- Home

- »

- Pharmaceuticals

- »

-

Peptide Drug Conjugates Market Size, Industry Report, 2030GVR Report cover

![Peptide Drug Conjugates Market Size, Share & Trends Report]()

Peptide Drug Conjugates Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Illuccix, Pluvicto, CBX-12, Pipeline Products), By Type (Diagnostic, Therapeutic), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-001-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Peptide Drug Conjugates Market Summary

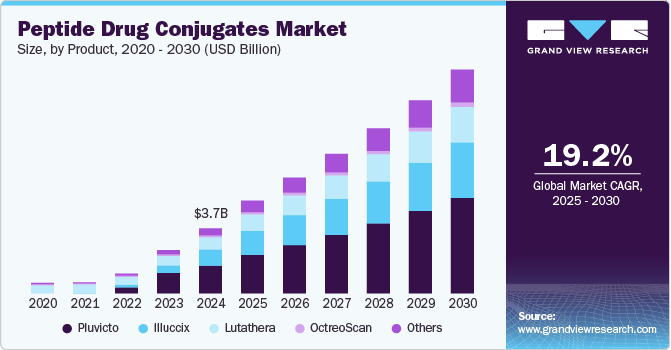

The global peptide drug conjugates market size was estimated at USD 3,731.3 million in 2024 and is projected to reach USD 12,842.9 million by 2030, growing at a CAGR of 19.2% from 2025 to 2030. The industry is driven by increasing cancer prevalence, growing demand for targeted therapies, and advancements in peptide synthesis technologies.

Key Market Trends & Insights

- North America peptide drug conjugates market held a leading position in 2024, accounting for 75.02% of the global share.

- Based on product, the pluvicto segment dominated the industry with a revenue share of 42.52% in 2024 and is expected to exhibit the fastest CAGR over the forecast period.

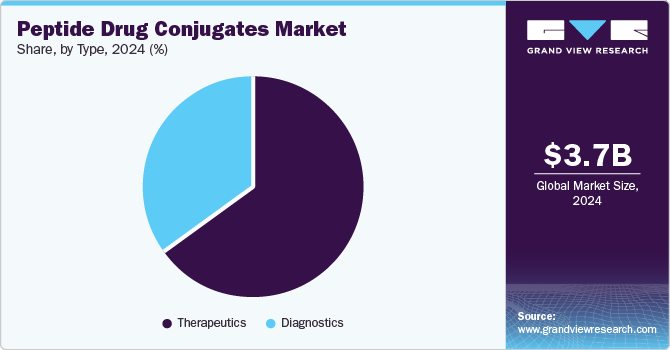

- Based on type, the therapeutic segment dominated the industry in 2024 and is anticipated to witness the fastest growth over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,731.3 Million

- 2030 Projected Market Size: USD 12,842.9 Million

- CAGR (2025-2030): 19.2%

- North America: Largest market in 2024

PDCs offer enhanced drug delivery, improved specificity, and reduced toxicity, making them attractive for oncology and chronic disease treatments. Rising investments in research and development, coupled with regulatory support and strategic collaborations, further propel industry growth. Additionally, expanding applications beyond oncology into infectious and metabolic diseases contributes to sustained demand.

Chronic diseases such as cancer, diabetes, and autoimmune disorders present significant treatment challenges due to their complex nature and difficulty in targeting specific cells or tissues. Peptide drug conjugates (PDCs) offer a more precise approach, enhancing drug delivery while minimizing side effects. The rising prevalence of chronic diseases is driving the demand for PDCs. According to the WHO, chronic diseases account for 71% of global deaths, with cardiovascular diseases alone causing 17.9 million deaths annually. Similarly, the American Hospital Association reports that nearly 133 million Americans-almost 50% of the population-have at least one chronic illness, a number expected to reach 170 million by 2030.

Table 1 U.S. estimated new cancer cases by cancer type in 2025

Cancer Type

Estimated New Cases (2025)

Breast

319,750

Prostate

313,780

Lung and Bronchus

226,650

Colorectal

154,270

Melanoma of the Skin

112,690

Colon

107,320

Lymphoma

89,070

Urinary Bladder

84,870

Kidney and Renal Pelvis

80,980

Uterine corpus

69,120

Pancrease

67,440

Leukemia

66,890

Oral Cavity & pharynx

59,660

Thyroid

44,020

Liver

42,240

Myeloma

36,110

Stomach

30,300

Pipeline Analysis

The industry is witnessing significant growth, driven by an expanding clinical trial pipeline focused on advancing targeted therapies for cancer, autoimmune disorders, and metabolic diseases. As pharmaceutical companies and biotech firms invest heavily in clinical research, the growing number of PDC candidates in various stages of clinical trials is accelerating innovation and commercialization. In April 2024, Novartis AG invested another USD 180 million into its radioligand therapy program, expanding its Peptide-Drug Conjugate (PDC) collaboration with PeptiDream. This investment highlights the increasing focus on targeted peptide-based therapies in oncology and beyond. Novartis' significant funding will fast-track ongoing Phase II and Phase III trials, particularly in oncology, where radioligand therapy and PDCs are proving to be highly effective for targeted tumor destruction. With increasing success in prostate cancer and neuroendocrine tumors, this investment will help expand clinical applications to other hard-to-treat malignancies, improving patient access to innovative treatments.

Table 2 Peptide Drug Conjugates Pipeline Overview

Candidate

Phases

Company

Illuccix

PHASE3

Angiochem Inc.

BT5528-100

PHASE2

Bicycle Therapeutics

Zelenectide pevedotin (Zele, formerly BT8009)

PHASE2/3

Others

PHASE2

OPD5

EARLY PHASE 1

Oncopeptides AB

OPDC3

EARLY PHASE 1

Gliopep

EARLY PHASE 1

CBX-12

PHASE2

Cybrexa

CBX-13

EARLY PHASE 1

CBX-15

EARLY PHASE 1

Sudocetaxel zendusortide (TH1902)

PHASE1

Theratechnologies Inc.

One of the primary drivers behind the robust PDC clinical pipeline is the rising demand for precision medicine in oncology. With cancer accounting for nearly 9.7 million deaths in 2022, according to WHO, pharmaceutical companies are increasingly focusing on peptide-based therapies that offer high specificity and reduced toxicity compared to traditional chemotherapy. Leading biotech firms are actively developing novel PDCs targeting hematologic malignancies, solid tumors, and hard-to-treat cancers, such as triple-negative breast cancer and glioblastoma.

In addition to oncology, clinical trials are expanding into autoimmune diseases and metabolic disorders, leveraging peptides' high target selectivity and biocompatibility. Several promising candidates are in Phase II and III trials, demonstrating strong efficacy and safety profiles. The increasing number of regulatory approvals for Investigational New Drug (IND) applications highlights growing confidence in PDCs as next-generation therapeutics.

Product Insights

The pluvicto segment dominated the industry with a revenue share of 42.52% in 2024 and is expected to exhibit the fastest CAGR over the forecast period. The success of Pluvicto (lutetium-177 vipivotide tetraxetan), a PSMA-targeted radioligand therapy developed by Novartis, is a significant driver influencing the peptide drug conjugates (PDC) market. While Pluvicto itself is not a PDC, its mechanism of selectively targeting PSMA-expressing prostate cancer cells aligns with the growing demand for precision oncology treatments, including peptide-based drug delivery systems. The increasing adoption of targeted therapies like Pluvicto underscores the demand for highly specific, biomarker-driven treatments, paving the way for PDCs that conjugate cytotoxic drugs to PSMA-targeting peptides.

Illuccix is projected to grow at a significant CAGR over the forecast period. Illuccix, a diagnostic radiopharmaceutical developed by Telix Pharmaceuticals, has significantly impacted the Peptide Drug Conjugates Market, particularly in prostate cancer imaging. As a ^68Ga-labeled PSMA-11 injection, Illuccix is used in positron emission tomography (PET) scans to detect prostate-specific membrane antigen (PSMA)-expressing prostate cancer lesions. Its introduction has been instrumental in advancing prostate cancer diagnostics, thereby influencing the PDCs market dynamics. In February 2025, Telix Pharmaceuticals Limited announced that the UK Medicines and Healthcare Products Regulatory Agency (MHRA) has approved the Marketing Authorization Application (MAA) for Illuccix (gallium-68 gozetotide injection). Illuccix is a PET imaging agent used for detecting and localizing PSMA-positive lesions in prostate cancer patients. This approval enables wider clinical adoption in the UK, improving prostate cancer diagnosis and treatment planning. This approval indirectly impacts the PDC market by strengthening PSMA-targeted diagnostics. As precision oncology advances, accurate biomarker-based imaging like Illuccix helps in selecting patients for PSMA-targeted therapies, including potential peptide-based drug conjugates. The expansion of PSMA-targeting strategies in oncology supports the broader adoption of peptide-based therapeutics, driving research and investment in the PDC market.

Type Insights

The therapeutic segment dominated the industry in 2024 and is anticipated to witness the fastest growth. The therapeutics segment is expected to experience significant growth due to the presence of approved PDCs, such as Lutathera and Pluvicto. Numerous clinical trials are evaluating PDCs like Illuccix, BT5528, and Others, which function as targeted therapies against tumor cells. Beyond oncology, pharmaceutical companies are developing PDCs for metabolic disorders and other conditions, further driving market expansion.

Diagnostics hold a significant share in the market, driven by their expanding role in cancer detection and monitoring. PDCs, particularly those conjugated with radionuclides, are increasingly utilized for precise tumor localization through imaging techniques like PET and SPECT. Radiolabeled PDCs, targeting tumor-specific receptors, enable early diagnosis, thereby improving treatment outcomes. FDA-approved diagnostic PDCs, such as Detectnet (64Cu oxodotreotide), Illuccix (68Ga PSMA-11), and Netspot (68Ga oxodotreotide), exemplify the growing adoption of these technologies. This trend, coupled with advancements in radioligand therapy, underscores the diagnostics segment’s contribution to market growth.

Regional Insights

North America peptide drug conjugates market held a leading position in 2024, accounting for 75.02% of the global share. The growth is driven by a high prevalence of cancer and chronic diseases, increased adoption of targeted therapies, and advancements in peptide synthesis technologies. The region benefits from significant biopharmaceutical investments, early regulatory approvals, and the growing use of RNAi-based therapeutics. Hospital pharmacies dominate distribution, while retail and online pharmacies are witnessing increasing demand for chronic disease treatments.

U.S. Peptide Drug Conjugates Market Trends

The peptide drug conjugates market in the U.S. is supported by substantial R&D expenditure, early adoption of novel therapeutics, and favorable regulatory pathways. The rising utilization of PDCs in oncology and metabolic disorders is accelerating market growth. Innovations in peptide-linker technologies and expanding clinical trials are enhancing drug efficacy and safety profiles. Hospital pharmacies remain the primary distribution channel, with retail pharmacies gaining traction.

Europe Peptide Drug Conjugates Market Trends

The peptide drug conjugates market in Europe is experiencing steady growth, with Germany, France, and the UK leading the region. Strong clinical research infrastructure and government support for biotechnology innovation are key growth drivers. Increased adoption of PDCs targeting cancer and autoimmune diseases is observed, along with rising applications in metabolic disorders. Hospital pharmacies hold the largest distribution share, with online pharmacy penetration improving patient access.

The UK peptide drug conjugates market is driven by increasing biopharmaceutical R&D funding and a focus on personalized medicine. Clinical trials targeting oncology and chronic diseases are expanding, with hospital pharmacies dominating distribution channels. Retail pharmacies are gradually strengthening their role in chronic disease management.

The peptide drug conjugates market in Germany is backed by advanced manufacturing capabilities and robust biotech investments. Demand for targeted therapies in oncology and metabolic disorders is increasing. Hospital pharmacies maintain a significant market share, with a growing online pharmacy presence enhancing treatment accessibility.

France peptide drug conjugates market is supported by the adoption of PDCs for autoimmune and inflammatory diseases. Regulatory advancements and public healthcare initiatives are driving market expansion, with hospital pharmacies leading the distribution segment.

Asia-Pacific Peptide Drug Conjugates Market Trends

The peptide drug conjugates market in Asia-Pacific is experiencing rapid growth due to the rising prevalence of cancer, expanding healthcare access, and increasing local manufacturing. China, Japan, and India are leading markets, supported by government initiatives and growing clinical trial activity. Innovations in peptide-linker technology are improving market penetration.

Japan peptide drug conjugates market is expanding through government-funded research in peptide-based therapies and a growing focus on age-related chronic diseases. Hospital pharmacies dominate distribution channels, with retail pharmacies enhancing access to targeted treatments.

The peptide drug conjugates market in China is growing rapidly, driven by significant R&D investments, biopharma manufacturing expansion, and healthcare reform initiatives. Demand for PDCs in oncology and metabolic disorder treatments is rising, with online pharmacies facilitating broader patient access.

Latin America Peptide Drug Conjugates Market Trends

The peptide drug conjugates market in Latin America is witnessing growth due to increasing healthcare expenditure and rising awareness of targeted therapies. Brazil leads the region with government healthcare initiatives and investments in local biopharmaceutical production.

Brazil peptide drug conjugates market is driven by high cancer prevalence and efforts to improve healthcare outcomes. Investments in biopharma manufacturing and collaborations with international companies are enhancing the availability of innovative PDCs.

Middle East & Africa Peptide Drug Conjugates Market Trends

The peptide drug conjugates market in the Middle East and Africa is expanding with improvements in healthcare infrastructure and the increasing prevalence of chronic diseases. Government-driven initiatives in countries like Saudi Arabia are boosting demand for targeted therapies.

Saudi Arabia peptide drug conjugates market is underpinned by healthcare modernization efforts and increased biotechnology research funding. Rising cancer incidence and government focus on advanced therapies are driving the adoption of PDCs.

Key Peptide Drug Conjugates Company Insights

Leading players in the peptide drug conjugates market include Bicycle Therapeutics plc, Oncopeptides AB, Theratechnologies Inc., Cybrexa Therapeutics, Angiochem Inc., Novartis AG, and Telix Pharmaceuticals Limited. Market growth is supported by increased demand for targeted therapies, advancements in peptide-linker technology, and growing adoption in oncology and metabolic disorder treatments.

Key Peptide Drug Conjugates Companies:

The following are the leading companies in the peptide drug conjugates market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- AstraZeneca

- Oncopeptides AB

- Bicycle Therapeutics

- Cybrexa

- Angiochem Inc.

- Soricimed Biopharma

- Theratechnologies Inc.

Recent Developments

-

In January 2025, Oncopeptides AB announced that the positive reimbursement decision for its drug Pepaxti (melflufen) had been officially published in the Italian Official Journal (Gazetta Ufficiale). This marks the final regulatory milestone for Pepaxti’s commercialization in Italy, paving the way for its first sales in H1 2025.

-

In May2024, Oncopeptides AB announced that the first hospital in Spain has begun treating patients with Pepaxti, marking a significant milestone in the drug’s commercial rollout in the country.

-

In April 2024, Novartis AG injected USD 180 million into its radioligand therapy program, expanding its Peptide-Drug Conjugate (PDC) collaboration with PeptiDream. This investment highlights the increasing focus on targeted peptide-based therapies in oncology and beyond.

Peptide Drug Conjugates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.33 billion

Revenue forecast in 2030

USD 12.84 billion

Growth rate

CAGR of 19.21% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novartis AG; AstraZeneca; Oncopeptides AB; Bicycle Therapeutics; Cybrexa; Angiochem Inc.; Soricimed Biopharma; Theratechnologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peptide Drug Conjugates Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global peptide drug conjugatesmarket report on the basis of product, type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

OctreoScan

-

Lutathera

-

Pluvicto

-

Illuccix

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic

-

Diagnostic

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peptide drug conjugates market size was estimated at USD 3.73 billion in 2024 and is expected to reach USD 5.33 billion in 2025.

b. The global peptide drug conjugates market is expected to grow at a compound annual growth rate of 19.21% from 2025 to 2030 to reach USD 12.84 billion by 2030.

b. Based on product, the pluvicto segment accounted for the largest revenue share of 45.52% in 2024, The success of Pluvicto (lutetium-177 vipivotide tetraxetan), a PSMA-targeted radioligand therapy developed by Novartis, is a significant driver influencing the peptide drug conjugates (PDC) market.

b. Key players operating in the market are Bicycle Therapeutics plc, Oncopeptides AB, Theratechnologies Inc., Cybrexa Therapeutics, Angiochem Inc., Novartis AG, and Telix Pharmaceuticals Limited.

b. The peptide drug conjugates market is driven by increasing cancer prevalence, growing demand for targeted therapies, and advancements in peptide synthesis technologies. PDCs offer enhanced drug delivery, improved specificity, and reduced toxicity, making them attractive for oncology and chronic disease treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.