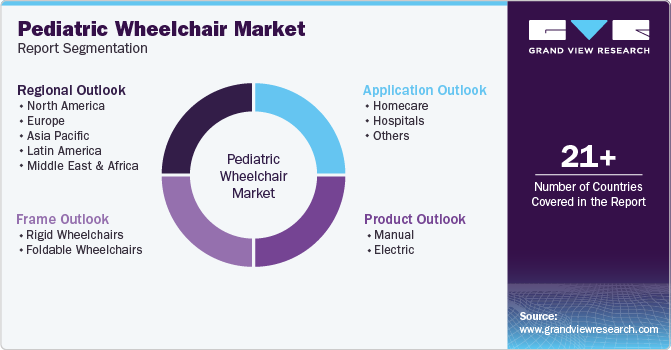

Pediatric Wheelchair Market Size, Share & Trends Analysis Report By Product (Manual, Electric), By Frame (Rigid Wheelchairs, Foldable Wheelchairs), By Application (Homecare, Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-961-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pediatric Wheelchair Market Size & Trends

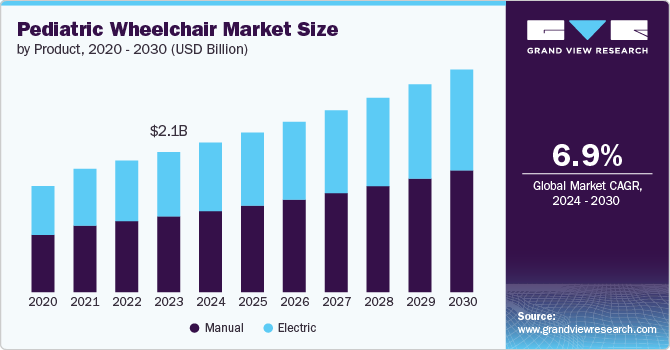

The global pediatric wheelchair market size was estimated at USD 2.10 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. This growth is attributed to the rising disabilities in children, high adoption of wheelchairs for pediatrics in developing countries, and increasing advancement in the wheelchair category. According to a report by UNICEF, nearly 240 million children globally are living with disabilities.

Many children are born with disabilities like autism, Polio, Multiple Sclerosis, Muscular Dystrophy, Spina bifida, cerebral palsy, tourette syndrome, etc. In the case of cerebral palsy, Polio, Muscular dystrophy, multiple Sclerosis, and Spina bifida patients require wheelchairs for mobility as they cannot walk or move on their own. Furthermore, the progressive nature of such disorders often leads to significant mobility impairments by adolescence, necessitating the use of wheelchairs to maintain mobility and independence

The increasing prevalence of disabilities in children is a governing growth factor as it directly implies a need for pediatric wheelchairs. Cerebral palsy (CP) remains one of the primary conditions necessitating wheelchair use in children. This neurological disorder, affecting movement and muscle tone, impacts approximately 1 in 345 children in the U.S. The National Institute of Neurological Disorders and Stroke (NINDS) estimates that around 10,000 babies and infants are diagnosed with CP annually. The severity of mobility impairments often leads to the early adoption of wheelchairs to enhance independence and quality of life. In addition, in March 2024, Centers for Disease Control and Prevention (CDC) highlighted, around 1 in 2,875 infants are born with spina bifida each year in the U.S. The mobility challenges associated with this condition often necessitate wheelchairs, especially for children with higher-level lesions that severely impact leg function.

The market is experiencing an increase in demand for tailor-made products. This shift is driven by the need for customized solutions that address the unique requirements of individual children. Customization involves designing wheelchairs that fit the specific physical dimensions, mobility needs, and medical conditions of each child. Healthcare providers and caregivers are seeking products that enhance comfort, functionality, and mobility. Tailor-made wheelchairs offer the ability to adjust components such as seat height, depth, and width, as well as support systems for posture and safety. This level of customization is essential for children with complex medical conditions or those who require specialized seating and positioning systems.

The market is further characterized by advancements in technology, advances in medical technology and materials have led to the development of more versatile and customizable wheelchair options tailored to children's specific needs. Advancements in suspension systems, frame materials, and power assist devices are making manual wheelchairs more comfortable and easier to use for pediatric users, thus the demand for pediatric wheelchairs is expected to rise. This trend presents significant opportunities for manufacturers and healthcare providers to innovate and cater to the unique needs of this population segment.

Governments initiatives focused on improving access to assistive technologies, including wheelchairs for pediatric use is further driving market growth. The U.S. government, through the Individuals with Disabilities Education Act (IDEA), ensures that children with disabilities receive necessary services, including mobility aids. Medicaid and the Children's Health Insurance Program (CHIP) provide coverage for wheelchairs for eligible children. In addition, the Assistive Technology Act supports states in providing assistive devices to individuals with disabilities, including children. Furthermore, Japan's Ministry of Health, Labour and Welfare provides subsidies for the purchase of assistive devices, including wheelchairs, through the Services and Supports for Persons with Disabilities Act. Such initiatives across global regions is poised to drive the market growth in forecast period.

The availability of reimbursement of wheelchairs from Medicare under HCPCS Code E1229 and other insurance companies is helping people to opt for better products and facilities. Furthermore, factors such as the increasing number of e-commerce platforms selling these products, growing internet penetration, and increasing urbanization are estimated to improve the awareness and availability of these products among the target population, especially in developing economies.

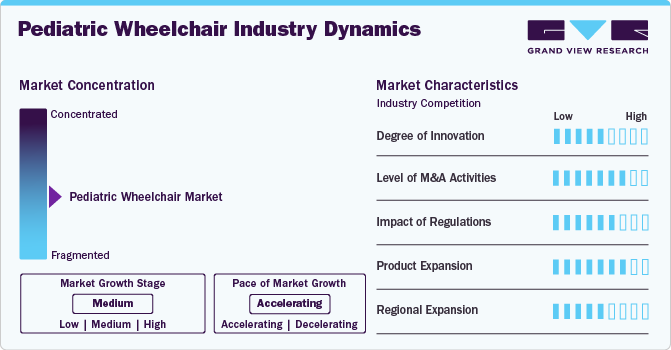

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by the need for more Innovations in wheelchair design and materials are enhancing the functionality and user experience of pediatric wheelchairs. This includes lightweight materials, improved ergonomics, and advanced power systems. These advancements make wheelchairs more comfortable, maneuverable, and adaptable to children's needs, driving market growth.

The market is characterized with moderate levels of technology launches and merger and acquisition (M&A) activity by the leading players. For instance, in November 2021, Permobil announced acquisition of Panthera, a Swedish manufacturer of ultralightweight wheelchairs. This strategic move aimed to expand Permobil's product offerings and enhance its position in the wheelchair market. The acquisition was expected to bring together Permobil's extensive distribution network and Panthera's innovative design capabilities, creating synergies that would benefit both companies and their customers.

Regulations play a significant role in shaping the global market. Regulatory standards ensure safety and accessibility, driving quality improvements and compliance costs.

Increased demand for customizable and advanced wheelchairs fosters innovation and broader product ranges. For instance, in January 2022, Ottobock acquired Veldink4kids, a specialist in children's wheelchairs. This acquisition allowed Ottobock to expand its portfolio of highly customized, pediatric-focused mobility solutions to better serve the needs of young wheelchair users. The Veldink4kids Kiddo Up wheelchair, designed for children as young as 12 months, is now part of Ottobock's product lineup.

Market growth in emerging regions is driven by rising awareness, healthcare improvements, and supportive policies.

Product Insights

The manual wheelchair segment led the market with the largest revenue share of 54.1% in 2023 and is further anticipated to witness at the fastest CAGR of 7.0% in forecast period. The demand for manual pediatric wheelchairs is growing, driven by advancements in design and materials that improve functionality and comfort. Customization options and ergonomic designs are increasingly preferred by healthcare providers and families. Technological improvements by manufacturers and greater awareness of mobility solutions further contribute to this trend. For instance, in September 2023, Permobil announced the acquisition of PDG Mobility, a Canadian leader in manual tilt-in-space wheelchairs. This acquisition aims to enhance Permobil’s product portfolio in the manual wheelchair segment. The integration of PDG’s innovative products with Permobil’s global reach and resources is expected to drive growth and expand market presence, benefiting end users with advanced mobility solutions.

The adoption of manual wheelchairs is rising due to their affordability, ease of use, and the increasing prevalence of pediatric mobility impairments. Manual wheelchairs are comparatively cheaper than electric wheelchairs. An advanced electric wheelchair typically costs between USD 3,500 and USD 7,000, compared to USD 300 and USD 1,500 for a manual wheelchair. Manual chairs are mostly preferred for use among the pediatric population as children for self-mobility however patients also choose wheelchairs depending on whether the wheelchair is used for outdoor or indoor mobility.

Frame Insights

Based on frame, the rigid wheelchairs segment led the market with the largest revenue share of 54.5% in 2023. The high share is characterized as the rigid wheelchairs allow for minimal accessibility constraints and the continuation of an active lifestyle of the patient. These wheelchairs offer improved stability and maneuverability, essential for active pediatric users. They are often chosen for their strength and ease of maintenance, making them suitable for various environments. They are also more comfortable as compared to foldable wheelchairs and have variety in their style. In terms of mobility, rigid wheelchairs are good as compared to foldable wheelchairs. For example, Invacare introduced the new ‘Action5 Rigid wheelchair’, designed with an energy-efficient box frame construction. This robust and lightweight model aims to reduce propulsion effort, featuring a patented backrest mechanism, extensive adjustability, and compatibility with the Alber e-pilot add-on. In addition, innovations in materials, such as titanium and carbon fiber, contribute to lighter yet stronger frames, enhancing user experience and expanding market appeal. For example, the ‘GTM Kid wheelchair’, distributed by Momentum Healthcare, is designed for active teenagers up to 75 kg. It combines features from the GTM Junior and GTM adult chairs, offering a sporty, customizable model.

The foldable wheelchairs segment is anticipated to witness at the fastest CAGR of 7.1% during the forecast period.Owing to their easy accessibility, portability, and frame style. The compact, collapsible nature of these wheelchairs enables users to access a wider range of environments and participate in a broader scope of activities. Foldable wheelchairs improve accessibility by allowing children to more easily maneuver through doorways, elevators, and other tight spaces that may pose challenges for rigid frame designs. Manufacturers' focus on designing feature-rich, customizable foldable wheelchairs will be a key factor in meeting the evolving needs of children with disabilities. Such factors are driving demand and are poised to grow over the forecast period.

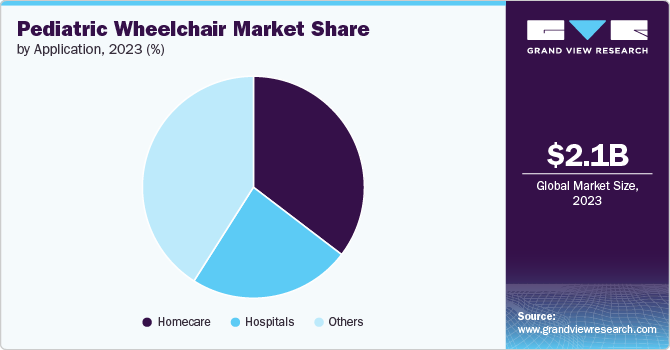

Application Insights

Based on application, the other segment led the market with the largest revenue share of 41.0% in 2023. These include schools and educational facilities that require mobility solutions that allow children with disabilities to navigate classrooms, playgrounds, and other school facilities. Specialized pediatric wheelchairs designed for recreational activities and adaptive sports. Furthermore, the rise in medical emergencies and requirements of wheel chair is associated with this segments growth. The need for wheelchairs is increased by the post-surgical procedures. These chairs are mostly utilized in hospitals for patient transportation and for a trip to the doctor's office in a sizable medical facility. Many organizations help patients by providing devices and products. According to UNICEF, “During 2021, over 134,000 children with disabilities were reached with assistive devices, disability-inclusive products, and emergency kits through UNICEF-supported programs across 81 countries”.

The homecare segment is anticipated to grow at the fastest CAGR of 7.0% over the forecast period, owing to the increasing adoption of wheelchairs at-home care. The adoption of wheelchairs at home has increased because of increasing disabilities. Also, wheelchairs are available in different types and at different rates through online channels and these channels also offer discounts with comparison features to allow consumers to make the right purchasing decision which might further boost their demand. Increasing disposable income, and availability of various types will help the market grow. Whereas various initiatives are focused on providing homecare provide wheelchair mobility solutions. For instance, in June 2024, Right at Home, a global home care provider, has launched an initiative to provide wheelchair mobility solutions in Kenya. The program further aims to address the needs of individuals who lack access to mobility aids, improving their quality of life.

Regional Insights

North America dominated the pediatric wheelchair market with the revenue share of 34.8% in 2023. This high share is attributable to the presence of major players, the high prevalence of physical impairment in the area, and the well-established healthcare infrastructure are some of the main reasons for the industry's growth. Additional factors such as rising government efforts and increasing product expansions in the region are anticipated to boost market growth. The U.S. has the largest market share in this region. Various governments programs in countries like U.S. and Canada drive market growth. For instance, in Canada, the Assistive Devices Program (ADP) in Ontario provides funding for essential mobility devices, including pediatric wheelchairs. Provinces like British Columbia and Alberta have similar programs to ensure children with mobility impairments have access to necessary equipment. Furthermore, growing demand for tailor-made products are also contributing to the market's expansion in the region.

U.S. Pediatric Wheelchair Market Trends

The pediatric wheelchair market in the U.S. is expected to grow at a substantial CAGR over the forecast period. Rising incidence of conditions such as cerebral palsy, muscular dystrophy, and spinal cord injuries contributing to the need for pediatric wheelchairs. Recently, in March 2024, data published by Medscape highlighted the incidence of pediatric spinal cord injuries (SCI) is estimated at 1.99 per 100,000 children in the U.S. About 1,455 hospitals admission occurs annually due to SCI in U.S. These injuries often result in permanent mobility impairments, making wheelchairs essential for daily activities and mobility. Organizations such as Individuals with Disabilities Education ensures that children with disabilities receive necessary services, including mobility aids. The number of student ages 3-21 served under the Individuals with Disabilities Education Act (IDEA) in the U.S. increased from 6.4 million in 2012-13 to 7.5 million in 2022-23. Furthermore, supportive government policies and funding for assistive technology, including wheelchairs, for children with disabilities.

Europe Pediatric Wheelchair Market Trends

The pediatric wheelchair market in Europe was identified as a lucrative region in this industry. European countries have implemented various initiatives to support pediatric wheelchair users. The European Union's Horizon 2020 program has funded numerous projects aimed at improving assistive technologies for children with disabilities. In the UK, the National Health Service (NHS) provides funding for pediatric wheelchairs through its Wheelchair Service, ensuring that children receive appropriate mobility aid based on their individual needs. Furthermore, there is growing advent of increasing investment in the wheelchair category among countries like UK, Germany, and France. These are significant factors propelling market growth.

The UK pediatric wheelchair market is expected to grow at the fastest CAGR over the forecast period, due to the Rising prevalence of conditions such as cerebral palsy, muscular dystrophy, and spinal cord injuries among children, necessitating mobility solutions like wheelchairs. In 2023, Cerebral Palsy Statistics UK reported that cerebral palsy affects approximately one in every 400 children in the UK, with around 1,800 new diagnoses each year. Among those diagnosed, 80% experience spastic motor impairment, and up to 25% face partial or total hip dislocation. In addition, as per the cerebral palsy organization of the UK, there are around 2000 babies born with cerebral palsy every year. Approximately 41% of infants and kids with cerebral palsy are likely to have limited ability to crawl, walk, or run. Such factors and prevalence of disorders drive the demand for use of pediatric wheelchairs and thus market is poised to grow over forecast period.

The pediatric wheelchair market in Germany is expected to grow at a substantial CAGR over the forecast period. Owing to and presence of robust support systems through its healthcare system, statutory health insurance covers the cost of medically necessary wheelchairs for children. Further factors such as growing demand for customized and made-to-order wheelchairs, growing importance of accessibility and inclusivity in public spaces and buildings, rising awareness about the importance of early intervention and rehabilitation for children with disabilities are driving need for pediatric wheelchair.

Asia Pacific Pediatric Wheelchair Market Trends

The pediatric wheelchair market in Asia Pacificis anticipated to witness at the fastest CAGR of 8.0% over the forecast period. This is driven by increasing healthcare expenditures and rising awareness about disabilities among children. Countries like China and India are experiencing a surge in demand due to their large pediatric populations and improving healthcare infrastructure. Technological advancements, such as lightweight materials and ergonomic designs, are enhancing the appeal and functionality of pediatric wheelchairs in this region. For instance, recent product launches by multinational companies tailored to local needs have further stimulated market growth, addressing specific mobility challenges faced by children in diverse healthcare settings.

The China pediatric wheelchair market is expected to grow at a significant CAGR over the forecast period. The market is characterized by a shift towards more personalized and adaptable wheelchair solutions, driven by technological innovations and competitive pricing strategies. Notably, strategic mergers and acquisitions by leading companies to expand their product portfolios have further intensified market competition and accelerated product development cycles.

The pediatric wheelchair market in Japan is expected to grow at a substantial CAGR over the forecast period. In Japan government initiatives supporting assistive technologies and favorable reimbursement policies are key drivers. Recently, in September 2023, wheelchairs originally intended for disposal have been refurbished by a Tokyo-based organization and donated to children worldwide. This initiative aims to improve mobility and enhance the quality of life for children facing mobility challenges globally. Recent regulatory approvals for advanced pediatric wheelchairs have also spurred market growth, enabling better mobility solutions for children with disabilities.

Latin America Pediatric Wheelchair Market Trends

The pediatric wheelchair market in Latin America is anticipated to grow at a substantial CAGR over the forecast period. Countries such as Brazil, Argentina stands out with a growing market driven by increasing healthcare access and governmental efforts to improve disability services.

The Brazil pediatric wheelchair market is expected to grow at the fastest CAGR over the forecast period. In Brazil, the market is expanding, driven by the market trend towards inclusive education and accessibility standards has bolstered demand for pediatric mobility aids. Recent partnerships between local healthcare providers and international manufacturers have facilitated the introduction of advanced pediatric wheelchairs tailored to regional needs, supporting better mobility outcomes for children across the country.

MEA Pediatric Wheelchair Market Trends

The pediatric wheelchair market in Saudi Arabia is expected to grow at a significant CAGR over the forecast period. The market is witnessing a trend towards digital integration and smart mobility solutions, catering to the needs of tech-savvy parents and caregivers. Notable developments include recent product launches and regulatory approvals aimed at enhancing pediatric mobility options, aligning with global standards and local healthcare demands.

Key Pediatric Wheelchair Company Insights

Some of the key players operating in the market include MEYRA GmbH, Sunrise Medical, SORG Rollstuhltechnik GmbH, Invacare and others. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Pediatric Wheelchair Companies:

The following are the leading companies in the pediatric wheelchair market. These companies collectively hold the largest market share and dictate industry trends.

- MEYRA GmbH

- Sunrise Medical

- SORG Rollstuhltechnik GmbH

- Invacare

- Momentum Healthcare

- Permobil

- AKCES-MED sp.z.

- Medline

- Drive Medical

- Numotion

- Carex Health

- Pride Mobility

Recent Developments

-

In November 2022, Invacare Corporation launched the Invacare AVIVA STORM RX, a narrow base power wheelchair designed to offer exceptional maneuverability and stability. This innovative product aims to enhance user experience through advanced technology and superior performance. The AVIVA STORM RX is expected to set a new standard in the power wheelchair market, providing users with greater independence and mobility

-

In September 2022, Sunrise Medical announced the introduction of two new wheelchairs, the Zippie Q300 M Mini and the Quickie Q200 R. The Zippie Q300 M Mini is designed for children, offering a compact and maneuverable solution for indoor and outdoor use

-

In September 2022, Karma Medical, a leading wheelchair manufacturer, introduced the Flexx Adapt, a highly adjustable pediatric manual wheelchair. The Flexx Adapt features a dynamic backrest that absorbs sudden movements, as well as tilt-in-space and recline functions to provide pressure relief and support growing children. Karma's pediatric wheelchair portfolio also includes the Flexx Junior, a multi-adjustable manual chair designed for children aged 7-15

Pediatric Wheelchair Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.24 billion |

|

Revenue forecast in 2030 |

USD 3.34 billion |

|

Growth rate |

CAGR of 6.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, frame, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

MEYRA GmbH; Sunrise Medical; SORG Rollstuhltechnik GmbH; Invacare, Momentum Healthcare; Permobil; AKCES-MED sp.z.; Medline; Drive Medical; Numotion; Carex Health; Pride Mobility |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pediatric Wheelchair Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric wheelchair market report based on product, frame, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric

-

-

Frame Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid wheelchairs

-

Foldable wheelchairs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Homecare

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pediatric wheelchair market size was estimated at USD 2.1 billion in 2023 and is expected to reach USD 2.24 billion in 2024.

b. The global pediatric wheelchair market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 3.34 billion by 2030

b. North America dominated the pediatric wheelchair market with a lucrative share of 34.8% in 2023. The presence of major players, the high prevalence of physical impairment in the area, and the well-established healthcare infrastructure are some of the main reasons for the industry's growth

b. Some key players operating in the pediatric wheelchairs market include MEYRA GmbH, Sunrise Medical, SORG Rollstuhltechnik GmbH, Invacare, Momentum Healthcare, Permobil, AKCES-MED sp.z., Medline, Drive Medical, Numotion, Carex Health, Pride Mobility, etc

b. Key factors that are driving the pediatric wheelchair market growth include increasing disabilities in children, adoption of wheelchairs for pediatrics in developing countries, and increasing advancement in the wheelchair category

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."