Peptide Antibiotics Market Size, Share & Trends Analysis Report By Disease (Skin Infection, HABP/VABP), By Route of Administration (Injectable, Oral), By Product, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-958-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Peptide Antibiotics Market Size & Trends

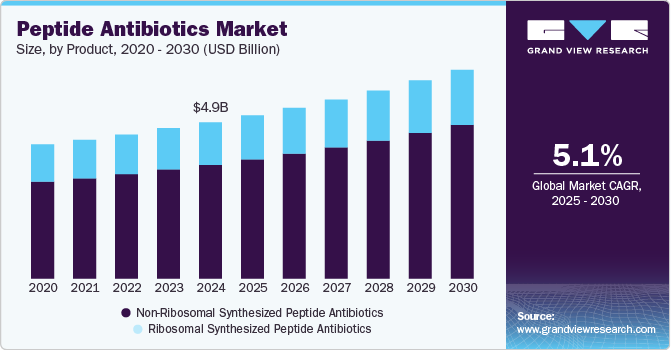

The global peptide antibiotics market size was estimated at USD 4.97 billion in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2030. The rising demand in hospitals and clinics primarily drives market growth. Key factors include the increasing prevalence of bacterial skin infections, bloodstream infections, and hospital-acquired infections. In addition, the market is bolstered by a surge in product approvals and new product launches, which are expected to further accelerate growth during the forecast period.

The significant prevalence of MRSA underscores the growing challenge of antibiotic resistance globally. A 2023 study published in the Journal of Antimicrobial Resistance & Infection Control reported a global prevalence of MRSA (Methicillin-resistant Staphylococcus aureus) at approximately 14.69%. The growing burden of MRSA infections is expected to drive demand for drugs, which offer targeted mechanisms of action and reduced likelihood of resistance compared to traditional antibiotics. As a result, the market will likely witness robust growth over the forecast period, propelled by their potential to effectively address resistant bacterial strains.

Technological advancements in drug development are significantly transforming the landscape of antimicrobial therapies. Innovations in bioengineering and synthetic biology have enabled the design of highly targeted peptide-based drugs with enhanced stability, potency, and reduced toxicity. Techniques such as peptide modification, conjugation with nanoparticles, and computational modeling are optimizing their pharmacokinetics and effectiveness against resistant pathogens like MRSA.

Moreover, advances in large-scale manufacturing processes, including recombinant DNA technology and solid-phase peptide synthesis (SPPS), reduce production costs and improve scalability. For instance, in July 2024 , Vapourtec introduced the Peptide-ExplorerLT, a new system designed to support chemists in optimizing and exploring linear peptide synthesis. Building on the success of the original Peptide-Explorer launched in 2020, the Peptide-ExplorerLT delivers the same high-quality peptide production capabilities while offering a more compact design and a more affordable price point, making it accessible to a broader range of users. These breakthroughs are paving the way for next-generation peptide antibiotics that address the limitations of conventional treatments and align with the growing demand for innovative solutions in combating antibiotic resistance.

Product Insights

The non-ribosomal synthesized peptide antibiotics segment dominated the market and accounted for 72.79% of the global revenue in 2024. The segment is experiencing significant growth, driven by its unique potential to combat multidrug-resistant pathogens. Unlike ribosomal peptides, these antibiotics are synthesized enzymatically by non-ribosomal peptide synthetases (NRPS), allowing for a broader range of chemical diversity and the inclusion of non-standard amino acids. This structural versatility enhances their antimicrobial potency and stability, making them effective against resistant bacterial strains. Furthermore, the increasing prevalence of antibiotic resistance and a rising demand for novel therapeutic options are propelling research and development in this segment.

The ribosomal synthesized peptide antibiotics segment is expected to witness lucrative market growth during the forecast period. The market is experiencing significant growth driven by increasing demand for novel therapeutic approaches to combat antimicrobial infections. These drugs, characterized by their precision in targeting specific pathogens and reduced off-target effects, have gained attention as a sustainable alternative to traditional small-molecule antibiotics. Advances in synthetic biology and genetic engineering have enabled the efficient production and optimization of ribosomally synthesized peptides, enhancing their therapeutic potential and scalability.

Disease Insights

Skin infection dominated the market with a market share of 34.08% in 2024. This dominance is attributed to the rising incidence and prevalence of skin infections worldwide. Common skin infections include cellulitis, erysipelas, impetigo, folliculitis, furuncles, and carbuncles. Cellulitis is particularly common among middle-aged and older Skin Infections, while erysipelas tend to affect young HABP/VABP and elderly individuals. The incidence rate of cellulitis is estimated to be approximately 200 cases per 100,000 patient years. In regions outside the tropics, cellulitis is observed more frequently during the warmer months, indicating a seasonal pattern.

The bloodstream infections segment is expected to grow at the fastest CAGR over the forecast period. Bloodstream infections (BSIs) represent an escalating public health challenge globally. In 2022, it was reported that North America and Europe alone saw approximately 2 million cases of BSIs each year, leading to around 250,000 deaths. As the leading cause of infection-related mortality, BSIs highlight the urgent need for effective treatment options. This growing burden has spurred increased demand for novel antimicrobial solutions, particularly peptide antibiotics. Given their potential to target multidrug-resistant pathogens that often cause BSIs, peptide antibiotics are becoming an essential component of the therapeutic arsenal. Their ability to combat infections that are difficult to treat with conventional medicines further fuels the demand for their development and use in critical care settings.

Route of Administration Insights

Injectable dominated the market with a market share of 43.50% in 2024. The injectable peptide antibiotics segment is gaining significant traction in the pharmaceutical market, driven by rising incidences of multidrug-resistant infections and the urgent need for innovative antimicrobial therapies. In September 2023, researchers at the Indian Institute of Technology Jodhpur developed and synthesized an antimicrobial peptide named SP1V3_1, designed to combat both gram-positive and gram-negative bacteria, including pathogens such as P. aeruginosa, E. coli, K. pneumoniae, and MRSA. This peptide adopts a helical structure when interacting with bacterial membranes, effectively neutralizing these microorganisms. Extensive studies have confirmed its non-toxic nature. Moreover, SP1V3_1 demonstrated the ability to accelerate wound healing in murine models and prevent MRSA-induced post-surgical infections at the application site. Thus, growing research in the field of peptides is expected to drive market growth.

The oral segment is expected to witness lucrative growth over the forecast period. The segment is witnessing growing momentum, fueled by the rising demand for convenient and patient-friendly treatment options for bacterial infections. Peptide antibiotics, recognized for their efficacy against resistant pathogens, are being developed in oral formulations to overcome challenges associated with injectable therapies, such as patient compliance and administration costs. Advances in peptide engineering and drug delivery technologies have significantly improved the stability and bioavailability of oral peptide antibiotics, making them viable alternatives to traditional oral antibiotics.

Distribution Channel Insights

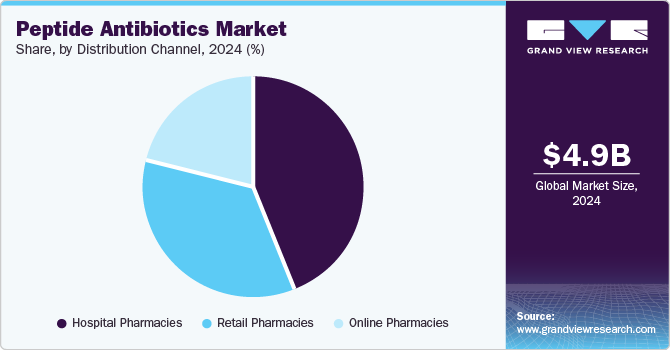

The hospital pharmacies segment dominated the market with a market share of 43.96% in 2024. The hospital pharmacies segment plays a pivotal role in the market, driven by the growing prevalence of multidrug-resistant bacterial infections and the critical need for effective antimicrobial therapies in inpatient care settings. Hospitals often manage severe and complex infections that require advanced treatments, fostering a robust demand for peptide antibiotics known for their efficacy and safety profile. According to World Health Organization (WHO) data in 2023, healthcare-associated infections (HAIs) affected approximately 25% of patients in developing countries and ranged between 5% and 15% in developed nations. Hospital pharmacies, as primary distributors of such medications, play a crucial role in addressing these infections. In regions with higher HAI rates, such as developing countries, the need for potent antibiotics like peptides may lead to increased procurement by hospital pharmacies. Thus, rising HAIs across the globe is anticipated to drive market growth.

The online pharmacies segment is expected to grow at the fastest CAGR over the forecast period.Regulatory support for e-pharmacy operations in many regions and increasing awareness of the benefits of peptide antibiotics are also contributing to this segment's robust growth. As a result, online pharmacies are emerging as a critical distribution channel in the market, offering accessibility and efficiency for both patients and healthcare providers.

Regional Insights

North America peptide antibiotics market is growing steadily, driven by increasing demand for effective solutions to combat complex infections such as hospital-acquired bacterial pneumonia (HABP) and ventilator-associated bacterial pneumonia (VABP). This medicine is gaining an edge over other drugs due to its efficacy in treating skin infections and bloodstream infections. Injectable formulations are preferred for severe cases, while oral and topical options are gaining popularity for outpatient care. The market faces barriers such as high healthcare costs and inconsistent insurance coverage, impacting accessibility for underserved populations. Key players such as Pfizer Inc. and Merck & Co., Inc. have a strong presence, focusing on innovative products for hospitals and retail pharmacies.

U.S. Peptide Antibiotics Market Trends

The peptide antibiotics market in the U.S. is advancing, with notable shifts toward personalized and advanced therapies for HABP/VABP and resistant skin infections. Ribosomal-synthesized antibiotics are widely utilized in hospitals, while non-ribosomal alternatives are gaining traction for their role in tackling antibiotic resistance. Injectable formulations dominate hospital pharmacies, whereas oral products are seeing growth in retail and online pharmacies. Companies like AbbVie Inc. and Teva Pharmaceutical Industries Limited are investing heavily in research to address unmet clinical needs. However, accessibility challenges persist for underinsured populations, limiting broader market adoption.

Europe Peptide Antibiotics Market Trends

The peptide antibiotics market in Europe is expanding, emphasizing early intervention for critical infections. In countries like Germany, injectable formulations are the standard in treating bloodstream infections, while topical options for skin infections are becoming increasingly common in outpatient care. France sees significant adoption of ribosomal-synthesized products in retail pharmacies, supported by a robust healthcare infrastructure. Companies such as Sanofi and The Menarini Group are leading the charge, focusing on novel products for hospital and retail pharmacies. Cost and insurance coverage, however, remain key challenges in driving market penetration.

The UK peptide antibiotics market is experiencing growth, driven by a preference for new drugs to address multi-drug-resistant infections. Hospital pharmacies are primary distributors of injectable treatments for severe infections like HABP/VABP, while oral formulations are increasingly used for outpatient care. The integration of digital health tools has improved patient access to peptide antibiotics through online pharmacy platforms. GSK Plc. is a major player in the UK, focusing on tailored solutions for complex infections. Government initiatives to support innovation in pharmaceuticals are further fueling market growth.

The peptide antibiotics market in Germany is on the rise. Demand for ribosomal-synthesized peptide antibiotics is on the rise, especially for bloodstream infections in critical care settings. Injectable formulations are the preferred mode of administration in hospitals, while topical treatments are gaining attention for addressing localized skin infections. NPS Pharmaceuticals is actively contributing to product innovation, targeting hospital and retail pharmacy channels. Patient education initiatives to improve adherence and timely access are essential for overcoming barriers related to insurance coverage and treatment affordability.

France peptide antibiotics market is witnessing growth with an increasing reliance on injectable formulations for severe infections like HABP/VABP. Oral and topical products are popular in managing skin infections and outpatient treatments. Hospital pharmacies dominate the distribution of these products, with support from government efforts to streamline healthcare access. Sanofi plays a pivotal role in the market, focusing on affordable and effective treatments to reduce reliance on broad-spectrum antibiotics. Despite these advancements, treatment costs remain a key concern.

Asia Pacific Peptide Antibiotics Market Trends

The peptide antibiotics market in Asia Pacific is experiencing rapid growth, driven by increased healthcare investment and a rising burden of multi-drug-resistant infections. In China and Japan, non-ribosomal drug options are gaining traction for treating resistant pathogens. Topical formulations are widely used for skin infections in outpatient care, while injectables dominate in hospitals. Companies like Xellia Pharmaceuticals and Eli Lilly and Company are expanding their presence, targeting both hospital and retail pharmacy channels. Limited rural access and high treatment costs remain barriers to widespread adoption.

China peptide antibiotics market is expanding, with significant demand for injectable antibiotics in treating bloodstream infections. Oral formulations are growing in popularity due to their convenience in managing milder cases. Pfizer Inc. and Merck & Co., Inc. are actively expanding their portfolios to meet the rising healthcare demands. The government is investing in expanding healthcare coverage to rural areas, which is expected to support long-term market growth.

The peptide antibiotics market in Japan is growing due to increasing recognition of their role in managing resistant infections. Ribosomal-synthesized products dominate in hospitals, while oral antibiotics see rising adoption for less severe cases. Injectable formulations are critical for elderly patients, given their efficacy in treating bloodstream infections. Companies like Teva Pharmaceutical Industries Limited are leveraging digital healthcare solutions to enhance patient access through online pharmacy platforms.

Latin America Peptide Antibiotics Market Trends

The peptide antibiotics market in Latin America is growing, driven by increasing healthcare investments and awareness of antibiotic-resistant infections. In Brazil, o and topical formulations are seeing greater adoption in retail pharmacies for managing HABP/VABP. Companies like Eli Lilly and Company focus on affordable solutions to improve access in urban and rural areas.

Brazil peptide antibiotics market is witnessing significant growth, with an increasing focus on treating complex infections such as hospital-acquired bacterial pneumonia (HABP) and ventilator-associated bacterial pneumonia (VABP). Ribosomal-synthesized peptide antibiotics are widely used in hospitals, particularly for severe infections requiring injectable formulations. Oral and topical antibiotics are also on the rise in retail pharmacies, catering to outpatient needs and skin infections. Leading pharmaceutical companies like Teva Pharmaceuticals Industries Limited and GSK Plc. are actively enhancing their presence in Brazil through affordable, effective solutions to address the growing demand for antibiotics. Despite efforts to improve healthcare access, challenges remain due to disparities in healthcare coverage, especially in rural regions.

MEA Peptide Antibiotics Market Trends

The peptide antibiotics market in MEA is seeing gradual growth, with a focus on managing infections like HABP/VABP and skin infections. Injectable antibiotics dominate hospital pharmacies, while oral formulations are gaining popularity in retail settings. Countries like the UAE are investing in healthcare infrastructure to enhance access to innovative antibiotics. Pharmaceutical companies are expanding their footprint in the region, focusing on non-ribosomal synthesized options to address resistance issues.

Saudi Arabia peptide antibiotics market is expanding as the country addresses the rising incidence of multi-drug-resistant infections, including bloodstream infections and HABP/VABP. Oral and topical formulations are also seeing increased demand for less critical conditions, available through retail and online pharmacies. Companies such as AbbVie Inc. and Xellia Pharmaceuticals are focusing on strengthening their portfolios to meet the country’s growing healthcare needs. Efforts by the Saudi government to improve healthcare infrastructure and expand access to mental health and infection treatments are expected to drive further growth in the market, though affordability remains a key challenge for broader adoption in underserved areas.

Key Peptide Antibiotics Company Insights

Key players in the market include Teva Pharmaceuticals Industries Limited, Pfizer Inc., and Merck & Co., Inc. These leading pharmaceutical companies are at the forefront of developing and manufacturing innovative peptide-based antibiotics to combat complex infections such as hospital-acquired bacterial pneumonia (HABP), ventilator-associated bacterial pneumonia (VABP), and bloodstream infections. With their broad product portfolios, which include both ribosomal and non-ribosomal synthesized peptides, these companies are well-positioned to meet the growing global demand for more effective and safer antibiotic treatments. By expanding access to affordable drugs and continuing to innovate in drug development, they are playing a critical role in addressing the challenges of antibiotic resistance and improving patient outcomes in the fight against severe infections.

Key Peptide Antibiotics Companies:

The following are the leading companies in the peptide antibiotics market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Teva Pharmaceuticals Industries Limited

- AbbVie Inc.

- Merck & Co., Inc.

- The Menarini Group

- Sanofi

- Eli Lilly and Company

- GSK Plc.

- NPS Pharmaceuticals

- Xellia Pharmaceuticals

Recent Developments

-

In September 2024, Beiersdorf and Macro Biologics formed a multi-year partnership aimed at developing antimicrobial peptides with a wide range of potential applications in both skincare and healthcare.

-

In April 2023, Peptilogics, a clinical-stage biotechnology company, announced the completion of patient enrollment for a Phase 1b clinical trial of PLG0206, an engineered peptide designed to treat Periprosthetic Joint Infection (PJI) following Total Knee Arthroplasty (TKA). The trial is an open-label, dose-escalating study, with two cohorts of seven patients each, comparing the outcomes to historical controls. The study aims to assess the safety, tolerability, and antimicrobial efficacy of PLG0206 in the treatment of PJI, a serious complication that can occur after joint replacement surgery.

-

In September 2022, Revance received FDA approval for its peptide-formulated product, DAXXIFY (DaxibotulinumtoxinA-lanm) injection. This approval is anticipated to drive market growth.

Peptide Antibiotics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.19 billion |

|

Revenue forecast in 2030 |

USD 6.64 billion |

|

Growth rate |

CAGR of 5.1% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, disease, route of administration, distribution channels, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait |

|

Key companies profiled |

Pfizer Inc.; Teva Pharmaceuticals Industries Limited; AbbVie Inc.; Merck & Co., Inc.; The Menarini Group; Sanofi; Eli Lilly and Company; GSK plc.; NPS Pharmaceuticals; Xellia Pharmaceuticals. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Peptide Antibiotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global peptide antibiotics market report based on product, disease, route of administration, distribution channels, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ribosomal Synthesized Peptide Antibiotics

-

Non-ribosomal Synthesized Peptide Antibiotics

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Infection

-

HABP/VABP

-

Blood Stream Infections

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global peptide antibiotics market size was estimated at USD 4.97 billion in 2024 and is expected to reach USD 5.19 billion in 2025.

b. The global peptide antibiotics market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 6.64 billion by 2030.

b. North America dominated the peptide antibiotics market with a share of 39.84%% in 2024. This is attributable to the presence of various key market players, rising demand for antibiotics, and strategic initiatives undertaken by market players in the region.

b. Some key players operating in the peptide antibiotics market include Pfizer Inc., Merck & Co., Inc., AbbVie Inc, GSK Group of Companies, Sandoz International GmbH, Xellia Pharmaceuticals, AuroMedics Pharma LLC, Theravance Biopharma

b. Key factors that are driving the peptide antibiotics market growth include increasing demand for peptide antibiotics in hospitals & clinics, rising prevalence of diseases such as bacterial skin infections, bloodstream infections, and hospital-acquired infections

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."