- Home

- »

- Advanced Interior Materials

- »

-

Perforating Gun Market Size, Share & Growth Report, 2030GVR Report cover

![Perforating Gun Market Size, Share & Trends Report]()

Perforating Gun Market Size, Share & Trends Analysis Report By Gun Type, By Application (Onshore, Offshore), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-364-1

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Perforating Gun Market Size & Trends

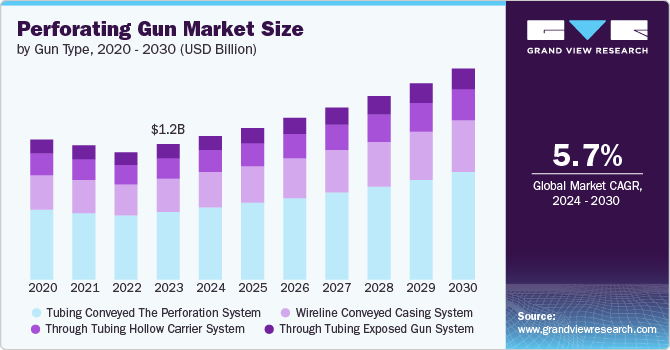

The global perforating gun market size was estimated at USD 1.17 billion in 2023 and is forecasted to grow at a CAGR of 5.7% from 2024 to 2030. This growth is attributed to the rising global energy demand which continues to drive exploration activities, directly boosting the demand for perforating guns used in well completion operations. Furthermore, flourishing shale gas production, particularly in regions like North America, is a significant driver for market growth as shale formations require specialized completion techniques.

Additionally, innovations in product design and materials are enhancing their efficiency, reliability, and safety. This is expected to attract adoption of product in both conventional and unconventional reservoirs. Moreover, operators are increasingly investing in well intervention activities to enhance production from existing wells, which in turn, is further expected to fuel demand for perforating guns over the years.

Presence of regulatory pressures and environmental considerations from government of various countries regarding the negative impact of oil and gas extraction operations may act as a challenge for market growth. Furthermore, fluctuations in crude oil prices can impact capital expenditures by oil and gas companies, affecting their investment in new drilling and completion activities. Thereby, negatively impacting product growth.

Increasing exploration and production activities in offshore fields present lucrative opportunities for perforating gun manufacturers due to higher technical demands and deeper reservoirs. Integration of digital technologies such as real-time monitoring and data analytics is opening new avenues for optimizing perforating operations and reducing costs. Furthermore, growing energy demand in emerging economies presents untapped opportunities for market expansion in regions like Asia-Pacific, Central & South America, and Middle East & Africa.

Gun Type Insights

Based on gun type, the market is segmented into through tubing hollow carrier system, wireline conveyed casing system, through tubing exposed gun system, and tubing conveyed the perforation system. Among these, tubing conveyed the perforation system accounted for the largest revenue share of 50.3% in 2023. This segment is further expected to grow at fastest rate over the forecast period as it provides flexibility in deployment and allows for perforation in multiple zones without the need for additional conveyance equipment. This system uses the production tubing itself to transfer the perforating gun to the desired depth in the well.

Through tubing hollow carrier system involves using a hollow carrier, often coiled tubing, through which the perforating gun can be deployed downhole. It allows for perforation operations to be conducted without pulling out the completion tubing, reducing operational downtime and cost. It is suitable for intervention operations in existing wells. Furthermore, through tubing exposed gun system allows for efficient cleanup operations after perforation. They are suitable for complex well geometries, including horizontal wells and wells with restrictions where conventional conveyance methods may not be feasible.

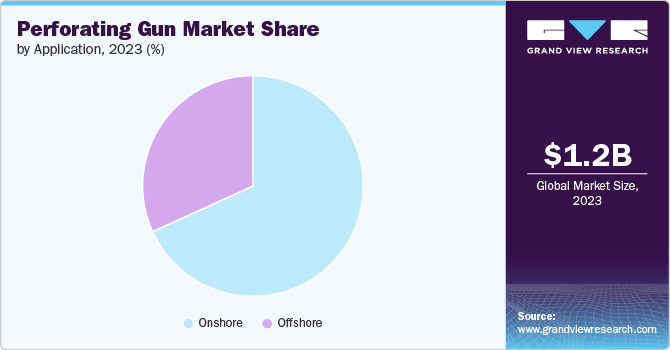

Application Insights

Based on application, the market is segmented into onshore and offshore. The onshore segment dominated the market with a revenue share of 68.1% in 2023. In onshore, this product is used in various applications such as conventional oil and gas fields, unconventional reservoirs, and enhanced oil recovery (EOR) projects. Onshore operations must adhere to local environmental regulations and community standards, influencing the choice of perforating technologies and practices.

Demand for perforating guns in offshore application is anticipated to grow at a fastest rate of 5.9% over forecast period. Offshore applications of this product include deepwater and ultra-deepwater wells, subsea well interventions, platform and rig-based operations, and complex reservoir conditions. This product is used in various offshore applications on account of its properties such as ability to withstand extreme depths, high pressure, enhance production, and offer well maintained operations.

Regional Insights

North America dominated the perforating gun market in 2023 with a revenue share of 35.3% and is expected to grow at a significant CAGR from 2024 to 2030. This is attributed to a significant increase in shale gas production in North American countries. Perforating guns are crucial for stimulating these unconventional reservoirs through hydraulic fracturing operations. Furthermore, with a presence of large number of existing wells requiring stimulation to maintain or increase production rates, there is a steady demand for this product across various shale plays and conventional fields in region.

U.S. Perforating Gun Market Trends

The perforating gun market in the U.S. is expected to grow at a CAGR of 5.8% over the forecast period. This country’s operators continually invest in advanced perforating technologies to improve well performance, reduce costs, and enhance environmental stewardship. This positively supports demand for product in country.

Europe Perforating Gun Market Trends

European countries are adopting advanced perforating technologies to improve operational efficiency and safety standards, supporting the demand for perforating guns in the region. Furthermore, regulatory frameworks promoting sustainable energy practices and safety standards further drive the adoption of advanced perforating technologies in European oil and gas operations.

Asia Pacific Perforating Gun Market Trends

Asia Pacific is expected to register the fastest CAGR over the forecast period. The region's growing energy demand is driving increased oil and gas exploration and production activities, leading to higher demand for perforating guns for well completion and intervention. Furthermore, countries such as China, Malaysia, and Australia are investing in offshore oil and gas projects, where this product is essential for completing and maintaining production from offshore wells. Thereby, fueling product adoption in region.

Key Perforating Gun Company Insights

Some of the key players operating in the market are Baker Hughes, Schlumberger Limited, and Weatherford International plc:

-

Baker Hughes was established in 1907 and is a U.S. based company involved in proving various products and services for oil & gas sector. Major operating segments of company includes oilfield services, oilfield equipment, and digital solutions. It operates in over 120 countries worldwide, with a significant presence in key oil and gas regions such as North America, Middle East, Europe, and Asia Pacific.

-

Schlumberger Limited is a U.S. based company established in 1926. It is an oilfield services company, providing a comprehensive range of services and technologies to the oil and gas exploration and production industry. Its products are categorized into following segments: reservoir characterization, drilling, production, and digital & integration.

China Shaanxi FYPE Rigid Machinery Co. Ltd and Core Laboratories NV are some of the emerging participants in the market.

-

China Shaanxi FYPE Rigid Machinery Co. Ltd is a manufacturer and supplier of oilfield services and equipment. The major products and services of company includes drilling tools, completion tools, well control equipment, and fishing tools and services.

-

Core Laboratories NV is a Netherland based company involved in providing reservoir description, production enhancement, and reservoir management services to the oil and gas industry.

Key Perforating Gun Companies:

The following are the leading companies in the perforating gun market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Hughes

- Schlumberger Limited

- Weatherford International plc

- NOV Inc.

- Halliburton Company

- Hunting PLC

- DMC Global Inc.

- China Shaanxi FYPE Rigid Machinery Co. Ltd

- Core Laboratories NV

- DynaEnergetics

Recent Developments

-

In June 2023, DynaEnergetics launched its new perforating gun product named DS GRAVITY 2.0. It is considered to me self-orienting and most compact product in oil & gas sector. It was designed to save time, cost, produce more profitable wells, and increase efficiency.

Perforating Gun Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.24 billion

Revenue forecast in 2030

USD 1.83 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Gun type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Baker Hughes; Schlumberger Limited; Weatherford International plc; NOV Inc.; Halliburton Company; Hunting PLC; DMC Global Inc.; China Shaanxi FYPE Rigid; Machinery Co. Ltd.; Core Laboratories NV; G&H Diversified Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Perforating Gun Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global perforating gun market report based on gun type, application, and region:

-

Gun Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Through Tubing Hollow Carrier System

-

Wireline Conveyed Casing System

-

Through Tubing Exposed Gun System

-

Tubing Conveyed The Perforation System

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global perforating gun market size was estimated at USD 1.17 billion in 2023 and is expected to reach USD 1.24 billion in 2024.

b. The global perforating gun market is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030 to reach USD 1.83 billion by 2030.

b. Tubing conveyed the perforation system accounted for the largest revenue share of 50.3% in 2023 as it provides flexibility in deployment and allows for perforation in multiple zones without the need for additional conveyance equipment.

b. Some key players operating in the perforating gun market include Baker Hughes, Schlumberger Limited, Weatherford International plc, NOV Inc., Halliburton Company, Hunting PLC, DMC Global Inc., China Shaanxi FYPE Rigid, Machinery Co. Ltd, Core Laboratories NV, and G&H Diversified Manufacturing.

b. The key factors that are driving the perforating gun market growth is the rising global energy demand which continues to drive exploration activities, directly boosting the demand for perforating guns used in well completion operations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."