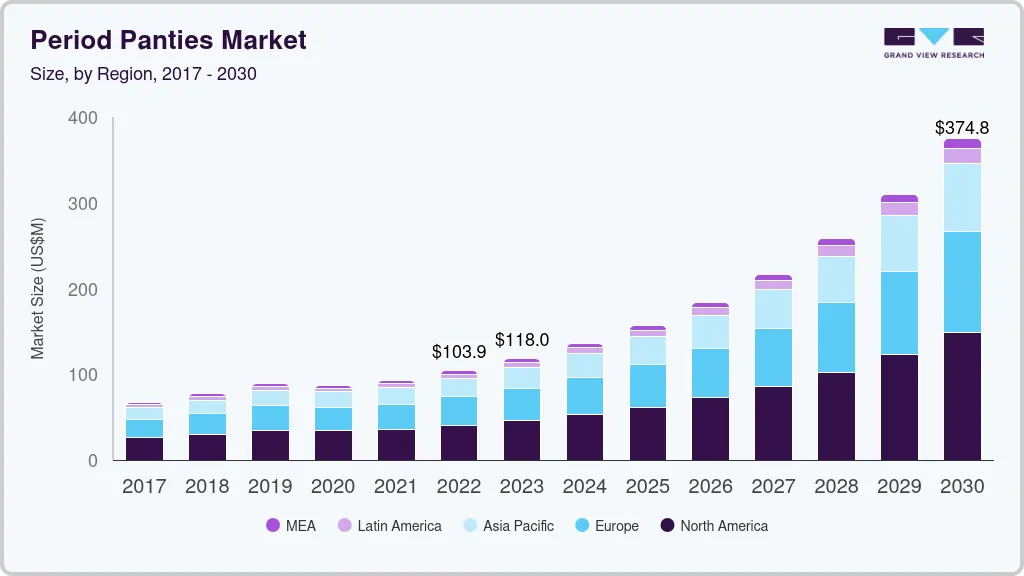

The global period panties market size was estimated at USD 103.9 million in 2022 and is projected to reach USD 374.8 million by 2030, growing at a CAGR of 17.4% from 2023 to 2030. The market is mainly driven by the growing awareness regarding menstruation hygiene, coupled with various initiatives and programs by organizations.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, South Africa is expected to register the highest CAGR from 2023 to 2030.

- In terms of product, brief accounted for a revenue share of 29% in 2022.

- Bikini is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 103.9 Million

- 2030 Projected Market Size: USD 374.8 Million

- CAGR (2023-2030): 17.4%

- North America: Largest market in 2022

For instance, the collaboration between UNICEF and local governments, communities, and schools for researching and delivering information related to menstruation has encouraged positive hygiene habits to break down social taboos. Moreover, the significant innovations and advanced products launched by manufacturers are further projected to provide ample opportunities for market growth over the coming years. COVID-19 has had a negative impact on the menstrual underwear industry. Store closures due to quarantine and lockdown measures have resulted in grim consequences, with sales decreasing considerably during the COVID-19 pandemic. Additionally, the pandemic disrupted manufacturing as well as sales of period panties across many countries through offline channels owing to social distancing and stay-at-home policies. In addition, the pandemic situation has forced people to spend more judiciously and avoid frivolous purchasing.

The increase in the demand for comfort and convenience, and the growing inclination towards eco-friendly hygiene products across the globe are the other major factors influencing the growth of the market in the forecast period. Moreover, menstrual underwear is a relatively newer period hygiene product that serves to be an alternative to more traditional products such as pads and tampons. The technology used varies among brands, however generally involves several layers of materials such as polyester, nylon, merino wool, and cotton, geared toward absorbency of blood and wicking moisture from the vulva so the wearer feels dry and comfortable.

Moreover, the significant working women population across the globe is further projected to provide ample opportunities for market growth. As per the World Bank Data in 2021, females hold a 39.3% share of the labor force across the globe. Period underwear is suitable for working women as it provides comfort and convenience during their work.

Moreover, various manufacturers are launching campaigns and expanding their period knickers' reach to consumers and further contributing to the market growth. For instance, in May 2022, one of the leading period underwear brands Thinx announced the launch of the Moist Panties" campaign aimed at ridding the world of 'moist panties' figuratively and literally, once and for all. Through this campaign, the brand expanded its air collection, offering sweat-wicking, breathable, ultra-thin, micromesh underwear designed for drier, moisture-free days during on and off menstruation.

Product Insights

Among products, the brief segment led the market and accounted for a 29.3% share of the global revenue in 2022. The market is mainly driven due to the availability of various products made of comfortable fabrics such as cotton and nylon, designed with various styles. In order to provide comfort and other benefits, the producers are developing specific sorts of briefs with jacquard and lace designs, no VPL lace trim, and high waist control, which is further boosting the growth.

The bikini segment is anticipated to be the fastest-growing segment with a CAGR of 17.8% from 2023 to 2030. The growing demand for bikini period underwear in developed countries, coupled with rising popularity within the target demographic and advancements in fabric technology and garment design, are both credited with the segment's growth. The market is expanding rapidly as a result of the influence that the body-positive movement has on consumers' purchasing decisions. Additionally, the need for intimates that can be adjusted to be more attractive while maintaining comfort is promoting the segment's expansion.

Distribution Channel Insights

Offline distribution channels dominated the market and accounted for a 65.6% share of the global revenue in 2022. Stores with multiple brands and styles of period underwear are among the most well-liked distribution methods. Before making a purchase, consumers at these establishments can select from a wide range of brands. Supermarkets usually offer discounts and other such benefits to attract consumers and increase product sales. They act as distribution centers for parent companies and offer a large number of brands in one place. Thus, with the presence of a diverse product range and ease of convenience, offline distribution held the largest market share.

The online distribution channel is expected to witness the fastest growth in the forecast period. The rising popularity of e-commerce channels is likely to lead to considerable growth prospects for the market owing to a wider distribution network and greater product availability. Moreover, manufacturers of period panties are collaborating with e-commerce companies to sell their products on online channels. For instance, in March 2022, Thinx Inc. announced its partnership with Walmart to make Thinx’s reusable period underwear more accessible to shoppers nationwide.

Regional Insights

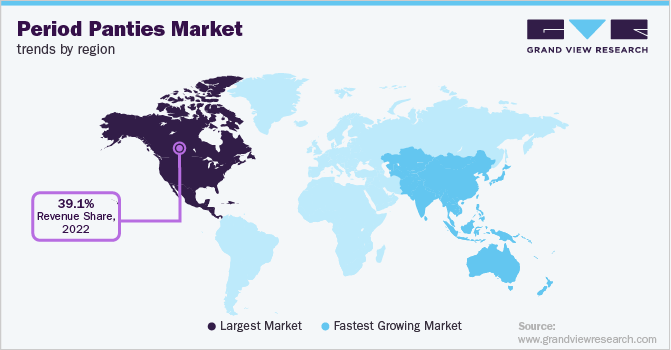

North America dominated the market for period panties and accounted for a 39.12% share of the global revenue in 2022. The presence of a large number of major players such as Knix Wear, Inc., Thinx, Inc., and Saalt, LLC, among others in the U.S. and Canada, further support the market growth in the region. Moreover, the high awareness regarding menstrual hygiene products further contributes to the significant demand for menstrual underwear in the region. Moreover, the various initiatives and campaigns by the companies and manufacturers related to menstrual hygiene awareness are further projected to create significant demand for period underwear in the upcoming years.

Asia Pacific is projected to be the fastest-growing market at a CAGR of 18.0% over the forecast period. Growth in awareness regarding menstrual hygiene products, changes in lifestyles of working millennials, and increasing income to invest in the best available products are the key factors driving product demand. Moreover, the large population in countries like India and China, with a high number of women in their reproductive years, is one of the prime reasons driving the regional expansion. Additionally, the rising per capita income enables women to choose from a wide range of hygiene and eco-friendly sanitary solutions such as reusable period panties. Aggressive marketing strategies to raise awareness and drive sales by manufacturers have augmented regional growth.

Key Companies & Market Share Insights

Prominent market players are likely to focus on establishing their businesses across the globe owing to the rapidly expanding customer base. In this respect, key market participants are expected to invest in research & development activities to remain competitive over the forecast period. Some of the key developments and strategic initiatives carried out by leading manufacturers are listed below:

-

In March 2022, Modibodi and PUMA partnered to launch a range of leak-free period underwear and activewear, created to support women in staying comfortable and active during their periods, whilst making a positive environmental impact.

-

In February 2022, Kimberly-Clark Corporation, one of the leading companies of menstrual hygiene products, announced that it has completed its acquisition of a majority stake in Thinx, Inc., one of the leading companies offering reusable period and incontinence underwear. The company made an initial minority investment in Thinx in 2019.

-

In January 2021, Essity announced the launch of TENA Silhouette, an absorbent underwear for menstruation and incontinence. The launch of the product was initiated in Latin America and continued in other markets in select stores and online channels during the first quarter of 2021.

Some of the prominent players in the global period panties market include:

-

Neione

-

Ruby Love (PANTYPROP INC)

-

Proof

-

Knix Wear, Inc.

-

Rael

-

Saalt, LLC

-

Victoria's Secret

-

FANNYPANTS

-

The Period Company

-

Thinx, Inc. (Kimberly-Clark)

Period Panties Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 117.98 million

Revenue forecast in 2030

USD 374.74 million

Growth rate

CAGR of 17.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; France; China; Japan; India; Brazil; South Africa

Key companies profiled

Neione; Ruby Love (PANTYPROP INC); Proof; Knix Wear, Inc.; Rael; Saalt, LLC; Victoria's Secret; FANNYPANTS; The Period Company; Thinx, Inc. (Kimberly-Clark)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Period Panties Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global period panties market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Brief

-

Bikini

-

Boyshort

-

Hi-waist

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global period panties market size was estimated at USD 103.87 million in 2022 and is expected to reach USD 117.98 million in 2023.

b. The global period panties market is expected to grow at a compound annual growth rate of 17.4 from 2023 to 2030 to reach USD 374.74 million by 2030.

b. North America dominated the period panties market with a share of 39.12% in 2022. High awareness regarding menstrual hygiene products in the region further contributed to the significant demand for menstrual underwear in the region. Moreover, the various initiatives and campaigns by the companies and manufacturers related to menstrual hygiene awareness are further projected to create significant demand for period underwear in the upcoming years.

b. Some key players operating in the period panties market include Neione, Ruby Love (PANTYPROP INC), Proof, Knix Wear, Inc., Rael, Saalt, LLC, Victoria's Secret, FANNYPANTS, The Period Company, Thinx, Inc. (Kimberly-Clark)

b. Key factors that are driving the period panties market growth include growing awareness regarding menstruation hygiene coupled with various initiatives and programs by the organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.