- Home

- »

- Healthcare IT

- »

-

Pediatric Telehealth Market Size, Share, Growth Report 2030GVR Report cover

![Pediatric Telehealth Market Size, Share & Trends Report]()

Pediatric Telehealth Market Size, Share & Trends Analysis Report By Product Type, By Delivery Mode, By End-use (Payers, Providers, Patients), By Disease Area, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-266-5

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pediatric Telehealth Market Size & Trends

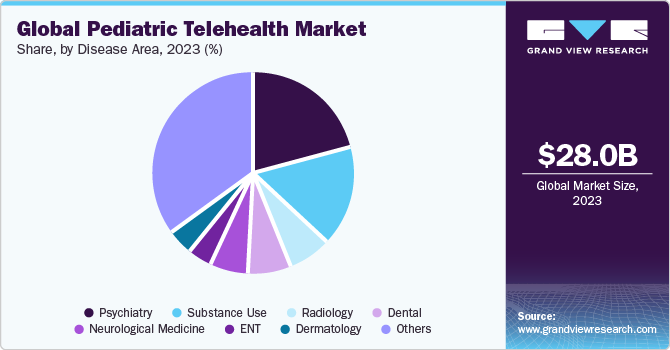

The global pediatric telehealth market size was estimated at USD 28.0 billion in 2023 and is anticipated to grow at a CAGR of 26.6% from 2024 to 2030. The increasing demand for pediatric healthcare services amid the COVID-19 pandemic and advancements in telemedicine technology are driving growth. Furthermore, rising awareness among parents about the convenience and accessibility of telehealth for pediatric care, coupled with the shortage of pediatric specialists in certain regions, is further propelling the market.

The growing demand for real-time patient monitoring and virtual consultations is driving market growth. Hence, players are actively launching and adopting telehealth solutions in pediatrics. For instance, in September 2023, Kismet Health launched a pediatric telehealth platform developed for providers. The platform provides high-quality & accessible care for children and their families while providing clinical support to providers. Furthermore, various hospitals are partnering with schools to offer virtual healthcare visits for children at school. For instance, in June 2023, the Los Angeles Unified School District partnered with Children's Hospital Los Angeles (CHLA) to launch the Virtual Care at School Program, which would enable students to receive specialized care from CHLA experts in a personalized and convenient way. The schools were chosen based on the number of students with chronic illnesses and a thorough analysis of absenteeism rates at each school.

As per “The Complexities of Physician Supply and Demand: Projections from 2019 to 2034” report by the Association of American Medical Colleges (AAMC), the number of pediatric specialists is insufficient to cater to the growing pediatric population in the U.S. This indicates a need for alternative solutions to cater to the increasing number of pediatric patients. Telehealth is one such solution that can help address this issue. Telehealth allows healthcare providers to remotely assess, diagnose, and treat pediatric patients, regardless of their location. This makes it a promising solution to bridge the gap between the increasing demand for pediatric care and the limited availability of pediatric specialists.

In addition, the high hospital admission expenses are reduced significantly by telehealth solutions. According to an article published by the National Institute on Drug Abuse in January 2024, about 54% of residential addiction treatment facilities had beds available. The average daily treatment cost was USD 878, and about 48% of these facilities required full or partial payment upfront. Moreover, the monthly cost of treatment in a residential addiction treatment facility was over USD 26,000. In a pre-COVID-19 study of 40,000 Cigna beneficiaries, 20,000 beneficiaries used the MDLive telehealth platform and found that their healthcare costs were 17% lower than those receiving nonvirtual care. Therefore, telehealth can be a beneficial alternative to hospital admission, as it can help patients reduce their expenses considerably.

The increasing prevalence of cardiovascular diseases in the pediatric population is a significant driver of pediatric telehealth market’s growth. According to data from The Children's Heart Foundation, Congenital Heart Defects (CHDs) affect approximately 1 in every 100 newborns each year in the U.S. alone. Moreover, CHDs are the most common type of birth defect, with an estimated 40,000 infants born annually with CHDs in the States. This growing prevalence of cardiac conditions in pediatric patients underscores the critical need for specialized cardiac care, including timely diagnosis, monitoring, and treatment. Telecardiology services enable remote consultation, diagnosis, and monitoring of cardiac conditions, allowing healthcare providers to reach & support a broader pediatric patient population. In addition, telehealth facilitates early detection and intervention, which is crucial for managing cardiac conditions effectively and improving patient outcomes.

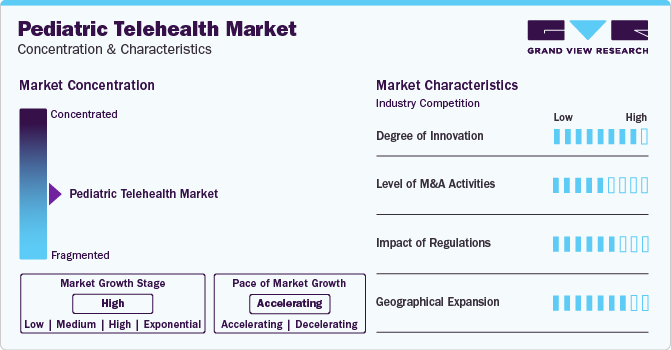

Market Concentration & Characteristics

The industry growth stage is high, and the pace of growth is accelerating.

The degree of innovation in the pediatric telehealth market is high, owing to the increasing number of virtual consultations, remote patient monitoring, and the introduction of several medical devices. For instance, in February 2024, Masimo received a clearance for MightySat Medical, an Over the Counter (OTC) fingertip pulse oximeter.

Industry players implement various business strategies to increase revenues, promoting global industry growth. The market players undertake mergers & acquisitions to expand their product portfolios, further contributing to industry growth. For instance, in March 2021, SOC Telemed acquired Access Physicians, a telemedicine company.

Regulatory bodies, such as the FDA, administer medical peripheral devices under pediatric telehealth. Furthermore, telehealth companies are expected to adhere to several acts, such as the Health Insurance Portability and Accountability Act (HIPAA) of 1996 and the General Data Protection Regulation (GDPR). These acts ensure data privacy & safety and help maintain patient confidentiality.

The companies in the pediatric telehealth industry undergo geographical expansion to establish their presence in the untapped markets, consequently capturing the customer base from the respective locations. The companies might launch R&D or manufacturing facilities in new locations or forge partnerships & collaborations to gain access to advanced technologies and customer base. For instance, in May 2023, a collaboration between Montana Pediatrics and the Dennis and Phyllis Washington Foundation, involving a USD 1 million investment, intended to enhance a pediatric telehealth program with the goal of expanding healthcare accessibility in Montana.

Product Type Insights

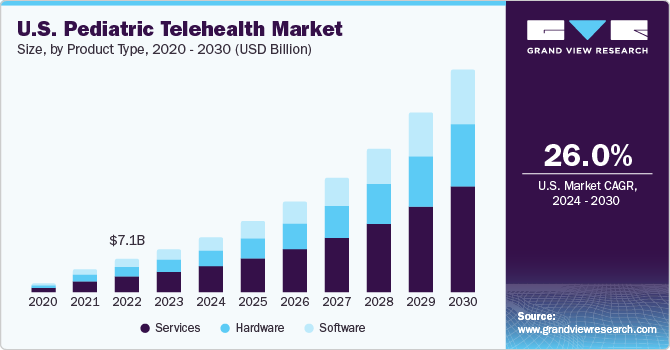

The services segment dominated with the largest revenue share of 47.1% in the global pediatric telehealth market in 2023, owing to increasing demand for specialized healthcare services for children, particularly in remote or underserved areas. The convenience offered by virtual consultations, coupled with the emphasis on preventive and ongoing pediatric care, further propels growth of telehealth services for children. In addition, companies are increasingly investing in developing, launching, and advancing telehealth services to cater to the pediatric population. For instance, in December 2022, OSF Healthcare launched a Real Patient Monitoring (RPM) program for toddlers and infants suffering from Respiratory Syncytial Virus (RSV) infection. This enabled the hospital to reduce the number of occupied beds for RSV and offer remote care for toddlers & infants.

The software segment is expected to register the fastest growth rate during the forecast period. This growth can be attributed to technological advancements, including Artificial Intelligence (AI) & Machine Learning (ML) integration and increasing use of Electronic Health Record (EHR) & Electronic Medical Record (EMR) software. For instance, in February 2024, Vital partnered with Children’s Hospital Los Angeles (CHLA) and launched an AI-powered application to offer real-time updates on the progress of discharge, labs & imaging results, wait time, and patient education for families & patients in the emergency department.

Delivery Mode Insights

The web-based segment dominated the pediatric telehealth market with the largest revenue share in 2023. Web-based telehealth solutions are delivered to users through web servers using the internet protocol. Web-based delivery solutions contain four aspects: web server, data administrator, internet connection, and software coding system. The web-based and internet services offer access to remote areas using a single monitoring device or computer. Moreover, this data can be analyzed and accessed in real time, significantly decreasing decision-making time. For instance, HyperSend, a web-based delivery system, adheres to the Health Insurance Portability and Accountability Act (HIPAA) and is used by several healthcare companies.

The cloud-based segment is expected to register the fastest CAGR of 26.2% during the forecast period. This technology enables hosting software & systems, applications, and services remotely and can be accessed or used through the internet. Cloud-based delivery mode or cloud computing in the healthcare industry has expanded due to several security infringements in on-premises and web-based deployment. Furthermore, virtualization in cloud computing reduces operational spending for healthcare establishments while enabling them to provide personalized, high-quality care. In addition, cloud solutions for healthcare enabled professionals to outsource data storage to cloud service providers such as Azure and AWS to efficiently comply with privacy & security standards like GDPR and HIPAA.

End-use Insights

The providers segment in end-use dominated the pediatric telehealth market with the largest share of 52.8% in 2023. This growth is due to the various advantages telehealth services offer and growing initiatives by market players & government organizations. The segment comprises healthcare institutions, such as hospitals & clinics, among other providers. The increasing demand to reduce hospital admissions and enhance hospital workflows promotes the adoption of telehealth technologies by providers. Furthermore, the growing number of collaborations and partnerships among several public & private healthcare institutions is expected to drive accessibility and adoption of telehealth services, contributing to segment growth. For instance, in August 2022, Louisiana Hospital partnered with Cleveland Clinic to obtain enhanced access to pediatric radiology experts through telehealth.

Payers segment is anticipated to grow at the fastest CAGR during the forecast period. The segment includes Medicaid, Medicare, and health plan providers. The payer segment has experienced exponential growth in telehealth claims due to the pandemic. Moreover, payers are opting for telehealth to deliver proper care to their members while saving the money of employers & members due to significant cost-saving prospects presented by telehealth services, including fewer diagnostic steps associated with telehealth visits compared to in-person visits and lower cost per consultation than in-person visits.

Disease Area Insights

The psychiatry segment in the disease area dominated the pediatric telehealth market, with the largest revenue share of 21.3% in 2023. The growth can be attributed to the increasing awareness of mental health issues due to several reasons, including drug abuse. Furthermore, various healthcare institutions and companies operating in the market are undertaking initiatives to encourage the use of telehealth for promoting mental health awareness & management. For instance, in November 2022, the Governor of Illinois launched a new program to assist pediatricians and various healthcare providers in meeting the mental health needs of children. The program aims to support mental health services in schools and emergency departments. In addition, the program investigates the possibility of implementing telehealth services for direct patient-provider consultation.

The substance-use segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the increasing prevalence of substance use among adolescents (aged 10 to 19). The use of nicotine vapes, alcohol, and marijuana has become common in this age group, according to the American Academy of Pediatrics in 2022. Moreover, according to insights by Monitoring the Future survey, in 2022, 32.6% of 12th graders, 11% of eighth graders, and 21.5% of 10th graders used illicit drugs. To address substance-use problems remotely, many organizations and governments are incorporating telehealth services into their treatment plans. In order to cater to rural communities, the U.S. representatives launched at-home virtual substance use and mental health services in December 2023.

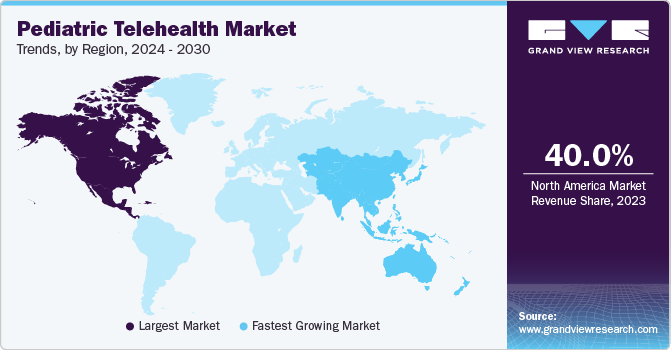

Regional Insights

North America held the largest market share of more than 40% in 2023. The expansion of pediatric telehealth services in North America is driven by the region's substantial investment in healthcare IT and the widespread adoption of the internet & smartphones. As an early adopter of innovative healthcare solutions, North America has integrated technologies such as eHealth services, smart wearables, and mobile health applications, facilitating remote management & access to information for severe and chronic conditions. Furthermore, the presence of market players such as Teladoc Health, Inc.; American Well; and Oracle in the region contributes to the growth of North America pediatric telehealth.

U.S. Pediatric Telehealth Market Trends

The pediatric telehealth market in the U.S. dominated North America with a share of over 70% in 2023. This growth can be attributed to technological advancements, growing number of initiatives by players, and increasing demand for remote patient & real-time monitoring solutions. For instance, in January 2022, Good Parents Inc., the Kiddo Remote Patient Monitoring (RPM) innovator, secured a Series A growth investment of around USD 16.0 million. This capital investment and strategic alliance will empower Kiddo to significantly expand its workforce in the U.S. and Asia.

Europe Pediatric Telehealth Market Trends

The pediatric telehealth market in Europe is expected to grow at a significant pace during the forecast period, owing to the increasing initiatives by the European government bodies & players, growing need for remote patient monitoring, and technological advancement in telehealth.

The pediatric telehealth market in the UK is expected to grow at a significant pace during the forecast period. This growth is due to the growing initiatives of government organizations and market players. For instance, in September 2021, TytoCare collaborated with the NHS to facilitate the rollout of TytoCare's telehealth solution across 14 organizations and 26 projects in Yorkshire and Humber, including Leeds Children's Hospital, Sheffield Children's NHS Foundation Trust, and nearly 70 care homes. Integrating TytoCare into the NHS' current virtual care offerings will allow clinicians to diagnose and treat patients remotely with in-depth, physical examinations during video visits. The device will also be used offline for asynchronous exams.

The Germany pediatric telehealth market dominated the European region in 2023. This growth can be attributed to the widespread adoption of telehealth services in the pediatric domain. For instance, in November 2023, a project funded by the EU, Telemedicine-Integrated German-Polish Pediatric Cancer Centre in the Euroregion Pomerania, won an award for advancing pediatric cancer care through various techniques, including telemedicine.

Asia Pacific Pediatric Telehealth Market Trends

The pediatric telehealth market in Asia Pacific is anticipated to witness the fastest growth during the forecast period, which can be attributed to the increasing birth rate in countries, including China & India; technological advancements in the field of digital healthcare; and the active participation of players & governments. For instance, in June 2023, the government of South Australia announced funding of around USD 21.0 million for the Child and Adolescent Virtual Urgent Care Service (CAVUCS) for the next 4 years.

The China pediatric telehealth market dominated the Asia Pacific region with the largest share in 2023. This growth can be attributed to rapid technological advancements in the healthcare industry, the growing demand for remote patient monitoring post-COVID-19 pandemic, and increasing initiatives by healthcare institutions & companies to integrate telehealth with the pediatrics department. For instance, in May 2023, the Hong Kong’s Hospital Authority announced plans for digital advancements in the pediatrics sector, including the adoption of telemedicine.

Key Pediatric Telehealth Company Insights

Some of the key players operating in the market are Oracle, Medtronic, and Siemens Healthineers AG. Key players are adopting initiatives such as partnerships, new product development, and mergers & acquisitions to increase their market share.

-

Siemens Healthineers AG's portfolio encompasses enterprise imaging IT solutions, AI-enhanced decision support, eHealth solutions, and patient engagement strategies. In addition, it includes business intelligence & performance management tools, teleoperations technologies, cutting-edge cardiology IT, digital pathology, diagnostics IT solutions, and laboratory automation technologies.

-

Oracle provides “Child & Adolescent Psychological Services” using telehealth platforms. Its team of clinicians has extensive experience in telehealth modalities, delivering professional services through remote consultations. The company’s child psychologists employ a comprehensive suite of strategies and tools designed to support teenagers, children, and their families during telehealth engagements. By leveraging a variety of technologies and media, it ensures that the sessions are interactive, informative, practical, & beneficial.

Key Pediatric Telehealth Companies:

The following are the leading companies in the pediatric telehealth market. These companies collectively hold the largest market share and dictate industry trends.

- Teladoc Health, Inc.

- American Well

- MDLive

- Oracle

- GlobalMedia Group, LLC

- Siemens Healthineers AG

- Medtronic

- Pediatric Partners

- Anytime Pediatrics

- Kiddo Health Inc.

- PediaMetrix

- Brave Care, Inc.

Recent Developments

-

In February 2024, Oracle Health and Children’s National Hospital announced the winners of the Bear Institute Pediatric Accelerator Challenge for Kids, a competition designed to stimulate start-up innovation in the digital health sector for children. The awarded entities-Bend Health Inc., RareCareNow, Thynk Inc., and Kismet Health-were acknowledged for their groundbreaking work, including the adoption of telemedicine.

-

In April 2023, Oracle collaborated with Zoom to deliver easier, faster, and more efficient telehealth services. Oracle and Zoom combined forces to integrate telehealth features with Oracle Cerner Millennium. This integration will allow healthcare providers to access the necessary patient electronic health records easily and quickly during appointments, no matter where they are in the world.

-

In April 2023, expert pediatricians launched a telehealth platform called Vamio Health to help children suffering from nocturnal enuresis, commonly known as bedwetting. With over 5 million children affected by this condition in the U.S. alone, the platform aims to simplify the consultation process for families. To get started, families can schedule a consultation on the Vamio Health website, usually approved within 24 hours. They would then receive a urinalysis kit to use at home and upload the results on a secure platform. Finally, Vamio Health will send a link for the telehealth consultation.

-

In September 2020, Medtronic's MiniMed 770G Insulin Pump obtained FDA approval. This insulin pump system has smartphone connectivity that helps manage type 1 diabetes more efficiently. In addition, Medtronic extended the benefits of hybrid closed-loop therapy to younger children diagnosed with type 1 diabetes. This modification has made acquiring and sharing real-time Continuous Glucose Monitoring (CGM) and pump data easier.

-

In May 2020, SteadyMD announced a new partnership with GoodRx, which will enable them to launch a nationwide pediatric telehealth service. The service will connect patients with their personal doctors for wellness checks and continuous virtual care.

Pediatric Telehealth Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.3 billion

Revenue forecast in 2030

USD 149.0 billion

Growth rate

CAGR of 26.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, delivery mode, end-use, disease area, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teladoc Health, Inc.; American Well; Mdlive; Oracle; GlobalMedia Group, LLC; Siemens Healthineers AG; Medtronic; Pediatric Partners; Anytime Pediatrics; Kiddo Health Inc.; PediaMetrix; Brave Care, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pediatric Telehealth Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global pediatric telehealth market report based on product type, delivery mode, end-use, disease area, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Monitors

-

Medical Peripheral Devices

-

Blood Pressure Meters

-

Blood Glucose Meters

-

Weighing Scales

-

Pulse Oximeters

-

Peak Flow Meters

-

ECG Monitors

-

Others

-

-

-

Software

-

Standalone Software

-

Integrated Software

-

-

Services

-

Remote Patient Monitoring

-

Real-Time Interactions

-

Store and Forward

-

Other Services

-

-

-

Delivery Mode Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Web-based

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Payers

-

Providers

-

Patients

-

-

Disease Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Psychiatry

-

Substance Use

-

Radiology

-

Dermatology

-

Neurological Medicine

-

ENT

-

Dental

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pediatric telehealth market size was estimated at USD 28.0 billion in 2023 and is expected to reach USD 36.3 billion in 2024.

b. The global pediatric telehealth market is expected to grow at a compound annual growth rate of 26.6% from 2024 to 2030 to reach USD 149.0 billion by 2030.

b. North America held the largest market share of more than 40% in 2023. The expansion of pediatric telehealth services in North America is driven by the region's substantial investment in healthcare IT and the widespread adoption of the internet and smartphones.

b. Some key players operating in the pediatric telehealth market include Teladoc Health, Inc.; American Well; Mdlive; Oracle; GlobalMedia Group, LLC; Siemens Healthineers AG; Medtronic; Pediatric Partners; Anytime Pediatrics; Kiddo Health Inc.; PediaMetrix; Brave Care, Inc.

b. rising awareness among parents about the convenience and accessibility of telehealth for pediatric care, coupled with the shortage of pediatric specialists in certain regions, is further propelling the expansion of the global pediatric telehealth market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."