- Home

- »

- Organic Chemicals

- »

-

Pentaerythritol Market Size, Share & Growth Report, 2030GVR Report cover

![Pentaerythritol Market Size, Share & Trends Report]()

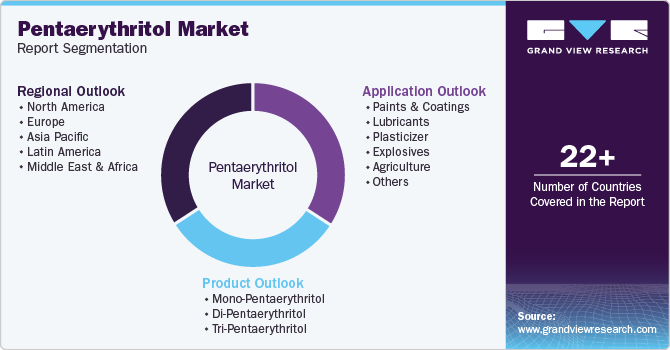

Pentaerythritol Market Size, Share & Trends Analysis By Product (Mono- Pentaerythritol, Di-Pentaerythritol), By Application (Paints & Coatings, Lubricants, Plasticizers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-342-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Pentaerythritol Market Size & Trends

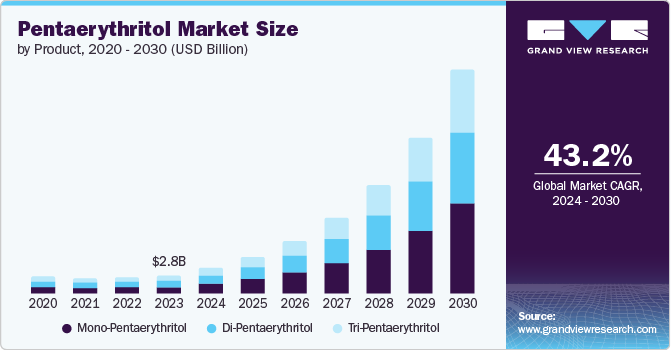

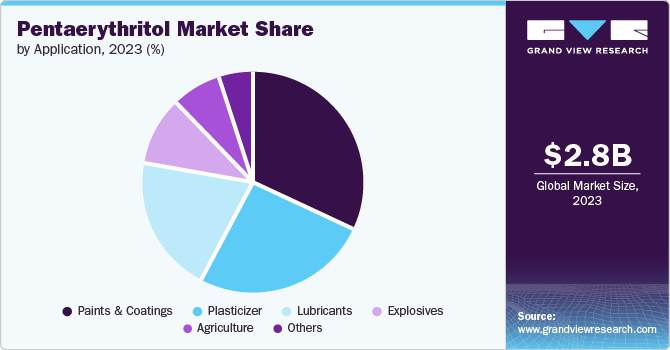

The global pentaerythritol market size was valued at USD 2.80 billion in 2023 and is expected to grow at a CAGR of 43.2% from 2024 to 2030. The market growth is attributable to the robust expansion of the automotive sector across the globe. Pentaerythritol is extensively used in manufacturing automotive lubricants and polyurethane foams that are integrated into vehicle interiors, door handles, bumper systems, gear knobs, dashboards, and seat cushions.

The market was further propelled by the rising demand for formaldehyde and acetaldehyde substitutes for various applications. Industries increasingly utilized these chemicals in the production of paints, coatings, alkyd adhesives, plasticizers, radiation-cured coatings, industrial inks, and synthetic rubber.

Pentaerythritol has emerged as a stable alternative for electrical transformer liquids, addressing safety and performance concerns in this critical application. Industries have rapidly recognized its suitability and reliability owing to its low volatility and high flash point. They apply pentaerythritol as an excellent alternative to dielectric fluids used in transformers, providing enhanced ignition resistance.

In addition, the growing environmental awareness has led to a preference for bio-based polyols, including pentaerythritol. This biodegradable chemical has aligned with the shift toward sustainable materials. Moreover, government initiatives have encouraged extensive research and development activities to keep up with the ongoing industrialization momentum.

Product Insights

Mono-pentaerythritol chemicals secured the dominant market share of 39.6% in 2023 owing to the growing demand from paints and coatings applications. Mono-pentaerythritol is a crucial component in the production of alkyd resins, which are widely used in oil-based paints and coatings for residential spaces including home exteriors, kitchens, and baths.

Di-pentaerythritol chemicals are expected to emerge as the fastest-growing segment over the forecast period owing to the robust expansion of the automotive industry. These specialized chemicals are widely applied in lubricants and hydraulic fluids in the automotive sector. Furthermore, manufacturers in the construction industry extensively employed di-pentaerythritol as chemical intermediaries for rosin easters, radiation-curing oligomers, polymers, and monomers.

Application Insights

Paints and coatings registered the dominant market share in 2023 as pentaerythritol is applied in manufacturing alkyd resins for commercial oil-based coatings. These coatings are applied in residential spaces, including home exteriors, kitchens, baths, doors, and interior decoration. Moreover, alkyd inks and adhesives benefit from pentaerythritol’s properties, such as high luster, flexibility, and water resistance. Pentaerythritol is also essential in radiation-cured coatings, which offer fast curing and excellent performance in industries including agriculture and refrigeration systems. The chemical enhances the quality of varnishes and industrial inks, providing durability and gloss.

Plasticizers are projected to grow substantially at the fastest CAGR of 43.2% during the forecast period owing to the growing demand for polymers with chemical and flame resistance. Plasticizers play a crucial role in enhancing the flexibility and durability of polymers. Furthermore, manufacturers have introduced bio-plasticizers as a cost-effective alternative in polymer processing. They have considerably invested in research and development efforts to focus on enhancing these bio-plasticizers to reduce environmental impact

Regional Insights

The pentaerythritol market in North America accounted for the dominant market share with 40.5% in 2023 owing to the rising demand in the automotive industry. With the expansion of the automotive industry, the market witnessed a surge for pentaerythritol chemicals to apply in lubricants and hydraulic acids. Moreover, the growing environmental consciousness resulted in an inclination toward bio-based polyols, including pentaerythritol. Its use in alkyd resins, which dominate oil-based coatings, aligned with sustainability goals and created opportunities for market growth.

Asia Pacific Pentaerythritol Market Trends

The Asia Pacific pentaerythritol market held 24.5% of the market share and is anticipated to grow at the fastest CAGR during the forecast period. The region’s construction industry is expected to continue lucrative expansion which increasingly demands pentaerythritol chemicals for coatings and paintings. The rising building projects and strong economic growth further fuel the market expansion in the region.

Europe Pentaerythritol Market Trends

The pentaerythritol market in Europe held 18.4% of the market share in 2023. This growth can be credited to the rising demand for greenhouses, driven by agricultural and environmental considerations. The regional governments have supported commercial construction and remodeling projects, further fueling the rising need for pentaerythritol.

Key Pentaerythritol Company Insights

Some of the key players operating in the global pentaerythritol market are Ercros SA, KH Chemicals, and Perstop, among others. These companies have increasingly focused on strategic collaborations, acquisitions and mergers to expand the market and continue their lucrative dominance.

-

Ercros SA is an industrial group that operates within the chemistry and plastics industries. The company’s product portfolio includes basic chemicals such as hydrochloric acid, acetaldehyde, chlorine, ammonia, and caustic soda. In addition, the company offers plastics such as PVC compounds and dichloroethane (EDC).

Key Pentaerythritol Companies:

The following are the leading companies in the pentaerythritol market. These companies collectively hold the largest market share and dictate industry trends.

- Ercros SA

- KH Chemicals

- Perstorp

- Chemanol

- HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD

- Chifeng Ruiyang Chemical Co.,Ltd

- Henan Pengcheng Group

- Samyang Chemical Corporation

- Solventis

- Yuntianhua Group Co., Ltd.

Recent Development

-

In February 2024, Perstorp launched the state-of-the-art plant in Gujrat, India to manufacture a Penta product mix that includes their renewable-based, ISCC PLUS-certified grade called Voxtar, alongside Penta Mono and Calcium Formate. The production plant will utilize raw materials from renewable sources and a hybrid electricity supply. Operating on a traceable mass balance approach, Voxtar aims to reduce the carbon footprint across the value chain and facilitate the use of renewable and recycled materials.

Pentaerythritol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.01 billion

Revenue forecast in 2030

USD 34.61 billion

Growth rate

CAGR of 43.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Ercros SA; KH Chemicals; Perstorp; Chemanol; HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD; Chifeng Ruiyang Chemical Co.,Ltd; Henan Pengcheng Group; Samyang Chemical Corporation; Solventis; Yuntianhua Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pentaerythritol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pentaerythritol market report based on product, application and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Mono-Pentaerythritol

-

Di-Pentaerythritol

-

Tri-Pentaerythritol

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Paints & Coatings

-

Lubricants

-

Plasticizer

-

Explosives

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."