Penetration Testing Market Size, Share & Trends Analysis Report By Offering, By Type (Web Applications, Mobile Applications, Network Infrastructure), By Deployment Mode, By Organization Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-371-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Penetration Testing Market Size & Trends

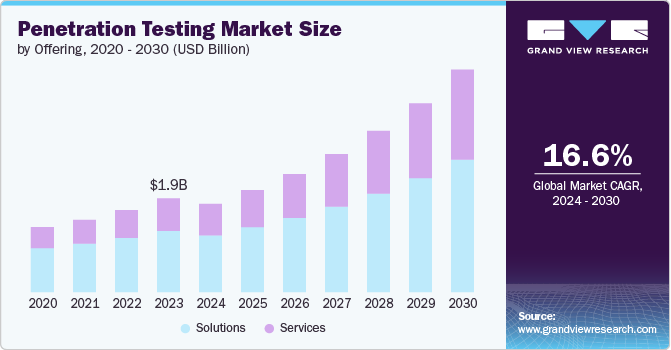

The global penetration testing market size was estimated at USD 1.82 billion in 2023 and is expected to expand at a CAGR of 16.6% from 2024 to 2030. The widespread adoption of cloud computing solutions and services, along with the growing number of data centers, is driving the growth of the global market. Moreover, stringent government regulations are boosting the adoption of penetration testing solutions and services, positively impacting market expansion. The increasing integration of technologies like machine learning (ML) and artificial intelligence (AI) into penetration testing, coupled with the rising trend of adopting penetration testing as a service (PTaaS) and remote working security assessments, offers favorable opportunities for market growth.

IT systems are teeming with interconnected devices and applications. While this connectivity drives innovation, it also increases complexity, creating a productive ground for exposure. Each application and device can serve as an entry point for attackers, extending the attack surface. Custom integrations and legacy code add further complications, providing opportunities for misconfigurations. This intricacy often results in blind spots where malicious activity can go undetected. Penetration testing stands out in this complex environment, simulating real-world attacks to find vulnerabilities that traditional security measures might overlook. By addressing these weaknesses, penetration testing strengthens overall security and mitigates risks in today's intricate IT landscapes.

Penetration Testing as a Service (PTaaS) is transforming cybersecurity, particularly for small businesses. Traditionally, penetration testing was often inaccessible due to limited scope, high costs, and resource constraints associated with one-time engagements. PTaaS introduces a subscription-based model that addresses challenges like complex workflows and data security protocols, making advanced security testing more attainable. By distributing costs over a subscription period, it becomes affordable for smaller businesses and offers scalability to adapt to changing testing needs. It eliminates the need for in-house expertise, as service providers handle recruitment and management.

Offering Insights

The solutions segment led the market in 2023, accounting for over 65% share of the global revenue. The increasing sophistication and frequency of cyber threats have compelled organizations to prioritize robust security measures, driving demand for advanced penetration testing solutions. These solutions offer comprehensive vulnerability assessments, enabling businesses to identify and mitigate potential security risks effectively. Additionally, the growing adoption of cloud computing and IoT devices has expanded the attack surface, necessitating more rigorous and continuous testing methodologies.

The services segment is predicted to foresee significant growth in the coming years. The increasing complexity of IT infrastructure and the sophisticated nature of modern cyber threats have necessitated specialized expertise that many organizations lack in-house. This has fueled the demand for professional penetration testing services, which offer expert analysis and tailored security assessments. These services provide comprehensive evaluations of an organization’s security posture, identifying vulnerabilities that might be overlooked by automated solutions alone.

Type Insights

The web applications segment accounted for the largest market revenue share in 2023, driven by the exponential growth of web-based services and the increasing prevalence of sophisticated cyber threats targeting web applications. As businesses continue to digitalize operations and expand their online presence, web applications have become critical touchpoints for customer interaction and data exchange. This has made them prime targets for cyberattacks, such as SQL injection, cross-site scripting (XSS), and remote code execution. The rising frequency of such attacks has heightened the need for rigorous security measures, propelling the demand for web application penetration testing.

The mobile application segment is predicted to foresee significant growth in the coming years, driven by the explosive growth of mobile device usage and the proliferation of mobile applications across various industries. As consumers and businesses increasingly rely on mobile apps for communication, commerce, and productivity, these applications have become prime targets for cyberattacks. The complexity and diversity of mobile platforms, coupled with the sensitive data they handle, have heightened the need for rigorous security testing. This surge in mobile app development has necessitated robust penetration testing to identify and mitigate vulnerabilities specific to mobile environments, such as insecure data storage, weak encryption, and flaws in authentication mechanisms.

Deployment Mode Insights

The cloud segment accounted for the largest market revenue share in 2023 due to the widespread shift towards cloud-based infrastructures by businesses across various industries. This transition has been driven by the cloud's scalability, flexibility, and cost-efficiency. However, the increased reliance on cloud environments has also introduced new security challenges, such as misconfigurations, data breaches, and vulnerabilities unique to cloud architectures. These complexities have heightened the need for rigorous penetration testing to ensure robust security measures.

The on-premises segment is anticipated to witness significant growth in the coming years. Despite the growing popularity of cloud solutions, many organizations, particularly in highly regulated industries such as finance, healthcare, and government, continue to rely on on-premises infrastructure for enhanced control and security of their sensitive data. This reliance is driven by strict compliance requirements and the need to adhere to rigorous data protection standards, which necessitate comprehensive and frequent security assessments. Moreover, on-premises systems often include legacy applications and complex integrations that can harbor hidden vulnerabilities, making regular penetration testing crucial to identify and address potential security gaps. The increasing sophistication of cyber threats targeting on-premises environments has further emphasized the importance of robust security measures.

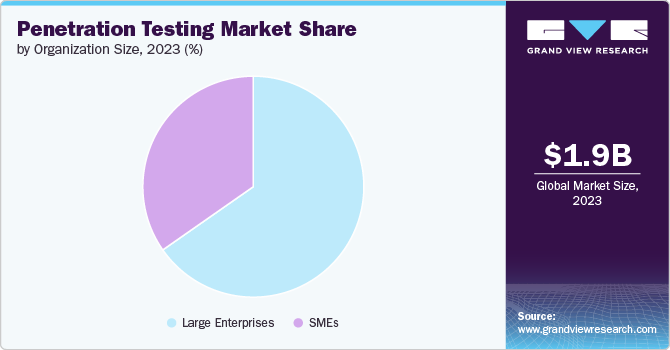

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises often face sophisticated and targeted cyberattacks, necessitating advanced and frequent security assessments to identify and mitigate potential vulnerabilities. The scale and critical nature of their operations also mean that a security breach can have severe financial and reputational consequences. Consequently, large enterprises invest heavily in penetration testing services to proactively manage and address these risks

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period. Cybercriminals are increasingly targeting SMEs due to their often less mature security defenses and valuable data. As digital transformation accelerates, SMEs are adopting advanced technologies and moving their operations online, which exposes them to new security vulnerabilities. Additionally, regulatory pressures and industry standards are compelling SMEs to implement robust security measures to protect sensitive information and ensure compliance. Penetration testing provides SMEs with affordable, scalable, and effective security assessments that help identify and address potential weaknesses in their systems.

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2023. The BFSI sector is a prime target for cybercriminals seeking to exploit vulnerabilities for financial gain, making comprehensive security testing essential. The high value of financial assets and personal information handled by this sector necessitates regular and thorough penetration testing to identify and address potential weaknesses in security systems. Additionally, evolving cyber threats and increasing regulatory pressures drive the BFSI sector to prioritize advanced security measures. Penetration testing helps these organizations meet compliance requirements and safeguard against sophisticated attacks, ensuring the integrity and confidentiality of financial transactions and customer data.

The healthcare segment is anticipated to exhibit the highest CAGR over the forecast period. The healthcare industry handles vast amounts of personal health information, making it a prime target for cyberattacks seeking to exploit vulnerabilities for financial gain or data breaches. The rise in digital health records and connected medical devices has increased the complexity of healthcare IT environments, heightening the risk of security threats. By identifying and addressing potential vulnerabilities, penetration testing helps healthcare organizations safeguard against data breaches and ensure compliance with legal obligations.

Regional Insights

North America penetration testing market dominated with a revenue share of over 38% in 2023. North America, particularly the U.S. and Canada, is home to numerous large enterprises and critical industries that heavily invest in cybersecurity to protect sensitive data and maintain operational integrity. The region's proactive approach to addressing evolving cyber threats drives significant demand for penetration testing services. Additionally, the presence of numerous leading cybersecurity firms and innovative technology hubs in the region further supports the growth of the penetration testing market.

U.S. Penetration Testing Market Trends

The penetration testing market of U.S. is expected to grow at a CAGR of 12.5% from 2024 to 2030 due to its extensive technological infrastructure, significant investment in cybersecurity, and stringent regulatory requirements. As a hub for numerous large enterprises and critical industries, the U.S. faces high cybersecurity risks, driving demand for advanced penetration testing to safeguard sensitive data.

Europe Penetration Testing Market Trends

Europe penetration testing market is expected to witness significant growth over the forecast period due to its stringent regulatory frameworks and increasing focus on cybersecurity. The implementation of regulations such as the General Data Protection Regulation (GDPR) has heightened the need for rigorous security measures to ensure compliance and protect sensitive personal data. Additionally, the region's growing adoption of digital technologies and the rise in cyber threats drive demand for effective penetration testing solutions. The presence of numerous large enterprises and a proactive approach to addressing cybersecurity challenges further contribute to Europe's high share in the penetration testing market.

Asia Pacific Penetration Testing Market Trends

The penetration testing market of Asia Pacific region is anticipated to register the highest CAGR over the forecast period. As countries in Asia Pacific adopt advanced technologies and expand their digital infrastructures, the demand for robust security measures, including penetration testing, has surged. Growing concerns over data protection and compliance with emerging regulations also drive the market. Additionally, the rise in cyberattacks targeting both large enterprises and SMEs in the region underscores the need for comprehensive security assessments, contributing to the segment’s high growth in the penetration testing market.

Key Penetration Testing Company Insights

Key companies include Cisco Systems, Inc., Coalfire Systems, Inc., CrowdStrike, Inc., and Fortinet, Inc. Companies active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in February 2024, the National Cyber Security Agency announced the commencement of accepting applications for its Penetration Testing Accreditation program for service providers. This initiative is part of a broader set of Accreditation programs aimed at enhancing the security of the cyber services supply chain in the State of Qatar.

Key Penetration Testing Companies:

The following are the leading companies in the penetration testing market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Coalfire Systems, Inc.

- CrowdStrike, Inc.

- Fortinet, Inc.

- International Business Machines Corporation

- Isecurion

- Rapid7

- Secureworks, Inc.

- Synopsys, Inc.

- Trustwave Holdings, Inc.

Recent Developments

-

In March 2024, Pentera unveiled the general availability of Pentera Cloud, expanding its automated security validation platform to include this new offering alongside its well-established Pentera Core and Surface products. Pentera Cloud is a software solution designed to provide on-demand security testing and resilience assessments for corporate cloud accounts, specifically targeting cloud-native attacks. Integrated into the company's automated security validation platform, Pentera Cloud enables security teams to minimize their exposure to cloud-native threats across the entire IT attack surface, including external, on-premises, and cloud environments.

-

In March 2024, F5, Inc. revealed the integration of new penetration testing features and automated reconnaissance into F5 Distributed Cloud Services. These enhancements, made possible through the acquisition of Heyhack, simplify the process for users to safeguard the growing number of applications and APIs in today's multi-cloud environments. With these capabilities, users of F5 Distributed Cloud Services can efficiently scan for and identify vulnerabilities affecting their web applications.

-

In August 2023, Appdome, Inc., a foremost provider of mobile app defense solutions, announced the launch of its new Mobile App Defense Project. This community initiative is designed to enhance mobile DevSecOps through collaboration with over 50 prominent mobile app penetration testers worldwide. The project aims to strengthen the security of the mobile app ecosystem, elevate standards for mobile app defense, and deliver fast, validated, and continuous cybersecurity and anti-fraud solutions for mobile applications globally.

Penetration Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.09 billion |

|

Revenue forecast in 2030 |

USD 5.24 billion |

|

Growth rate |

CAGR of 16.6% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, type, deployment mode, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Cisco Systems, Inc.; Coalfire Systems, Inc.; CrowdStrike, Inc.; Fortinet, Inc.; International Business Machines Corporation; Isecurion; Rapid7; Secureworks, Inc.; Synopsys, Inc.; Trustwave Holdings, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Penetration Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global penetration testing market report based on offering, type, deployment mode, organization size, vertical, and region:

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Web Applications

-

Mobile Applications

-

Network Solutions

-

Cloud

-

Social Engineering

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare

-

IT & IteS

-

Telecommunication

-

Retail & eCommerce

-

Manufacturing

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global penetration testing market size was estimated at USD 1.82 billion in 2023 and is expected to reach USD 2.09 billion in 2024.

b. The global penetration testing market is expected to grow at a compound annual growth rate of 16.6% from 2024 to 2030 to reach USD 5.24 billion by 2030.

b. North America dominated the market in 2023, accounting for over 38.0% of the global revenue. The region is home to numerous large enterprises and critical industries that heavily invest in cybersecurity to protect sensitive data and maintain operational integrity.

b. Some key players operating in the penetration testing market include Cisco Systems, Inc.' Coalfire Systems, Inc.; CrowdStrike, Inc.; Fortinet, Inc., International Business Machines Corporation; Isecurion; Rapid7; Secureworks, Inc.; Synopsys, Inc.; and Trustwave Holdings, Inc.

b. Key factors driving the vector database market growth include the widespread adoption of cloud services and growing awareness about cybersecurity risks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."