Pediatric Orthopedic Devices Market Size, Share & Trends Analysis Report By Product (Trauma, Sports Medicine, Spine), By End Use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-418-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pediatric Orthopedic Devices Market Trends

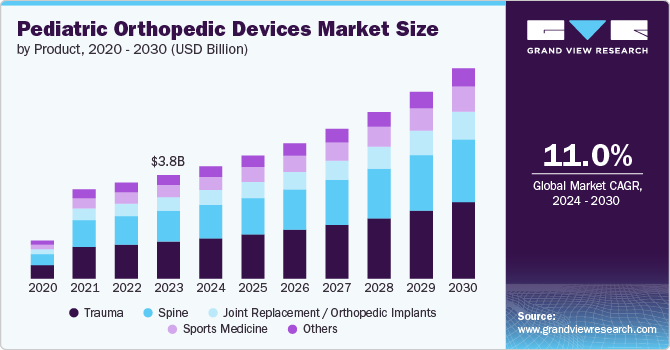

The global pediatric orthopedic devices market size was estimated at USD 3.83 billion in 2023 and is projected to grow at a CAGR of 11.0% from 2024 to 2030. Factors such as growing awareness of orthopedic conditions in children and the rise in congenital & developmental disorders, coupled with advancements in design & materials to provide effectiveness & comfort, are driving demand. Furthermore, innovations such as adjustable & customizable devices and improved materials for better functionality & safety are fueling the market. For example, OrthoPediatrics Corp. offers Hinge Pediatric Plating System, an articulated plate and screw system to address knee deformities in children by modulating their growth.

Rising technological advancements in the orthopedic devices sector, including pediatric orthopedic devices, are expected to accelerate the market growth. For instance, in March 2022, Explorer Surgical, a GHX company, in collaboration with Pega Medical, a Pediatric orthopedic medical device innovator, extended its presence in the pediatric orthopedic medical device to enhance surgical procedures and support remote case management. Moreover, advanced biomaterials with better durability and biocompatibility have improved the quality of orthopedic implants, leading to a growth in their demand. These biomaterials, which include various alloys and ceramics, are designed to replicate the function of natural bones and joints, further propelling the market growth.

Moreover, rapid development in healthcare infrastructure and the availability of technologically advanced orthopedic devices globally are anticipated to drive market growth over the forecast period. In addition, rising awareness, the availability of minimally invasive surgical techniques, and the rise in U.S. Food and Drug Administration (FDA) clearances boost the market growth. For instance, in December 2023, OSSIO, Inc., an orthopedic fixation technology company, received U.S. FDA clearance for its OSSIOfiber bio-integrative fixation technology to use in orthopedic surgical procedures such as bone fracture repairs, osteotomies, or fusions for children and adolescents.

The growing focus on early diagnosing bone deformities and preventive care in pediatrics propels market growth. As parents and healthcare practitioners seek solutions to treat and manage pediatric musculoskeletal conditions, this is expected to fuel market growth. According to data published by the Australian Institute of Health and Welfare, in Australia, around 34,200 disability-adjusted life years (DALYs) were recorded in 2023 for individuals aged 0 to 24 in Australia suffering from musculoskeletal conditions. In addition, approximately USD 696.5 million was invested within the Australian healthcare system to address musculoskeletal conditions for people aged 0 to 24 in 2020-2021.

Moreover, the rapid rise in sports participation among children led to increased sports injuries, which increased the demand for pediatric orthopedic devices. For instance, according to the National Survey of Children's Health, in the U.S., 36.3 million children aged 6 to 17 participated in sports activities or took lessons in 20 22. Moreover, according to Stanford Medicine Children's Health, in the U.S., over 775,000 children participating in sport-related activities are injured annually, and one in four injuries is supposed to be serious.

In addition, increasing government initiatives, reform policies, and funding raised by public and private companies boost market growth. For instance, in August 2021, WishBone Medical, Inc., a pediatric orthopedic medical devices company, received USD 10 million from LKCM Headwater Investments to expand its manufacturing facilities, support other operational initiatives, and accelerate product development to meet growing demands.

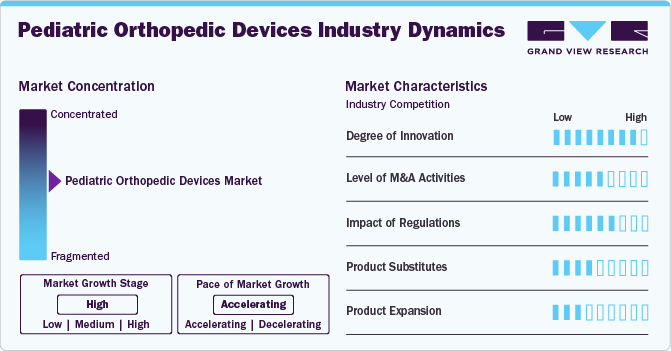

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by technological advancements in biomechanics, materials science, and surgical techniques. For instance, the Nemours Pediatric Engineering Research Lab (PERL), based in the U.S., works with devices that rehabilitate and assist children with neuromuscular disabilities and orthopedic disorders such as spinal muscular atrophy, muscular dystrophy (MD), arthrogryposis, scoliosis, limb length discrepancies, and spinal cord injury.

The market is characterized by a medium level of merger and acquisition (M&A) activity, owing to a desire to extend the business to cater to the growing demand and maintain a competitive edge. For instance, in May 2023, OrthoPediatrics Corp. acquired Medtech Concepts , an enabling technology platform, for USD 15.2 million to offer intraoperative resources for surgeons that enhance decision-making, drive operating room efficiency, and ultimately improve healthcare for children.

Regulations play an important role in shaping the market, ensuring the efficacy, safety, and quality of orthopedic devices available for pediatric patients. Regulatory requirements govern various aspects of orthopedic device manufacturing, development, and distribution and impose design, materials, sterilization, and labeling standards. In the UK, pediatric orthopedic devices are governed by The Medicines and Healthcare Products Regulatory Agency (MHRA) to ensure the quality and safety of the products.

Rehabilitation and physical therapy equipment serve as alternatives to orthopedic devices. Such equipment includes balance boards, therapy balls designed to enhance strength and flexibility, and exercise bands. Technological advancements led to the development of mobile applications and wearable devices that assist individuals through customized rehabilitation programs, offering convenience and accessibility.

Several market players are expanding their business by launching new products to strengthen their market position. For instance, in May 2023, Stryker introduced the Ortho Q Guidance system. The system integrates advanced optical tracking features through a redesigned, modern camera with sophisticated algorithms of the newly introduced Ortho Guidance software to enhance surgical planning and guidance capabilities.

Product Insights

By product, the trauma segment dominated the market revenue share of 35.72% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Accidents, sports-related injuries, falls (including falling from heights), burns, assaults, and drownings are the most reported causes of traumatic mortality among children. For instance, according to an article published by NCBI in May 2023, trauma accounts for over 15,000 fatalities, and 50% of all reported deaths are children every year. The rising trend of urbanization and the increase in outdoor activities among children are expected to increase the incidence of trauma significantly. Thus, such factors boost the segment growth.

The sports medicine segment held a significant market share in 2023. The demand for sports medicine is growing due to the increasing prevalence of sports injuries and growing participation in sports & fitness-related activities. Growing career opportunities and a rising inclination toward fitness due to increasing health awareness have improved the number of people choosing sports as a hobby or a career. This, in turn, is expected to increase their chances of incurring injuries, which further drives the market growth.

End Use Insights

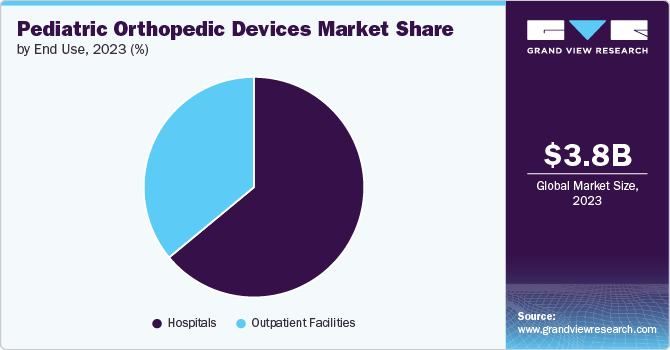

By end use, hospitals held the largest market share in 2023 and is anticipated to witness the fastest growth with a CAGR of 11.2% over the forecast period. Hospitals are primary centers for orthopedic surgeries, where patients receive comprehensive care from diagnosis to post-operative rehabilitation. Moreover, advancements in minimally invasive surgeries have made orthopedic procedures more feasible, further driving demand for these facilities. The presence of skilled healthcare professionals specializing in orthopedics and the availability of modern medical equipment fuel the segment's growth. For instance, according to Stanford Medicine Children's Health, in the U.S., 110,000 children ages 5 to 14 were treated in hospital emergency rooms due to baseball-related injuries.

The outpatient facilities segment is expected to grow significantly over the forecast period. As the trend towards ambulatory care continues to grow, outpatient facilities are becoming increasingly popular for patients seeking quicker recovery times and reduced healthcare costs associated with inpatient hospital stays. For instance, according to the Ambulatory Surgery Center Association, as of 2023, there are more than 6,200 Medicare-certified Ambulatory surgery centers in the U.S.

Regional Insights

North America dominated the pediatric orthopedic devices market with a revenue share of 46.2% in 2023. owing to a rise in musculoskeletal disorders, such as juvenile idiopathic arthritis. In addition, the presence of well-established healthcare infrastructure and reimbursement policies further stimulates market growth. Furthermore, the growing focus on minimally invasive surgeries and the rise in trauma and fracture cases in the region is anticipated to boost the market growth.

U.S. Pediatric Orthopedic Devices Market Trends

The pediatric orthopedic devices market in the U.S. held the largest market share in 2023. Favorable government initiatives and investment in arthritis are boosting market growth. For instance, in July 2022, the Arthritis Foundation collaborated with the Childhood Arthritis and Rheumatology Research Alliance (CARRA) and invested USD 1.12 million to research childhood rheumatic diseases, especially juvenile idiopathic arthritis.

Europe Pediatric Orthopedic Devices Market Trends

The pediatric orthopedic devices market in Europe is anticipated to grow considerably during the forecast period. The region's strong focus on R&D fosters continuous innovation in orthopedic implant technologies, enhancing product effectiveness and patient outcomes. Furthermore, robust regulatory frameworks and favorable healthcare policies ensure the quality and safety of pediatric orthopedic devices, thus increasing their demands among the patient population.

France pediatric orthopedic devices market is anticipated to register a significant growth rate during the forecast period. The market for orthopedic implants in France is expected to witness growth driven by new government initiatives. In March 2022, the government of France introduced the Innovative Medical Devices plan to support the medical device sector as part of the France 2030 project. This strategic plan involves a government investment of USD 450 million in the MedTech industry.

The pediatric orthopedic devices market in the UK is anticipated to grow considerably during the forecast period. The UK's National Health Service (NHS) provides universal healthcare coverage to all its residents, ensuring access to orthopedic treatments and stimulating market growth. Moreover, ongoing research activities on childhood arthritis boost market growth. For example, in February 2021, the UK's charity institute Versus Arthritis was awarded the UK's Experimental Arthritis Treatment Centre for Children (EATC4Children).

Asia Pacific Orthopedic Devices Market Trends

The pediatric orthopedic devices market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. Technological advancements in healthcare infrastructure and increasing healthcare expenditures in countries such as India, Japan, and China stimulate the growth of pediatric orthopedic devices. In addition, a rise in sports-related injuries is driving the demand for orthopedic surgeries, including orthopedic implants, in the region.

India pediatric orthopedic devices market is anticipated to register a significant growth rate during the forecast period. Factors such as recent implementations of state and federal government insurance programs and an annual expansion of insurance coverage are expected to boost the country's market growth.

The pediatric orthopedic devices market in Japan is anticipated to register a considerable growth rate during the forecast period. Japan has a highly developed medical device industry with advanced manufacturing facilities and technologies. The availability of resources that enable the development of advanced technologies at cheaper costs is boosting the number of local manufacturing facilities for pediatric orthopedic devices.

Latin America Orthopedic Devices Market Trends

The pediatric orthopedic devices market in Latin America is witnessing considerable growth due to the growing awareness among healthcare professionals and patients of the benefits and availability of pediatric orthopedic solutions.

Brazil pediatric orthopedic devices market is anticipated to register a significant growth rate during the forecast period. Growing sport-related injuries and accidents in the country fuel the market growth. For instance, according to a study published by Elsevier in October 2022, 40% and 25% of children aged between 1 to 14 die due to accidents and drownings, respectively.

Middle East and Africa Pediatric Devices Market Trends

The pediatric orthopedic devices market in the Middle East and Africa is experiencing lucrative growth. Growing awareness of orthopedic implant surgeries among patients and healthcare professionals, rising product launches, and favorable reimbursement policies for orthopedic procedures boost the market growth.

The UAE pediatric orthopedic devices market is anticipated to grow fastest during the forecast period. The country's improving healthcare system and increasing investments in medical technology will supplement market growth by enabling better access to orthopedic treatments.

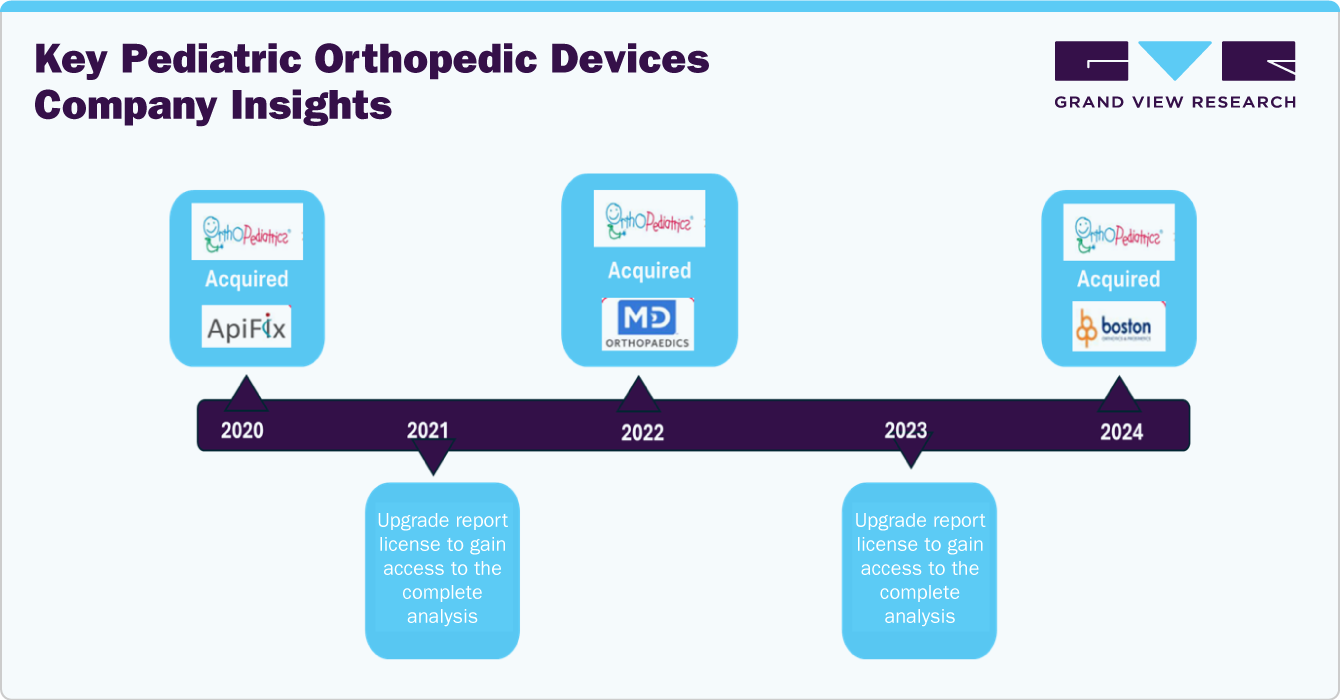

Key Pediatric Orthopedic Devices Company Insights

Key participants in the market focus on devising innovative business growth strategies in product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Pediatric Orthopedic Devices Companies:

The following are the leading companies in the pediatric orthopedic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Orthofix Medical Inc.

- OrthoPediatrics Corporation

- WishBone Medical

- Pega Medical Inc.

- Arthrex Inc.

- Johnson & Johnson Services, Inc. (DePuy Synthes)

- NuVasive Inc.

- Smith+Nephew

- Stryker

- Zimmer Biomet

- Medtronic

- Auxein Medical

Recent Developments

-

In December 2023, OrthoPediatrics Corp. launched the OrthoPediatrics Specialty Bracing Division (OPSB), a non-surgical intervention for pediatric orthopedics.

-

In June 2023, OrthoPediatrics Corp. (KIDS) introduced the GIRO Growth Modulation System for pediatric trauma and deformity correction.

Pediatric Orthopedic Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.16 billion |

|

Revenue forecast in 2030 |

USD 7.78 billion |

|

Growth rate |

CAGR of 11.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Orthofix Medical Inc.; OrthoPediatrics Corporation; WishBone Medical; Pega Medical Inc.; Arthrex Inc.; Johnson & Johnson Services, Inc. (DePuy Synthes); NuVasive Inc.; Smith+Nephew; Stryker; Zimmer Biomet; Medtronic; Auxein Medical |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pediatric Orthopedic Devices Market Report Segmentation

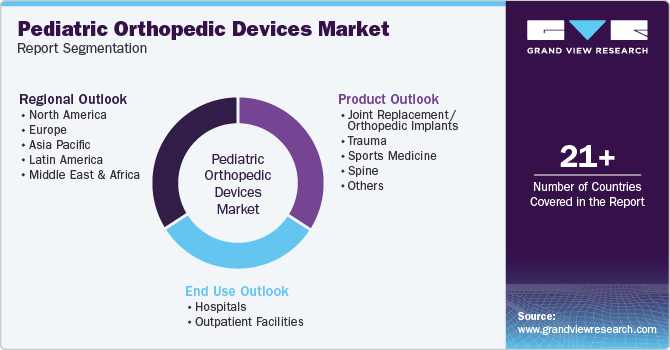

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global pediatric orthopedic devices market report based on product, end use, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Joint Replacement/ Orthopedic Implants

-

Lower Extremity Implants

-

Knee Implants

-

Hip Implants

-

Foot & Ankle Implants

-

-

Dental

-

Dental Implants

-

Craniomaxillofacial Implants

-

-

Upper Extremity Implants

-

Elbow Implants

-

Hand & Wrist Implants

-

Shoulder Implants

-

-

-

Trauma

-

Implants

-

Accessories (Plates, Screws, Nails, Pins, Wires)

-

Instruments

-

-

Sports Medicine

-

Body Reconstruction & Repair

-

Accessories

-

Body Monitoring & Evaluation

-

Body Support & Recovery

-

-

Spine

-

Others (Orthobiologics, Enabling Technology, Miscellaneous Items)

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pediatric orthopedic devices market size was estimated at USD 3.83 billion in 2023 and is expected to reach USD 4.16 billion in 2024.

b. The global pediatric orthopedic devices market is expected to grow at a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 7.78 billion by 2030.

b. North America dominated the pediatric orthopedic devices market with a revenue share of 46.2% in 2023. owing to a rise in musculoskeletal disorders, such as juvenile idiopathic arthritis.

b. Some key players operating in the market include Orthofix Medical Inc., OrthoPediatrics Corporation, WishBone Medical, Pega Medical Inc., Arthrex Inc., Johnson & Johnson Services, Inc. (DePuy Synthes), NuVasive Inc., Smith+Nephew, Stryker, Zimmer Biomet, Medtronic, Auxein Medical

b. Factors such as growing awareness of orthopedic conditions in children and the rise in congenital & developmental disorders, coupled with advancements in design & materials to provide effectiveness & comfort, are driving demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."